Answered step by step

Verified Expert Solution

Question

1 Approved Answer

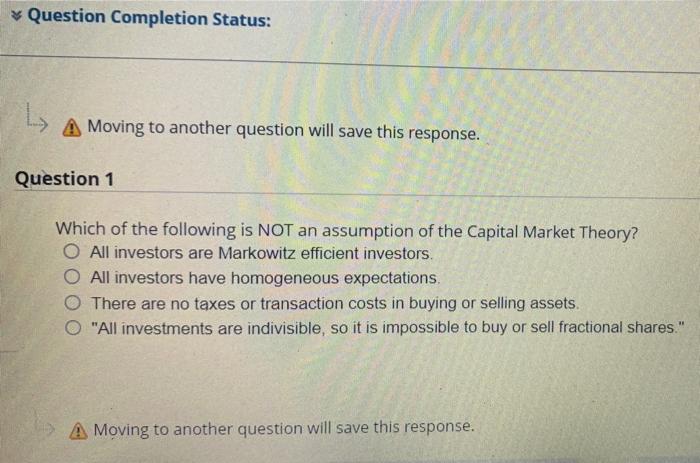

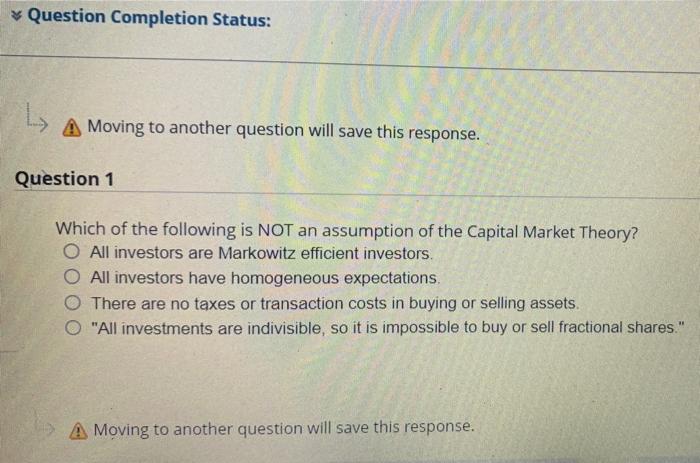

please quickly Question Completion Status: L A Moving to another question will save this response. Question 1 Which of the following is NOT an assumption

please quickly

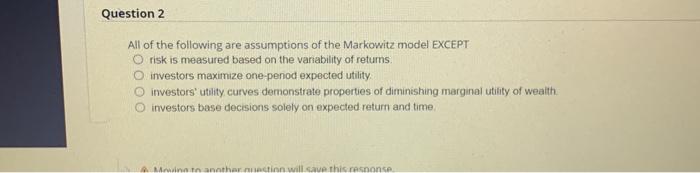

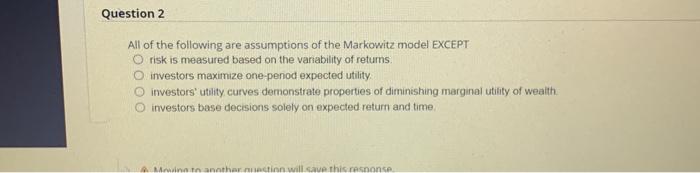

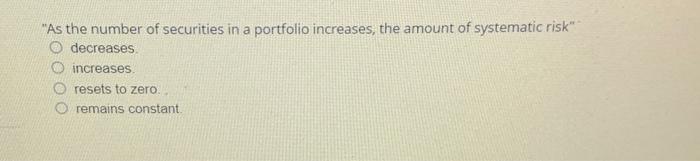

Question Completion Status: L A Moving to another question will save this response. Question 1 Which of the following is NOT an assumption of the Capital Market Theory? O All investors are Markowitz efficient investors. O All investors have homogeneous expectations, There are no taxes or transaction costs in buying or selling assets. O "All investments are indivisible, so it is impossible to buy or sell fractional shares." A Moving to another question will save this response. Question 2 All of the following are assumptions of the Markowitz model EXCEPT O risk is measured based on the variability of retums. investors maximize one-penod expected utility investors'utility curves demonstrate properties of diminishing marginal utility of wealth. investors base decisions solely on expected return and time Antanatharminction will save this resnonse "As the number of securities in a portfolio increases, the amount of systematic risk" decreases increases resets to zero remains constant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started