Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provied material needed marked with red x a like will follow! Santana Rey receives the March bank statement for Business Solutions on April 11,

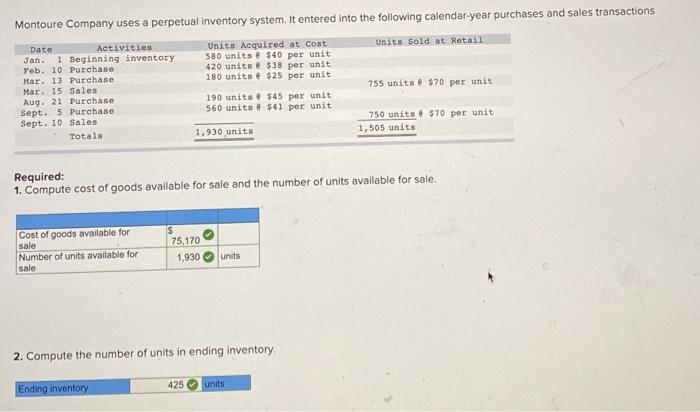

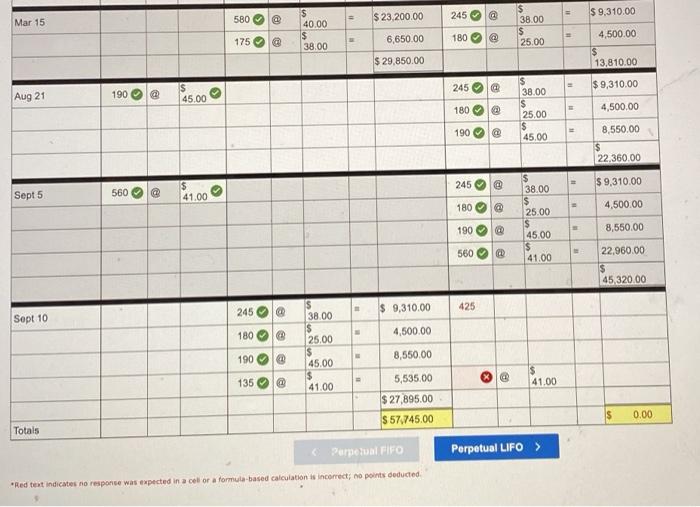

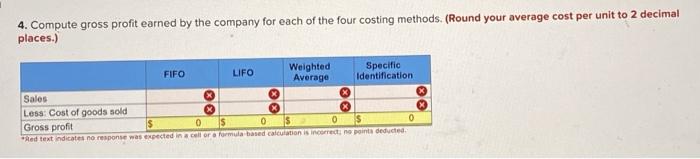

Please provied material needed marked with red "x" a like will follow!

