Please provide workings. Would greatly mean alot to understand. Thank you.

Please provide workings. Would greatly mean alot to understand. Thank you.

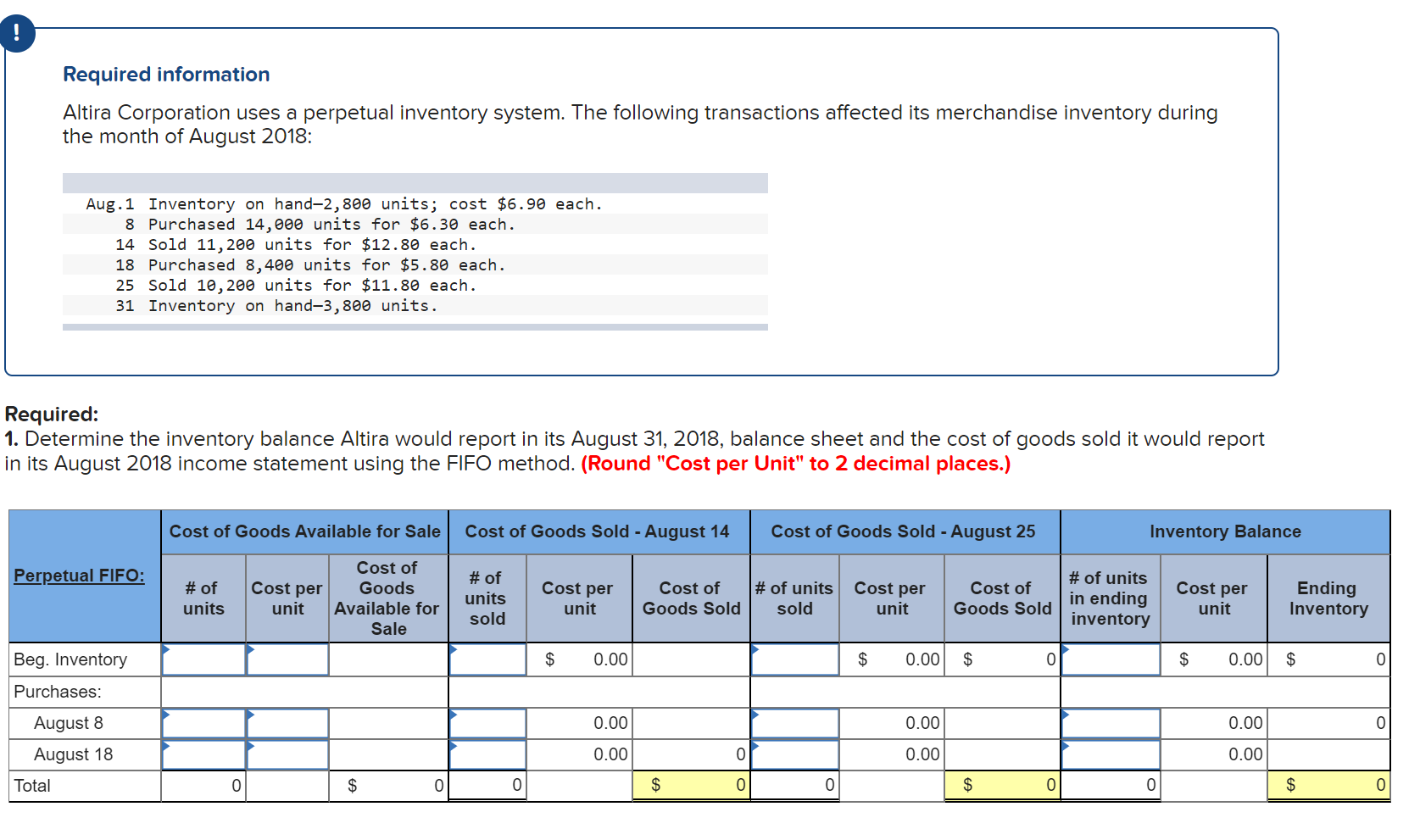

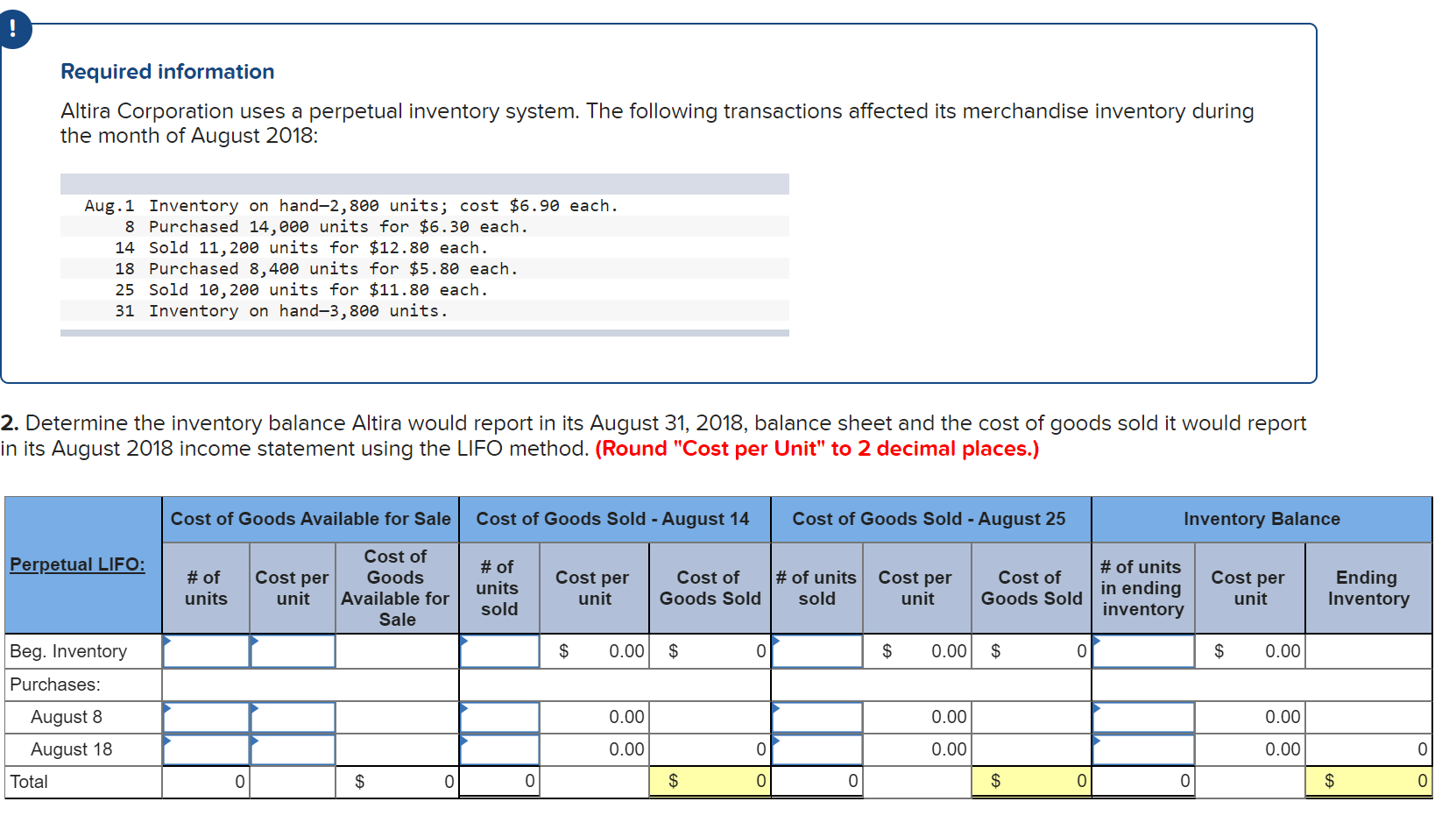

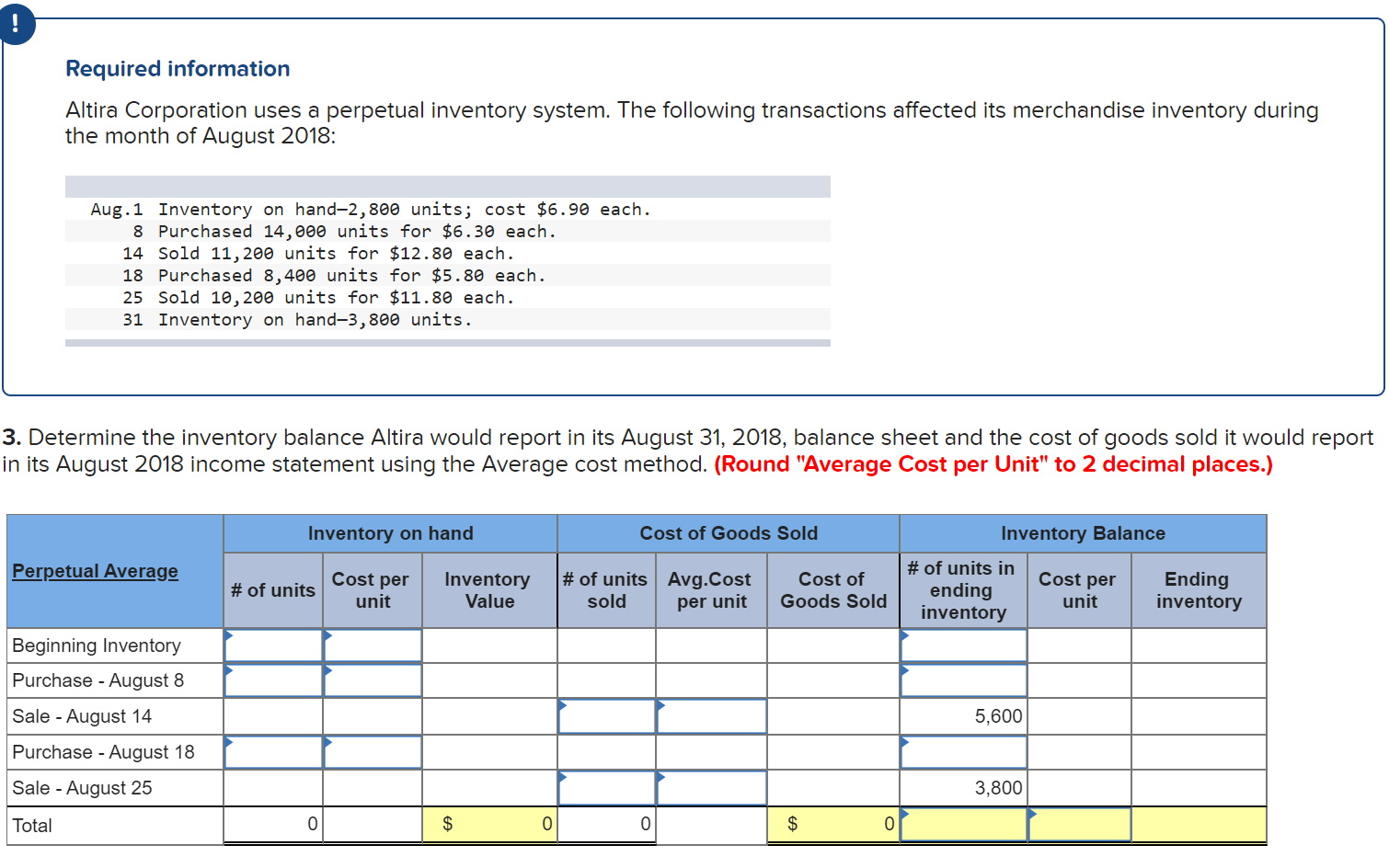

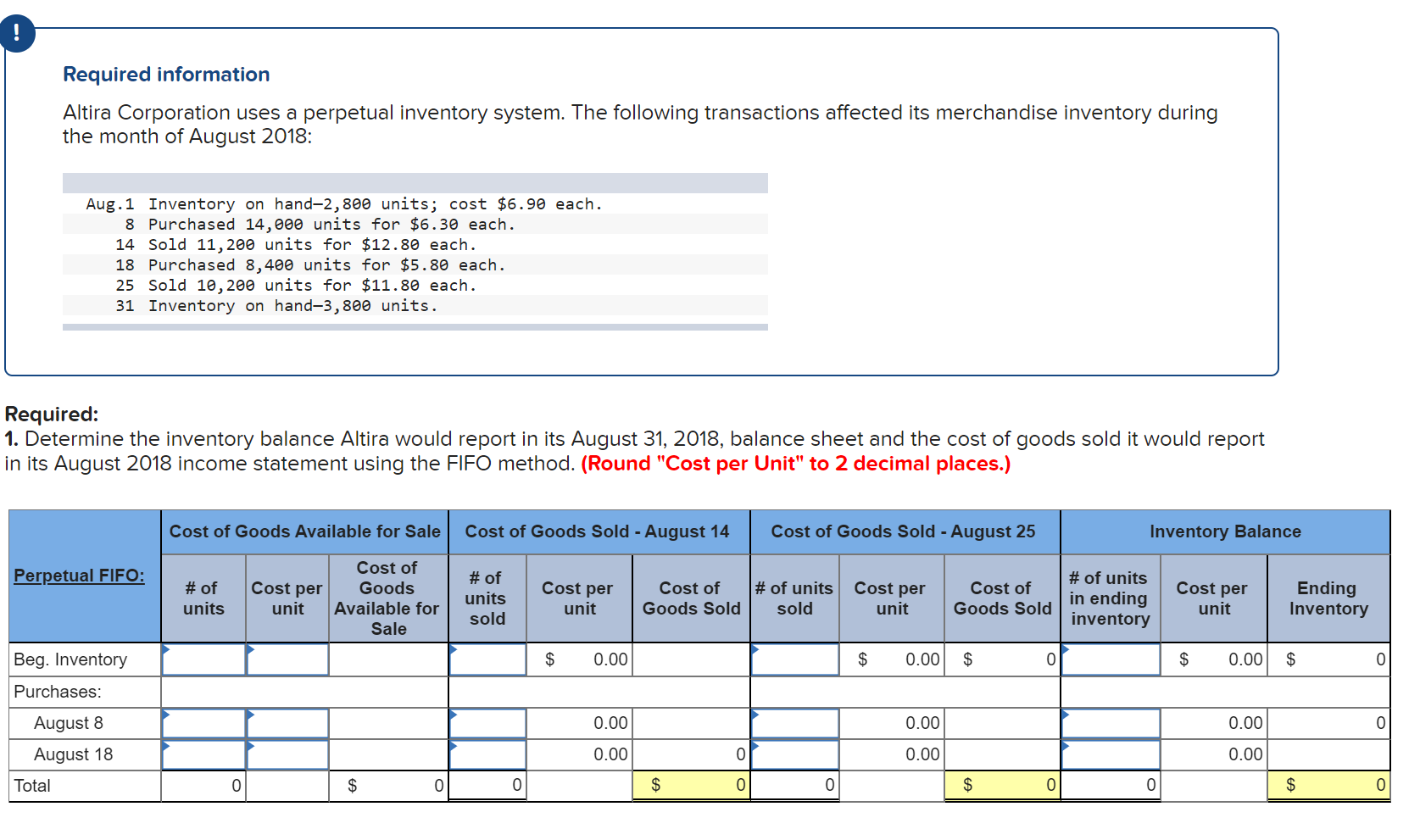

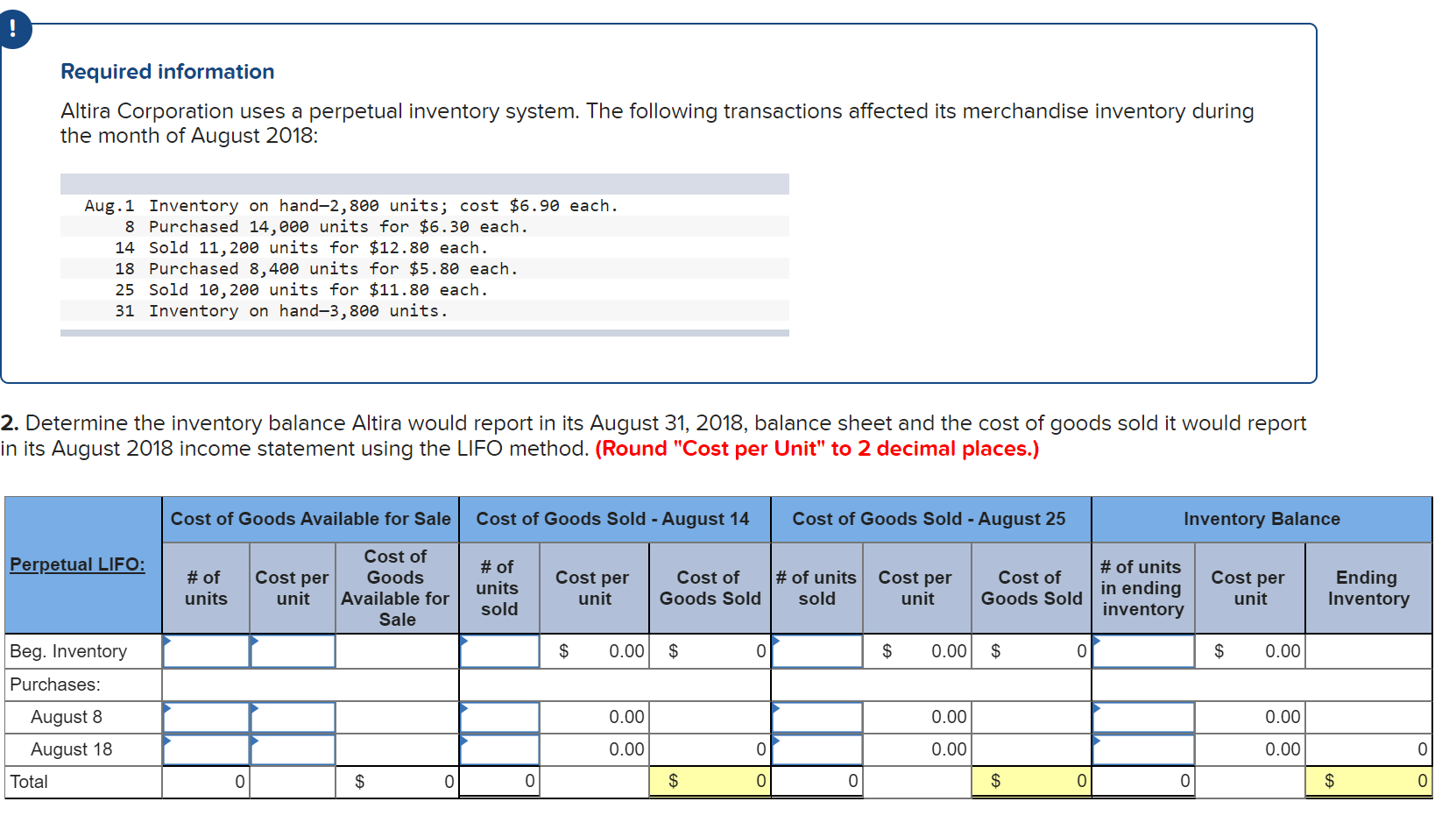

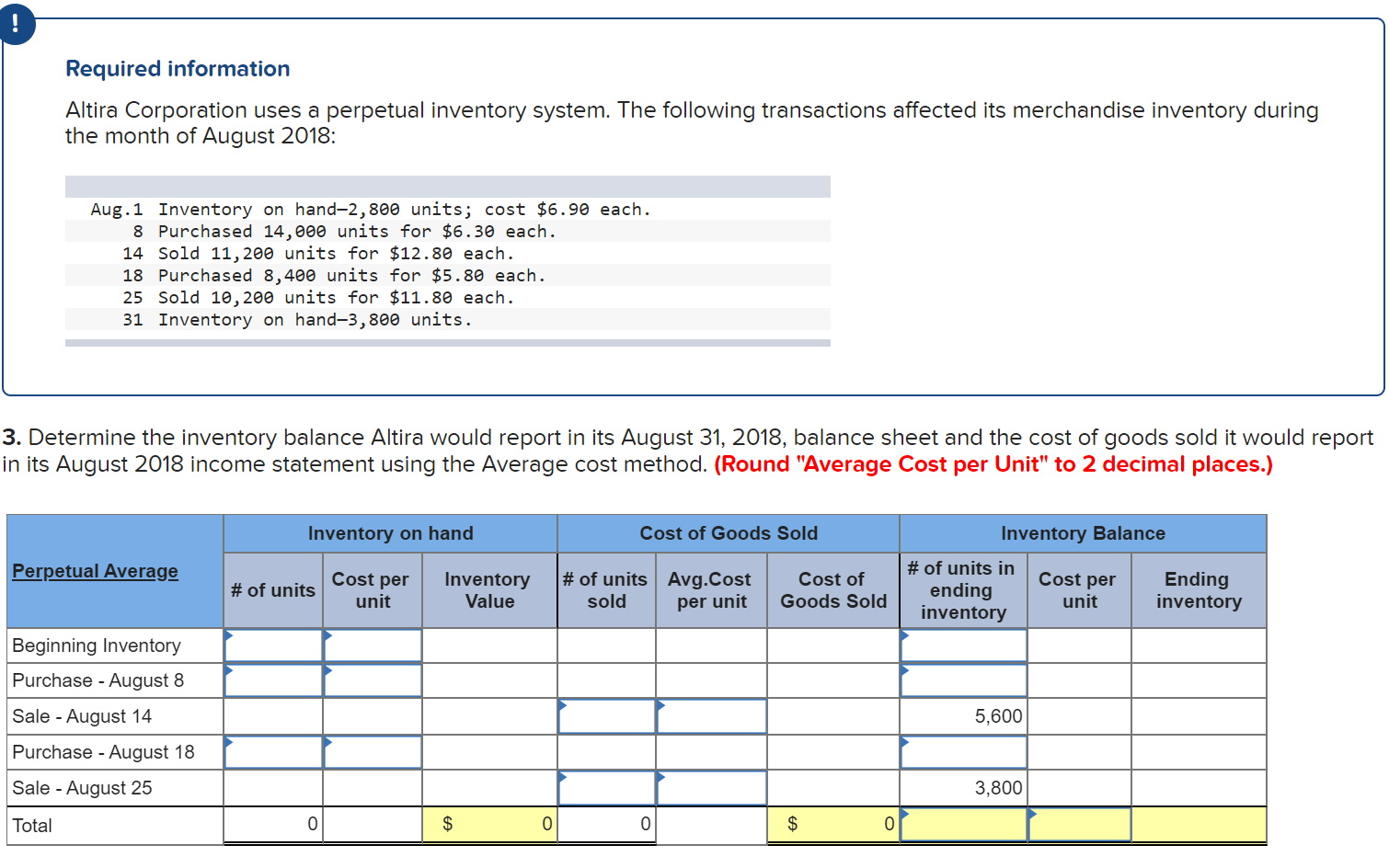

! Required information Altira Corporation uses a perpetual inventory system. The following transactions affected its merchandise inventory during the