Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provided answer according to Accounting For deferred Tax IFRS .Please use english version instead of Malay version.Please provide details answer according to mark.THank you

Please provided answer according to Accounting For deferred Tax IFRS .Please use english version instead of Malay version.Please provide details answer according to mark.THank you

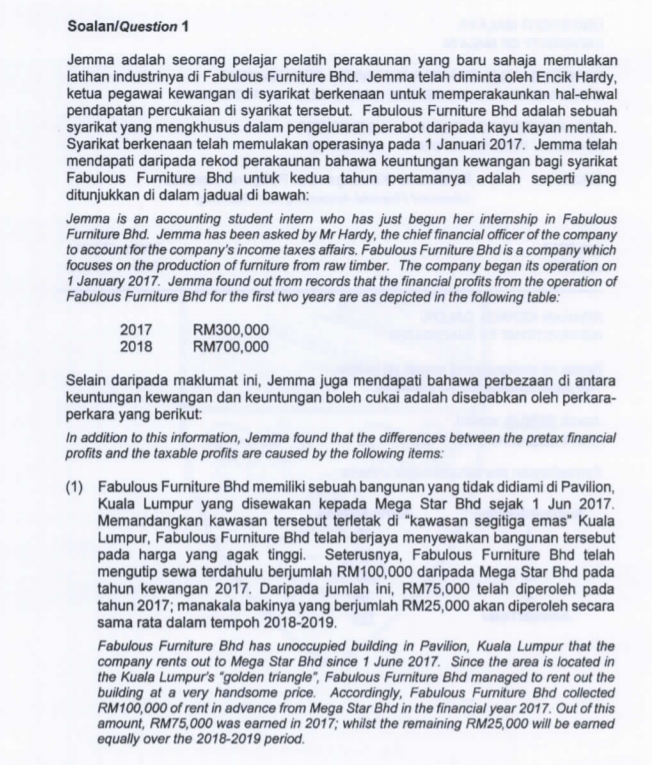

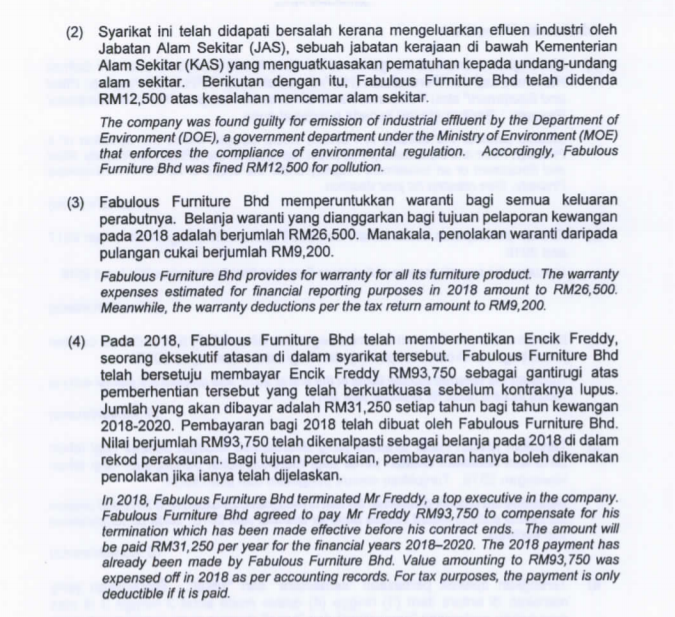

Soalan/Question 1 Jemma adalah seorang pelajar pelatih perakaunan yang baru sahaja memulakan latihan industrinya di Fabulous Furniture Bhd. Jemma telah diminta oleh Encik Hardy, ketua pegawai kewangan di syarikat berkenaan untuk memperakaunkan hal-ehwal pendapatan percukaian di syarikat tersebut. Fabulous Furniture Bhd adalah sebuah syarikat yang mengkhusus dalam pengeluaran perabot daripada kayu kayan mentah. Syarikat berkenaan telah memulakan operasinya pada 1 Januari 2017. Jemma telah mendapati daripada rekod perakaunan bahawa keuntungan kewangan bagi syarikat Fabulous Furniture Bhd untuk kedua tahun pertamanya adalah seperti yang ditunjukkan di dalam jadual di bawah: Jemma is an accounting student intern who has just begun her internship in Fabulous Furniture Bhd. Jemma has been asked by Mr Hardy, the chief financial officer of the company to account for the company's income taxes affairs. Fabulous Furniture Bhd is a company which focuses on the production of furniture from raw timber. The company began its operation on 1 January 2017. Jemma found out from records that the financial profits from the operation of Fabulous Furniture Bhd for the first two years are as depicted in the following table: 2017 RM300,000 2018 RM700,000 Selain daripada maklumat ini, Jemma juga mendapati bahawa perbezaan di antara keuntungan kewangan dan keuntungan boleh cukai adalah disebabkan oleh perkara- perkara yang berikut: In addition to this information, Jemma found that the differences between the pretax financial profits and the taxable profits are caused by the following items: (1) Fabulous Furniture Bhd memiliki sebuah bangunan yang tidak didiami di Pavilion, Kuala Lumpur yang disewakan kepada Mega Star Bhd sejak 1 Jun 2017 Memandangkan kawasan tersebut terletak di kawasan segitiga emas" Kuala Lumpur, Fabulous Furniture Bhd telah berjaya menyewakan bangunan tersebut pada harga yang agak tinggi. Seterusnya, Fabulous Furniture Bhd telah mengutip sewa terdahulu berjumlah RM100,000 daripada Mega Star Bhd pada tahun kewangan 2017. Daripada jumlah ini, RM75,000 telah diperoleh pada tahun 2017, manakala bakinya yang berjumlah RM25,000 akan diperoleh secara sama rata dalam tempoh 2018-2019. Fabulous Furniture Bhd has unoccupied building in Pavilion, Kuala Lumpur that the company rents out to Mega Star Bhd since 1 June 2017. Since the area is located in the Kuala Lumpur's "golden triangle", Fabulous Furniture Bhd managed to rent out the building at a very handsome price. Accordingly, Fabulous Furniture Bhd collected RM100,000 of rent in advance from Mega Star Bhd in the financial year 