PLEASE PUT ANSWERS AND FOURMULS INTO THE BOXES

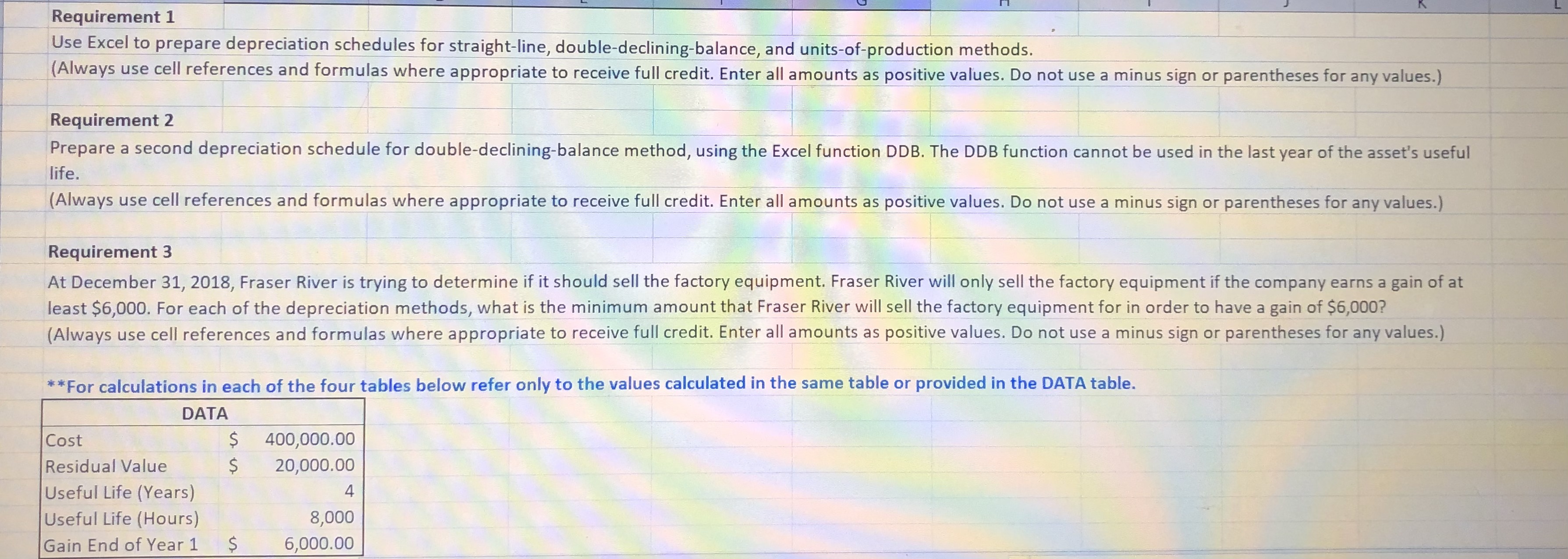

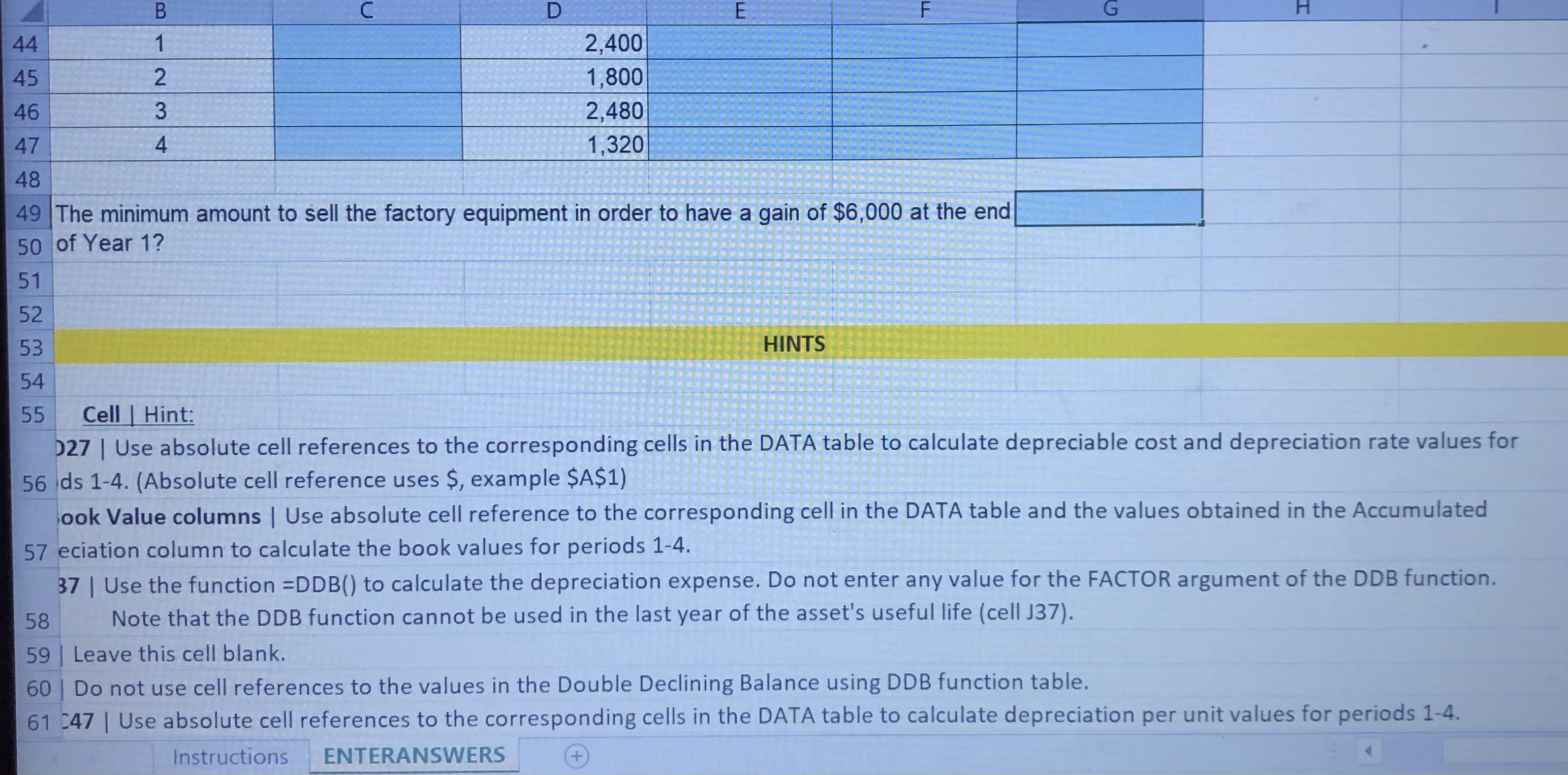

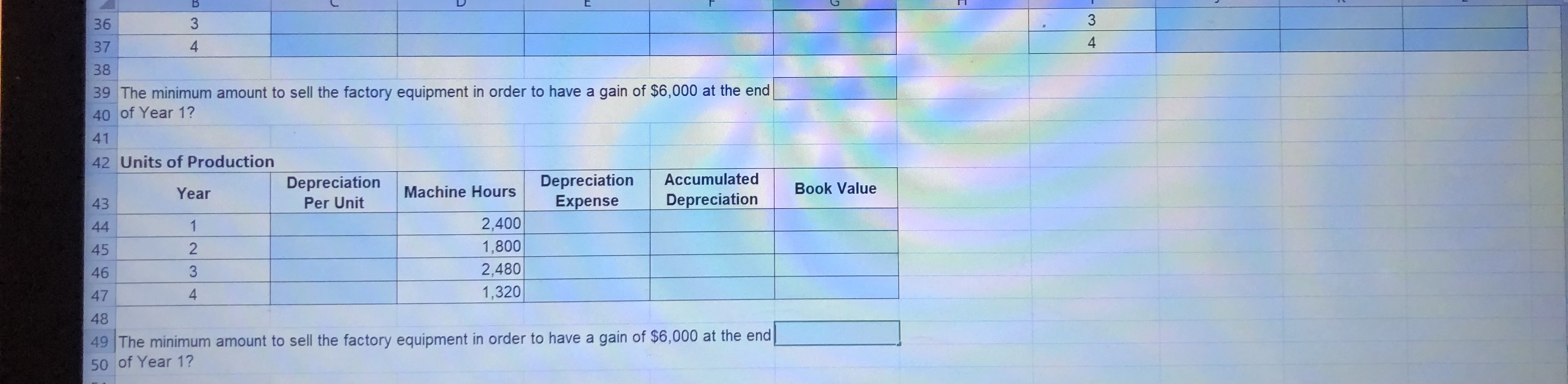

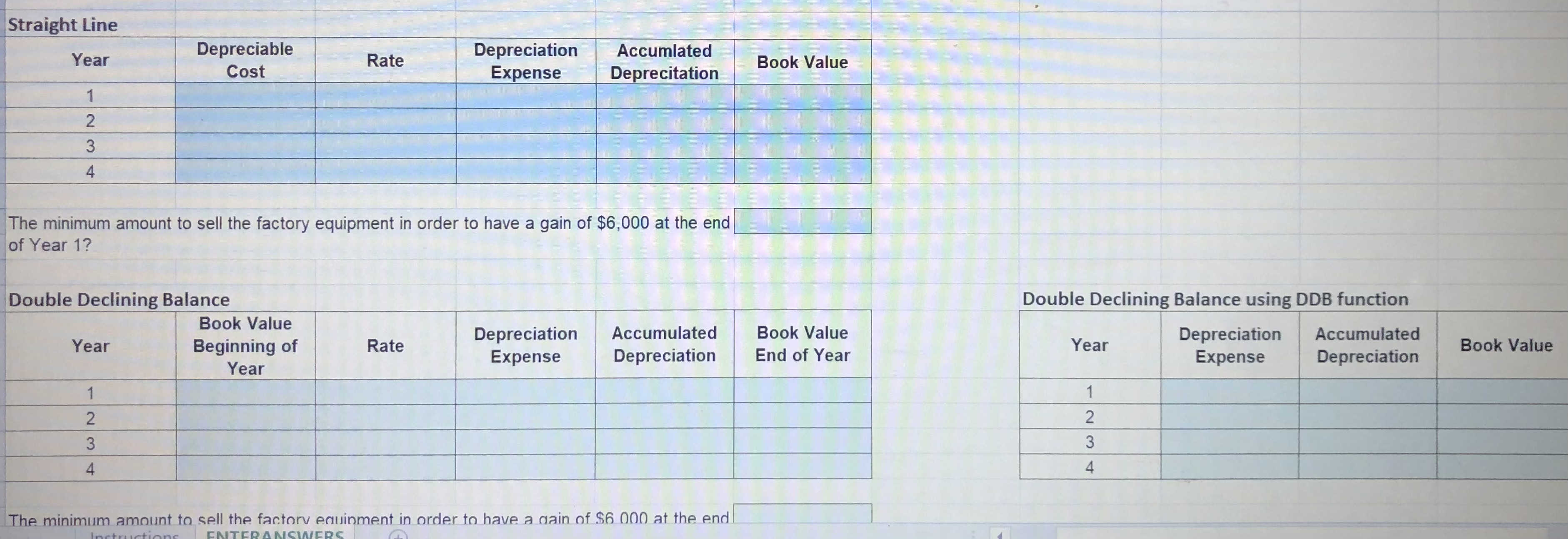

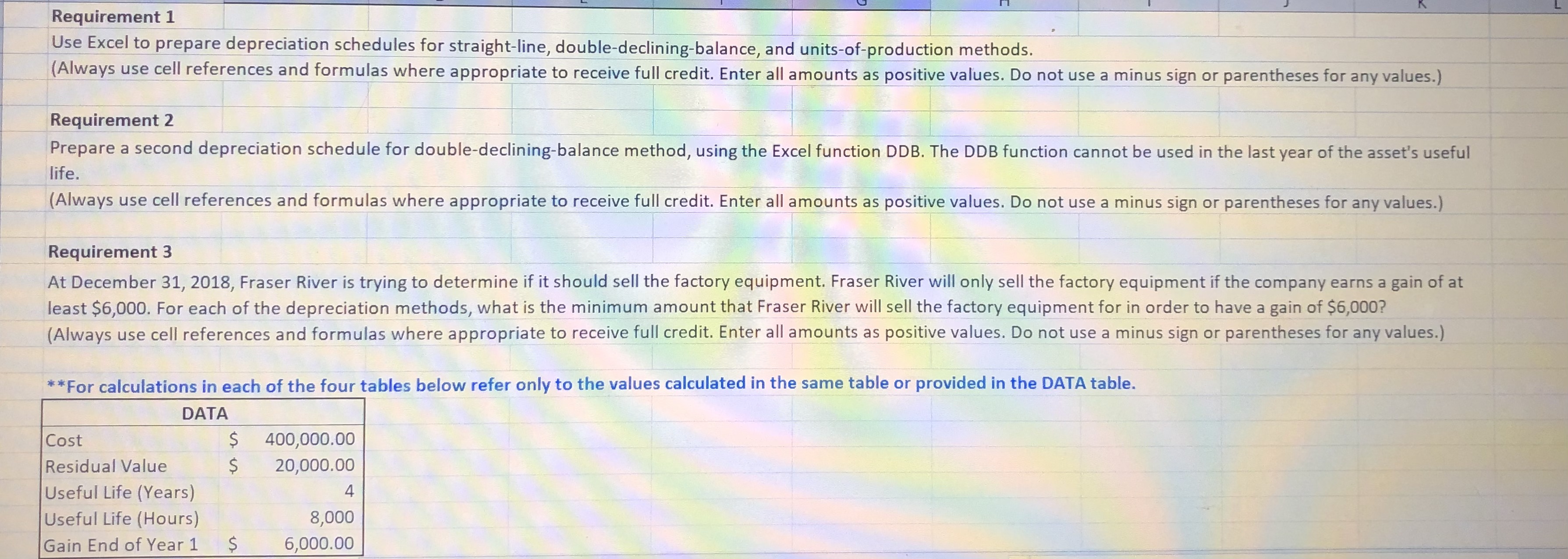

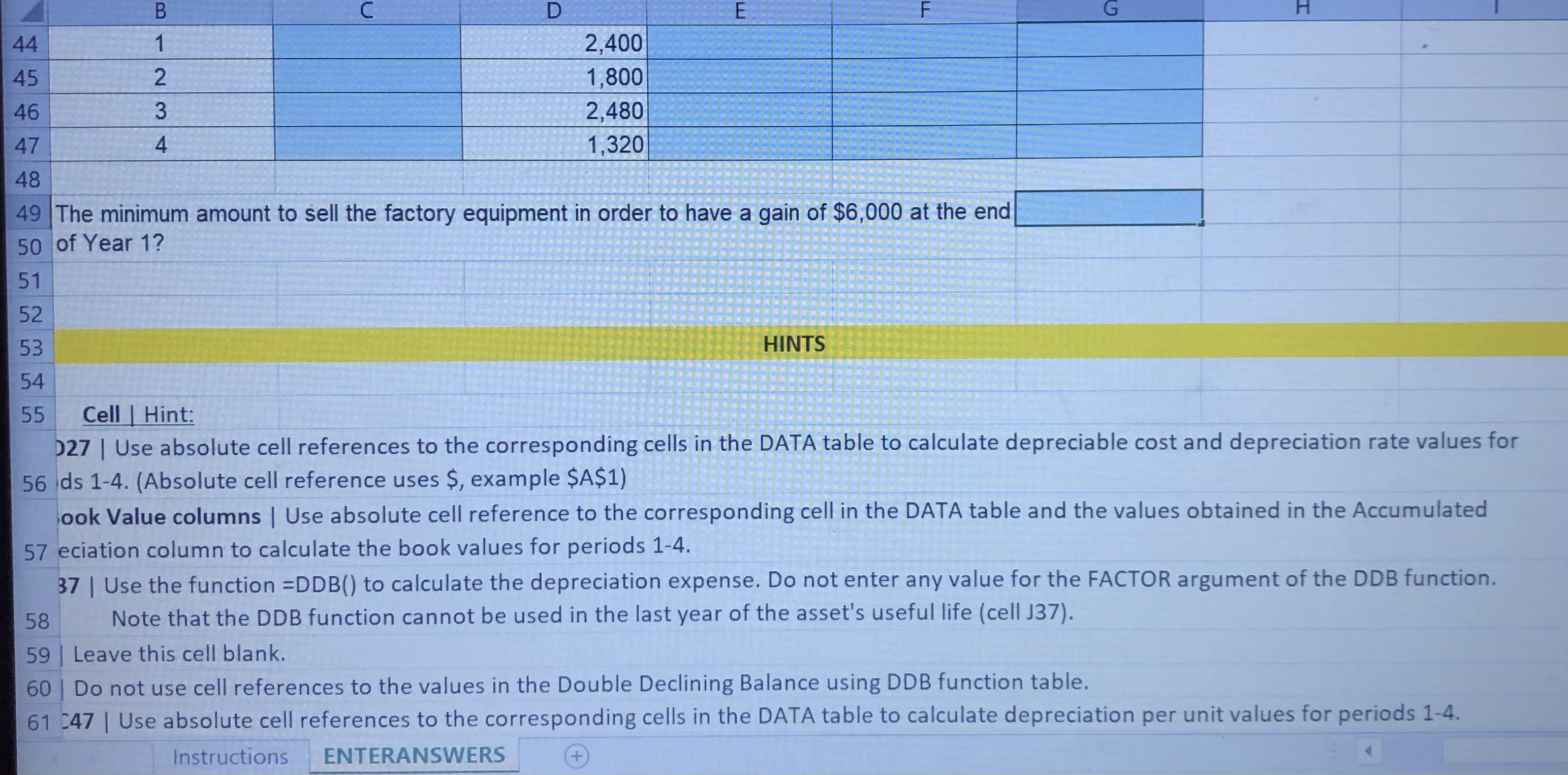

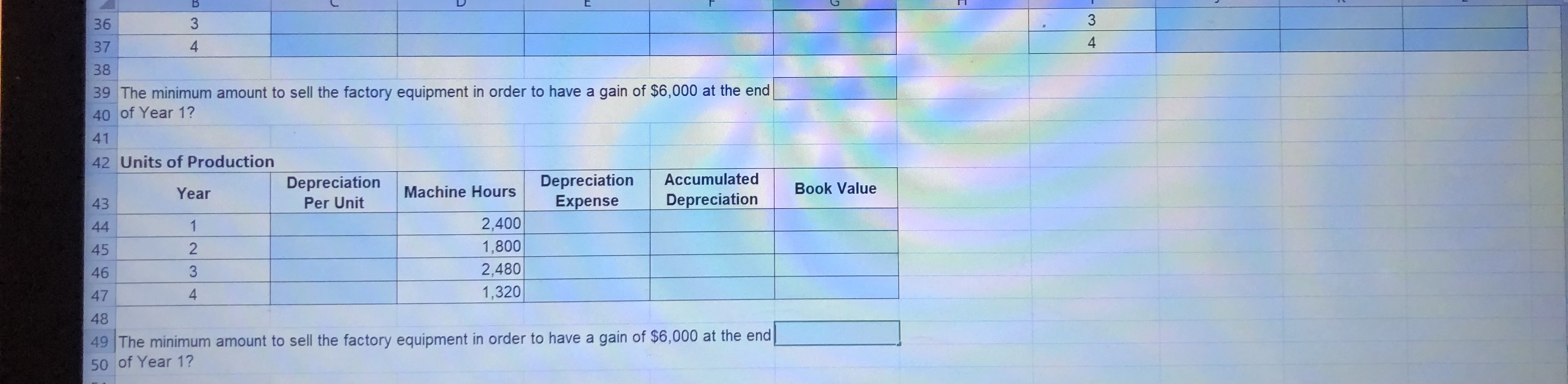

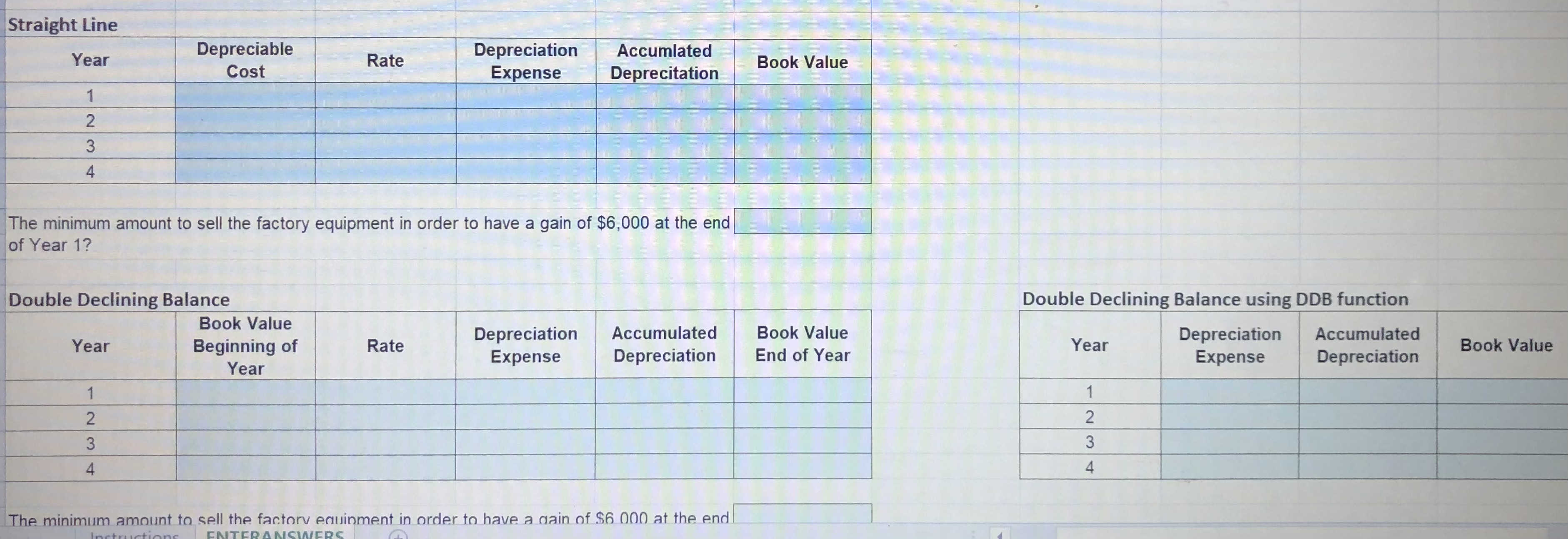

