Answered step by step

Verified Expert Solution

Question

1 Approved Answer

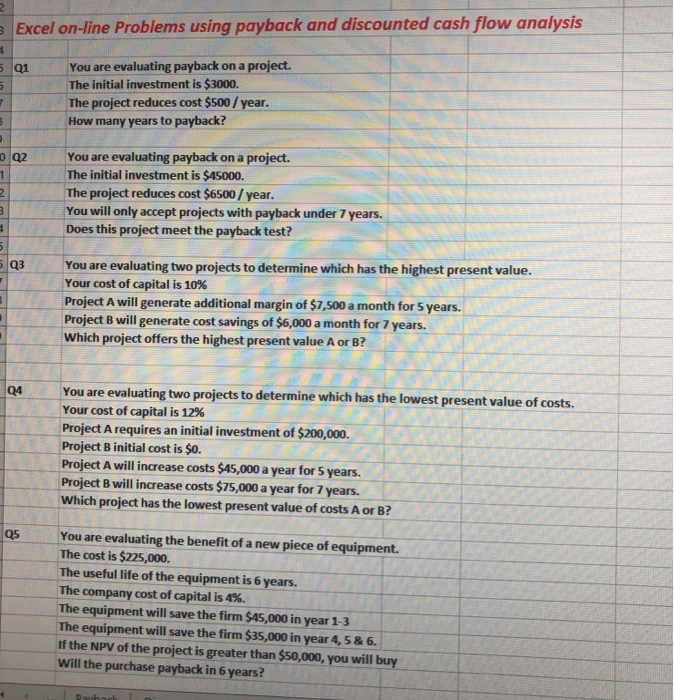

please put in the formulas that you used and the final answer. thanks ! i need this asap !! 2 Excel on-line Problems using payback

please put in the formulas that you used and the final answer. thanks !

i need this asap !!

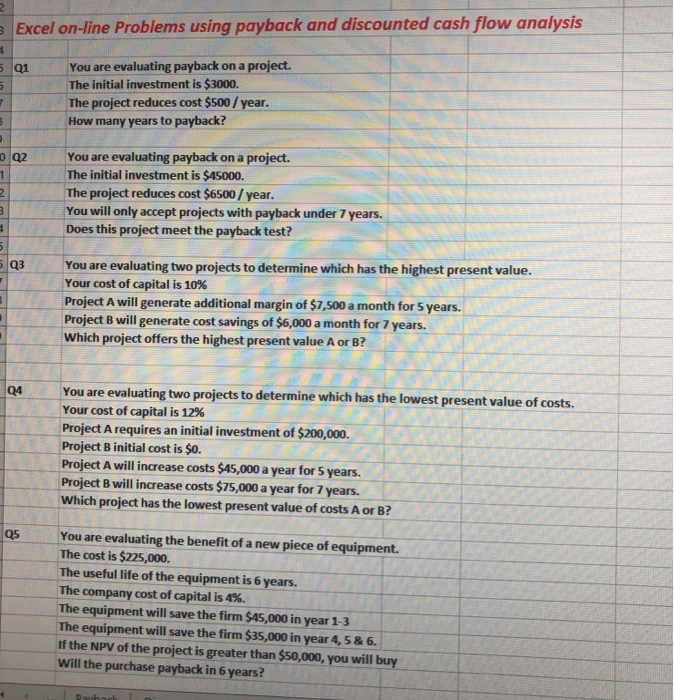

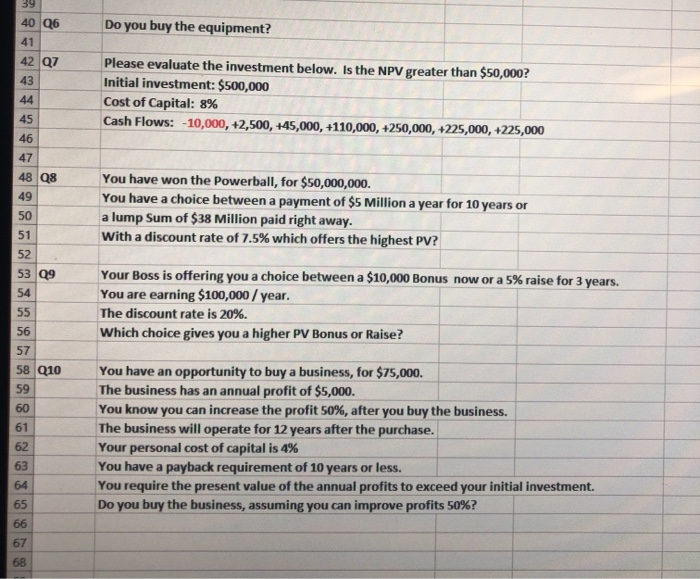

2 Excel on-line Problems using payback and discounted cash flow analysis You are evaluating payback on a project. The initial investment is $3000. The project reduces cost $500/year. How many years to payback? 5 Q1 You are evaluating payback on a project. The initial investment is $45000. The project reduces cost $6500/year. You will only accept projects with payback under 7 years. Does this project meet the payback test? o 02 2 You are evaluating two projects to determine which has the highest present value. Your cost of capital is 10% Project A will generate additional margin of $7,500 a month for 5 years. Project B will generate cost savings of $6,000 a month for 7 years. Which project offers the highest present value A or B? 5 Q3 You are evaluating two projects to determine which has the lowest present value of costs. Your cost of capital is 12 % Q4 Project A requires an initial investment of $200,000. Project B initial cost is $0. Project A will increase costs $45,000 a year for 5 years. Project B will increase costs $75,000 a year for 7 years. Which project has the lowest present value of costs A or B? You are evaluating the benefit of a new piece of equipment The cost is $225,000. The useful life of the equipment is 6 The company cost of capital is 4% The equipment will save the firm $45,000 in year 1-3 The equipment will save the firm $35,000 in year 4, 5 & 6. If the NPV of the project is greater than $50,000, you will buy Will the purchase payback in 6 years? Q5 years. Dauback 39 40 06 Do you buy the equipment? 41 42 Q7 Please evaluate the investment below. Is the NPV greater than $50,000? Initial investment: $500,000 Cost of Capital: 8% 43 44 45 Cash Flows:-10,000, +2,500, +45,000, +110,000, +250,000, +225,000, +225,000 46 47 48 Q8 You have won the Powerball, for $50,000,000. You have a choice between a payment of $5 Million a year for 10 years or 49 a lump Sum of $38 Million paid right away. With a discount rate of 7.5% which offers the highest PV? 50 51 52 53 Q9 Your Boss is offering you a choice between a $10,000 Bonus now or a 5% raise for 3 years. You are earning $100,000/year. The discount rate is 20%. Which choice gives you a higher PV Bonus or Raise? 54 55 56 57 58 Q10 You have an opportunity to buy a business, for $75,000. The business has an annual profit of $5,000. You know you can increase the profit 50% , after you buy the business. The business will operate for 12 years after the purchase. Your personal cost of capital is 49% You have a payback requirement of 10 years or less. You require the present value of the annual profits to exceed your initial investment. Do you buy the business, assuming you can improve profits 50%? 59 60 61 62 63 64 65 66 67 68 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started