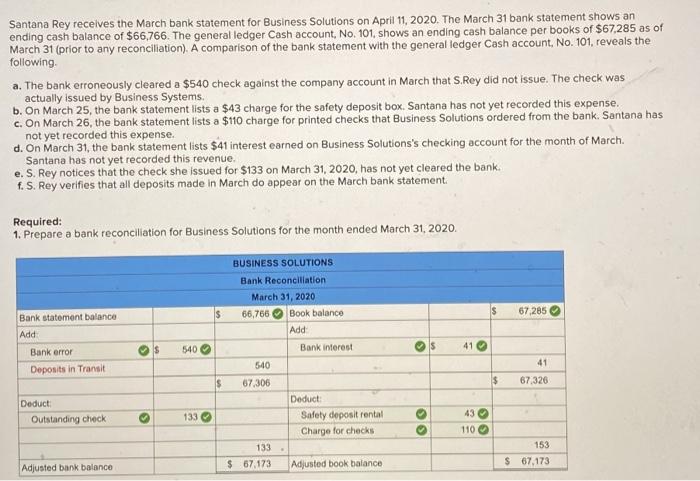

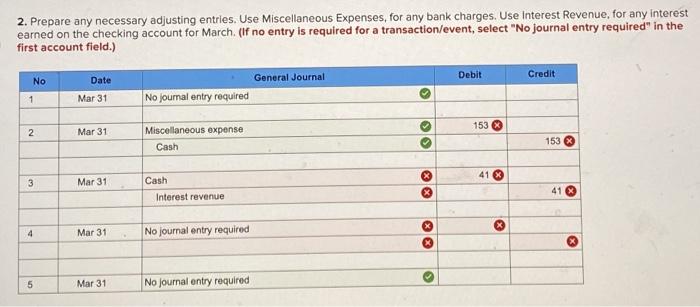

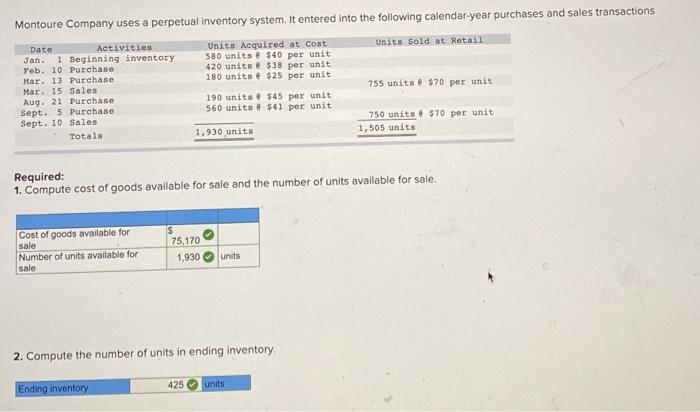

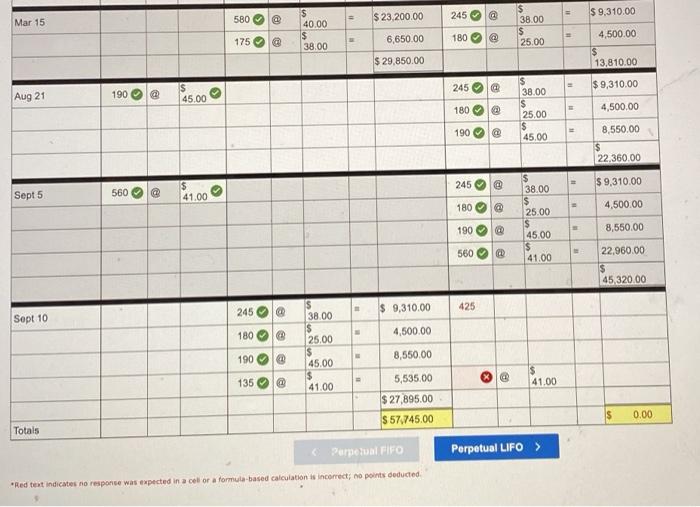

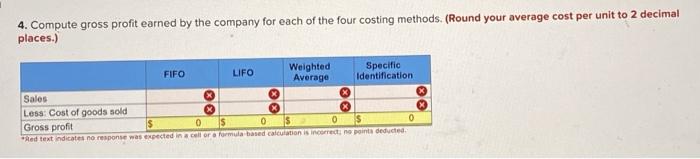

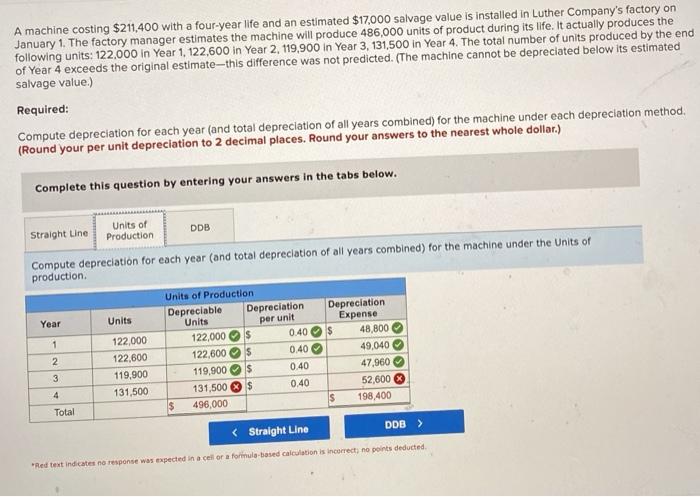

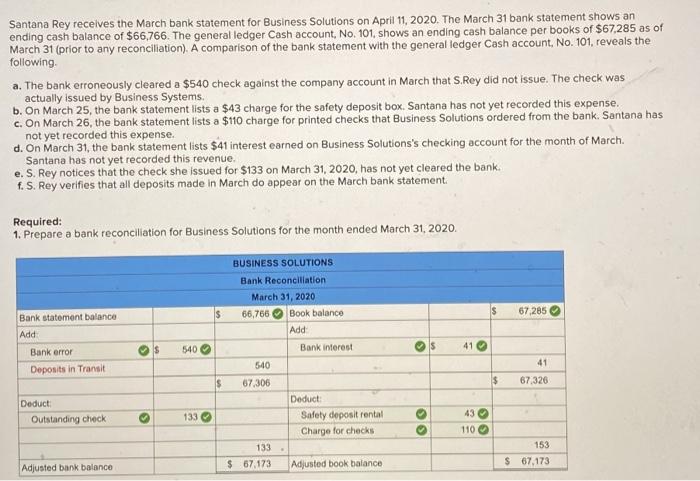

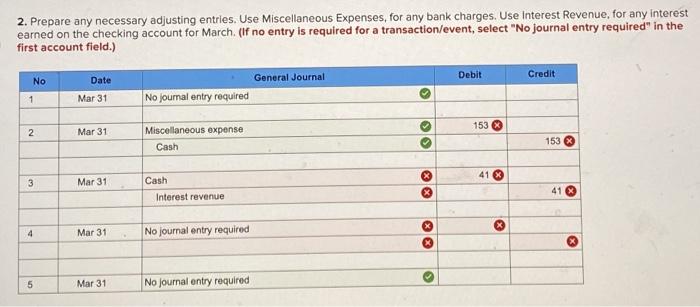

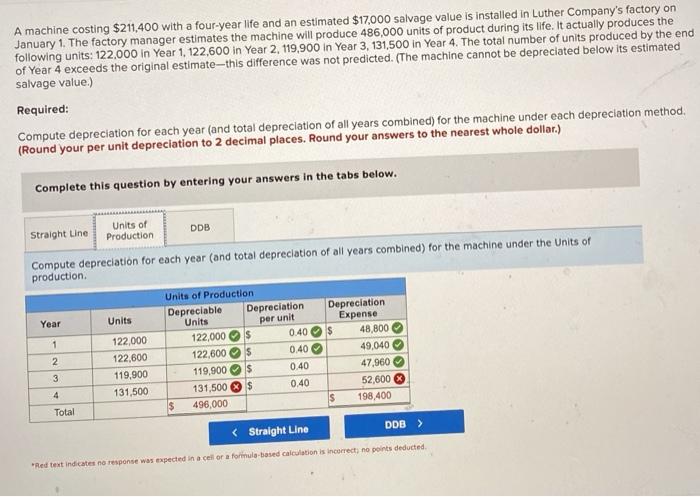

Santana Rey receives the March bank statement for Business Solutions on April 11, 2020. The March 31 bank statement shows an ending cash balance of $66,766. The general ledger Cash account, No. 101, shows an ending cash balance per books of $67.285 as of March 31 (prior to any reconciliation). A comparison of the bank statement with the general ledger Cash account, No. 101, reveals the following a. The bank erroneously cleared a $540 check against the company account in March that S.Rey did not issue. The check was actually issued by Business Systems. b. On March 25, the bank statement lists a $43 charge for the safety deposit box. Santana has not yet recorded this expense. c. On March 26, the bank statement lists a $110 charge for printed checks that Business Solutions ordered from the bank. Santana has not yet recorded this expense, d. On March 31, the bank statement lists $41 interest earned on Business Solutions's checking account for the month of March Santana has not yet recorded this revenue, e. S. Rey notices that the check she issued for $133 on March 31, 2020, has not yet cleared the bank. f. S. Rey verifies that all deposits made in March do appear on the March bank statement Required: 1. Prepare a bank reconciliation for Business Solutions for the month ended March 31, 2020. $ BUSINESS SOLUTIONS Bank