Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please read the story! I only need help with TWO question! i provided all the information that is needed for you! please help! Question: 1).

please read the story! I only need help with TWO question! i provided all the information that is needed for you! please help!

please read the story! I only need help with TWO question! i provided all the information that is needed for you! please help!

Question:

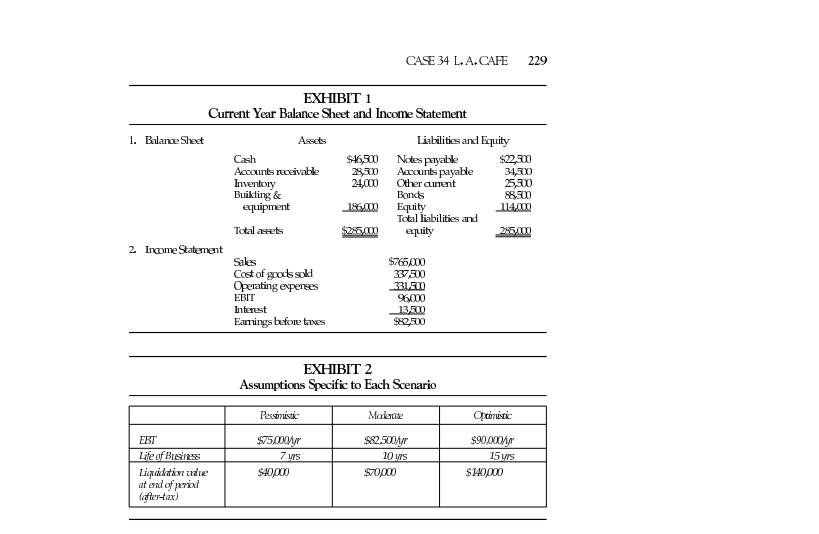

1). using the business brokers' rule of thumb, estimate the value of the restaurent.

2). Suppose Rogers obtains information on three other restaurants that were sold in the last year, and their market to book (MV/BV) ratios were 1,085, and 0.75. how would this information affect the negotiations?

