Question

Please read the commentary below. I would like to make an argument that a disadvantage of fiscal policy is crowding out. But I am unsure

Please read the commentary below. I would like to make an argument that a disadvantage of fiscal policy is crowding out. But I am unsure whether or not crowding out will happen during a deep recession. Will interest rates in the loanable funds market increase and crowd out business and consumer borrowing? I mean the economy is in a deep recession in this situation and there is a lot of spare capacity so I'm not sure if crowding out will occur. What are the implications on the national debt of the US economy? Will future generations have to pay higher taxes to cover the borrowed money from the private sector? The government is going to have to pay for the stimulus somehow in the future right.

Commentary : "Coronavirus: Trump signs into law largest bailout in US history"

COVID-19 has driven the US economy into a recession. President Trump signed the largest-ever recorded fiscal stimulus relief package worth $2 tn, known as the CARES act, to stimulate the economy and increase aggregate demand. The package is a form of government spending on unemployment benefits, direct checks to households and small businesses. Loans and tax breaks have also been offered to small businesses. Will this stimulus save the economy from the recession and what are its implications?

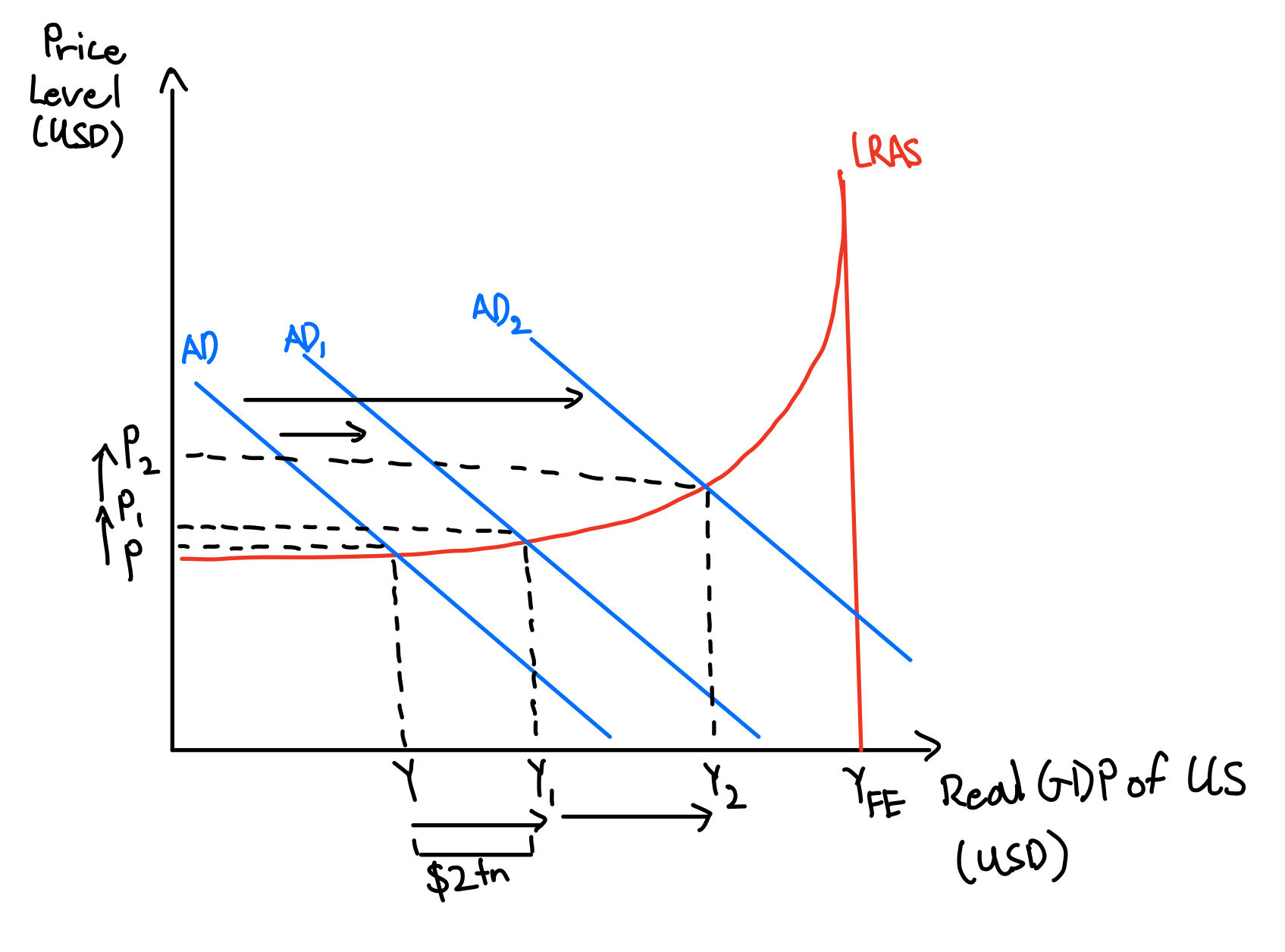

Figure 1 - Effects of CARES Act on US Economy

In figure 1, aggregate demand increases from AD-AD1 due to the $2tn government spending. Output increases from Y-Y1 and Price to P1. The spending multiplier amplifies the initial increase in spending, leaving output at Y2 and price, P2. Consequently, the economy is closer to the full-employment level of output, YFE and the country utilizes more of its spare capacity.

One advantage of the CARES act is the ability to pull the US out of the deep recession imposed by COVID-19, where consumer and business confidence are at its lowest. The package provides "$1,200 to every American earning less than $75,000 per year and $500 per child...and bolsters the unemployment benefits programme", effectively capitalizing on the spending multiplier. Since unemployed workers and struggling businesses are likely to spend virtually all their extra income, an initial increase in government spending of $2tn which shifts Y-Y1, might result in several trillion dollars or more of actual spending in the economy, extending the shift to Y2.

Another advantage of the fiscal stimulus is relatively short time lag. As "unemployment surged to a record high of 3.3 million people," spending in the US fell to an all time low. Because this policy puts money in the hands of consumers and business directly, particularly the unemployed and mid to low income households, while providing "tax breaks to companies that face going out of business", the right demographics will have more disposable income to consume and invest. Thus, the policy will quickly and seamlessly feed through the economy. It can also be argued that this fiscal stimulus is superior to its monetary counterpart, which relies on people's response to low interest rates - adding time lags during times of low confidence.

