Please read and review the followng.

Questions: what is your bid for Plastic molding company? Give your valuation of the company using the three valuation approaches 1 : restated book value, 2: current market value using earning multiples, and 3: discounted future cash flow analysis. give reasons for arriving at your bid.

Also, pelase list terms and conditions for your offer to purchase (such as: Dollar amount down, amounts to be paid on a promissory note overtime, consulting payments to the previous owner, payments on a noncompete agreement, whether it is a purchase of stock or a purchase of assets etc.)

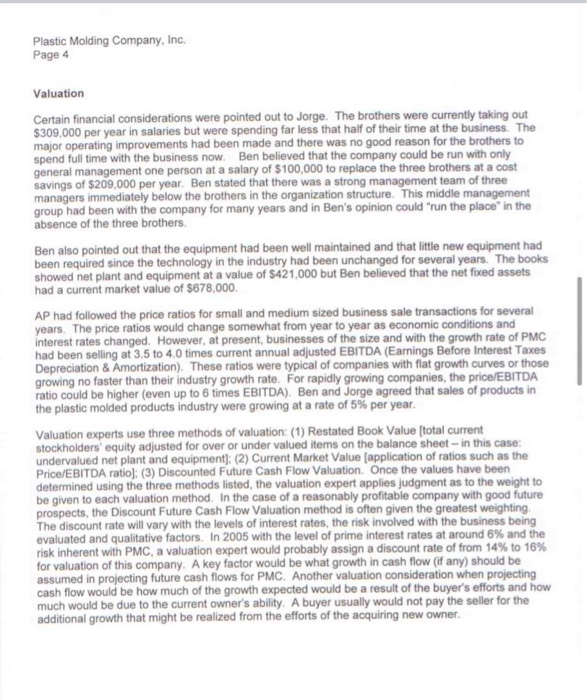

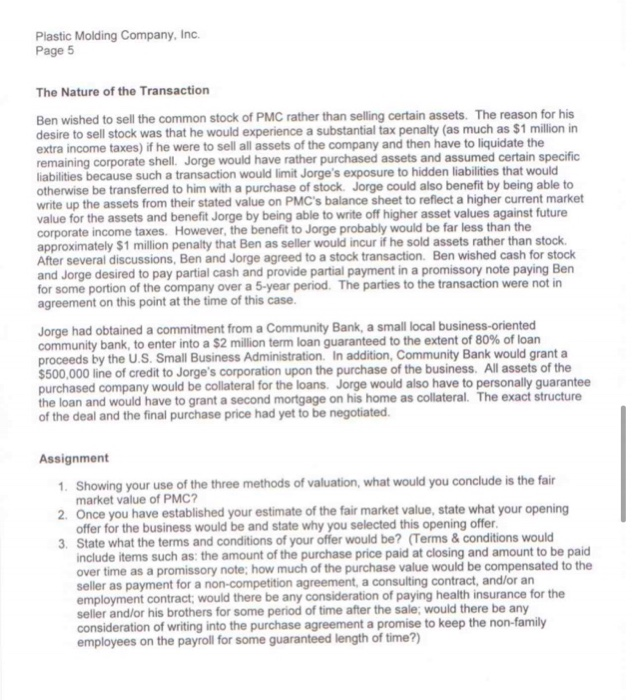

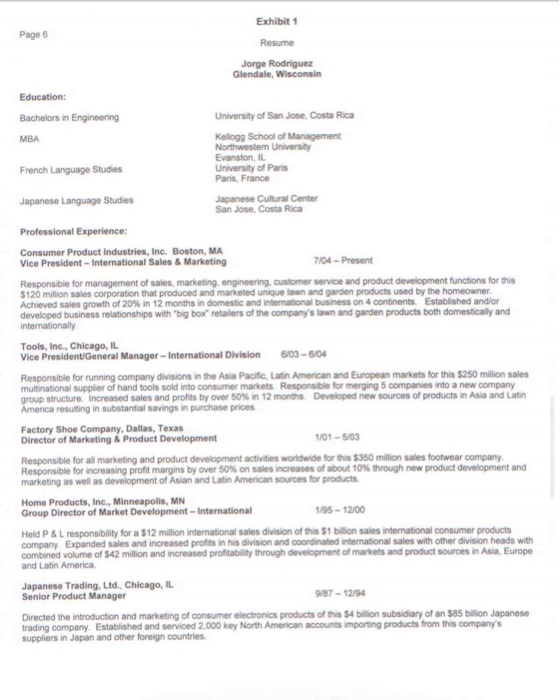

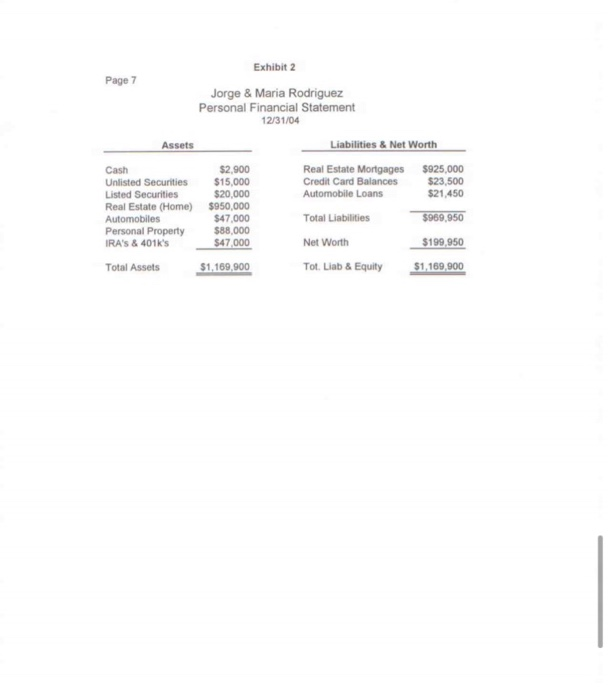

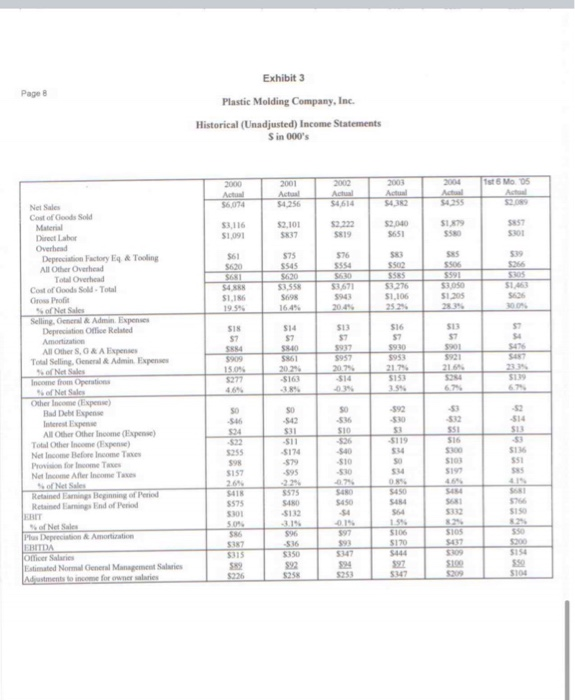

Plastic Molding Company, Inc. Jorge Rodriguez Jorge Rodriguez has been working for several large companies for his entire working career after emigrating from Cost Rica in 1986. He had been very successful rising to the position of vice president in charge of the international portion of two significant businesses in recent years. He had proven himself as a sound manager and someone who could grow sales and profits primarily through aggressive new product development, strong marketing and efficient overseas sourcing. Early in his career, he had obtained an MBA from the Kellogg School of Management at Northwestern University giving him polishing touches to his business career and creating a strong network of business executives to counsel and introduce him as needed to open the necessary doors for business development The positions that Jorge had held required much international travel and Jorge would often find himself gone from home from Sunday evening until Friday night or Saturday morning for many weeks at a time. Being a family-oriented person and having three children yet in elementary or high school Jorge felt that he was missing out on the growing up years with his children and decided to leave the world of large corporations and buy his own small business. Jorge believed that the skills that he had obtained through his education and his professional career to this point in time would put him in a good position to take a small business that could use his management skills, strong sales and marketing orientation and international sourcing ability and grow it into a significant business with substantial value. (See his resume contained in Exhibit 1.) Jorge had lived well in Glendale, an upscale section of the greater Milwaukee area, and had just put a major addition on his home. As a result, his first mortgage and home equity loan used up almost all of the equity in his home. However, he had a few investments and retirement funds to somewhat offset his car loans and credit card balances. However, to invest in a new business, he would need to call upon his father, a well-to-do entrepreneur in Costa Rica with several investments. Jorge's father had agreed to provide $500,000 in financing to assist Jorge in his quest for a business to buy and own (Jorge's and his wife's personal financial statement is shown in Exhibit 2) Jorge had kept in touch with executives he had known when he had worked with prior employers and let them know of his interest in finding a business to buy and run. One of these executives, now a CEO of a small but growing business, became aware of a business for sale that seemed to have a need for someone with Jorge's skills. This executive notified the investment banking firm handling the sale of this business and gave them Jorge's contact information. The firm contacted Jorge, obtained his signature on a confidentiality agreement and sent Jorge a Confidential Business Memorandum describing the business. Copyright 2005 by James H Hunter & Associates LLC. All rights reserved. The names, places and events in this case have been disguised to protect the confidential nature of the information provided To order copies or request permission to reproduce materials, write: Case Writing Office, James H Hunter & Associates LLC, PO Box 26335, Milwaukee, WI 53226. No part of this publication may be reproduced in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means -electronic, mechanical, photocopying, recording, or otherwise-without the permission of James H Hunter & Associates, LLC Plastic Molding Company, Inc. Page 2 Plastic Molding Company, Inc. Plastic Molding Company, Inc. (the business that was for sale) had been started in 1976 as family