Question

****PLEASE READ THE STATEMENT IN BOLD BEFORE ASSISTING**** Please help with completing the table provided in this question. Use Excel and include the formulas used

****PLEASE READ THE STATEMENT IN BOLD BEFORE ASSISTING****

Please help with completing the table provided in this question. Use Excel and include the formulas used to find the numbers given in your answer.

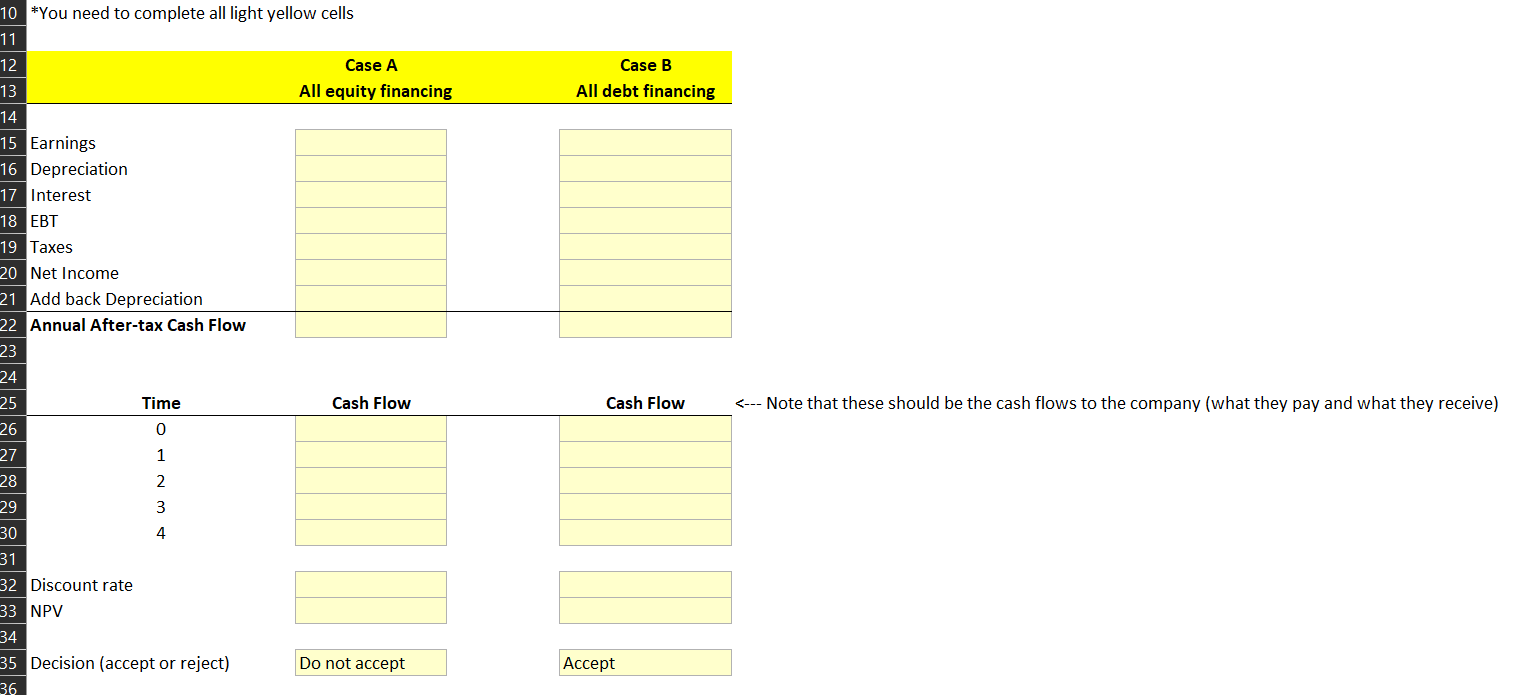

This homework assignment asks you to calculate NPV (similar to module 3, please review the material if needed) for a firm that uses all equity and a firm that uses all debt (same project). It is intended to demonstrate how and if the choice of financing choice (equity or debt) affects investment choices. A template is provided.

Gemini, Inc., an all-equity firm, is considering a $1.7 million investment that will be depreciated according to the straight-line method over its four-year life. The project is expected to generate earnings before taxes and depreciation of $595,000 per year for four years. The investment will not change the risk level of the firm. The company can obtain a four-year, 9.5 percent loan to finance the project from a local bank. They will receive the total amount needed for investment ($1.7 million at time 0) and all principal will be repaid in one balloon payment at the end of the fourth year (similar to a bond). Every year the company would need to pay interest (@9.5%). If the company finances the project entirely with equity, the firms cost of capital would be 13 percent. The corporate tax rate is 30 percent. Calculate the cash flows and NPV for the two cases: a) If the company finances the project entirely with equity, and b) if the company finances the project entirely with the bank loan. Are the answers different? If so, why? Should the project be undertaken? (Hint: In the first case you need to discount your cash flows at 13% and in the second case with 9.5% when you calculate NPV).

*You need to complete all light yellow cells

*You need to complete all light yellow cells Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started