Please, read the following case and answer the question in details.

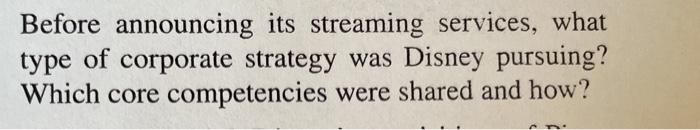

Disney: Building Billion-Dollar Franchises WITH $55 BILLION in annual revenues in 2017, Dis- ney is the world's largest media company and is renowned for its Walt Disney Studios and the popular Walt Disney Parks and Resorts. Over the past decade, Disney has grown through a number of high-profile acquisitions, including Pixar (2006), Marvel (2009). and Lucasfilm (2012), the creator of Star Wars. All this was done with the goal of building billion-dollar franchises based on movie sequels, park rides, and merchandise. In 2017, Disney revealed even bigger ambitions. Star Wars: The Force Awakens is part of the global Star Wars franchise. This sequel alone is estimated to turn into a 110 billion franchise for Disney Mim Friday/Alamy Stock Photo as Time Warner, Sony's Columbia Pictures, and 21" Century Fox Disney's Corporate Strategy As a diversified media company, Disney is active in a wide array of business activities--movies, amusement parks, cable and broadcast television networks (ABC, ESPN, and others), cruises, and retailing. It became the world's leading media company to a large extent by pursuing a corporate strategy of related-linked diversification. That is, some, but not all of Disney's business activities share common resources, capabili- ties, and competencies. Disney executes its corporate strategy by entering alliances and acquiring other media businesses to create theme-based franchises. The corporate strategy of cre- ating billion-dollar franchises through diversification is Disney's main focus. CEO Bob Iger leads a group of about 20 executives whose sole responsibility is to hunt for new billion-dollar franchises. This group of senior leaders decides top-down which projects are a go and which are not. They also allocate resources to particu- lar projects. Disney has even organized its employees in the consumer products group around franchises such as Frozen, Toy Story, Star Wars, and other cash cows. The corporate strategy around building billion-dollar franchises is certainly paying off: Disney has seen a steady growth to its top line, and it earned some $10 billion in profits in 2016. Its stock rose more than 350 percent between 2010 and 2017, outperforming rivals such Disney and Pixar: "Try Before You Buy" To understand Disney's corporate strategy of growing through acquisition, let's look at one of the most suc- cessful deals in recent history: Disney acquired Pixar. and then built a number of billion-dollar franchises around it. It all started with a strategic alliance. Pixar started as a computer hardware company producing high-end graphic display systems. One of its custom- ers was Disney. To demonstrate the graphic display systems' capabilities, Pixar produced short, computer- animated movies. Despite being sophisticated, Pixar's computer hardware was not selling well, and the new venture was hemorrhaging money. To the rescue rode Frank T. Rothermal prepared this MiniCase for the purpose of clans discussion. He gratefully acknowledge research assistance by Amey Sahasrabuddhe. This MiniCase is not intended to be used for any kind of endorsement source of data, or depiction of efficient or inefficient management. All opinions expressed, all errors and omissions are entirely the author's Revised and updated: August 1, 2017. O Frank T. Rothermal not Buzz Lightyear, but Steve Jobs. Shortly after being ousted from Apple in 1986, Jobs bought the struggling hardware company for $5 million and founded Pixar Animation Studios, investing another $5 million into it. The Pixar team, led by Edwin Catmull and John Lasseter, then transformed the company into a computer- animation film studio. To finance and distribute its newly created computer- animated movies, Pixar entered a strategic alliance with Disney. Disney's distribution network and its stellar reputation in animated movies were critical comple- mentary assets that Pixar needed to commercialize its new type of films. In turn, Disney was able to rejuve- nate its floundering product lineup, retaining the rights to the newly created Pixar characters and to any sequels Pixar became successful beyond imagination as it rolled out one blockbuster after another. Toy Story (1, 2, and 3). A Bug's Life, Monsters Inc., Finding Nemo, The Incredibles, and Cars, grossing several billion dollars. Given Pixar's huge success and Disney's abysmal performance with its own releases during this time, the bargaining power in the alliance shifted dramatically. Renegotiations of the Pixar-Disney alliance broke down in 2004, reportedly because of personality conflicts between Steve Jobs and then- Disney Chairman and CEO Michael Eisner. After Robert Iger was appointed CEO, Disney acquired Pixar for $7.4 billion in 2006. The success of the alliance demonstrated that the two entities complementary assets matched, and it gave Disney an inside perspective on the