month of August 2018: Aug. 1 Inventory on hand-2,800 units; cost $6.90 each. 8 Purchased 14,000 units for $6.30 each. 14 Sold 11, 200 units for $12.80 each. 18 Purchased 8,400 units for $5.80 each. 25 Sold 10, 200 units for $11.80 each. 31 Inventory on hand-3,800 units. Required: 1. Determine the inventory balance Altira would report in its August 31, 2018, balance sheet and the cost of goods sold it would report in its August 2018 income statement using the FIFO method. (Round "Cost per Unit" to 2 decimal places.) Cost of Goods Available for Sale Cost of Goods Sold - August 14 Cost of Goods Sold - August 25 Inventory Balance Perpetual FIFO: Cost per # of units Cost of Goods Available for Sale # of units sold Cost per unit Cost of Goods Sold # of units sold Cost per unit Cost of Goods Sold # of units in ending inventory Cost per unit Ending Inventory unit $ 0.00 $ 0.00 $ 0 $ 0.00 $ 0 Beg. Inventory Purchases: 0.00 0.00 0.00 0 August 8 August 18 0.00 0.00 0.00 Total 0 $ 0 0 $ 0 $ 0 0 $ 0 Required information Altira Corporation uses a perpetual inventory system. The following transactions affected its merchandise inventory during the month of August 2018: Aug. 1 Inventory on hand-2,800 units; cost $6.90 each. 8 Purchased 14,000 units for $6.30 each. 14 Sold 11, 200 units for $12.80 each. 18 Purchased 8,400 units for $5.80 each. 25 Sold 10, 200 units for $11.80 each. 31 Inventory on hand-3,800 units. 2. Determine the inventory balance Altira would report in its August 31, 2018, balance sheet and the cost of goods sold it would report in its August 2018 income statement using the LIFO method. (Round "Cost per Unit" to 2 decimal places.) Cost