Please read case study appendix 33-C. This case study shows a successful proposal. Given what is gone on with the pandemic a number of viable projects have struggled as a result. This assignment calls for you to recast the project given the following new criteria:

Please read case study appendix 33-C. This case study shows a successful proposal. Given what is gone on with the pandemic a number of viable projects have struggled as a result. This assignment calls for you to recast the project given the following new criteria:

- RX sales drop 15%

- Cost of goods sold increase by 6.2%

- Salaries are increased by 2%

- GM drop by 3.2%

- Cast a year 4 with a 10% decrease in all categories from year 3.

- Interest is now 21000 a year

- Provision for bad debts increases by 4.5%

- Net Income drops by 5% for each year

- Number of prescriptions per day increases by 2%

- Bad Debt Percentage rises to 4%

- Inflation Rates drop by .5%

- Unexpected costs not currently accounted for each year $35,435

You need to recast the statement and exhibits given the criteria listed above and answer the following questions.

- Is the project still economically viable why or why not?

- Is there any information that you think is missing? What do you think you need? Why?

- What happens when projects are started and the parameters change because of outside factors? Do you stop, cancel or continue on when the financials change?

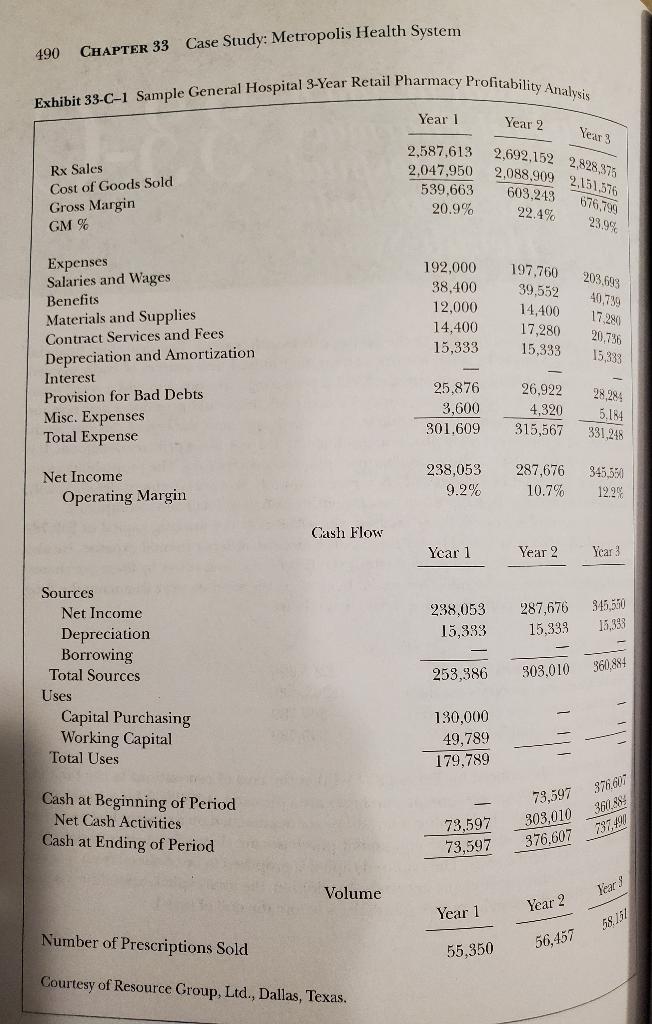

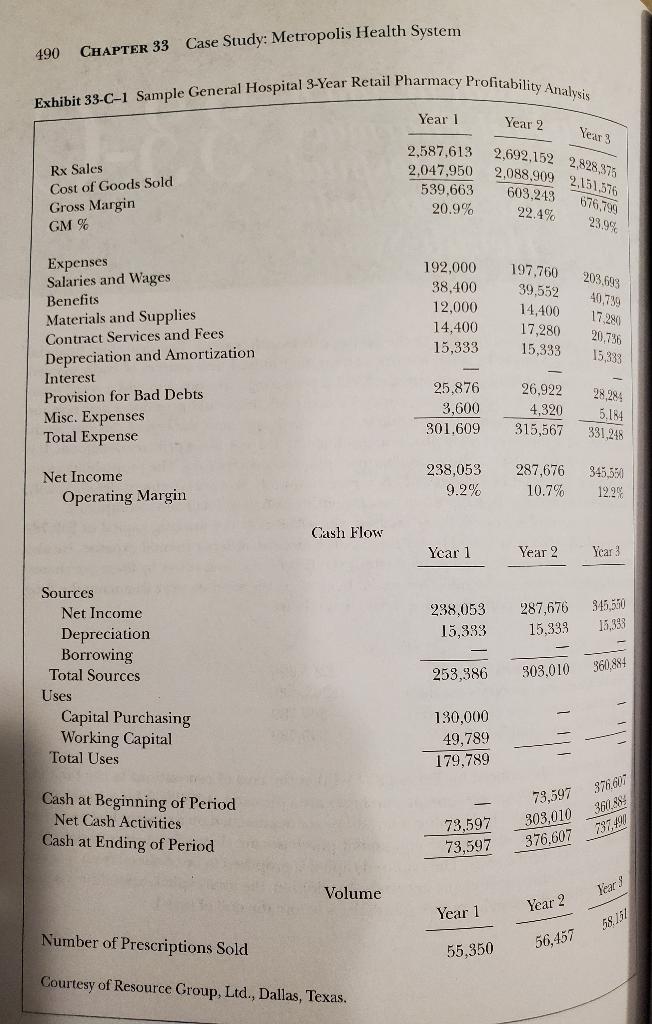

Sample General Hospital belongs to the Metropolis Health System. The new chief financial nuenue for the facility. Consequently, the CFO is preparing a proposal to add a retail phar- ficer (CFO) at Sample Hospital has been attempting to find new sources of badly needed may within the hospital itself. If the proposal is accepted, this would generate a new reteme Vervdor financing (accounts payable) Departmental expense (3 months) the controller also noticed on Exhibit 33-C-4 that the cost of renovations to the building Youre of $130,000. The building renovations are depreciated on a straight-line basis over wated at $80,000 and equipment purchases are estimated at $50,000 for a total capital Wife of 15 years, whereas the equipment purchases are depreciated on a straight-line , and no borrowing would be necessary. In addition, the total capital expenditure is pro ex a useful life of 5 years. The required capital is proposed to be obtained from hospital Total Working Capital Required be retrieved through operating cash flows before the end of year 1. PPENDIX Retail Pharmacy, Proposal to Add a Hospital 33-0 to a in the Metropolis Health System wan. The