Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please put the answer in tabular form for better clarification. Thanks Newark Plastics Corporation developed its overhead application rate from the annual budget. The budget

Please put the answer in tabular form for better clarification. Thanks

Please put the answer in tabular form for better clarification. Thanks

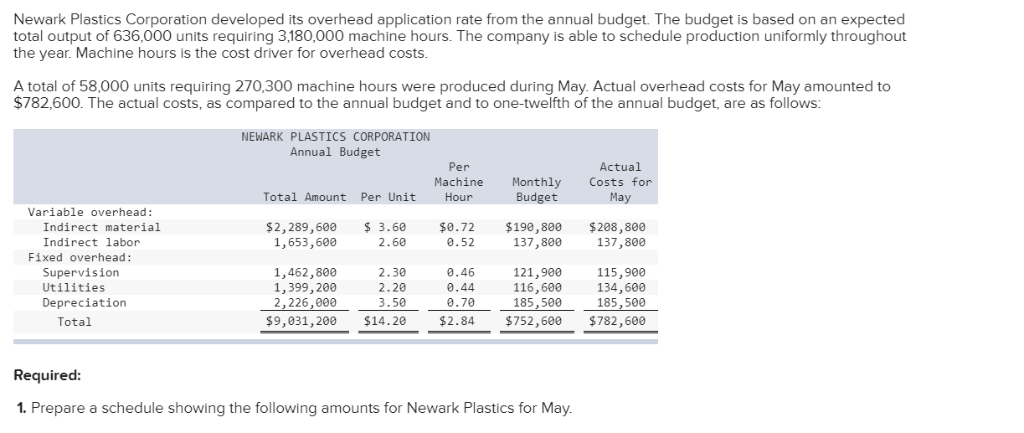

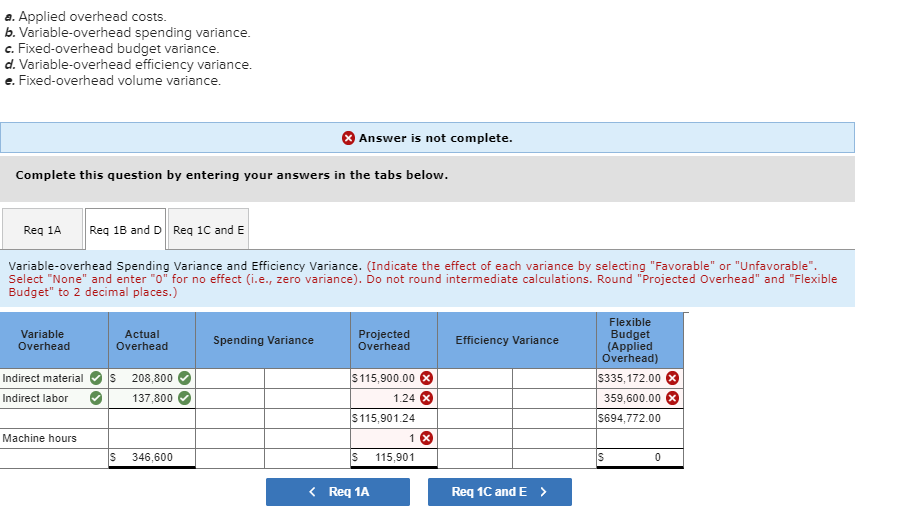

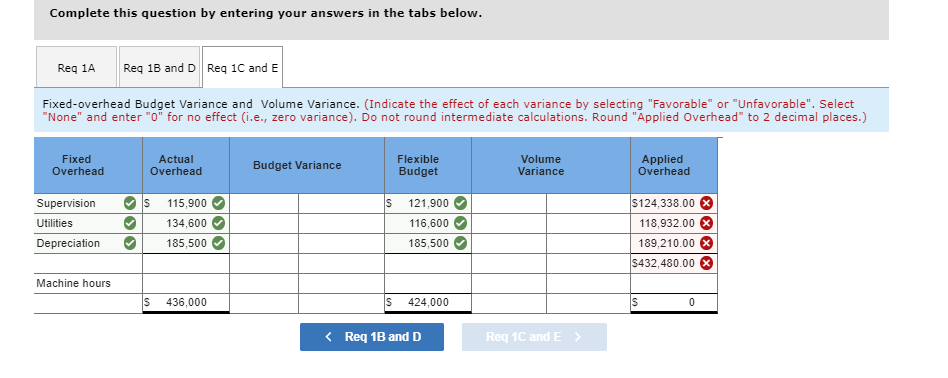

Newark Plastics Corporation developed its overhead application rate from the annual budget. The budget is based on an expected total output of 636,000 units requiring 3,180,000 machine hours. The company is able to schedule production uniformly throughout the year. Machine hours is the cost driver for overhead costs. A total of 58,000 units requiring 270,300 machine hours were produced during May. Actual overhead costs for May amounted to $782,600. The actual costs, as compared to the annual budget and to one-twelfth of the annual budget, are as follows: NEWARK PLASTICS CORPORATION Annual Budget Per Machine Total Amount Per Unit Hour Monthly Budget Actual Costs for May $2,289,600 1,653,600 $ 3.60 2.60 $0.72 0.52 $190,800 137,800 $ 208,800 137,800 Variable overhead: Indirect material Indirect labor Fixed overhead: Supervision Utilities Depreciation Total 1,462,800 1,399,200 2,226,000 $9,031,200 2.30 2.20 3.50 $14.20 0.46 0.44 0.70 $2.84 121,900 116,600 185,500 $752,600 115,900 134,600 185,500 $782,600 Required: 1. Prepare a schedule showing the following amounts for Newark Plastics for May. a. Applied overhead costs. b. Variable-overhead spending variance. c. Fixed-overhead budget variance. d. Variable-overhead efficiency variance. e. Fixed-overhead volume variance. > Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Req 1B and D Req 1C and E Variable-overhead Spending Variance and Efficiency Variance. (Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect i.e., zero variance). Do not round intermediate calculations. Round "Projected Overhead" and "Flexible Budget" to 2 decimal places.) Variable Overhead Actual Overhead Spending Variance Projected Overhead Efficiency Variance S Indirect material Indirect labor 208,800 137,800 $ 115,900.00 X 1.24 X $ 115,901.24 1 x $ 115,901 Flexible Budget (Applied Overhead) $335,172.00 359,600.00 % 5694,772.00 Machine hours S 346,600 SO Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B and D Req 1C and E Fixed-overhead Budget Variance and Volume Variance. (Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect i.e., zero variance). Do not round intermediate calculations. Round "Applied Overhead" to 2 decimal places.) Fixed Overhead Actual Overhead Budget Variance Flexible Budget Volume Variance Applied Overhead $ Supervision Utilities Depreciation 115,900 134,600 185,500 121,900 116,600 185,500 $124.338.00 118,932.00 X 189,210.00 $432,480.00 % Machine hours S 436,000 $ 424,000 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started