business engaged in molding a broad range of plastic office products. These products were manufactured to customers' specifications and were sold to office product manufacturers and distributors. The designs were prepared by the customers and Plastic Molding Company (PMC) just molded the products to the customers' designs. The founders grew the business to over $2 million in revenues and in 1996 decided to retire and sell the business to Ben Hooper who had been seeking a business to buy. Ben's desire was to find a business needing little investment in capital equipment and a company needing better efficiency in manufacturing operations. PMC was an ideal candidate since the founder had not been experienced in automation of manufacturing or in organizing production workers to operate with the greatest efficiency. A deal was struck, Ben put in about $21,000 and he borrowed the rest to make the purchase. He hired his brother, Ted, who was an expert in the manufacturing of molded plastic products and he hired his other brother, Jack, to run the sales department The company grew from the level of about $2 million at the time Ben purchased the business to a level peaking at $6 million in 2000. At that time PMC lost its major customer who pulled production into their shop rather than subcontract the plastic molding work to PMC. Ben decided to purchase a product line that PMC had been producing for a sales and marketing company to supplement the business lost when the largest customer pulled work in. This product line, called Lawn Helper, was a unique molded plastic stool that made it easy for home gardeners to work in their flower beds and carry the needed gardening tools. Lawn Helper Distribution of the product had included sales to several "big box' home centers and hardware chains as well as small independent garden centers and hardware retailers. The product had been patented but the patent had run out prior to Ben's purchase. The product line had represented about $500,000 in business to PMC annually when they had produced it for the previous owner of Lawn Helper, but once PMC acquired the product line in 2001, they realized that the price to retailers was very attractive and on the same number of units sold, the net sales volume was now in the range of $1 million annually. This product line went a long way toward making up for the loss in 2000 of PMC's major customer's business. Also, once PMC was both manufacturing the product and selling it to retailers, many economies were available to PMC and they were able to cut the manufacturing cost in half. Now that the Lawn Helper product line was well incorporated into PMC's production process, the bottom line profit for the company looked better and better every year. While unprofitable in 2001 and 2002, the company produced a positive cash flow in 2002 and an outright profit from 2003 forward. (See the financial statements in Exhibits 3 & 4.) Not only had Lawn Helper enhanced the bottom line, it put PMC into the position of having a proprietary product rather than just making office products that were manufactured to office product companies' specifications Plastic Molding Company, Inc. Page 4 Valuation Certain financial considerations were pointed out to Jorge. The brothers were currently taking out $309.000 per year in salaries but were spending far less that half of their time at the business. The major operating improvements had been made and there was no good reason for the brothers to spend full time with the business now. Ben believed that the company could be run with only general management one person at a salary of $100,000 to replace the three brothers at a cost savings of $209,000 per year. Ben stated that there was a strong management team of three managers immediately below the brothers in the organization structure. This middle management group had been with the company for many years and in Ben's opinion could "run the place in the absence of the three brothers. Ben also pointed out that the equipment had been well maintained and that little new equipment had been required since the technology in the industry had been unchanged for several years. The books showed net plant and equipment at a value of $421,000 but Ben believed that the net fixed assets had a current market value of $678,000 AP had followed the price ratios for small and medium sized business sale transactions for several years. The price ratios would change somewhat from year to year as economic conditions and interest rates changed. However, at