please prvide answer for problem 1.30 and 2.30 and 3.28 thank you

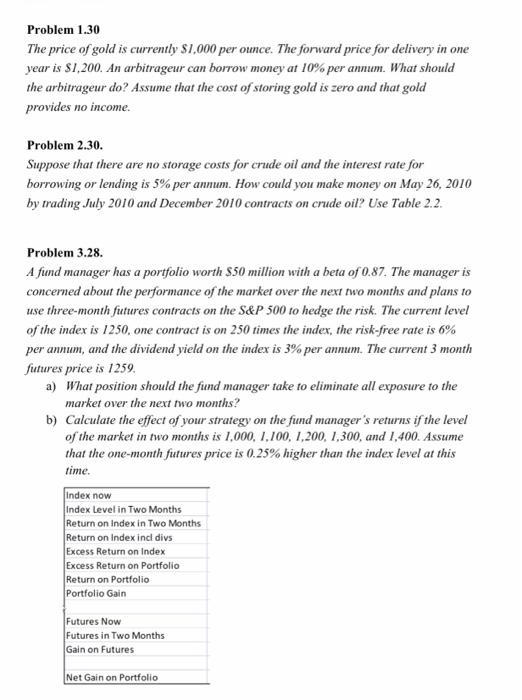

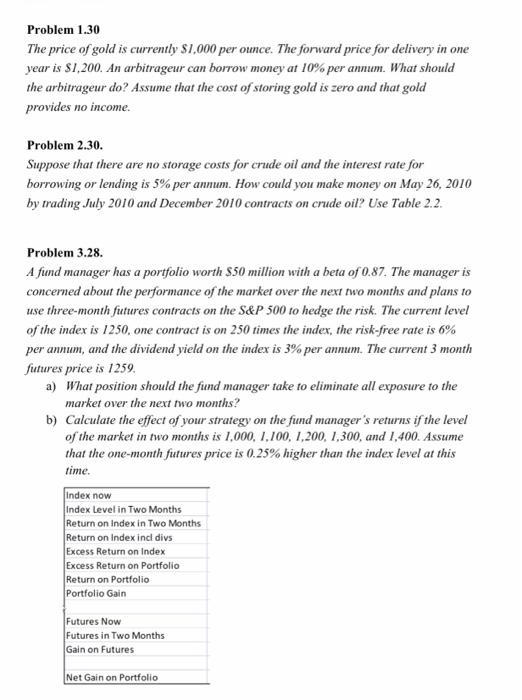

Problem 1.30 The price of gold is currently $1,000 per ounce. The forward price for delivery in one year is $1,200. An arbitrageur can borrow money at 10% per annum. What should the arbitrageur do? Assume that the cost of storing gold is zero and that gold provides no income. Problem 2.30. Suppose that there are no storage costs for crude oil and the interest rate for borrowing or lending is 5% per annum. How could you make money on May 26, 2010 by trading July 2010 and December 2010 contracts on crude oil? Use Table 2.2. Problem 3.28. A fund manager has a portfolio worth $50 million with a beta of 0.87. The manager is concerned about the performance of the market over the next two months and plans to use three-month futures contracts on the S&P 500 to hedge the risk. The current level of the index is 1250, one contract is on 250 times the index, the risk-free rate is 6% per annum, and the dividend yield on the index is 3% per annum. The current 3 month futures price is 1259 a) What position should the fund manager take to eliminate all exposure to the market over the next two months? b) Calculate the effect of your strategy on the fund manager's returns if the level of the market in two months is 1.000, 1.100, 1,200, 1,300, and 1,400. Assume that the one-month futures price is 0.25% higher than the index level at this time. Index now Index Level in Two Months Return on Index in Two Months Return on Index incl divs Excess Return on Index Excess Return on Portfolio Return on Portfolio Portfolio Gain Futures Now Futures in Two Months Gain on Futures Net Gain on Portfolio Problem 1.30 The price of gold is currently $1,000 per ounce. The forward price for delivery in one year is $1,200. An arbitrageur can borrow money at 10% per annum. What should the arbitrageur do? Assume that the cost of storing gold is zero and that gold provides no income. Problem 2.30. Suppose that there are no storage costs for crude oil and the interest rate for borrowing or lending is 5% per annum. How could you make money on May 26, 2010 by trading July 2010 and December 2010 contracts on crude oil? Use Table 2.2. Problem 3.28. A fund manager has a portfolio worth $50 million with a beta of 0.87. The manager is concerned about the performance of the market over the next two months and plans to use three-month futures contracts on the S&P 500 to hedge the risk. The current level of the index is 1250, one contract is on 250 times the index, the risk-free rate is 6% per annum, and the dividend yield on the index is 3% per annum. The current 3 month futures price is 1259 a) What position should the fund manager take to eliminate all exposure to the market over the next two months? b) Calculate the effect of your strategy on the fund manager's returns if the level of the market in two months is 1.000, 1.100, 1,200, 1,300, and 1,400. Assume that the one-month futures price is 0.25% higher than the index level at this time. Index now Index Level in Two Months Return on Index in Two Months Return on Index incl divs Excess Return on Index Excess Return on Portfolio Return on Portfolio Portfolio Gain Futures Now Futures in Two Months Gain on Futures Net Gain on Portfolio