Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE READ THIS CASE STUDY AND ANSWER THESE TWO QUESTION. I. External Environment Natural Environment Societal Environment Task Environment II. Internal Environment Corporate Structure Corporate

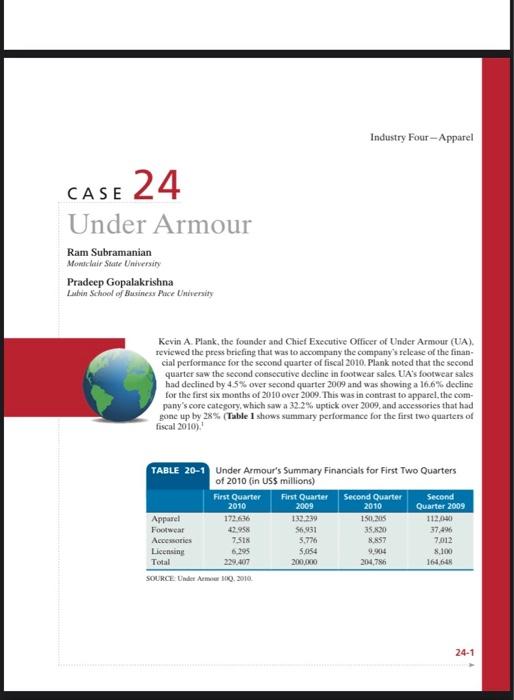

PLEASE READ THIS CASE STUDY AND ANSWER THESE TWO QUESTION.

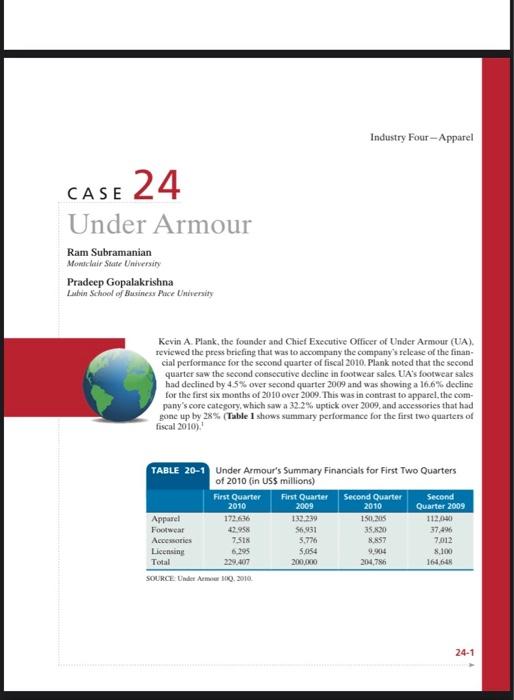

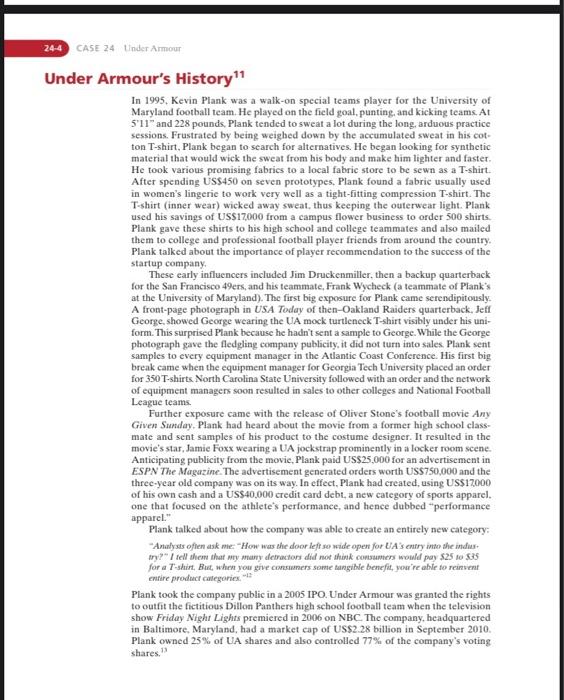

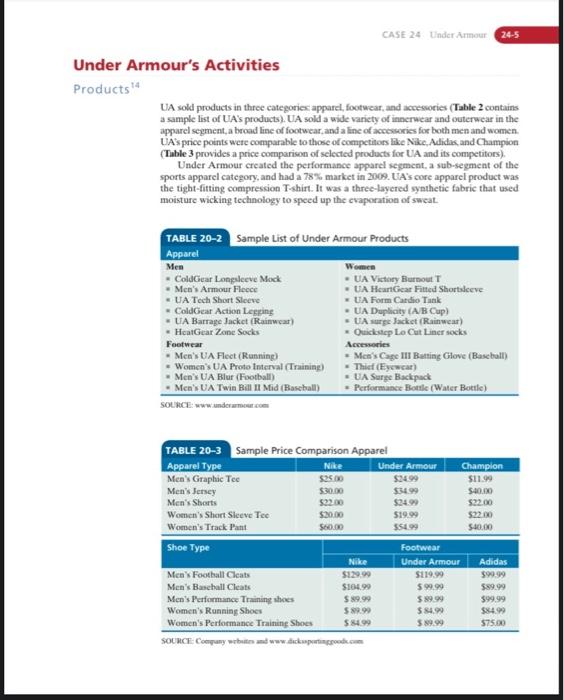

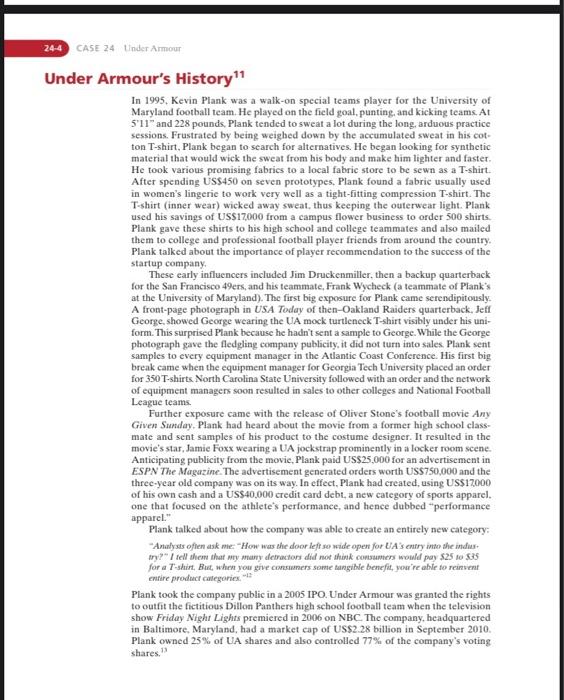

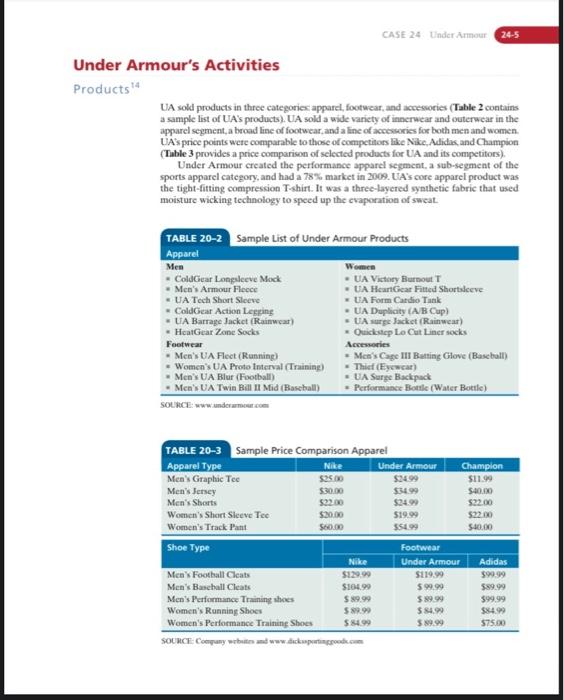

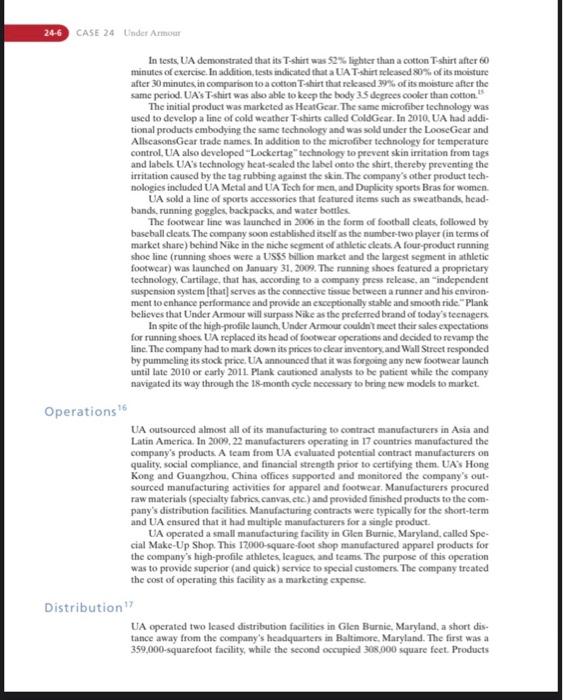

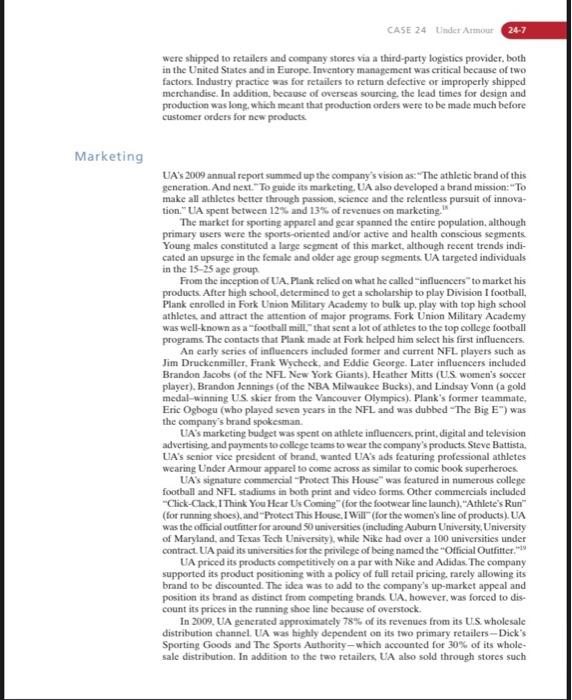

Ram Subramanian Monedair Saute Universio Pradeep Gopalakrishna Lubin Sohool of Busines Puce University Kevin A. Plank, the founder and Chief Executive Officer of Under Armour (UA). reviewed the peess bricfing that was to accompany the company's release of the financial performance for the second quarter of fiscal 2010. Plank noted that the second quarter saw the second consecutive decline in footwear sales. UA's footwear sales had declined by 45% over second quarter 3009 and was showing a 16.6% decline for the first six months of 2010 over 2009 . This was in contrast to apparel, the company's core category, which saw a 32.2% uptick over 2009 , and accessories that had gone up by 28% (Table 1 shows summary performance for the first two quarters of fiscal 2010)1 TABLE 20-1 Under Armour's Summary Financials for First Two Quarters of 2010 (in USS millions) SOURKE Under Aemien M00. 3016 The Sporting Goods Manufacturers Association (SGMA) projected the industry's revenues in the United States to hit US\$75.03 billion (wholesale) in 2010 , an increase of 4.5% over 20092 Sports apparel and athletic footwear were two important industry catcgories. Sports apparel accounted for approximately USS30 biltion in revenues and was projected to grow at 2.4%, while footwear was US\$12.9 billion with a projected growth rate of 5.1%. The womenis segment of the sports apparel category was the fastest growing industry segment with an anticipated 42% growth rate. The sporting goods industry was cyclical in nature and was impacted by the macrocconomic busincss cycle. There was a high correlation between dipoeable income and industry sales. The 4.3% drop in 2009 industry revenues over 2008 was due to the 20002009 recession, and as the economy recovers s0 will consumer spending on fitness and athletic apparel. Ten brands accocinted for 30 S. of the sports apparel market share. The rest were spread out amone numerous small companies that focused on specific segments. Apparel made from synthetic products was the fasteit growing segment of the sports apparel markef. This category was referred to as "performance apparel" (the category created by (.A), and products in this category were purchased for use in active sports or exercise. Performance apparel consisted of apparel that provided compression. moisture management, and temperature control. The sports apparel market was fragmented, with Nike ( 16.4% market share in 2008 ) and Adidas (1.3.8\%) accounting for less than one-thind of the market. Champion, a brand owned by Haneshrands lnc, was reganded as an up-and-ooening player in this segmeat. The performance apparel segment was concentrated with W'A holding a 78% market share in 2009. ." The athletic footwear market was domtinated by Nike and Adidas (that also owned the Recbok brand). In 2009 , Nike had an estimated 35% market sharc, Adidas 22%, followed by New Balance and Puma." Sporting goods companics typically designed the product and outsourced manufacturing to contract manufacturers in various Asian countrics. In the footwear segmeat, Vietnam, China, and Indonesia were the leading countries for contract manufacture, while Chim, Thailand, and Indonesia were the most used by sports apparel companies. Many leading sporting goods companies (Nike, Adidas, and UA, among them) sourced inputs (such as synthetic rubber and fiber, leather, and canvas) to take advantage of purchasing power and pass on the inpets to the contract manufacturers. Nike, for example, also used a Japanese company for global procurement of key inputs The contract manufacturers were responsible for shipping the finished products cither to the client (for sale through company stores or online) or to the warehouses of retail chains. All the leading sporting goods companies had local offices to monitor their contract manufacturers Sporting goods were sold in the United States through department stores (such as Scars). mass merchandisers (such as Target and Wal-Mart), sports specialty chaias (such as Dick's Sporting Goods. Modell s, and The Sports Authority), and thousands of independent stores, both freestanding and mall-based." According to Standard k. Poor ' x. in 20099 sports specialty stores accounted for 307 of sporting goods sales, followed by 22% for mass merchandisers, and 14% for department stores. Internet retailers, factory stores, and independent outlets accounted for the rest of the retail sales. Leading coenpanies in the industry sold their products throuph a wide variety of channels, including company owned "flagship" and factory-outlet stotes, as well as via the Internet. Consumers faced a number of choices in cach catcgory of sporting goods, with some categories like athletic footwear offering 30 plus well-known brands Sporting goods companies competed on a varicty of price points, with most product catepories offering some variation of the "good," better," "best" possibilities. UA regarded its key competitors as Nike and Adidac. In addition. Champion competed with UA in the apparel category. Founded in 1964 by Bill Bowerman and Phil Knight, Nike was the world's leading supplier of athletic footwear and appareL. It reported revenues of US519.014 billion, gross margins of 46.3%, and net income of US51.907 billion in 2010 . It sold US510.332 billion worth of footwear, US55.037 of apparel, and USS1.035 million of equipment (the rest of the revenues came from licensing and its other brands such as Cole Haan). Fifty-eight percent of its revenues came from intemational markets It sold its products in over 170 countries, and it employed around 30,000 people. The company identified its target market as any individual playing a sport anywhere in the world. It s slogan in this regard