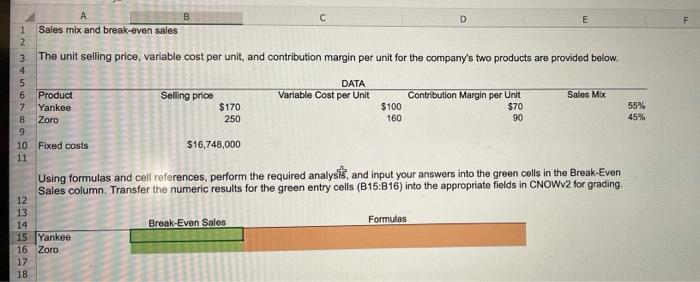

please put down the formula too.. thank you

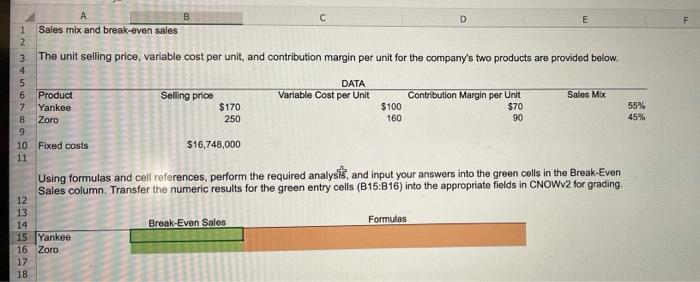

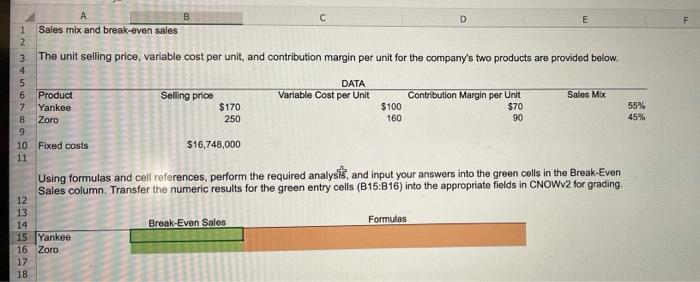

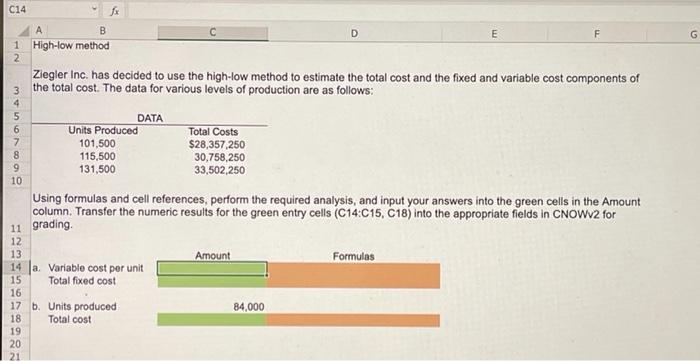

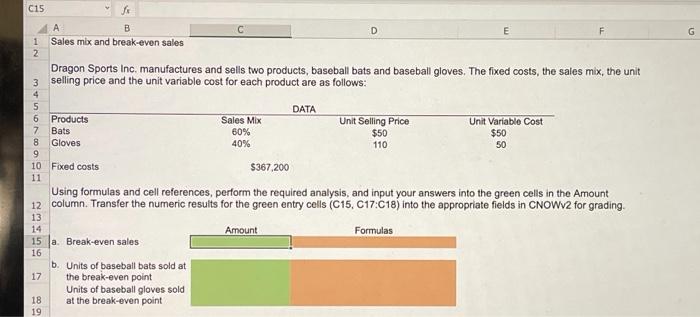

6 8 D E 1 Sales mix and break-even sales 2 3 The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. 4 5 DATA Product Selling price Variable Cost per Unit Contribution Margin per Unit Salos Mix 7 Yankee $170 $100 $70 55% 8 Zoro 250 160 90 45% 9 10 Fixed costs $16,748,000 11 Using formulas and cell references, perform the required analysis, and input your answers into the green cells in the Break-Even Sales column. Transfer the numeric results for the green entry cells (B15:B16) into the appropriate fields in CNOWV2 for grading, 12 13 14 Break-Even Sales Formulas 15 Yankee 16 Zoro 17 18 C14 f A B High-low method D E F G 1 2 Ziegler Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: DATA Units Produced 101,500 115,500 131,500 8 9 10 Total Costs $28,357,250 30,758,250 33,502,250 Using formulas and cell references, perform the required analysis, and input your answers into the green cells in the Amount column. Transfer the numeric results for the green entry cells (C14:C15, C18) into the appropriate fields in CNOWV2 for 11 grading. 12 13 Amount Formulas 14 a Variable cost per unit 15 Total fixed cost 16 17 b. Units produced 84,000 18 Total cost 19 20 21 G C15 fo A B D E F 1 Sales mix and break-even sales 2 Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs, the sales mix, the unit 3 selling price and the unit variable cost for each product are as follows: 4 5 DATA 6 Products Sales Mix Unit Selling Price Unit Variable Cost 7 Bats 60% $50 $50 8 Gloves 40% 110 50 9 10 Fixed costs $367,200 11 Using formulas and cell references, perform the required analysis, and input your answers into the green cells in the Amount 12 column. Transfer the numeric results for the green entry cells (C15, C17:C18) into the appropriate fields in CNOWV2 for grading 13 14 Amount Formulas 15 a. Break-even sales 16 b. Units of baseball bats sold at 17 the break-even point Units of baseball gloves sold 18 at the break-even point 19