Answered step by step

Verified Expert Solution

Question

1 Approved Answer

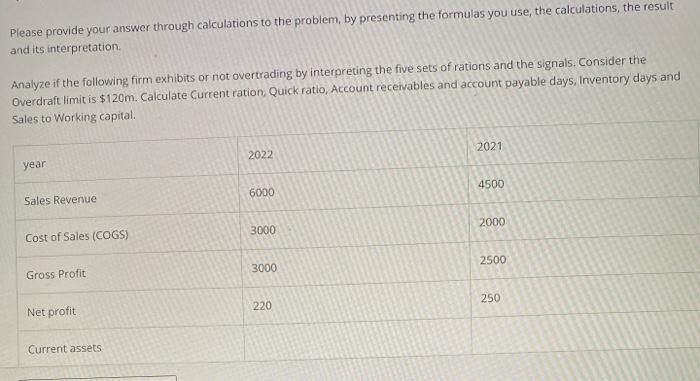

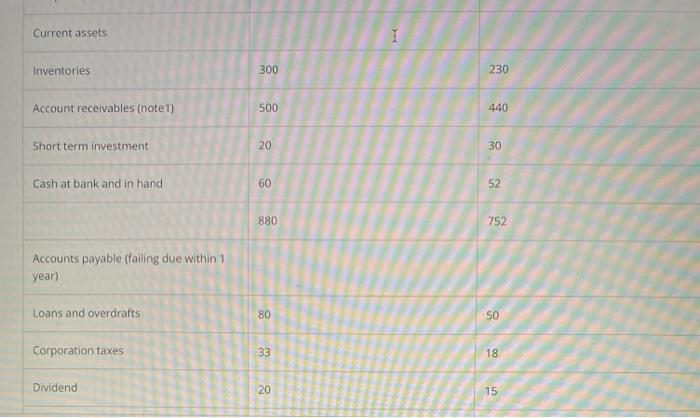

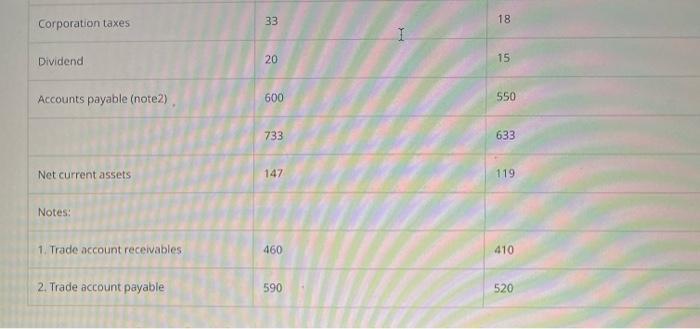

Please provide your answer through calculations to the problem, by presenting the formulas you use, the calculations, the result and its interpretation. Analyze if the

Please provide your answer through calculations to the problem, by presenting the formulas you use, the calculations, the result

and its interpretation.

Analyze if the following firm exhibits or not overtrading by interpreting the five sets of rations and the signals. Consider the

Overdraft limit is $120m. Calculate Current ration, Quick ratio, Account receivables and account payable days, Inventory days and

Sales to Working capital.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started