Question: Please read the case to answer the questions below. Your responses are much appreciated. Please read the Case Study, (attached below) and answer the questions

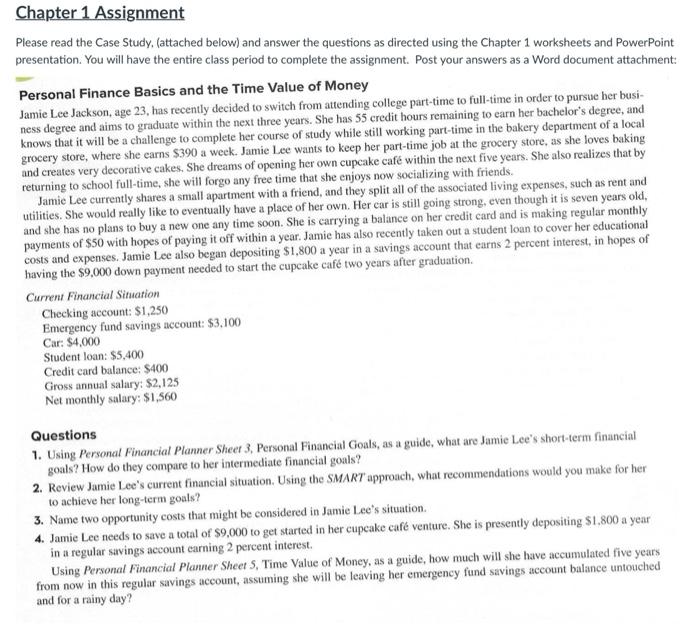

Please read the Case Study, (attached below) and answer the questions as directed using the Chapter 1 worksheets and PowerPoint presentation. You will have the entire class period to complete the assignment. Post your answers as a Word document attachment. Personal Finance Basics and the Time Value of Money Jamie Lee Jackson, age 23, has recently decided to switch from attending college part-time to full-time in order to pursue her business degree and aims to graduate within the next three years. She has 55 credit hours remaining to earn her bachelor's degree, and knows that it will be a challenge to complete her course of study while still working part-time in the bakery department of a local grocery store, where she earns $390 a week. Jamie Lee wants to keep her part-time job at the grocery store, as she loves baking and creates very decorative cakes. She dreams of opening her own cupcake cafe within the next five years. She also realizes that by returning to school full-time, she will forgo any free time that she enjoys now socializing with friends. Jamie Lee currently shares a small apartment with a friend, and they split all of the associated living expenses, such as rent and utilities. She would really like to eventually have a place of her own. Her car is still going strong, even though it is seven years old, and she has no plans to buy a new one any time soon. She is carrying a balance on her credit card and is making regular monthly payments of $50 with hopes of paying it off within a year. Jamie has also recently taken out a student loan to cover her educational costs and expenses. Jamie Lee also began depositing $1,800 a year in a savings account that earns 2 percent interest, in hopes of having the $9,000 down payment needed to start the cupcake caf two years after graduation. Current Financial Situation Checking account: $1,250 Emergency fund savings account: $3,100 Car: $4,000 Student loan: $5,400 Credit card balance: $400 Gross annual salary: \$2,125 Net monthly salary: $1,560 Questions 1. Using Personal Financial Planner Sheet 3, Personal Financial Goals, as a guide, what are Jamie Lee's short-term financial goals? How do they compare to her intermediate financial goals? 2. Review Jamie Lee's current financial situation. Using the SMART approach, what recommendations would you make for her to achieve her long-term goals? 3. Name two opportunity costs that might be considered in Jamie Lee's situation. 4. Jamie Lee needs to save a total of $9,000 to get started in her cupcake caf venture. She is presently depositing $1.800 a year in a regular savings account earning 2 percent interest. Using Personal Financial Planner Sheet 5, Time Value of Money, as a guide, how much will she have accumulated five years from now in this regular savings account, assuming she will be leaving her emergency fund savings account balance untouched and for a rainy day

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts