Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please, read the question and look at answers. Don't copy paste other response on Chegg which doesn't refer to this question. The final answer must

please, read the question and look at answers. Don't copy paste other response on Chegg which doesn't refer to this question. The final answer must be 8,500!!! thank you!

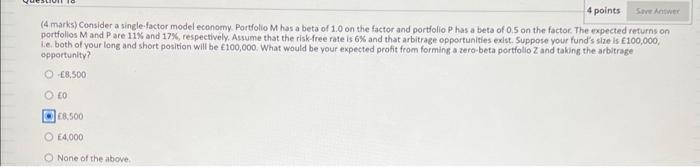

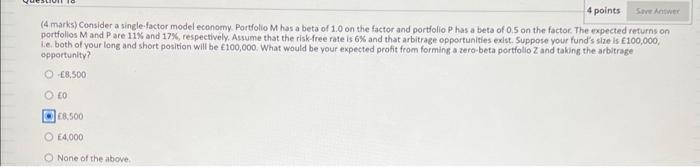

4 points Save Answer (4 marks) Consider a single-factor model economy. Portfolio M has a beta of 1.0 on the factor and portfolio P has a beta of 0.5 on the factor. The expected returns on portfolios M and P are 11% and 17%, respectively. Assume that the risk-free rate is 6% and that arbitrage opportunities exist. Suppose your fund's size is 100,000, i.e. both of your long and short position will be 100,000. What would be your expected profit from forming a zero-beta portfolio Z and taking the arbitrage opportunity? O-8,500 O EO 8,500 4,000 O None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started