Confident in their job prospects business need to be confident of profitability in the future

One disadvantage of the fiscal stimulus is that the transferred income may end up being saved or squandered in unproductive ways. During times of deep recession, where prices are expected to fall further later on, there is no guarantee that businesses or consumers will invest and spend their additional income on sectors of the economy that stimulate AD. Instead, they may save their income in the present so that their purchasing power increases in the future. The leakage of money out of the circular flow could cause the increase in AD to be negligible compared to if the government were to independently spend the money in different sectors of the economy. Even with the extra income, it is especially hard to encourage spending when "a fifth of the US workforce is on some form of lockdown" and "one in every four Americans [are] ordered to remain at home and only go outside for essential needs."

A government spending valued at $2tn will add to the US's national debt and budget deficit, which can lead to crowding out. To finance the care package, the government must borrow money from private banks, increasing the demand for loanable funds. In the future, there may be higher market interest rates as banks lend more money to the government to cover their expenses. Hence, any prior increases in AD may be offset as business and consumers borrow and spend less with higher interest rates.

Another disadvantage of the CARES act is its inability to spark long run economic growth. The government loans and tax deferrals are only applicable to businesses should they maintain payroll. Hence, it is unlikely that direct checks given to business will be spent on physical capital. Likewise, transfer incomes to consumers will be used to cover daily expenses instead and come at the opportunity cost of investing directly into human capital. The demand side policy is not set up to bring about increases in SRAS and LRAS.

In my judgement, I believe that the CARES act is effective at stimulating the economy out of the recession. The greatest benefit of the stimulus is its ability to exploit the spending multiplier and pull the economy out of a deep recession. As the stimulus comes in the form of direct checks to individuals and businesses, there is little lag which severely dampens the effects of the recession. Furthermore, by cutting corporate taxes and issuing incomes the government creates an economic environment where household business investments are strongly incentivized. The main weakness of the cares act is the burden it puts on the US national debt. Although the deficit-financed CARES act promotes a short-term boost in GDP, it could have serious implications on interest rates in the long run, especially with removal of corporate tax revenue. Furthermore, it is unlikely that this policy will bring about long run economic growth and shifts in LRAS. Because businesses are forced to use the stimulus to maintain payroll and consumers use the bill to sustain daily consumptions, there is an opportunity cost in investmenting in human and physical capital. If the article contains information on how much the government has borrowed, a better evaluation could be made.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started