Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide the following September 1, 2019 Company A borrows $600,000 by issuing a nine-month, 4% promissory note. The note is due on May 31,

Please provide the following

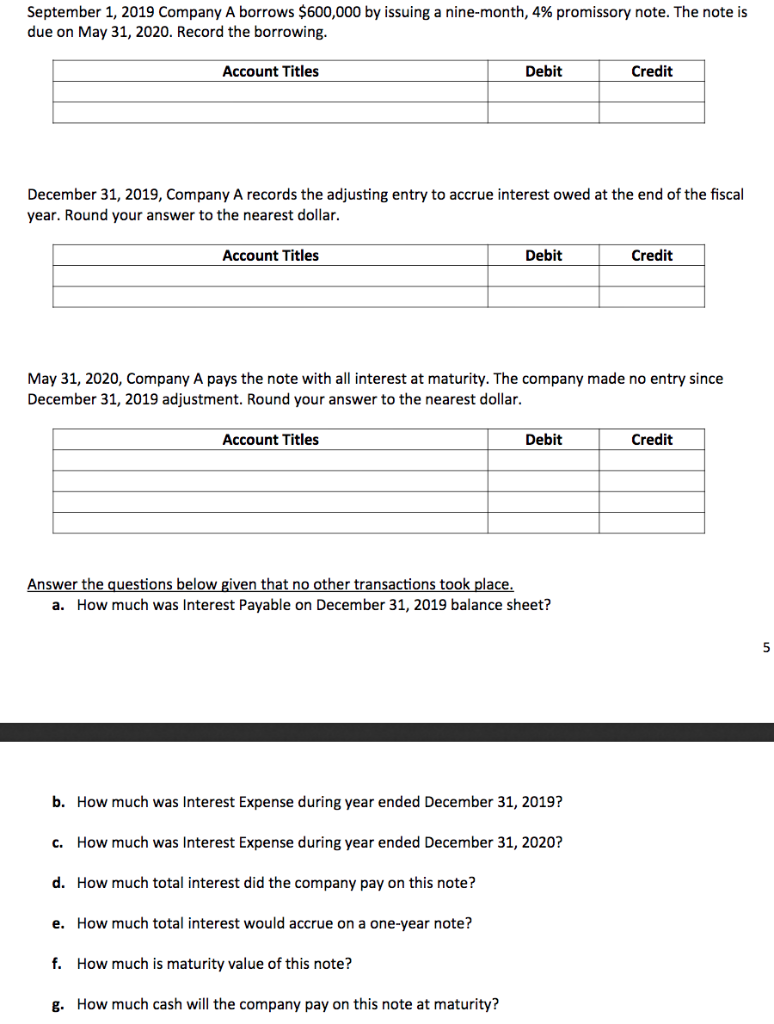

September 1, 2019 Company A borrows $600,000 by issuing a nine-month, 4% promissory note. The note is due on May 31, 2020. Record the borrowing. Account Titles Debit Credit December 31, 2019, Company A records the adjusting entry to accrue interest owed at the end of the fiscal year. Round your answer to the nearest dollar. Debit Credit Account Titles May 31, 2020, Company A pays the note with all interest at maturity. The company made no entry since December 31, 2019 adjustment. Round your answer to the nearest dollar. Debit Credit Account Titles Answer the questions below given that no other transactions took place, a. How much was Interest Payable on December 31, 2019 balance sheet? b. How much was Interest Expense during year ended December 31, 2019? How much was Interest Expense during year ended December 31, 2020? c. d. How much total interest did the company pay on this note? e. How much total interest would accrue on a one-year note? f. How much is maturity value of this note? g. How much cash will the company pay on this note at maturityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started