present, businesses of the size and with the growth rate of PMC had been selling at 3.5 to 4.0 times current annual adjusted EBITDA (Earnings Before Interest Taxes Depreciation & Amortization). These ratios were typical of companies with flat growth curves or those growing no faster than their industry growth rate. For rapidly growing companies, the price/EBITDA ratio could be higher (even up to 6 times EBITDA). Ben and Jorge agreed that sales of products in the plastic molded products industry were growing at a rate of 5% per year. Valuation experts use three methods of valuation: (1) Restated Book Value (total current stockholders' equity adjusted for over or under valued items on the balance sheet - in this case: undervalued net plant and equipment); (2) Current Market Value (application of ratios such as the Price/EBITDA ratio): (3) Discounted Future Cash Flow Valuation. Once the values have been determined using the three methods listed, the valuation expert applies judgment as to the weight to be given to each valuation method. In the case of a reasonably profitable company with good future prospects, the Discount Future Cash Flow Valuation method is often given the greatest weighting The discount rate will vary with the levels of interest rates, the risk involved with the business being evaluated and qualitative factors. In 2005 with the level of prime interest rates at around 6% and the risk inherent with PMC, a valuation expert would probably assign a discount rate of from 14% to 16% for valuation of this company. A key factor would be what growth in cash flow (if any) should be assumed in projecting future cash flows for PMC. Another valuation consideration when projecting cash flow would be how much of the growth expected would be a result of the buyer's efforts and how much would be due to the current owner's ability. A buyer usually would not pay the seller for the additional growth that might be realized from the efforts of the acquiring new owner. Plastic Molding Company, Inc. Page 5 The Nature of the Transaction Ben wished to sell the common stock of PMC rather than selling certain assets. The reason for his desire to sell stock was that he would experience a substantial tax penalty (as much as $1 million in extra income taxes) if he were to sell all assets of the company and then have to liquidate the remaining corporate shell. Jorge would have rather purchased assets and assumed certain specific liabilities because such a transaction would limit Jorge's exposure to hidden liabilities that would otherwise be transferred to him with a purchase of stock. Jorge could also benefit by being able to write up the assets from their stated value on PMC's balance sheet to reflect a higher current market value for the assets and benefit Jorge by being able to write off higher asset values against future corporate income taxes. However, the benefit to Jorge probably would be far less than the approximately $1 million penalty that Ben as seller would incur if he sold assets rather than stock After several discussions, Ben and Jorge agreed to a stock transaction. Ben wished cash for stock and Jorge desired to pay partial cash and provide partial payment in a promissory note paying Ben for some portion of the company over a 5-year period. The parties to the transaction were not in agreement on this point at the time of this case. Jorge had obtained a commitment from a Community Bank, a small local business-oriented community bank, to enter into a $2 million term loan guaranteed to the extent of 80% of loan proceeds by the U.S. Small Business Administration. In addition, Community Bank would grant a $500,000 line of credit to Jorge's corporation upon the purchase of the business. All assets of the purchased company would be collateral for the loans. Jorge would also have to personally guarantee the loan and would have to grant a second mortgage on his home as collateral. The exact structure of the deal and the final purchase price had yet to be negotiated. Assignment 1. Showing your use of the three methods of valuation, what would you conclude is the fair market value of PMC? 2. Once you have established your estimate of the fair market value, state what your opening offer for the business would be and state why you selected this opening offer. 