Answered step by step

Verified Expert Solution

Question

1 Approved Answer

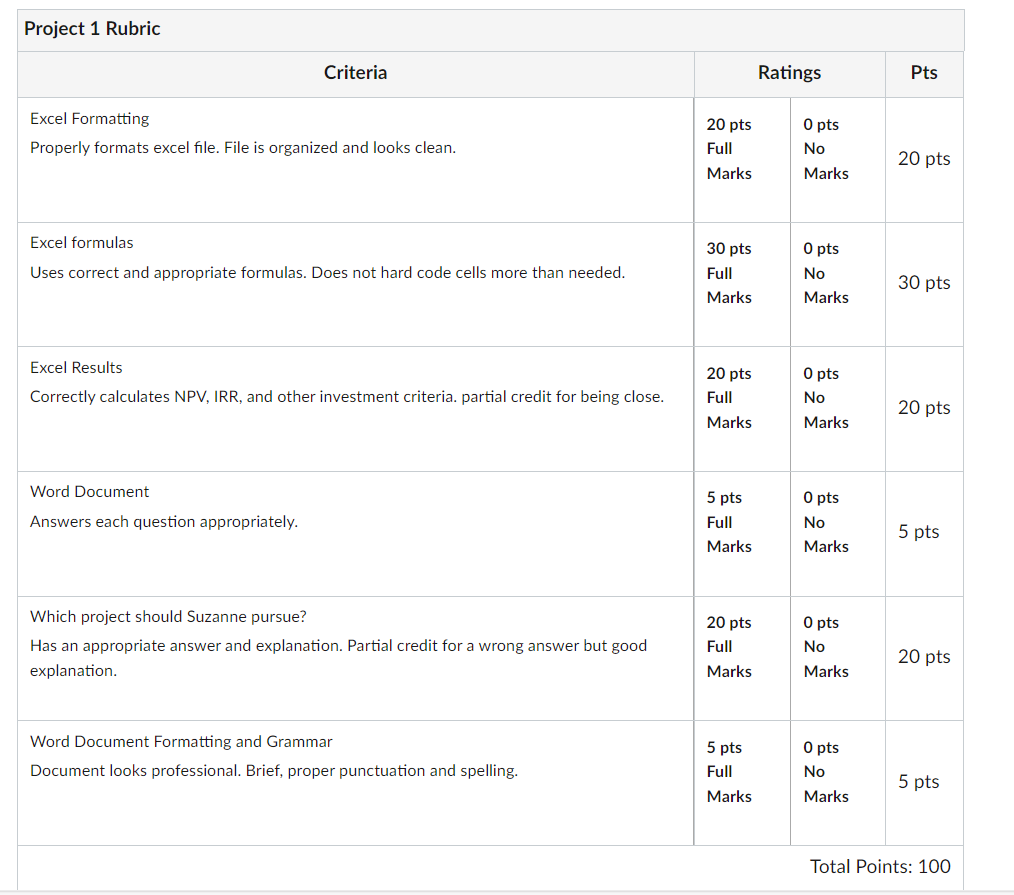

* * PLEASE READ INSTRUCTIONS, DO THIS IN AN EXCEL AND UPLOAD * * Calculate the operating cash flows for each year for potential project.

PLEASE READ INSTRUCTIONS, DO THIS IN AN EXCEL AND UPLOAD

Calculate the operating cash flows for each year for potential project. Then use those cash flows to calculate NPV IRR, PI and Payback period information answer the questions below. Turn in your excel sheet that shows your Proforma Income statement and calculations, and word document with your answers.

Suzanne is recently retired and enjoys quilting. She is considering starting a quilting business to keep her busy in her retirement. She has options when purchasing a long arm quilting machine.

A She can purchase a longarm quilting machine for $ with this machine she believes that she will be able to quilt quilts a week.

B She could purchase an automated quilting machine for $ using this machine she believes that she will be able to quilt quilts a day for days a week.

In either case, Suzanne figures she can charge cents a square inch and make about $ per quilt an average quilt is about x inches She also figures that each quilt will cost her about $ dollars in material batting and thread She expects to run her quilting company for years and expects that her sales and costs will each increase each year by She will have no relevant fixed expenses as she will operate the business out of her own home. She will use straightline depreciation for each of the years annual depreciation is $ for project A and $ for project B Taxes are

Assume she has a discount rate if she takes project A and a discount rate if she takes project B calculate the:

NPV

IRR?

PI ratio?

Payback period?

Assuming that the projects are mutually exclusive, which if any should she do Briefly explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started