Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please read ALL THREE questions CAREFULLY and answer ALL questions CORRECTLY. Please DOUBLE CHECK your work BEFORE posting the solution. Any wrong OR missing answers

Please read ALL THREE questions CAREFULLY and answer ALL questions CORRECTLY. Please DOUBLE CHECK your work BEFORE posting the solution. Any wrong OR missing answers will be DOWNVOTED. Thank you!

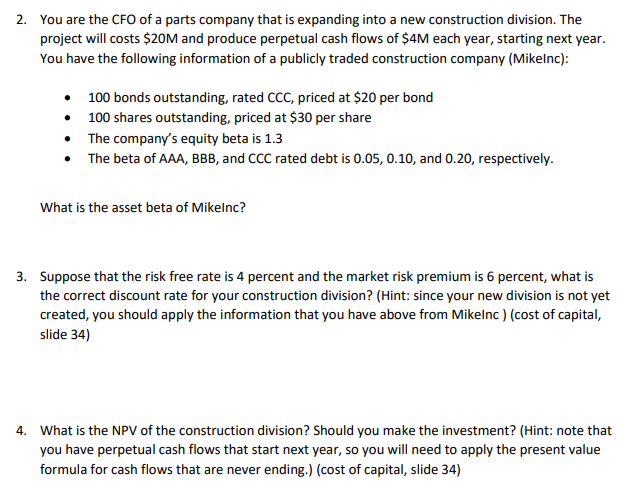

2. You are the CFO of a parts company that is expanding into a new construction division. The project will costs $20M and produce perpetual cash flows of $4M each year, starting next year. You have the following information of a publicly traded construction company (Mikelnc): - 100 bonds outstanding, rated CCC, priced at $20 per bond - 100 shares outstanding, priced at $30 per share - The company's equity beta is 1.3 - The beta of AAA, BBB, and CCC rated debt is 0.05,0.10, and 0.20 , respectively. What is the asset beta of Mikelnc? 3. Suppose that the risk free rate is 4 percent and the market risk premium is 6 percent, what is the correct discount rate for your construction division? (Hint: since your new division is not yet created, you should apply the information that you have above from Mikelnc) (cost of capital, slide 34) 4. What is the NPV of the construction division? Should you make the investment? (Hint: note that you have perpetual cash flows that start next year, so you will need to apply the present value formula for cash flows that are never ending.) (cost of capital, slide 34)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started