3. State what the terms and conditions of your offer would be? (Terms & conditions would include items such as the amount of the purchase price paid at closing and amount to be paid over time as a promissory note; how much of the purchase value would be compensated to the seller as payment for a non-competition agreement, a consulting contract, and/or an employment contract; would there be any consideration of paying health insurance for the seller and/or his brothers for some period of time after the sale; would there be any consideration of writing into the purchase agreement a promise to keep the non-family employees on the payroll for some guaranteed length of time?) Exhibit 1 Page 6 Resume Jorge Rodriguez Glendale, Wisconsin Education: Bachelors in Engineering University of San Jose, Costa Rica MBA Kellogg School of Management Northwestern University Evanston, IL University of Paris Paris, France French Language Studies Japanese Language Studies Japanese Cultural Center San Jose, Costa Rica Professional Experience: Consumer Product Industries, Inc. Boston, MA Vice President - International Sales & Marketing 7/04 - Present Responsible for management of sales, marketing, engineering, customer service and product development functions for this $120 million sales corporation that produced and marketed unique lawn and garden products used by the homeowner Achieved sales growth of 20% in 12 months in domestic and international business on 4 continents Established and/or developed business relationships with 'big box retailers of the company's lawn and garden products both domestically and internationally Tools, Inc., Chicago, IL Vice President General Manager - International Division 6/03-504 Responsible for running company divisions in the Asia Pacific, Latin American and European markets for this $250 million sales multinational supplier of hand tools sold into consumer markets. Responsible for merging 5 companies into a new company group structure. Increased sales and profits by over 50% in 12 months Developed new sources of products in Asia and Latin America resulting in substantial savings in purchase prices Factory Shoe Company, Dallas, Texas Director of Marketing & Product Development 1/01 - 5/03 Responsible for all marketing and product development activities worldwide for this $350 million sales footwear company Responsible for increasing profit margins by over 50% on sales increases of about 10% through new product development and marketing as well as development of Asian and Latin American Sources for products Home Products, Inc., Minneapolis, MN Group Director of Market Development - International 1/95-12/00 Held P&L responsibility for a $12 million international sales division of this $1 bilion sales international consumer products company Expanded sales and increased profits in his division and coordinated international sales with other division heads with combined volume of $42 million and increased profitability through development of markets and product sources in Asia, Europe and Latin America Japanese Trading, Ltd., Chicago, IL Senior Product Manager 9/87 - 12/94 Directed the introduction and marketing of consumer electronics products of this s4 billion subsidiary of an 585 bin Japanese trading company, Established and serviced 2.000 key North American accounts importing products from this company's suppliers in Japan and other foreign countries Exhibit 2 Page 7 Jorge & Maria Rodriguez Personal Financial Statement 12/31/04 Assets Liabilities & Net Worth Real Estate Mortgages Credit Card Balances Automobile Loans $925,000 $23.500 $21.450 Cash Unlisted Securities Listed Securities Real Estate (Home) Automobiles Personal Property IRA'S & 401k's $2,900 $15,000 $20,000 $950,000 $47.000 $88,000 $47.000 Total Liabilities $969,950 Net Worth $199,950 Total Assets $1,169,900 Tot. Liab & Equity $1,169,900 Exhibit 3 Page 8 Plastic Molding Company, Inc. Historical (Unadjusted) Income Statements Sin 000's 2001 2004 V 05 2000 Actual Actu 5667 2003 Actu 54.382 $4256 54614 $4255 $2.101 53.116 51 091 52.222 5819 50.000 5651 SIXT SSRO 5301 576 $61 5620 SX3 5502 5554 Nel Sales Cast of Good Sold Material Direct Labor Overhead Depreciation Factory Tooling All Other Overhead TO Overhead Cost of Goods S . Total CroProfit of Net Sales Selling General Admin Expenses Depreciation Office Related Amortation All Other SOA Expenses Total Selling General Admin Expenses 575 5525 5420 SE55 5698 16.49 $3671 54 KK S1.16 5376 $1,106 252 S1205 $426 SIS $14 $13 $16 S13 ST SYD S90 5840 5861 5931 $957 $909 15.09 31 $14 464 -5163 3.8%. -592 520 -546 -542 52 5119 Income from Operations of Net Sales Other Income (Expense) Bad Debt Expense Interest Expense All Other Other Income (Expense) Total Other Income (Expense) Net