2017. Out of this amount, RM75,000 was earned in 2017, whilst the remaining RM25,000 will be earned equally over the 2018-2019 period. (2) Syarikat ini telah didapati bersalah kerana mengeluarkan efluen industri oleh Jabatan Alam Sekitar (JAS), sebuah jabatan kerajaan di bawah Kementerian Alam Sekitar (KAS) yang menguatkuasakan pematuhan kepada undang-undang alam sekitar. Berikutan dengan itu, Fabulous Furniture Bhd telah didenda RM12,500 atas kesalahan mencemar alam sekitar. The company was found guilty for emission of industrial effluent by the Department of Environment (DOE), a government department under the Ministry of Environment (MOE) that enforces the compliance of environmental regulation. Accordingly, Fabulous Furniture Bhd was fined RM12,500 for pollution (3) Fabulous Furniture Bhd memperuntukkan waranti bagi semua keluaran perabutnya. Belanja waranti yang dianggarkan bagi tujuan pelaporan kewangan pada 2018 adalah berjumlah RM26,500. Manakala, penolakan waranti daripada pulangan cukai berjumlah RM9,200. Fabulous Furniture Bhd provides for warranty for all its furniture product. The warranty expenses estimated for financial reporting purposes in 2018 amount to RM26,500. Meanwhile, the warranty deductions per the tax return amount to RM9,200. (4) Pada 2018, Fabulous Furniture Bhd telah memberhentikan Encik Freddy, seorang eksekutif atasan di dalam syarikat tersebut. Fabulous Furniture Bhd telah bersetuju membayar Encik Freddy RM93,750 sebagai gantirugi atas pemberhentian tersebut yang telah berkuatkuasa sebelum kontraknya lupus. Jumlah yang akan dibayar adalah RM31,250 setiap tahun bagi tahun kewangan 2018-2020. Pembayaran bagi 2018 telah dibuat oleh Fabulous Furniture Bhd. Nilai berjumlah RM93,750 telah dikenalpasti sebagai belanja pada 2018 di dalam rekod perakaunan. Bagi tujuan percukaian, pembayaran hanya boleh dikenakan penolakan jika ianya telah dijelaskan. In 2018, Fabulous Furniture Bhd terminated Mr Freddy, a top executive in the company. Fabulous Furniture Bhd agreed to pay Mr Freddy RM93,750 to compensate for his termination which has been made effective before his contract ends. The amount will be paid RM31,250 per year for the financial years 2018-2020. The 2018 payment has already been made by Fabulous Furniture Bhd. Value amounting to RM93,750 was expensed off in 2018 as per accounting records. For tax purposes, the payment is only deductible if it is paid. b) Kirakan pendapatan boleh cukai Fabulous Furniture Bhd bagi tahun-tahun 2017 and 2018 Calculate the taxable income of Fabulous Furniture Bhd for the years 2017 and 2018. (4 markah/marks) C) Kirakan cukai pendapatan tertunda bagi akhir tahun 2017; dan sediakan catatan jurnal bagi merekod cukai pendapatan bagi tahun kewangan 2017 Calculate the deferred income taxes at the end of 2017; and prepare the journal entry to record income taxes for financial year 2017 (4 markah/marks) d) Tentukan jumlah cukai tertunda yang dikenalpasti sebagai belanja bagi tahun 2018 dan sediakan catatan jurnal bagi merekod cukai pendapatan bagi tahun kewangan 2018. Tunjukkan semua pengiraan dan