Requirement 5 Prepare a second depreciation schedule for double-declining-balance method, using the Excel function DDB. The DDB function cannot be used in the last year of the asset's useful life. (Always use cell references and formulas where appropriate to receive full credit. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values.) Requirement 3 At December 31, 2018, Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equipment if the company earns a gain of at least $6,000. For each of the depreciation methods, what is the minimum amount that Fraser River will sell the factory equipment for in order to have a gain of $6,000 ? (Always use cell references and formulas where appropriate to receive full credit. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values.) 55 Cell | Hint: 227 | Use absolute cell references to the corresponding cells in the DATA table to calculate depreciable cost and depreciation rate values for 56 ds 1-4. (Absolute cell reference uses \$, example \$A\$1) ook Value columns | Use absolute cell reference to the corresponding cell in the DATA table and the values obtained in the Accumulated 57 eciation column to calculate the book values for periods 1-4. 37 | Use the function =DDB() to calculate the depreciation expense. Do not enter any value for the FACTOR argument of the DDB function. Note that the DDB function cannot be used in the last year of the asset's useful life (cell J37). Leave this cell blank. 60 | Do not use cell references to the values in the Double Declining Balance using DDB function table. 61 -47 | Use absolute cell references to the corresponding cells in the DATA table to calculate depreciation per unit values for periods 1-4. 39 The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the end of Year 1 ? The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the end of Year 1 ? The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the end of Year 1? Double Declining Balance using DDB function