CFO has prepared four exhibits, all of which appear at the end of this case studs Balibit 33-C-1, a three-year retail pharmacy profitability analysis, is the primary document. It is apported by Exhibit 33-C-2, the retail pharmacy proposal assumptions. The profitabilir analy- sis further supported by Exhibit 33-C-3, a year 1 monthly income statement detail. Finally, Exhibit 33-C-4 presents the supporting year 1 monthly cash flow detail and assumptions. When the controller reviewed the exhibits, she asked how the working capital of $49,789 was derived. The CFO explained that it represents 3 months of departmental expense. He also splaimed that the cost of drugs purchased for the first 60 days was offset by these purchases" counts payable cycle, so the net effect was 0. In essence, the vendors were financing the drug pochases. Thus, the working capital reconciled as follows: Working Capital cost of drugs (2 months) S303,400 ($303,400) $49,789 $49,789 490 CHAPTER 33 Case Study: Metropolis Health System Exhibit 33-C-1 Sample General Hospital 3-Year Retail Pharmacy Profitability Analysis Year 1 Year 2 Year 3 2,587,613 2,047,950 539.663 20.9% 2,692.152 2,828,375 2.088,909 2,151,576 676,7% Rx Sales Cost of Goods Sold Gross Margin GM % 603.243 22.4% 23.9% 203.693 192,000 38,400 12,000 14,400 15,333 Expenses Salaries and Wages Benefits Materials and Supplies Contract Services and Fees Depreciation and Amortization Interest Provision for Bad Debts Misc. Expenses Total Expense 197,760 39,552 14,400 17,280 15,333 40.739 17.280 20,736 15,333 25,876 3,600 301.609 26,922 4,320 315,567 28,284 5.154 331,248 Net Income Operating Margin 238,053 9.2% 287,676 10.7% 3455 12.99 Cash Flow Year 1 Year 2 Year 3 345,550 238,053 15,333 287,676 15,333 15,333 Sources Net Income Depreciation Borrowing Total Sources Uses Capital Purchasing Working Capital Total Uses 360,884 253,386 303,010 130,000 49.789 179.789 Smau Cash at Beginning of Period Net Cash Activities Cash at Ending of Period 73,597 73,597 73,597 303,010 376,607 Volume Year 1 Year 2 59131 Number of Prescriptions Sold 56,457 55,350 Courtesy of Resource Group, Ltd., Dallas, Texas

Please read case study appendix 33-C. This case study shows a successful proposal. Given what is gone on with the pandemic a number of viable projects have struggled as a result. This assignment calls for you to recast the project given the following new criteria:

Please read case study appendix 33-C. This case study shows a successful proposal. Given what is gone on with the pandemic a number of viable projects have struggled as a result. This assignment calls for you to recast the project given the following new criteria: