please read the Question. do not copy other peoples work or use CHATGPT. i want an honest and clear answer please. Thank you.

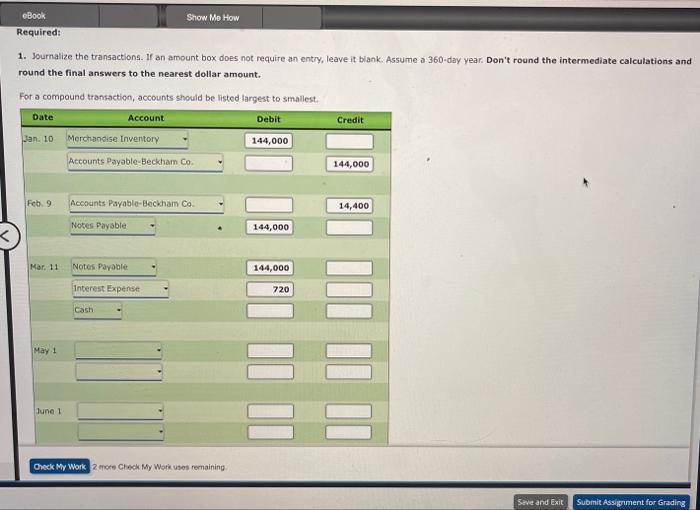

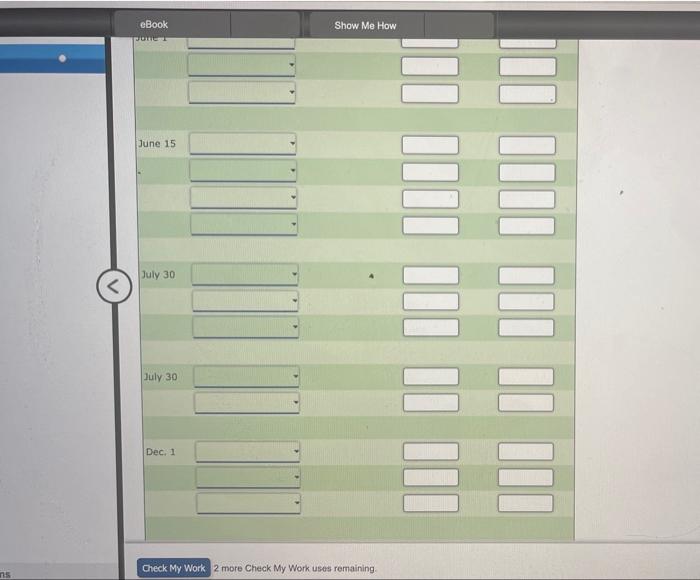

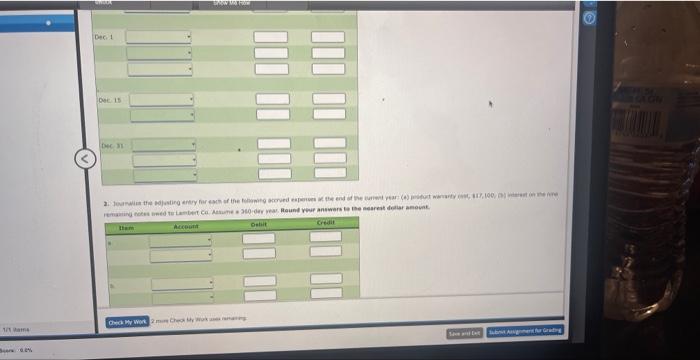

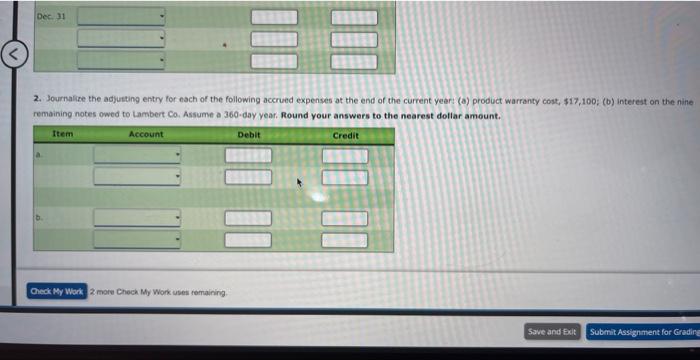

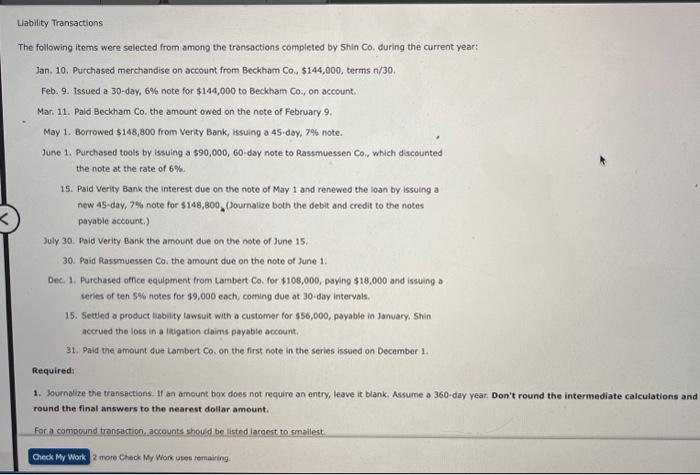

Llability Transactions The following items were selected from among the transactions completed by Shin Co. during the current year: Jan. 10. Purchased merchandise on account from Beckham Co7$144,000, terms n/30. Feb. 9. Issued a 30-day, 6% note for $144,000 to Beckham Co., on account. Mar. 11. Paid Beckham Co. the amount owed on the note of February 9. May 1. Borrowed $148,800 from Verity Bank, issuing a 45day,7% note. June 1. Purchased tools by issuing a $90,000,60-day note to Rassmuessen Co, with discounted the note at the rate of 6%. 15. Paid Verity Bank the interest due on the note of May 1 and renewed the loan by issuing a new 45-day, 7% note for $148,800. (Joumalue both the debit and credit to the notes payable account.) July 30. Paid Verity Bank the amount due on the note of June 15 . 30. Paid Rassmuessen Co, the amount due on the note of June 1 . Dec. 1. Hurchased office equipment from Lambert Co. for $108,000, paying $18,000 and issuing a series of ten 5% notes for $9,000 each, coming due at 30 -day intervals. 15. Settled a product lability lawsuit with a customer for 556,000 , payable in Janvary. Shin accrued the loss in a latigation daims payable account. 31. Pald the amount due Lambert Co. on the first note in the series issued on December 1. Required: 1. Journalize the transectians. If an amount box does not require an entry, leave it blank. Assume a 360 -day year. Don't round the intermediate calculations and round the final answers to the nearest dollar amount. For a compound transaction, accounts should be listrd laranst to smallest. 2 more Cteck My Wionk uses remairing. 1. Journalize the transactions. If an amount box does not require an entry, leave it blank. Assume o 360 -day year. Don't round the intermediate calculations and round the final answers to the nearest dollar amount. For a compound transaction, accounts should be listed largest to smallest. 2 more Check My Work uses remaining Journalize the adjusting entry for each of the following accrued expenses at the end of the current yeart (a) product warranty cost, $17,100; (b) interest on the nine emaining notes owed to Lambert Co. Assume a 360-day year. Round your answers to the nearest doflar amount. 2 more Chech My Work uses remaining