Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE READ BEFORE ANSWERING THE FOLLOWING CHEGG QUESTION: Hello, I will attach the exercise along with some DETAILED questions regarding the exercise. I would like

PLEASE READ BEFORE ANSWERING THE FOLLOWING CHEGG QUESTION:

Hello, I will attach the exercise along with some DETAILED questions regarding the exercise. I would like you (the expert) to read carefully and answer the questions that are in the excel spreadsheet next to the exercise (as detailed as possible). If answered accordingly to what I am specifically asking I will rate thumbs up.

EXERCISE

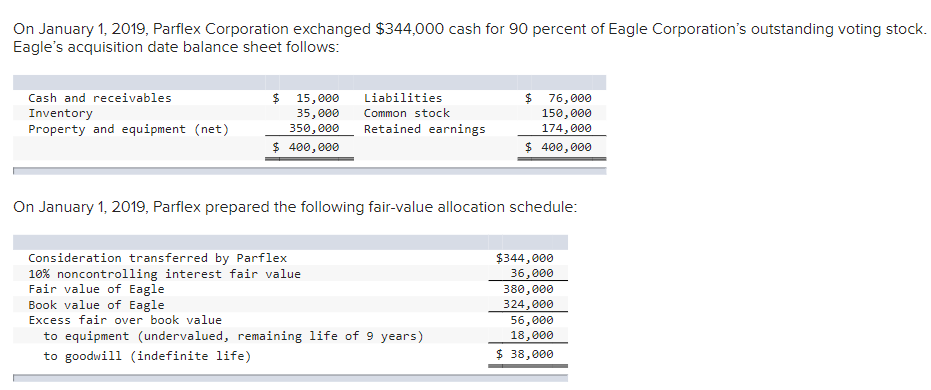

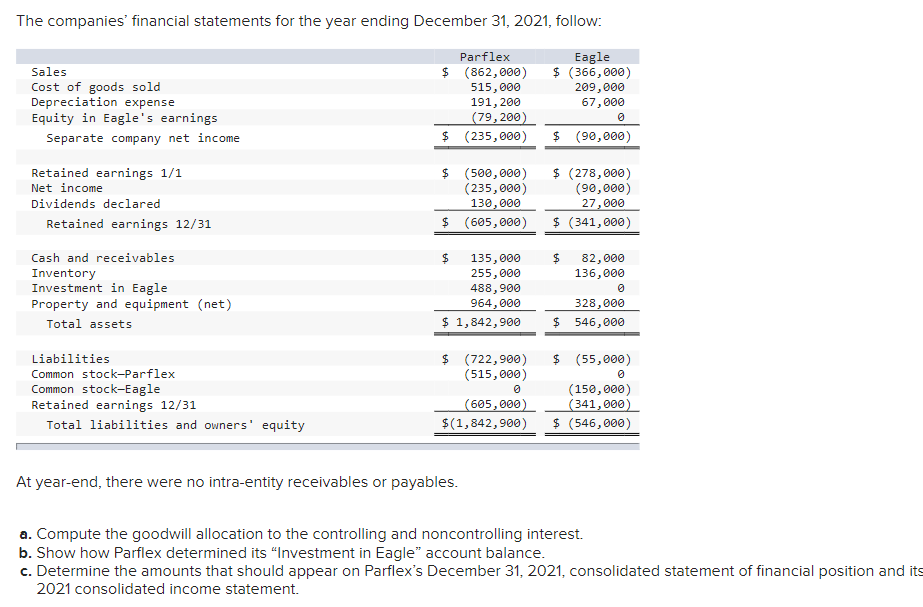

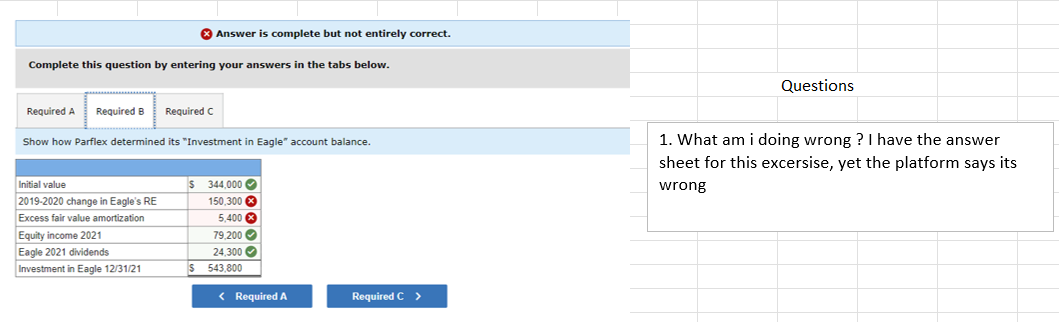

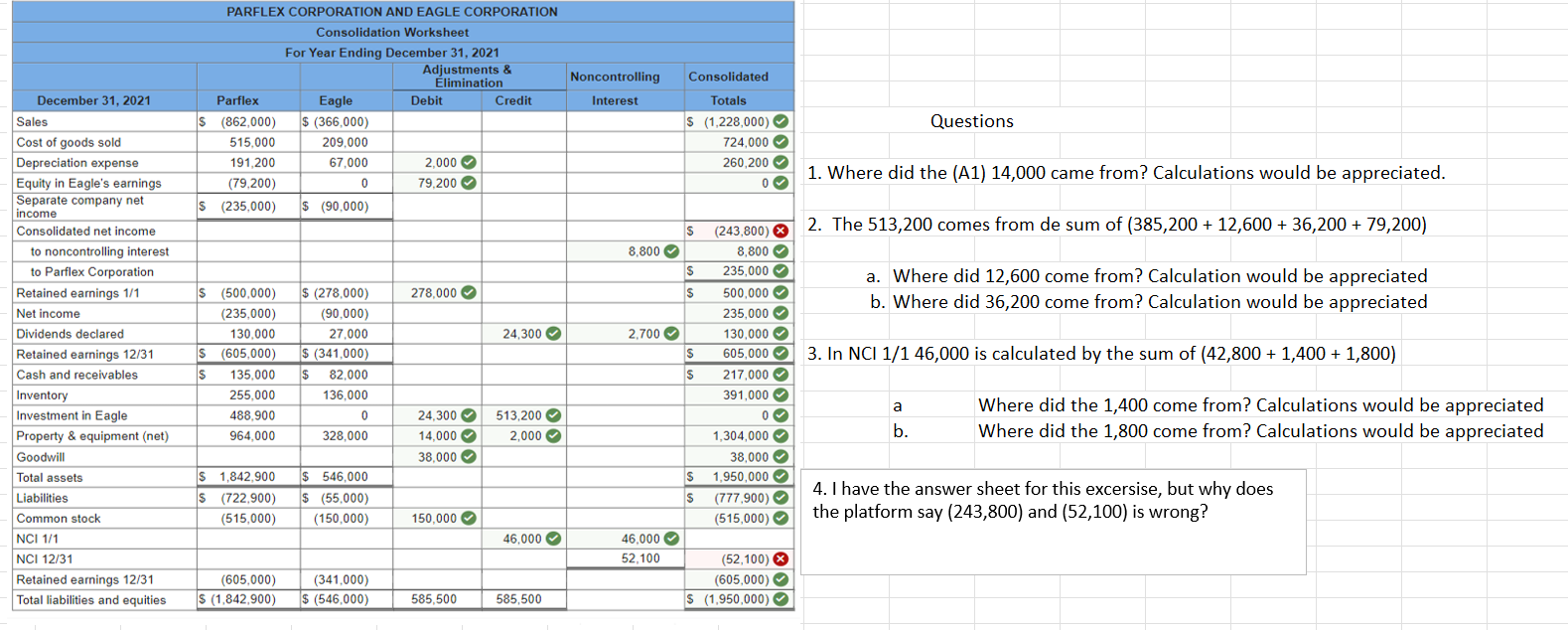

On January 1, 2019, Parflex Corporation exchanged $344,000 cash for 90 percent of Eagle Corporation's outstanding voting stock. Eagle's acquisition date balance sheet follows: On January 1, 2019, Parflex prepared the following fair-value allocation schedule: The companies' financial statements for the year ending December 31, 2021, follow: At year-end, there were no intra-entity receivables or payables. a. Compute the goodwill allocation to the controlling and noncontrolling interest. b. Show how Parflex determined its "Investment in Eagle" account balance. c. Determine the amounts that should appear on Parflex's December 31, 2021, consolidated statement of financial position and it 2021 consolidated income statement. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Questions Show how Parflex determined its "Investment in Eagle" account balance. 1. What am i doing wrong ? I have the answer sheet for this excersise, yet the platform says its wrong PARFLEX CORPORATION AND EAGLE CORPORATION Consolidation Worksheet Questions 1. Where did the (A1) 14,000 came from? Calculations would be appreciated. 2. The 513,200 comes from de sum of (385,200+12,600+36,200+79,200) a. Where did 12,600 come from? Calculation would be appreciated b. Where did 36,200 come from? Calculation would be appreciated 3. In NCI 1/146,000 is calculated by the sum of (42,800+1,400+1,800) a Where did the 1,400 come from? Calculations would be appreciated b. Where did the 1,800 come from? Calculations would be appreciated 4. I have the answer sheet for this excersise, but why does the platform say (243,800) and (52,100) is wrong

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started