was, "If you have a body, you are an athlete." Nike was positioned as a premium brand and the company sought to maximize its brand equity. It sold through 23,000 U.S and 24,000 international outlets. Its 2010 marketing budget was US\$2 356 billion. The company's athletic endorsers included Tiger Woods, Kobe Bryant, LeBron James and Cristiano Ronaldo. In its 2010 annual report, Nike's CEO. Mark Parker, spoke about China being the next great opportunity for the company. In addition, he identified "action sports" as a key growth category and emphasized the need to leverage the company's Nike, Converse, and Hurley brands in this category. He spoke about the strength of the Nike brand: -The NIKE brand will alwars be our greatod competitive afvandege. Ir's the source of our most advanced RAD. If deliven insight and sall and lenerusc to every NIKE, Inc brand and busines. If x the source of our cullure and penonaliry ther connects so strongh with consoners atraind the warld. Thr NIKE Brand is a sockre of butant condibulity and opportunity that we never take for granted - The Adidas Group was a Germany-based globul industry leader. It was the largest athletic products company in Europe and second in the world, after Nike. It reported 2009 revenues of 10.381 billion euros, a gross profit of 4.712 billion curos, and net income of 245 million curos. It employed 39.596 people and sold products under the Adidas, Reebok, Rockport, and Taylor Made brand names. It used leading athletes such as Lionel Messi and David Beckham to endorse its products Each of the company's subsidiaries created brands that catered to specific target markets, such as Taylor Made for golf, Rockport for the metropolitan professional, and Recbok Classic for the lifestyle consumer. Champion, a leading sports apparel company, was part of Hanesbrands, Inc. Hanesbrands, Inc, was spun off from Sara Lee Corporation and owned brands such as Hanex Champion, Playtex, and Legger Champion competed in the sports apparel and performance sports apparel segments with T-shirts shorts fleece, sports bras, and thermals. The company obtained 89% of its revenues from the United States. It reported revenues of US\$3.691 billion in fiscal 2010, gross profits of US\$1.265 billion, and net income of US\$51.83 million. It employed 47400 employees In 1995, Kevin Plank was a walk-on special teams player for the University of Maryland football team. He played on the field goal, punting, and kicking teams. At 5'11" and 228 pounds, Plank tended to sweat a lot during the long, arduous practice sessions. Frustrated by being weighed down by the accumulated sweat in his cotton T-shirt, Plank began to search for alternatives. He began looking for synthetic material that would wick the sweat from his body and make him lighter and faster. He took various promising fabrics to a local fabric store to be sewn as a T-shirt. After spending US\$450 on seven prototypes. Plank found a fabric usually used in women's lingerie to work very well as a tight-fitting compression T-shirt. The T-shirt (inner wear) wicked away sweat, thus keeping the outerwear light. Plank used his savings of US\$17,000 from a campus flower business