SPARTAN ROOFING LOAN EVALUATION The Spartan Roofing Company makes excellent products!' So laudatory independent report commissioned by a bank in 1996 THE SPARTANROOFING COMPANY The Spartan Roofing Company was in 1951 as a sole proprietorship in Ohio. The company is an innovative of aluminum roofing products. Its standard products include the safeguard gravel stop system, the teglet and expansion joint system, and a wide variety of roofing panel systems The safeguard system, which is patented, is designed to comect three major problems encountered by the roofing industry-water leakage of joints, tar drippage on the exterior of the finished building, and shrinkage. The company's products designed to favor both building owner and con- tractor. The building owner benefits because of design technology that ensures Spartan's materials will last many years with little maintenance. The contractor benefits because the materials are simple to install. As a result the firm's prod- up are extremely popular with the building industry, and many architects and engineers specify Spartan materials by brand name. Market studies support this claim and also indicate that Spartan could increase its market share sub- startally given that the company has only a 5-percent share at present. Not surprisingly the firm is very strong in technical expertise; the engineering department is an important component of the business, and the development of new products is very much encouraged. Consequently, the company has been granted over eight patents in the last 20 years. While Spartan's technical expertise is unquestioned, the firm is a bit suspect financial matters. Periodically it has had difficulties with such matters as following year. All things considered, there is litte doubt that Spartan has com piled an impressive track record over the last 20 years In fact, when one bank evaluated Spartan in 1991 it concluded that "this is one of the bestrun compa pies we have ever in its size sales gateganka at the suggestion ofLawrence Wilson, In 1985, the firm relocated to the firm s CEO and son of the founder. The company's bank has been First City since the move South, but Tennessee National Bank TNB) has aggressively sought Spartan's business. Since 1985 TNB has called on Wilson on more than 30 occasions and has made six different financing proposals. Wilson was always reluctant to switch, though he almost left First GA for TNB in November 1993 because he was upset at First City for areasonnever clear to TNB. JOHN PATTILLA. In December 1994 John Papila of TNB had written a 12-page memorandum recommending that the bank make a spedic finandag proposal to Spartan. Patuas analysis was quite thorough and induded projections of the finm's sit- uatiou using a "best guess" or "most likely" and "worst case" set of assump UARE, See Ethibit l for excerpts from his 1994 report, Exhibit 2 for his net income projections, Exhibit 3 for his balance sheet projections, and Exhibit 4 for his worst case cash flow estimates) Pattilla had a few conversations with Wilson to get information for the pro- iections. The final estimates, however, reflect Papilla's assessment of the siRua- tia and Wilson has never seen these numbers. PaPilla had recommended that ThNB extend the company up to 5700f 00 in loans. The money would be used to finance Spartans working capital and fited-asset needs for anticipated strong sales growth from an expanding econonay and the introduction of a number of products. The company was especially excited about its new aaacocatbide product line. Naaogarbide is known for its unusually long bfe and is very useful in the roofing industry. It is now early 1996 and PapUlla has to decide whether TNB should make another proposal to Lawrence Wilson. As Patilla leans back in his chair, be leafi through infomation on Spartan, and a number of items catch his eye. He smiles as he notices the nearly 40 percent increase in sales for 1995, an increase he pre- dicted almost to the penny. Patilla, realizes, however, that Spartan must have benefited enormously fom the economic uptum, since the sales of its new products have not gone as well as expected. Especially disappointing were the sales of Spartan's macrocarbide product line. It appears to Papila that the sales growth is due more to an extemal factor outside the company's controlthe economy-than to internal factors under its control. He also notes that Wilson tapped the firm's line of credit with First City for over S500,000, a result not at all consistent with his 1994 projections. Patlla knows that any proposal would involve a buy out of First City, and TNB's offer should be at least the amount of Spartan's credit line with First City, or about S750,000. Patilahad concluded SPARTAN ROOFING LOAN EVALUATION The Spartan Roofing Company makes excellent products!' So laudatory independent report commissioned by a bank in 1996 THE SPARTANROOFING COMPANY The Spartan Roofing Company was in 1951 as a sole proprietorship in Ohio. The company is an innovative of aluminum roofing products. Its standard products include the safeguard gravel stop system, the teglet and expansion joint system, and a wide variety of roofing panel systems The safeguard system, which is patented, is designed to comect three major problems encountered by the roofing industry-water leakage of joints, tar drippage on the exterior of the finished building, and shrinkage. The company's products designed to favor both building owner and con- tractor. The building owner benefits because of design technology that ensures Spartan's materials will last many years with little maintenance. The contractor benefits because the materials are simple to install. As a result the firm's prod- up are extremely popular with the building industry, and many architects and engineers specify Spartan materials by brand name. Market studies support this claim and also indicate that Spartan could increase its market share sub- startally given that the company has only a 5-percent share at present. Not surprisingly the firm is very strong in technical expertise; the engineering department is an important component of the business, and the development of new products is very much encouraged. Consequently, the company has been granted over eight patents in the last 20 years. While Spartan's technical expertise is unquestioned, the firm is a bit suspect financial matters. Periodically it has had difficulties with such matters as following year. All things considered, there is litte doubt that Spartan has com piled an impressive track record over the last 20 years In fact, when one bank evaluated Spartan in 1991 it concluded that "this is one of the bestrun compa pies we have ever in its size sales gateganka at the suggestion ofLawrence Wilson, In 1985, the firm relocated to the firm s CEO and son of the founder. The company's bank has been First City since the move South, but Tennessee National Bank TNB) has aggressively sought Spartan's business. Since 1985 TNB has called on Wilson on more than 30 occasions and has made six different financing proposals. Wilson was always reluctant to switch, though he almost left First GA for TNB in November 1993 because he was upset at First City for areasonnever clear to TNB. JOHN PATTILLA. In December 1994 John Papila of TNB had written a 12-page memorandum recommending that the bank make a spedic finandag proposal to Spartan. Patuas analysis was quite thorough and induded projections of the finm's sit- uatiou using a "best guess" or "most likely" and "worst case" set of assump UARE, See Ethibit l for excerpts from his 1994 report, Exhibit 2 for his net income projections, Exhibit 3 for his balance sheet projections, and Exhibit 4 for his worst case cash flow estimates) Pattilla had a few conversations with Wilson to get information for the pro- iections. The final estimates, however, reflect Papilla's assessment of the siRua- tia and Wilson has never seen these numbers. PaPilla had recommended that ThNB extend the company up to 5700f 00 in loans. The money would be used to finance Spartans working capital and fited-asset needs for anticipated strong sales growth from an expanding econonay and the introduction of a number of products. The company was especially excited about its new aaacocatbide product line. Naaogarbide is known for its unusually long bfe and is very useful in the roofing industry. It is now early 1996 and PapUlla has to decide whether TNB should make another proposal to Lawrence Wilson. As Patilla leans back in his chair, be leafi through infomation on Spartan, and a number of items catch his eye. He smiles as he notices the nearly 40 percent increase in sales for 1995, an increase he pre- dicted almost to the penny. Patilla, realizes, however, that Spartan must have benefited enormously fom the economic uptum, since the sales of its new products have not gone as well as expected. Especially disappointing were the sales of Spartan's macrocarbide product line. It appears to Papila that the sales growth is due more to an extemal factor outside the company's controlthe economy-than to internal factors under its control. He also notes that Wilson tapped the firm's line of credit with First City for over S500,000, a result not at all consistent with his 1994 projections. Patlla knows that any proposal would involve a buy out of First City, and TNB's offer should be at least the amount of Spartan's credit line with First City, or about S750,000. Patilahad concludedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started