Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please read the instruction and also do it in axcel thanks We will focus on the basic line items on the 2022 Form 941. Once

please read the instruction and also do it in axcel thanks

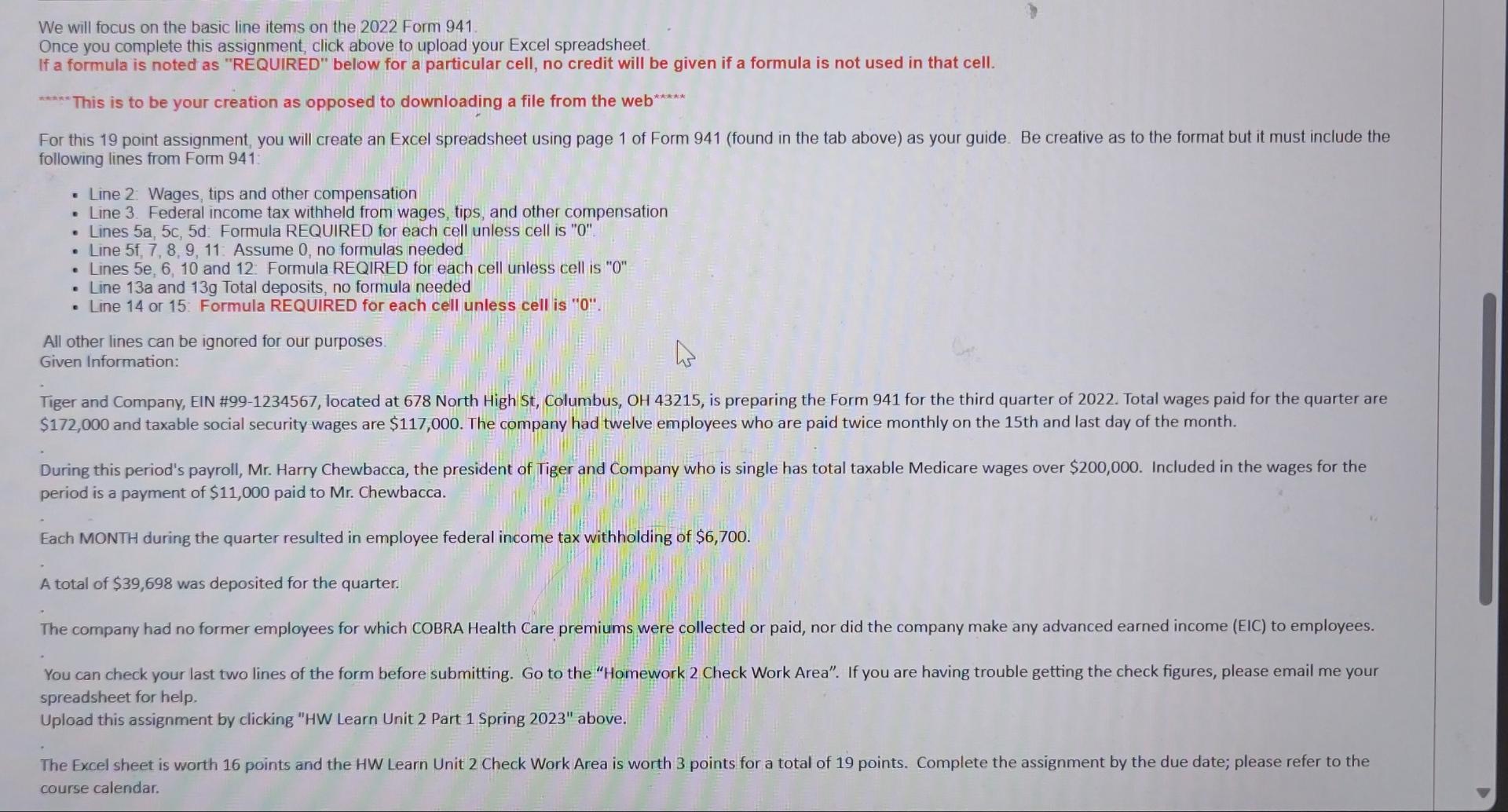

We will focus on the basic line items on the 2022 Form 941. Once you complete this assignment, click above to upload your Excel spreadsheet. If a formula is noted as "REQUIRED" below for a particular cell, no credit will be given if a formula is not used in that cell. This is to be your creation as opposed to downloading a file from the web" For this 19 point assignment, you will create an Excel spreadsheet using page 1 of Form 941 (found in the tab above) as your guide. Be creative as to the format but it must include the following lines from Form 941 : - Line 2. Wages, tips and other compensation - Line 3. Federal income tax withheld from wages, tips, and other compensation - Lines 5a, 5c, 5d. Formula REQUIRED for each cell unless cell is "0". - Line 5f,7,8,9,11. Assume 0 , no formulas needed - Lines 5e,6,10 and 12 Formula REQIRED for each cell unless cell is "0" - Line 13a and 13g Total deposits, no formula needed - Line 14 or 15 Formula REQUIRED for each cell unless cell is "0". All other lines can be ignored for our purposes. Given Information: Tiger and Company, EIN \#99-1234567, located at 678 North High St, Columbus, OH43215, is preparing the Form 941 for the third quarter of 2022 . Total wages paid for the quarter are $172,000 and taxable social security wages are $117,000. The company had twelve employees who are paid twice monthly on the 15 th and last day of the month. During this period's payroll, Mr. Harry Chewbacca, the president of Tiger and Company who is single has total taxable Medicare wages over \$200,000. Included in the wages for the period is a payment of $11,000 paid to Mr. Chewbacca. Each MONTH during the quarter resulted in employee federal income tax withholding of $6,700. A total of $39,698 was deposited for the quarter. The company had no former employees for which COBRA Health Care premiums were collected or paid, nor did the company make any advanced earned income (EIC) to employees. You can check your last two lines of the form before submitting. Go to the "Homework 2 Check Work Area". If you are having trouble getting the check figures, please email me your spreadsheet for help. Upload this assignment by clicking "HW Learn Unit 2 Part 1 Spring 2023" above. The Excel sheet is worth 16 points and the HW Learn Unit 2 Check Work Area is worth 3 