Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please read the first attached document, and then please answer the questions. PART ONE - Document A Investor Overview - Megabank Total assets grew for

Please read the first attached document, and then please answer the questions.

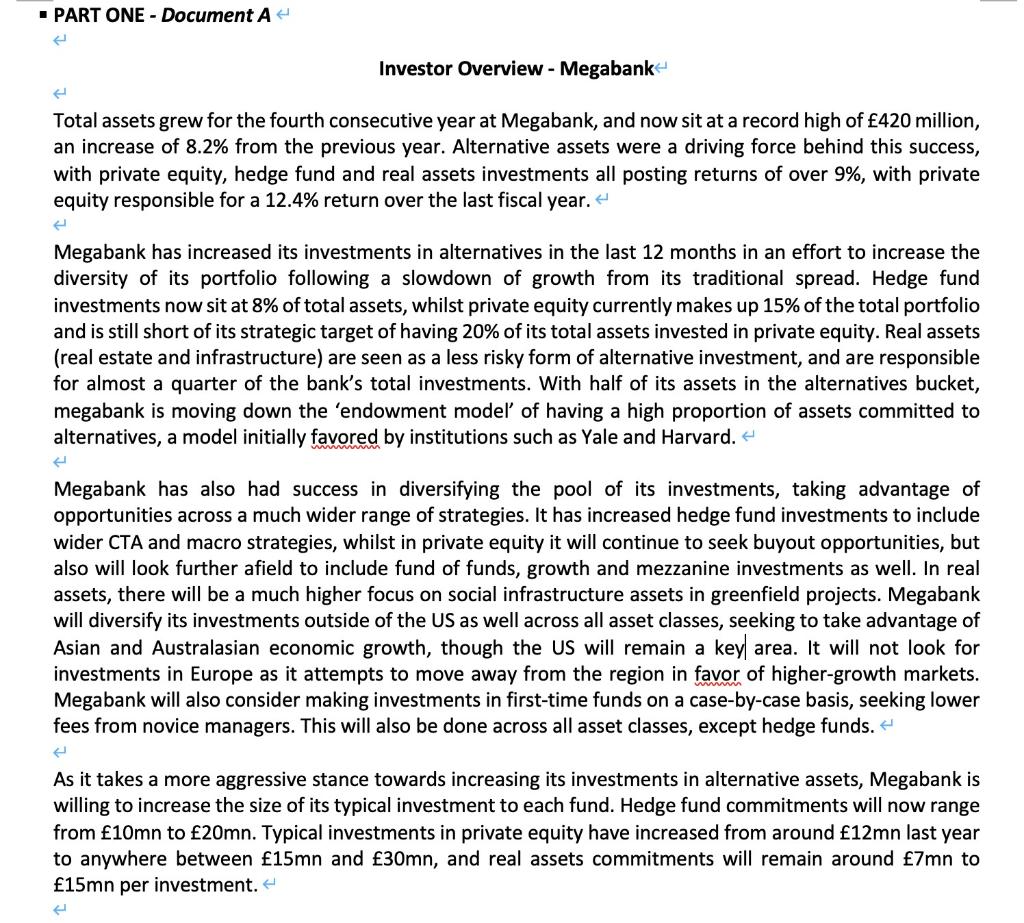

PART ONE - Document A Investor Overview - Megabank Total assets grew for the fourth consecutive year at Megabank, and now sit at a record high of 420 million, an increase of 8.2% from the previous year. Alternative assets were a driving force behind this success, with private equity, hedge fund and real assets investments all posting returns of over 9%, with private equity responsible for a 12.4% return over the last fiscal year. Megabank has increased its investments in alternatives in the last 12 months in an effort to increase the diversity of its portfolio following a slowdown of growth from its traditional spread. Hedge fund investments now sit at 8% of total assets, whilst private equity currently makes up 15% of the total portfolio and is still short of its strategic target of having 20% of its total assets invested in private equity. Real assets (real estate and infrastructure) are seen as a less risky form of alternative investment, and are responsible for almost a quarter of the bank's total investments. With half of its assets in the alternatives bucket, megabank is moving down the 'endowment model of having a high proportion of assets committed to alternatives, a model initially favored by institutions such as Yale and Harvard. Megabank has also had success in diversifying the pool of its investments, taking advantage of opportunities across a much wider range of strategies. It has increased hedge fund investments to include wider CTA and macro strategies, whilst in private equity it will continue to seek buyout opportunities, but also will look further afield to include fund of funds, growth and mezzanine investments as well. In real assets, there will be a much higher focus on social infrastructure assets in greenfield projects. Megabank will diversify its investments outside of the US as well across all asset classes, seeking to take advantage of Asian and Australasian economic growth, though the US will remain a key area. It will not look for investments in Europe as it attempts to move away from the region in favor of higher-growth markets. Megabank will also consider making investments in first-time funds on a case-by-case basis, seeking lower fees from novice managers. This will also be done across all asset classes, except hedge funds. H As it takes a more aggressive stance towards increasing its investments in alternative assets, Megabank is willing to increase the size of its typical investment to each fund. Hedge fund commitments will now range from 10mn to 20mn. Typical investments in private equity have increased from around 12mn last year to anywhere between 15mn and 30mn, and real assets commitments will remain around 7mn to 15mn per investment. 1. PATR ONE Please read Document A and answer the following questions based on the information provided. . Question 1: What is the current allocation amount and percentage of Megabank to private equity? . Question 2: What is the target allocation amount and percentage of Megabank to private equity? . Question 3: Where does Megabank look to invest? (Africa, Asia, Australasia, Caribbean, Central America, Europe, North America, South America) . Question 4: What type of fund does Megabank prefer? (i.e. Balanced, Bridge Fund, Buyout, Co-Investment, Direct Secondaries, Distressed Debt, Early Stage, Seed Stage, Expansion/ Late Stage, Fund of Funds, Growth, Hybrid, Mezzanine,, PIPE, Secondaries, Turnaround, Venture Debt) . Question 5: - 5 Will Megabank invest in first-time funds? (i.e. Yes, No, Considering) . Question 6: What is the typical investment amount (mn) of Megabank in private equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started