to order 500 shirts. Plank gave these shirts to his high school and college teammates and also mailed them to college and professional football player friends from around the country. Plank talked about the importance of player recommendation to the success of the startup company. These early influencers included Jim Druckenmiller, then a backup quarterback for the San Francisco 49ers, and his teammate, Frank Wycheck (a teammate of Plank's at the University of Maryland). The first big exposure for Plank came serendipitously. A front-page photograph in USA Todlay of then-Oakland Raiders quarterback, Jeft George, showed George wearing the UA mock turtleneck T-shirt visibly under his uniform. This surprised Plank because he hadn't sent a sample to George. While the George photograph gave the fledgling company publicity, it did not turn into sales. Plank sent samples to every equipment manager in the Atlantic Coast Conference. His first big break came when the equipment manager for Georgia Tech University placed an order for 350 T-shirts North Carolina State University followed with an order and the network of equipment managers soon resulted in sales to other colleges and National Football League teams Further exposure came with the release of Oliver Stone's football movic Any Given Sunday. Plank had heard about the movie from a former high school classmate and sent samples of his product to the costume designer. It resulted in the movie's star, Jamie Foxx wearing a UA jockstrap prominently in a locker room scene. Anticipating publicity from the movic, Plank paid US\$25,000 for an advertisement in ESPN The Maguzine. The advertisement generated orders worth US5750,000 and the three-year old company was on its way. In effect, Plank had created, using US\$17000 of his own cash and a US\$40,000 credit card debt, a new category of sports apparel. one that focused on the athlete's performance, and hence dubbed "performance apparel" Plank talked about how the company was able to create an entirely new category: "Analysts often ask me-"How was the door left so wide open for UiA's entry imt the indur. mri? 1 tell them that my many detractors did not think consumers would pay $25 to $35 for a T-shirt, But, when you grive consuaners some tangible benefit, your ire able to reinsint entire product culegaries. 13 Plank took the company public in a 2005 IPO. Under Armour was granted the rights to outfit the fictitious Dillon Panthers high school football team when the television show Friday Night Lights premiered in 2006 on NBC. The company, headquartered in Baltimore, Maryland, had a market cap of US\$2.28 billion in September 2010. Plank owned 25\% of UA shares and also controlled 77% of the company's voting shares. 13 UA sold products in three categories apparel, footwear, and accessories (Table 2 contains a sample list of UA's products). UA sold a wide variety of innerwear and outerwear in the apparel seement, a broad line of footwear, and a line of accessories for both men and women UAs price points were comparable to those of competilors like Nike, Adidns, and Champion (Tuble 3 provides a price comparison of selected products for UA and its competitors). Under Armour created the performanee apparel segment, a sub-segment of the sports apparel catceory, and had a 78% market in 2009 . UA's core apparel product was the tight-fitting comprescion T-shirt. It was a three-layered synthetic fabric that used moisture wicking technology to speed up the evaporation of sweat. 