please re show work how to get answer

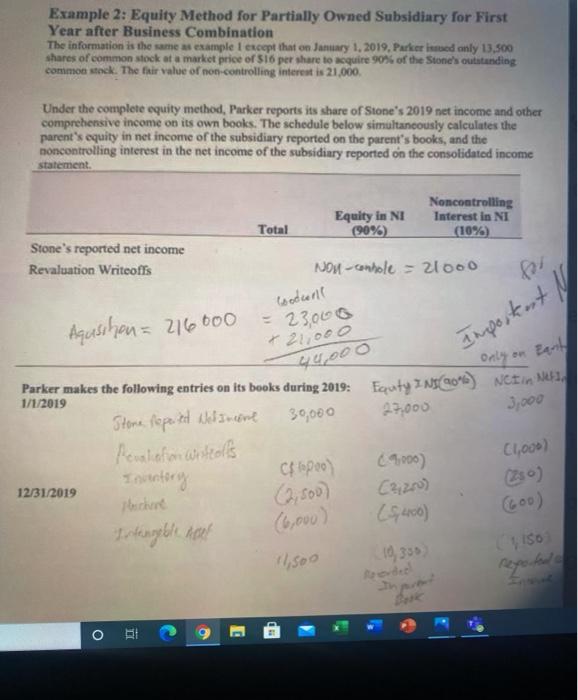

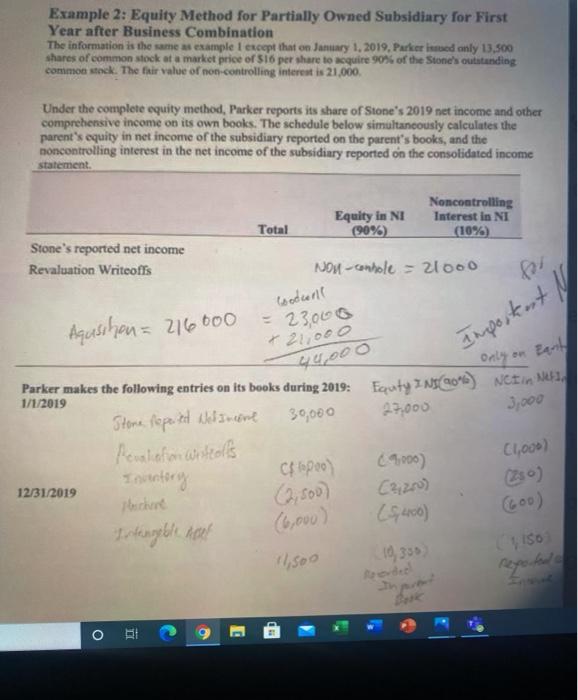

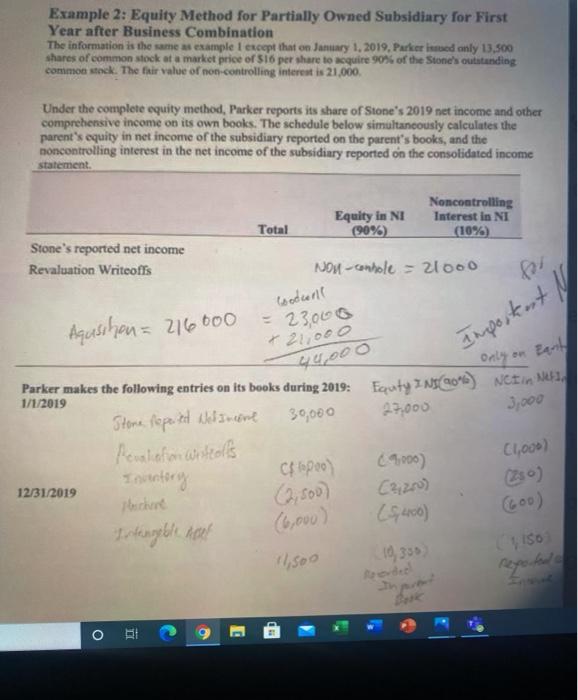

Example 2: Equity Method for Partially Owned Subsidiary for First Year after Business Combination The information is the same as example 1 except that on January 1, 2019. Parkeribed only 13,500 shares of common stock at a market price of 16 per share to equire 90% of the Stone's outstanding common stock. The fair value of non-controlling interest is 21,000. Under the complete equity method, Parker reports its share of Stone's 2019 net income and other comprehensive income on its own books. The schedule below simultaneously calculates the parent's equity in net income of the subsidiary reported on the parent's books, and the noncontrolling interest in the net income of the subsidiary reported on the consolidated income statement Noncontrolling Interest in NI (10%) Equity in NI (90%) Total Stone's reported net income Revaluation Writeoffs NON-Conhole - 21000 Aquschen = 216000 = 23,000 + 21,000 Important N Earl 44,000 Only on 3,000 C1,00) Parker makes the following entries on its books during 2019: Equity INSC0") NCE ME 1/1/2019 Stone, repeted Net Income 30,000 23,000 Pewakafan Writtel 49,000) Crpool Love stochure (5400) Intangeble at 10,30 12/31/2019 (6,000) 150 1,500 Podel o g E Example 2: Equity Method for Partially Owned Subsidiary for First Year after Business Combination The information is the same as example 1 except that on January 1, 2019. Parkeribed only 13,500 shares of common stock at a market price of 16 per share to equire 90% of the Stone's outstanding common stock. The fair value of non-controlling interest is 21,000. Under the complete equity method, Parker reports its share of Stone's 2019 net income and other comprehensive income on its own books. The schedule below simultaneously calculates the parent's equity in net income of the subsidiary reported on the parent's books, and the noncontrolling interest in the net income of the subsidiary reported on the consolidated income statement Noncontrolling Interest in NI (10%) Equity in NI (90%) Total Stone's reported net income Revaluation Writeoffs NON-Conhole - 21000 Aquschen = 216000 = 23,000 + 21,000 Important N Earl 44,000 Only on 3,000 C1,00) Parker makes the following entries on its books during 2019: Equity INSC0") NCE ME 1/1/2019 Stone, repeted Net Income 30,000 23,000 Pewakafan Writtel 49,000) Crpool Love stochure (5400) Intangeble at 10,30 12/31/2019 (6,000) 150 1,500 Podel o g E