of Goods Available for Sale Cost of Goods Sold - August 14 Cost of Goods Sold - August 25 Inventory Balance Perpetual LIFO: Cost per Cost per Cost per # of units Cost of Goods Available for Sale # of units sold Cost per unit Cost of Goods Sold # of units sold Cost of Goods Sold # of units in ending inventory Ending Inventory unit unit unit $ 0.00 $ 0 $ 0.00 $ 0 $ 0.00 Beg. Inventory Purchases: 0.00 0.00 0.00 August 8 August 18 0.00 0 0.00 0.00 0 Total 0 $ 0 0 $ 0 0 $ 0 0 $ 0 Required information Altira Corporation uses a perpetual inventory system. The following transactions affected its merchandise inventory during the month of August 2018: Aug.1 Inventory on hand-2, 800 units; cost $6.90 each. 8 Purchased 14,000 units for $6.30 each. 14 Sold 11, 200 units for $12.80 each. 18 Purchased 8,400 units for $5.80 each. 25 Sold 10, 200 units for $11.80 each. 31 Inventory on hand-3,800 units. 3. Determine the inventory balance Altira would report in its August 31, 2018, balance sheet and the cost of goods sold it would report in its August 2018 income statement using the Average cost method. (Round "Average Cost per Unit" to 2 decimal places.) Inventory on hand Cost of Goods Sold Perpetual Average Cost per Inventory Value # of units # of units Avg.Cost sold Cost of Goods Sold Inventory Balance # of units in Cost per Ending ending unit inventory inventory unit per unit Beginning Inventory Purchase - August 8 Sale - August 14 Purchase - August 18 5,600 Sale - August 25 3,800 Total 0 $ 0 0 $ 0

Please provide workings. Would greatly mean alot to understand. Thank you.

Please provide workings. Would greatly mean alot to understand. Thank you.