points for a total of 19 points. Complete the assignment by the due date; please refer to the course calendar. We will focus on the basic line items on the 2022 Form 941. Once you complete this assignment, click above to upload your Excel spreadsheet. If a formula is noted as "REQUIRED" below for a particular cell, no credit will be given if a formula is not used in that cell. This is to be your creation as opposed to downloading a file from the web" For this 19 point assignment, you will create an Excel spreadsheet using page 1 of Form 941 (found in the tab above) as your guide. Be creative as to the format but it must include the following lines from Form 941 : - Line 2. Wages, tips and other compensation - Line 3. Federal income tax withheld from wages, tips, and other compensation - Lines 5a, 5c, 5d. Formula REQUIRED for each cell unless cell is "0". - Line 5f,7,8,9,11. Assume 0 , no formulas needed - Lines 5e,6,10 and 12 Formula REQIRED for each cell unless cell is "0" - Line 13a and 13g Total deposits, no formula needed - Line 14 or 15 Formula REQUIRED for each cell unless cell is "0". All other lines can be ignored for our purposes. Given Information: Tiger and Company, EIN \#99-1234567, located at 678 North High St, Columbus, OH43215, is preparing the Form 941 for the third quarter of 2022 . Total wages paid for the quarter are $172,000 and taxable social security wages are $117,000. The company had twelve employees who are paid twice monthly on the 15 th and last day of the month. During this period's payroll, Mr. Harry Chewbacca, the president of Tiger and Company who is single has total taxable Medicare wages over \$200,000. Included in the wages for the period is a payment of $11,000 paid to Mr. Chewbacca. Each MONTH during the quarter resulted in employee federal income tax withholding of $6,700. A total of $39,698 was deposited for the quarter. The company had no former employees for which COBRA Health Care premiums were collected or paid, nor did the company make any advanced earned income (EIC) to employees. You can check your last two lines of the form before submitting. Go to the "Homework 2 Check Work Area". If you are having trouble getting the check figures, please email me your spreadsheet for help. Upload this assignment by clicking "HW Learn Unit 2 Part 1 Spring 2023" above. The Excel sheet is worth 16 points and the HW Learn Unit 2 Check Work Area is worth 3 points for a total of 19 points. Complete the assignment by the due date; please refer to the course calendarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started