please read everything i included the "moms cookies" problem at the end to help you and showed the formulas used. thank you

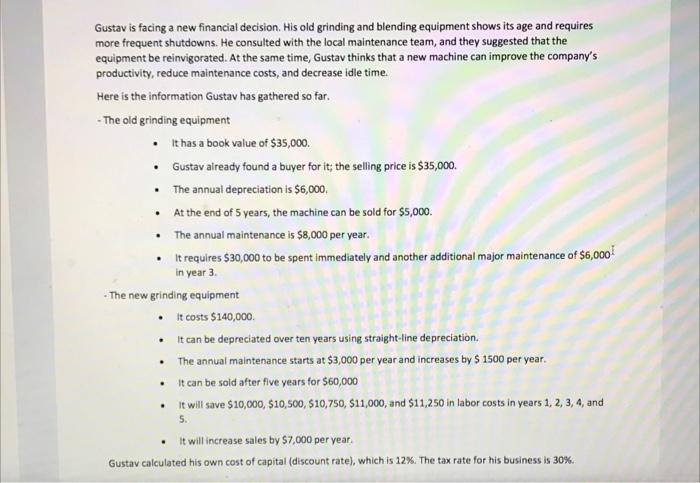

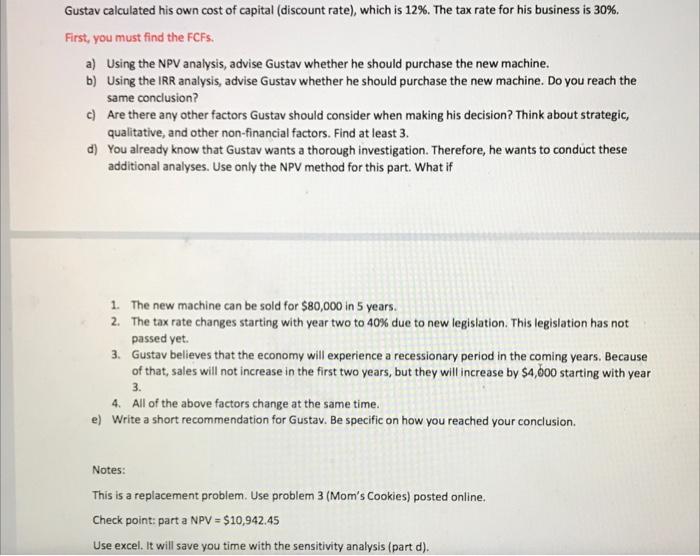

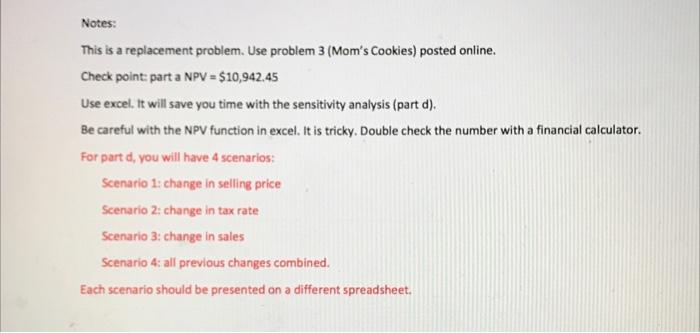

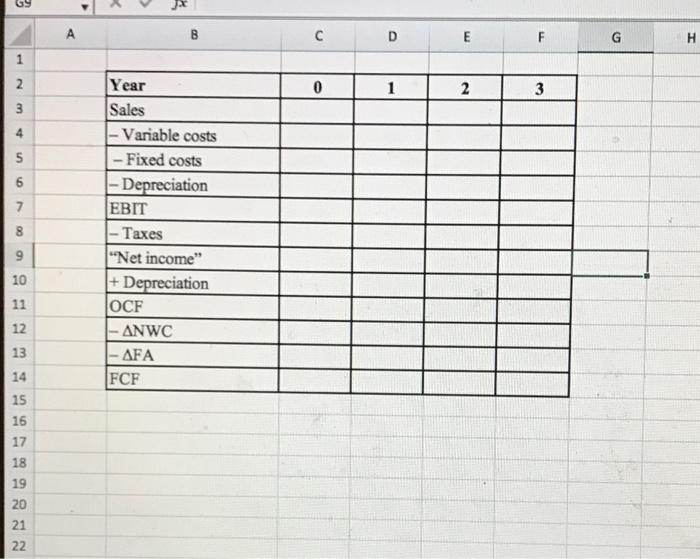

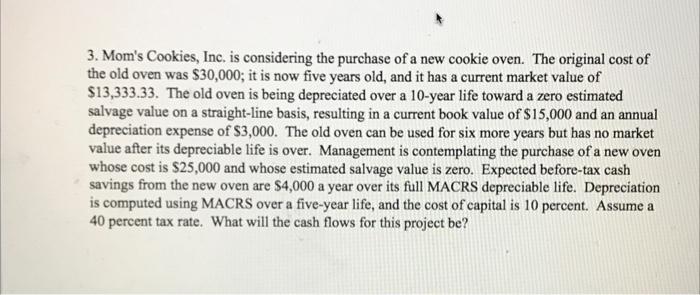

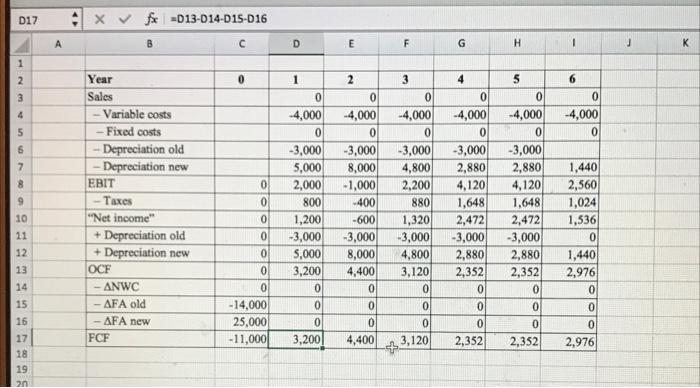

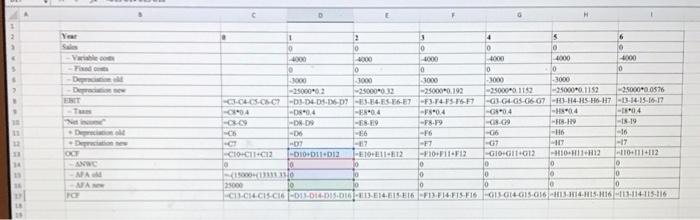

Gustav is facing a new financial decision. His old grinding and blending equipment shows its age and requires more frequent shutdowns. He consulted with the local maintenance team, and they suggested that the equipment be reinvigorated. At the same time, Gustav thinks that a new machine can improve the company's productivity, reduce maintenance costs, and decrease idle time. Here is the information Gustav has gathered so far. - The old grinding equipment It has a book value of $35,000. Gustav already found a buyer for it, the selling price is $35,000. The annual depreciation is $6,000, At the end of 5 years, the machine can be sold for $5,000. The annual maintenance is $8,000 per year. It requires $30,000 to be spent immediately and another additional major maintenance of $6,000 in year 3 - The new grinding equipment It costs $140,000 . It can be depreciated over ten years using straight-line depreciation, The annual maintenance starts at $3,000 per year and increases by $ 1500 per year. It can be sold after five years for $60,000 It will save $10,000, $10,500, 10,750, $11,000, and $11,250 in labor costs in years 1, 2, 3, 4, and 5. It will increase sales by 57,000 per year Gustav calculated his own cost of capital (discount rate), which is 12%. The tax rate for his business is 30% Gustav calculated his own cost of capital (discount rate), which is 12%. The tax rate for his business is 30%. First, you must find the FCFS. a) Using the NPV analysis, advise Gustav whether he should purchase the new machine. b) Using the IRR analysis, advise Gustav whether he should purchase the new