Answered step by step

Verified Expert Solution

Question

1 Approved Answer

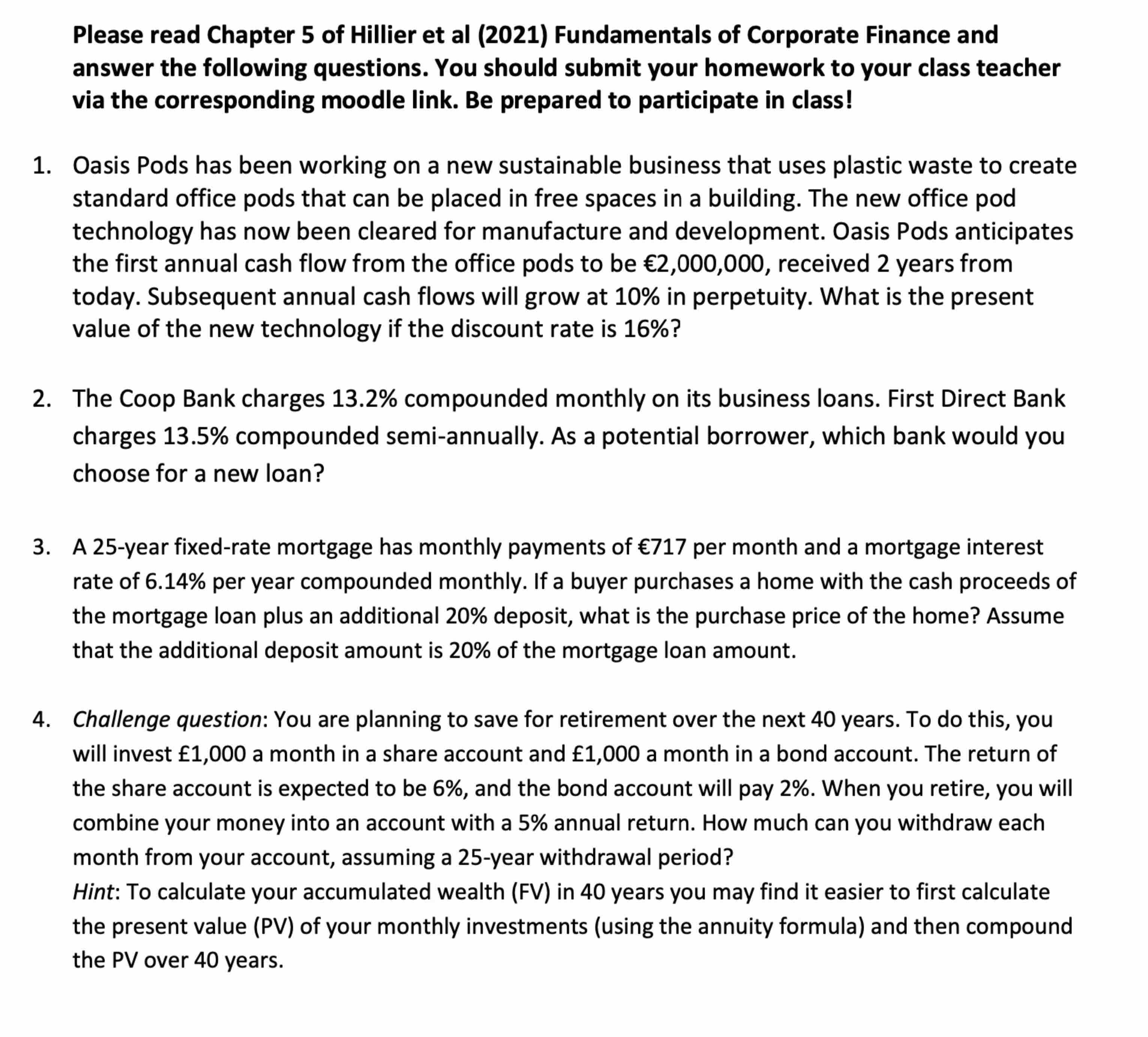

Please read Chapter 5 of Hillier et al ( 2 0 2 1 ) Fundamentals of Corporate Finance and answer the following questions. You should

Please read Chapter of Hillier et al Fundamentals of Corporate Finance and

answer the following questions. You should submit your homework to your class teacher

via the corresponding moodle link. Be prepared to participate in class!

Oasis Pods has been working on a new sustainable business that uses plastic waste to create

standard office pods that can be placed in free spaces in a building. The new office pod

technology has now been cleared for manufacture and development. Oasis Pods anticipates

the first annual cash flow from the office pods to be received years from

today. Subsequent annual cash flows will grow at in perpetuity. What is the present

value of the new technology if the discount rate is

The Coop Bank charges compounded monthly on its business loans. First Direct Bank

charges compounded semiannually. As a potential borrower, which bank would you

choose for a new loan?

A year fixedrate mortgage has monthly payments of per month and a mortgage interest

rate of per year compounded monthly. If a buyer purchases a home with the cash proceeds of

the mortgage loan plus an additional deposit, what is the purchase price of the home? Assume

that the additional deposit amount is of the mortgage loan amount.

Challenge question: You are planning to save for retirement over the next years. To do this, you

will invest a month in a share account and a month in a bond account. The return of

the share account is expected to be and the bond account will pay When you retire, you will

combine your money into an account with a annual return. How much can you withdraw each

month from your account, assuming a year withdrawal period?

Hint: To calculate your accumulated wealth FV in years you may find it easier to first calculate

the present value PV of your monthly investments using the annuity formula and then compound

the PV over years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started