jalan kerja. Determine the amount of deferred tax that is recognized as expense in 2018 and prepare the journal entry to record income taxes for financial year 2018. Show all computations and workings. (5 markah/marks) Soalan/Question 1 Jemma adalah seorang pelajar pelatih perakaunan yang baru sahaja memulakan latihan industrinya di Fabulous Furniture Bhd. Jemma telah diminta oleh Encik Hardy, ketua pegawai kewangan di syarikat berkenaan untuk memperakaunkan hal-ehwal pendapatan percukaian di syarikat tersebut. Fabulous Furniture Bhd adalah sebuah syarikat yang mengkhusus dalam pengeluaran perabot daripada kayu kayan mentah. Syarikat berkenaan telah memulakan operasinya pada 1 Januari 2017. Jemma telah mendapati daripada rekod perakaunan bahawa keuntungan kewangan bagi syarikat Fabulous Furniture Bhd untuk kedua tahun pertamanya adalah seperti yang ditunjukkan di dalam jadual di bawah: Jemma is an accounting student intern who has just begun her internship in Fabulous Furniture Bhd. Jemma has been asked by Mr Hardy, the chief financial officer of the company to account for the company's income taxes affairs. Fabulous Furniture Bhd is a company which focuses on the production of furniture from raw timber. The company began its operation on 1 January 2017. Jemma found out from records that the financial profits from the operation of Fabulous Furniture Bhd for the first two years are as depicted in the following table: 2017 RM300,000 2018 RM700,000 Selain daripada maklumat ini, Jemma juga mendapati bahawa perbezaan di antara keuntungan kewangan dan keuntungan boleh cukai adalah disebabkan oleh perkara- perkara yang berikut: In addition to this information, Jemma found that the differences between the pretax financial profits and the taxable profits are caused by the following items: (1) Fabulous Furniture Bhd memiliki sebuah bangunan yang tidak didiami di Pavilion, Kuala Lumpur yang disewakan kepada Mega Star Bhd sejak 1 Jun 2017 Memandangkan kawasan tersebut terletak di kawasan segitiga emas" Kuala Lumpur, Fabulous Furniture Bhd telah berjaya menyewakan bangunan tersebut pada harga yang agak tinggi. Seterusnya, Fabulous Furniture Bhd telah mengutip sewa terdahulu berjumlah RM100,000 daripada Mega Star Bhd pada tahun kewangan 2017. Daripada jumlah ini, RM75,000 telah diperoleh pada tahun 2017, manakala bakinya yang berjumlah RM25,000 akan diperoleh secara sama rata dalam tempoh 2018-2019. Fabulous Furniture Bhd has unoccupied building in Pavilion, Kuala Lumpur that the company rents out to Mega Star Bhd since 1 June 2017. Since the area is located in the Kuala Lumpur's "golden triangle", Fabulous Furniture Bhd managed to rent out the building at a very handsome price. Accordingly, Fabulous Furniture Bhd collected RM100,000 of rent in advance from Mega Star Bhd in the financial year 2017. Out of this amount, RM75,000 was earned in 2017, whilst the remaining RM25,000 will be earned equally over the 2018-2019 period. (2) Syarikat ini telah didapati bersalah kerana mengeluarkan efluen industri oleh Jabatan Alam Sekitar (JAS), sebuah jabatan kerajaan di bawah Kementerian Alam Sekitar (KAS) yang menguatkuasakan pematuhan kepada undang-undang alam sekitar. Berikutan dengan itu, Fabulous Furniture Bhd telah didenda RM12,500 atas kesalahan mencemar alam sekitar. The company was found guilty for emission of industrial effluent by the Department of Environment (DOE), a government department under the Ministry of Environment (MOE) that enforces the compliance of environmental regulation. Accordingly, Fabulous Furniture Bhd was fined RM12,500 for pollution (3) Fabulous Furniture Bhd memperuntukkan waranti bagi semua keluaran perabutnya. Belanja waranti yang dianggarkan bagi tujuan pelaporan kewangan pada 2018 adalah berjumlah RM26,500. Manakala, penolakan waranti daripada pulangan cukai berjumlah RM9,200. Fabulous Furniture Bhd provides for warranty for all its furniture product. The warranty expenses estimated for financial reporting purposes in 2018 amount to RM26,500. Meanwhile, the warranty deductions per the tax return amount to RM9,200. (4) Pada 2018, Fabulous Furniture Bhd telah memberhentikan Encik Freddy, seorang eksekutif atasan di dalam syarikat tersebut. Fabulous Furniture Bhd telah bersetuju membayar Encik Freddy RM93,750 sebagai gantirugi atas pemberhentian tersebut yang telah berkuatkuasa sebelum kontraknya lupus. Jumlah yang akan dibayar adalah RM31,250 setiap tahun bagi tahun kewangan 2018-2020. Pembayaran bagi 2018 telah dibuat oleh Fabulous Furniture Bhd. Nilai berjumlah RM93,750 telah dikenalpasti sebagai belanja pada 2018 di dalam rekod perakaunan. Bagi tujuan percukaian, pembayaran hanya boleh dikenakan penolakan jika ianya telah dijelaskan. In 2018, Fabulous Furniture Bhd terminated Mr Freddy, a top executive in the company. Fabulous Furniture Bhd agreed to pay Mr Freddy RM93,750 to compensate for his termination which has been made effective before his contract ends. The amount will be paid RM31,250 per year for the financial years 2018-2020. The 2018 payment has already been made by Fabulous Furniture Bhd. Value amounting to RM93,750 was expensed off in 2018 as per accounting records. For tax purposes, the payment is only deductible if it is paid. b) Kirakan pendapatan boleh cukai Fabulous Furniture Bhd bagi tahun-tahun 2017 and 2018 Calculate the taxable income of Fabulous Furniture Bhd for the years 2017 and 2018. (4 markah/marks) C) Kirakan cukai pendapatan tertunda bagi akhir tahun 2017; dan sediakan catatan jurnal bagi merekod cukai pendapatan bagi tahun kewangan 2017 Calculate the deferred income taxes at the end of 2017; and prepare the journal entry to record income taxes for financial year 2017 (4 markah/marks) d) Tentukan jumlah cukai tertunda yang dikenalpasti sebagai belanja bagi tahun 2018 dan sediakan catatan jurnal bagi merekod cukai pendapatan bagi tahun kewangan 2018. Tunjukkan semua pengiraan dan jalan kerja. Determine the amount of deferred tax that is recognized as expense in 2018 and prepare the journal entry to record income taxes for financial year 2018. Show all computations and workings. (5 markah/marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started