machine. Do you reach the same conclusion? c) Are there any other factors Gustav should consider when making his decision? Think about strategic, qualitative, and other non-financial factors. Find at least 3. d) You already know that Gustav wants a thorough investigation. Therefore, he wants to conduct these additional analyses. Use only the NPV method for this part. What if 1. The new machine can be sold for $80,000 in 5 years. 2. The tax rate changes starting with year two to 40% due to new legislation. This legislation has not passed yet. 3. Gustav believes that the economy will experience a recessionary period in the coming years. Because of that, sales will not increase in the first two years, but they will increase by $4,600 starting with year 3. 4. All of the above factors change at the same time. e) Write a short recommendation for Gustav. Be specific on how you reached your conclusion. Notes: This is a replacement problem. Use problem 3 (Mom's Cookies) posted online. Check points part a NPV = $10,942.45 Use excel. It will save you time with the sensitivity analysis (part d). Notes: This is a replacement problem. Use problem 3 (Mom's Cookies) posted online. Check point: part a NPV = $10,942.45 Use excel. It will save you time with the sensitivity analysis (part d). Be careful with the NPV function in excel. It is tricky. Double check the number with a financial calculator. For part d, you will have 4 scenarios: Scenario 1: change in selling price Scenario 2: change in tax rate Scenario 3: change in sales Scenario 4: all previous changes combined. Each scenario should be presented on a different spreadsheet. > JX A B C D E F G H 1 2 2 3 0 1 2 3 3 4 5 6 7 8 Year Sales - Variable costs - Fixed costs -Depreciation EBIT Taxes "Net income" + Depreciation OCF ANWC - AFA FCF 9 10 11 12 13 14 15 16 17 18 19 20 21 22 3. Mom's Cookies, Inc. is considering the purchase of a new cookie oven. The original cost of the old oven was $30,000; it is now five years old, and it has a current market value