value of Pixar's core compe- tencies in the creation of computer animated features. Integrating Pixar allowed Disney to transfer and apply some of its unique competencies including marketing, brand building, product extensions Acquisitions Ever After ... In 2009, Disney turned to acquisitions again. The acquisition of Marvel Entertainment for $4 billion added Spider-Man, Iron Man, The Incredible Hulk. and Captain America to its lineup of characters Marvel's superheroes grossed a cumulative $15 billion at the box office, with The Avengers bringing in some $2 billion. In 2012, Mickey Mouse's extended family was joined by Darth Vader, Obi-Wan Kenobi, Prin- cess Leia, and Luke Skywalker when Disney acquired Lucasfilm for more than $4 billion. In 2014, Disney acquired Maker Studios, a YouTube based multichannel network, for $675 million. Under Disney, Maker Studies is no longer focused on providing some 60,000 YouTube creators with sup port by promoting their channels and selling ads. Rather, Maker now the marching orders to focus on no more than the top 250 YouTube content creators with large followings. The goal is to build billion dollar franchises in the new on-demand TV space. One Maker Studios early success story was YouTube mega- star PewDiePie, who at one point had the most success- ful YouTube channel and for many years was one of the highest-profile stars on YouTube. In 2017, however, Disney cut ties with PewDiePie following his posting of videos in which he made inflammatory remarks, not in line with Disney's values Building Billion Dollar Franchises After taking the reins, CEO Iger transformed a lackluster Disney following a decade or so of inferior performance by refocusing it around what he calls franchises, which generally begin with a big movie hit and are followed up with derivative TV shows, theme park rides, video games, toys, clothing such as T-shirts and PJs, among many other spin-offs. Rather than churning out some 30 movies per year as it did before Iger, Disney now produces about 10 movies per year, focusing on cre- ating box-office hits. Disney's annual movie lineup is dominated by such franchises as Star Wars and Marvel superhero movies and also by live-action versions of animated classics such as Cinderella and Beauty and the Beast. The biggest Disney franchises that started with a movie hit include the Pirates of the Caribbean (with the franchise grossing more than 4 billion), Toy Story (over $2 billion), Monsters Inc. (close to $2 billion), Cars (over $1 billion), and, of course, Frogen. The 2013 animated movie Frogen (made by Walt Disney Animation Studios run by Pixar execs Catmull and Lasseter) has grossed over $1.5 billion, making it the most successful animated movic ever. To fur- ther build its Frosen franchise, Disney is working on a sequel of its animated movie hit for release in late 2019, and in the meanwhile it has spun off several shorter films, much merchandise, and a dreamlike ride through the fictional world of Arendelle at Disney World's Epcot Center, replacing a previous attractice that had grown stale The Star Wars franchise, however, is clearly the crown jewel in Disney's lineup of billion-do franchises. The 2015 Star Wars sequel The Awakens grossed over $2 billion on the big making it the third-best-selling movie ever after and Titanic Intergalactic Finance: The Star Wars Franchise Is Worth $10 Billion The numbers generated around the Star Wars fran- chise do seem fantastic. First, just consider the grosses of the movies. Although The Force Awakens grossed over $2 billion in box-office receipts on a budget of about $260 million, NYU finance professor Aswath Damodaran estimates the final gross receipts of the 2015 Star Wars sequel to be $10 billion. HOW ONE MOVIE GROSSES $10 BILLION. Profes- sor Damodaran extrapolated add-on revenue by using historical data, so he could project anticipated reve- nues not just from The Force Awakens but also from other announced sequels in the pipeline. Here is how a simple version of his model plays out, based on the reported box-office receipts the 2015 for sequel of roughly $10 million. Note that add-on revenue is computed using a multiplier (shown in parentheses) of box-office receipts. Box-office receipts: $2 billion. Streaming revenue (1.2): 52.4 billion. Toys and merchandise (1.8): $ 3.6 billion Books and e-books (0.2). $ 0.4 billion. Gaming (0.5): $ 1 billion. TV shows and other (0.5): $ 1 billion. Thus the total gross receipts for The Force Awakens are $10.4 billion 1. Risks of Relying on a Few Big Franchises. Dis- ney's approach is risky. What if the pipeline dries up? That is, how sustainable is an acquisition-led growth strategy? Not many media companies remain of the same caliber as Pixar, Marvel, or Lucasfilm. 2. Losing Originality. Critics worry that focusing on billion-dollar franchises hampers Disney's originality. Moviegoers could write off Disney's offerings as too predictable. 