Income Hefewe In The Proformes Net Income After Income Taxes of Net Sales Retained Emin Beginning of Period Read End of Period SO S101 519 .579 -395 551 S157 40 S10 -S10 07 SER 5450 54 1 5575 SINO SER 5418 5575 SOL 50 SS 561 SU $106 of Net Sales Depreci Amortization FRITDA Onicer Salaries Estimated Normal General Management Sales Adjustments income for worries S17 5315 S350 $92 S609 su $926 5253 SU $100 Plastic Molding Company, Inc. Jorge Rodriguez Jorge Rodriguez has been working for several large companies for his entire working career after emigrating from Cost Rica in 1986. He had been very successful rising to the position of vice president in charge of the international portion of two significant businesses in recent years. He had proven himself as a sound manager and someone who could grow sales and profits primarily through aggressive new product development, strong marketing and efficient overseas sourcing. Early in his career, he had obtained an MBA from the Kellogg School of Management at Northwestern University giving him polishing touches to his business career and creating a strong network of business executives to counsel and introduce him as needed to open the necessary doors for business development The positions that Jorge had held required much international travel and Jorge would often find himself gone from home from Sunday evening until Friday night or Saturday morning for many weeks at a time. Being a family-oriented person and having three children yet in elementary or high school Jorge felt that he was missing out on the growing up years with his children and decided to leave the world of large corporations and buy his own small business. Jorge believed that the skills that he had obtained through his education and his professional career to this point in time would put him in a good position to take a small business that could use his management skills, strong sales and marketing orientation and international sourcing ability and grow it into a significant business with substantial value. (See his resume contained in Exhibit 1.) Jorge had lived well in Glendale, an upscale section of the greater Milwaukee area, and had just put a major addition on his home. As a result, his first mortgage and home equity loan used up almost all of the equity in his home. However, he had a few investments and retirement funds to somewhat offset his car loans and credit card balances. However, to invest in a new business, he would need to call upon his father, a well-to-do entrepreneur in Costa Rica with several investments. Jorge's father had agreed to provide $500,000 in financing to assist Jorge in his quest for a business to buy and own (Jorge's and his wife's personal financial statement is shown in Exhibit 2) Jorge had kept in touch with executives he had known when he had worked with prior employers and let them know of his interest in finding a business to buy and run. One of these executives, now a CEO of a small but growing business, became aware of a business for sale that seemed to have a need for someone with Jorge's skills. This executive notified the investment banking firm handling the sale of this business and gave them Jorge's contact information. The firm contacted Jorge, obtained his signature on a confidentiality agreement and sent Jorge a Confidential Business Memorandum describing the business. Copyright 2005 by James H Hunter & Associates LLC. All rights reserved. The names, places and events in this case have been disguised to protect the confidential nature of the information provided To order copies or request permission to reproduce materials, write: Case Writing Office, James H Hunter & Associates LLC, PO Box 26335, Milwaukee, WI 53226. No part of this publication may be reproduced in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means -electronic, mechanical, photocopying, recording, or otherwise-without the permission of James H Hunter & Associates, LLC Plastic Molding Company, Inc. Page 2 Plastic Molding Company, Inc. Plastic Molding Company, Inc. (the business that was for sale) had been started in 1976 as family business engaged in molding a broad range of plastic office products. These products were manufactured to customers' specifications and were sold to office product manufacturers and distributors. The designs were prepared by the customers and Plastic Molding Company (PMC) just molded the products to the customers' designs. The founders grew the business to over $2 million in revenues and in 1996 decided to retire and sell the business to Ben Hooper who had been seeking a business to buy. Ben's desire was to find a business needing little investment in capital equipment and a company needing better efficiency in manufacturing operations. PMC was an ideal candidate since the founder had not been experienced in automation of manufacturing or in organizing production workers to operate with the greatest efficiency. A deal was struck, Ben put in about $21,000 and he borrowed the rest to make the purchase. He hired his brother, Ted, who was an expert in the manufacturing of molded plastic products and he hired his other brother, Jack, to run the sales department The company grew from the level of about $2 million at the time Ben purchased the business to a level peaking at $6 million in 2000. At that time PMC lost its major customer who pulled production into their shop rather than subcontract the plastic molding work to PMC. Ben decided to purchase a product line that PMC had been producing for a sales and marketing company to supplement the business lost when the largest customer pulled work in. This product line, called Lawn Helper, was a unique molded plastic stool that made it easy for home gardeners to work in their flower beds and carry the needed gardening tools. Lawn Helper Distribution of the product had included sales to several "big box' home centers and hardware chains as well as small independent garden centers and hardware retailers. The product had been patented but the patent had run out prior to Ben's purchase. The product line had represented about $500,000 in business to PMC annually when they had produced it for the previous owner of Lawn Helper, but once PMC acquired the product line in 2001, they realized that the price to retailers was very attractive and on the same number of units sold, the net sales volume was now in the range of $1 million annually. This product line went a long way toward making up for the loss in 2000 of PMC's major customer's business. Also, once PMC was both manufacturing the product and selling it to retailers, many economies were available to PMC and they were able to cut the manufacturing cost in half. Now that the Lawn Helper product line was well incorporated into PMC's production process, the bottom line profit for the company looked better and better every year. While unprofitable in 2001 and 2002, the company produced a positive cash flow in 2002 and an outright profit from 2003 forward. (See the financial statements in Exhibits 3 & 4.) Not only had Lawn Helper enhanced the bottom line, it put PMC into the position of having a proprietary product rather than just making office products that were manufactured to office product companies' specifications Plastic Molding Company, Inc. Page 4 Valuation Certain financial considerations were pointed out to Jorge. The brothers were currently taking out $309.000 per year in salaries but were spending far less that half of their time at the business. The major operating improvements had been made and there was no good reason for the brothers to spend full time with the business now. Ben believed that the company could be run with only general management one person at a salary of $100,000 to replace the three brothers at a cost savings of $209,000 per year. Ben stated that there was a strong management team of three managers immediately below the brothers in the organization structure. This middle management group had been with the company for many years and in Ben's opinion could "run the place in the absence of the three brothers. Ben also pointed out that the equipment had been well maintained and that little new equipment had been required since the technology in the industry had been unchanged for several years. The books showed net plant and equipment at a value of $421,000 but Ben believed that the net fixed assets had a current market value of $678,000 AP had followed the price ratios for small and medium sized business sale transactions for several years. The price ratios would change somewhat from year to year as economic conditions and interest rates changed. However, at present, businesses of the size and with the growth rate of PMC had been selling at 3.5 to 4.0 times current annual adjusted EBITDA (Earnings Before Interest Taxes Depreciation & Amortization). These ratios were typical of companies with flat growth curves or those growing no faster than their industry growth rate. For rapidly growing companies, the price/EBITDA ratio could be higher (even up to 6 times EBITDA). Ben and Jorge agreed that sales of products in the plastic molded products industry were growing at a rate of 5% per year. Valuation experts use three methods of valuation: (1) Restated Book Value (total current stockholders' equity adjusted for over or under valued items on the balance sheet - in this case: undervalued net plant and equipment); (2) Current Market Value (application of ratios such as the Price/EBITDA ratio): (3) Discounted Future Cash Flow Valuation. Once the values have been determined using the three methods listed, the valuation expert applies judgment as to the weight to be given to each valuation method. In the case of a reasonably profitable company with good future prospects, the Discount Future Cash Flow Valuation method is often given the greatest weighting The discount rate will vary with the levels of interest rates, the risk involved with the business being evaluated and qualitative factors. In 2005 with the level of prime interest rates at around 6% and the risk inherent with PMC, a valuation expert would probably assign a discount rate of from 14% to 16% for valuation of this company. A key factor would be what growth in cash flow (if any) should be assumed in projecting future cash flows for PMC. Another valuation consideration when projecting cash flow would be how much of the growth expected would be a result of the buyer's efforts and how much would be due to the current owner's ability. A buyer usually would not pay the seller for the additional growth that might be realized from the efforts of the acquiring new owner. Plastic Molding Company, Inc. Page 5 The Nature of the Transaction Ben wished to sell the common stock of PMC rather than selling certain assets. The reason for his desire to sell stock was that he would experience a substantial tax penalty (as much as $1 million in extra income taxes) if he were to sell all assets of the company and then have to liquidate the remaining corporate shell. Jorge would have rather purchased assets and assumed certain specific liabilities because such a transaction would limit Jorge's exposure to hidden liabilities that would otherwise be transferred to him with a purchase of stock. Jorge could also benefit by being able to write up the assets from their stated value on PMC's balance sheet to reflect a higher current market value for the assets and benefit Jorge by being able to write off higher asset values against future corporate income taxes. However, the benefit to Jorge probably would be far less than the approximately $1 million penalty that Ben as seller would incur if he sold assets rather than stock After several discussions, Ben and Jorge agreed to a stock transaction. Ben wished cash for stock and Jorge desired to pay partial cash and provide partial payment in a promissory note paying Ben for some portion of the company over a 5-year period. The parties to the transaction were not in agreement on this point at the time of this case. Jorge had obtained a commitment from a Community Bank, a small local business-oriented community bank, to enter into a $2 million term loan guaranteed to the extent of 80% of loan proceeds by the U.S. Small Business Administration. In addition, Community Bank would grant a $500,000 line of credit to Jorge's corporation upon the purchase of the business. All assets of the purchased company would be collateral for the loans. Jorge would also have to personally guarantee the loan and would have to grant a second mortgage on his home as collateral. The exact structure of the deal and the final purchase price had yet to be negotiated. Assignment 1. Showing your use of the three methods of valuation, what would you conclude is the fair market value of PMC? 2. Once you have established your estimate of the fair market value, state what your opening offer for the business would be and state why you selected this opening offer. 