of $13,333.33. The old oven is being depreciated over a 10-year life toward a zero estimated salvage value on a straight-line basis, resulting in a current book value of $15,000 and an annual depreciation expense of $3,000. The old oven can be used for six more years but has no market value after its depreciable life is over. Management is contemplating the purchase of a new oven whose cost is $25,000 and whose estimated salvage value is zero. Expected before-tax cash savings from the new oven are $4,000 a year over its full MACRS depreciable life. Depreciation is computed using MACRS over a five-year life, and the cost of capital is 10 percent. Assume a 40 percent tax rate. What will the cash flows for this project be? D17 x fx =D13-D14-015-016 A B D E F G H 1 J K 0 3 1 2 3 4 5 6 6 0 -4,000 0 0 7 8 9 10 11 12 Year Sales - Variable costs Fixed costs - Depreciation old - Depreciation new EBIT Taxes "Net income" Depreciation old +Depreciation new OCF -- ANWC - AFA old - AFA new FCF 1 0 -4,000 0 -3,000 5,000 2,000 800 1,200 -3,000 5,000 3,200 0 0 0 3,200! 0 0 2 0 -4,000 0 -3,000 8,000 -1,000 -400 -600 -3,000 8,000 4,400 0 0 0 4,400 0 -4,000 0 -3,000 4,800 2,200 880 1,320 -3,000 4,800 3,120 0 4 0 -4,000 0 -3,000 2,880 4,120 1,648 2,472 -3,000 2,880 2,352 0 0 0 2,352 5 0 -4,000 0 -3,000 2,880 4,120 1,648 2,472 -3,000 2,880 2,352 0 0 0 2,352 0 0 1,440 2,560 1,024 1,536 0 1,440 2,976 0 0 0 2,976 13 14 15 16 17 18 19 2n 0 0 - 14,000 25,000 -11,000 0 0 3,120 E 2 F H 9 o 000 De De ES 2 4 S 6 0 10 0 400 1000 4000 4000 4000 0 0 0 2000 1000 3000 3000 -250000 35000032 -250000.192 35000 1163 250000.1152 - 2500000576 C-CLCS-OSC -D3-DDS.ES -E3-84.ES -7 -73-74-75 76 7 -G G4 G5-06-07-20-114-115 H6-H7-03-14-15-16-17 -4 -804 -F5*0.4 -04 04 -1.04 -CC -DN-09 -08-09 - -18-19 -6 -66 -76 -65 -H6 16 - -01 -21 -17 CIOCIL-C12 I-DI0011013 101112 -F10 F11 F12 GIOCHT:12 10-12 110-1114112 10 0 O 0 0 0 0 10 0 0 CU.CHCIS CIG-09 DIDIS.00-13.14.615 6 F13 F14F15 FIG CH-015 016 01516-15116 MASTI 11 12 o ANWE NA ATA FO ORG VE 0