Reconciliation March 31, 2020 66,766 Book balance Add Bank interest 540 $ Bank statement balance Add Bank error Deposits in Transit 67,285 540 41 41 S $ 67.306 67.326 Deduct Outstanding check 133 Deduct Safety deposit rental Charge for checks 43 110 133 $ 67.173 153 $ 67,173 Adjusted bank balance Adjusted book balance 2. Prepare any necessary adjusting entries. Use Miscellaneous Expenses, for any bank charges. Use Interest Revenue, for any interest earned on the checking account for March. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Debit Credit No Date Mar 31 General Journal No journal entry required > 1 153 2 Mar 31 Miscellaneous expense Cash lo 153 X 41 3 Mar 31 Cash Interest revenue XX 41 X x 4 Mar 31 No journal entry required 5 Mar 31 No Journal entry required Montoure Company uses a perpetual Inventory system. It entered into the following calendar-year purchases and sales transactions Units Sold at Retail Date Activities Jan. 1 Beginning inventory Yeb. 10 Purchase Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase Sept. 5 Purchase Sept. 10 Sales Totals Units Acquired at Cost 580 units $40 per unit 420 units e$38 per unit 180 units e $25 per unit 190 unitse $45 per unit 560 units @ $41 per unit 755 units e$70 per unit 750 units e$70 per unit 1,505 units 1,930 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. Cost of goods available for sale 75,170 1,930 units Number of units available for sale 2. Compute the number of units in ending inventory 425 units Ending inventory = 245 580 $ 23,200.00 $ 9,310.00 @ @ Mar 15 $ 40.00 s 38.00 > > 38.00 $ 25.00 11 175 @ 6,650.00 180 4,500.00 $ 13,810.00 $ 29,850.00 245 $ 9,310.00 Aug 21 190 @ 38.00 45.00 180 > @ > > 4,500.00 @ @ 190 25,00 $ 45,00 8,550.00 $ 22,360.00 245 # $ 9,310.00 > 560 Sept 5 41.00 180 4,500.00 38.00 $ 25.00 $ 45.00 $ 41.00 190 8 8,550.00 > > 560 1 @ 22.960.00 $ 45,320.00 245 @ $ 9,310.00 425 Sept 10 180 4,500.00 $ 38.00 S 25.00 $ 45.00 $ 41.00 190 8,550.00 135 @ 41.00 5,535.00 $ 27,895.00 $ 0.00 S 57.745.00 Totals Perpetual FIFO Perpetual LIFO > Red text indicates no response was expected in a celor a formul-based calculation is incorrect; no points deducted 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) Weighted Specific FIFO LIFO Average Identification Sales Less: Cost of goods sold 0 IS 0 0 Gross profit $ 0 ed text indicates no response was expected in a cell or o formula based calculation is incorrecting points deducted A machine costing $211,400 with a four-year life and an estimated $17,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 486,000 units of product during its life. It actually produces the following units: 122,000 in Year 1, 122,600 in Year 2, 119,900 in Year 3, 131,500 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method, (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) Complete this question by entering your answers in the tabs below. Units of Production DDB Straight Line Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Units of production Year Units 1 Units of Production Depreciable Depreciation Depreciation Units per unit Expense 122,000 $ 0.40$ 48,800 122,600 $ 0.40 49,040 119,900 $ 0.40 47,960 131,500 $ 0.40 52,600 $ 496,000 s 198,400 122,000 122,600 119.900 131,500 2 3 4 Total "Red text indicates no response was expected in a celor a formula based calculation is incorrect, no points deducted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started