34Mine.1: ww w unacrarmonen aven In tests. UA demonstrated that its T-shirt was 52? liehter than a cotton T-shirt after 60 minutes of exercixc. In addition, tests indicated that a LA T-shirt releascd 80% of its motsture after 30 minutes, in comparison to a cotton T-shirt that released 39% of its asoisture afler the sarne period. UA's T-shist was alwo able to kecp the body 35 Jecrees cooler than cotton. The initial product was marketed as HeatGear. The same microtiber technology was used to develop a linc of cold weather T-shirts called ColdGear. In 2010 . UA had additional products cmbodying the same iechnolory and was sold under the LooseGear and AllscasonsGear trade names. In addition to the microfiber technology for temperature control, UA also developed "Lockertag" technology to prevent skin irritation from tags and labels. UA's technology heat-sealed the label onto the shirt, thereby preventing the irritation caused by the tag rubking against the skin. The company's other product technologies included UA Metal and UA Tech for men, and Duplicity spoets Bras for women. UA sold a line of sports aceessoties that featured items such as sweathands, headbands, running goggles, backpacks, and water bottes. The footwear line was launched in 2006 in the form of football cleats, followed by baseball cleats. The company soon established itself as the number-two player fin terms of market share) behind Nike in the niche scgment of athlctic cleats. A four-product running shoe line (running shoes were a US55 bullion market and the largest segment in athletic footwear) was launched on January 31, 2009. The running shoes featured a proprictary technology, Cartilage, that has, accotding to a company press release, an -independent suspension system [that] serves as the connective tissuc between a runner and his environ. ment to enhance performance and provide an esecptionally stable and smeoth ride." Plank believes that Under Armour will surpass Nike as the pecferred brand of today's teenagers. In spite of the high-protile launch, Under Armour couldnit meet their sales expectations for running shoes UA replaced its head of footwear operatiocs and decided to revamp the line. The company had to mark down its prices to dear inventory, and Wall Strect responded by pummcling its stock price, UA announced that it was forgoeng any new footwear launch until late 2010 or carly 2011 . Mank cautioned analysts to be paticnt whale the cocnpany navigated its way through the 18 -month cycle necessary to bring new models to market. UA outsourced almost all of its manufacturing to contract manufacturers in Asia and Latin America. In 2009,22 manufacturets operating in 17 countries manufactured the company's products A team from UA cvaluated potcatial contract manufacturers on quality, social compliance, and financial strength prior to certifying