3. Problems on the TV Side. Roughly half of Dis- ney's profits come from its TV networks ESPN, ABC, and others. Yet that industry is in disrup- tion. People spend more time and sometimes money watching content online via YouTube, Net- flix, Hulu, and other streaming services, and they watch less TV. This means the numbers of TV viewers and cable subscribers are in decline. 4. Underperforming Acquisitions. Disney's acqui- sitions have not been uniformly successful. While Disney won big with franchise-based studios Pixar and Lucasfilm, it has also lost money and focus with the acquisition of technology companies, Examples include online video producer Maker Studios (2014) and social gaming company Play- dom Inc. (2010). 5. Issues of Succession. Who will succeed Robert Iger as CEO? He was the architect of Disney's corpo rate strategy of building billion-dollar franchises and implemented it to achieve new levels of growth. Appointed in 2005, he originally planned to step down in 2015. Most recently he extended his ten- ure until 2019. With no clear internal candidates to take over the mantle as CEO, Disney has no heir apparent These challenges were suddenly cast in a new light when Iger announced a strategic shift, significantly changing the complexity of several of these challenges. Iger Join the Disruption In 2017 Iger announced that Disney would launch two streaming services similar to Netflix. One service would focus on ESPN's audience and start in 2018 the other on Disney's huge catalog of original content and start in 2019. . VALUATION OF A FRANCHISE. By coincidence, Damo daran ultimately values the entire Star Wars franchise at the same amount--around $10 billion. He therefore concludes that Disney's $4 billion price tag for Lucas- film was a good investment. Again, the astonishing valuation of the franchise-or the reveal of the likely true gross receipts of a new film in the franchise-is explained by Disney's ability to build revenue on top of billion-dollar franchises through product extensions and add-ons. The Star Wars empire has a far reach in many corners of commerce, let alone in the galaxy. Clouds on Disney's Horizon While things have been sunny in Southern California. where Disney is headquartered, there are clouds on the horizon, which is to say Disney has been facing a number of potential challenges. AN ESPN STREAMING SERVICE. While the ESPN service will focus on ESPN's audience, it will not cannibalize the existing ESPN stations. The ESPX streaming service will carry new sports content that extends the ESPN cable content-if you already sub- scribe to ESPN on cable, you would be able to also watch the cable events over the streaming service. This decision may reflect the importance that cable companies place on the ESPN sports channels as their single biggest draw overall, their must-have" compo- nent of the cable offering. But the cable companies were increasingly frustrated by rising costs, especially as the costs affected viewership. ESPN, often the most expensive part of the cable bundle, accounts for over $8 per month of cable charges even when distributed across all subscribers, by some estimates. Cable companies wanted Disney to rein in fees because subscribers were growing more restive and some had already jumped ship. ESPN at its peak had 100 million subscribers, but has lost close to 12 million subscribers in the past five years. And cable companies feared such a loss was just the beginning of a subscriber revolt, with subscribers demanding ESPN become unbundled from cable packages. A FRANCHISE STREAMING SERVICE. While the pro posed ESPN streaming service may not adversely impact ESPN channels, the decision to create a streaming ser- vice for many of Disney's blue-chip franchises has much greater potential, with special impact on Netflix Iger has announced that Disney will be pulling most of its movies from Netflix over the next two years. Some analysts see this move as reducing the value of Netflix to subscribers. Others see the con- tent being pulled as relatively minor. First, Disney has not yet decided if it would pull its Marvel or Star Wars movies from Netflix, and second, none of the Marvel series (think the Marvel Defenders, Jessica Jones, and Luke Cage) will go because they are copro- ductions with Netflix TECHNOLOGY IS KEY. To make this streaming happen, Disney is making one highly focused technology acquisition. Last year it acquired a third of Bam Tech- which supplies streaming services for HBO and many sports events--and has an option to buy a controlling interest EARLY DAYS. It is too carly yet to tell how this shift in corporate strategy will play out. But what is clear now is that in the face of various issues noted above, Disney under Iger has decided to increase its indepen- dence in unsettled media markets. Instead of fighting the disruption, Disney is joining it. Before announcing its streaming services, what type of corporate strategy was Disney pursuing? Which core competencies were shared and how