3. State what the terms and conditions of your offer would be? (Terms & conditions would include items such as the amount of the purchase price paid at closing and amount to be paid over time as a promissory note; how much of the purchase value would be compensated to the seller as payment for a non-competition agreement, a consulting contract, and/or an employment contract; would there be any consideration of paying health insurance for the seller and/or his brothers for some period of time after the sale; would there be any consideration of writing into the purchase agreement a promise to keep the non-family employees on the payroll for some guaranteed length of time?) Exhibit 1 Page 6 Resume Jorge Rodriguez Glendale, Wisconsin Education: Bachelors in Engineering University of San Jose, Costa Rica MBA Kellogg School of Management Northwestern University Evanston, IL University of Paris Paris, France French Language Studies Japanese Language Studies Japanese Cultural Center San Jose, Costa Rica Professional Experience: Consumer Product Industries, Inc. Boston, MA Vice President - International Sales & Marketing 7/04 - Present Responsible for management of sales, marketing, engineering, customer service and product development functions for this $120 million sales corporation that produced and marketed unique lawn and garden products used by the homeowner Achieved sales growth of 20% in 12 months in domestic and international business on 4 continents Established and/or developed business relationships with 'big box retailers of the company's lawn and garden products both domestically and internationally Tools, Inc., Chicago, IL Vice President General Manager - International Division 6/03-504 Responsible for running company divisions in the Asia Pacific, Latin American and European markets for this $250 million sales multinational supplier of hand tools sold into consumer markets. Responsible for merging 5 companies into a new company group structure. Increased sales and profits by over 50% in 12 months Developed new sources of products in Asia and Latin America resulting in substantial savings in purchase prices Factory Shoe Company, Dallas, Texas Director of Marketing & Product Development 1/01 - 5/03 Responsible for all marketing and product development activities worldwide for this $350 million sales footwear company Responsible for increasing profit margins by over 50% on sales increases of about 10% through new product development and marketing as well as development of Asian and Latin American Sources for products Home Products, Inc., Minneapolis, MN Group Director of Market Development - International 1/95-12/00 Held P&L responsibility for a $12 million international sales division of this $1 bilion sales international consumer products company Expanded sales and increased profits in his division and coordinated international sales with other division heads with combined volume of $42 million and increased profitability through development of markets and product sources in Asia, Europe and Latin America Japanese Trading, Ltd., Chicago, IL Senior Product Manager 9/87 - 12/94 Directed the introduction and marketing of consumer electronics products of this s4 billion subsidiary of an 585 bin Japanese trading company, Established and serviced 2.000 key North American accounts importing products from this company's suppliers in Japan and other foreign countries Exhibit 2 Page 7 Jorge & Maria Rodriguez Personal Financial Statement 12/31/04 Assets Liabilities & Net Worth Real Estate Mortgages Credit Card Balances Automobile Loans $925,000 $23.500 $21.450 Cash Unlisted Securities Listed Securities Real Estate (Home) Automobiles Personal Property IRA'S & 401k's $2,900 $15,000 $20,000 $950,000 $47.000 $88,000 $47.000 Total Liabilities $969,950 Net Worth $199,950 Total Assets $1,169,900 Tot. Liab & Equity $1,169,900 Exhibit 3 Page 8 Plastic Molding Company, Inc. Historical (Unadjusted) Income Statements Sin 000's 2001 2004 V 05 2000 Actual Actu 5667 2003 Actu 54.382 $4256 54614 $4255 $2.101 53.116 51 091 52.222 5819 50.000 5651 SIXT SSRO 5301 576 $61 5620 SX3 5502 5554 Nel Sales Cast of Good Sold Material Direct Labor Overhead Depreciation Factory Tooling All Other Overhead TO Overhead Cost of Goods S . Total CroProfit of Net Sales Selling General Admin Expenses Depreciation Office Related Amortation All Other SOA Expenses Total Selling General Admin Expenses 575 5525 5420 SE55 5698 16.49 $3671 54 KK S1.16 5376 $1,106 252 S1205 $426 SIS $14 $13 $16 S13 ST SYD S90 5840 5861 5931 $957 $909 15.09 31 $14 464 -5163 3.8%. -592 520 -546 -542 52 5119 Income from Operations of Net Sales Other Income (Expense) Bad Debt Expense Interest Expense All Other Other Income (Expense) Total Other Income (Expense) Net Income Hefewe In The Proformes Net Income After Income Taxes of Net Sales Retained Emin Beginning of Period Read End of Period SO S101 519 .579 -395 551 S157 40 S10 -S10 07 SER 5450 54 1 5575 SINO SER 5418 5575 SOL 50 SS 561 SU $106 of Net Sales Depreci Amortization FRITDA Onicer Salaries Estimated Normal General Management Sales Adjustments income for worries S17 5315 S350 $92 S609 su $926 5253 SU $100