them. UA' Hong Kong and Guangehou, China offices supported and monitorcd the company's outsourced manufacturing activities for apparel and footwear. Manufacturers procured raw materials (specialty fabrics, canvas, ctc.) and provided finished products to the company's distribution facilities. Manufacturing contracts were typically for the short-term and UA ensured that it had multiple manufacturers for a single product. UA operated a small manufacturing facility in Glen Burnie, Maryland, called Special Make-Up Shop. This 17000-squarc-foot shop manufactured apparel products for the company's high-profile athletes, leagues, and teams. The purpose of this operation was to provide superior (and quick) service to special customers. The company treated the cost of operating this facility as a marketing expense. UA operated two leased distribution facilities in Glen Plurnie. Maryland, an short distance away from the company's headquarters in Baltimore. Maryland. The first was a 359.000-squarefoot facility, while the second occupied 306.000 square feet. Products were shipped to retailers and company stores via a third-party logistics provider. both in the United States and in Europe. Inventory management was critical because of two factors. Industry practice was for retailers to return defective or improperly shipped merchandise. In addition, because of overseas sourcing, the lead times for design and production was lone, which meant that ptoduction orders were to be made much before customer orders for new products UA's 2009 annual report summed up the company's vision as: "The athletic brand of this generation. And next. - To guide its marketing, UA also developed a brand mission:"To make all athletes better through passion, science and the relentless pursuit of innovation." UA spent between 12% and 13% of revenues on marketing. In The market for sporting apparel and gear spanned the entire population, although primary wsers were the sports-oriented andlor active and health conscious segments Young males constituted a large segment of this market, although recent trends indicated an upsurge in the female and older age group segments. UA targeted individuals in the 1525 age group From the inception of UA. Phank relicd on what he called "influcncers" to market his products. After high school, determined to get a scholarship to play Division I football, Plank enrolled in Fork Union Military Academy to bulk up, play with top high school athletes, and attract the attention of major programs. Fork Union Military Academy was well-known as a "foothall mill." that sent a lot of athletes to the top college football programs. The contacts that Plank made at Fork helped him select his first influencers. An early series of infleencers included former and current NFL. players such as Jim Druckenmiller, Frank. Wycheck, and Eddie George. Later influencers included Brandon Jacobs (of the NFL. New York Giants). Heather Mitts (U.S. women's soceer player). Brandon Jennings (of the NBA Milwaukee Bucks), and Lindsay Vonn (a gold medal-winning US. skier from the Vancouver Olympics). Plank's former teammate. Eric Ogbogu (who played seven years in the NFL and was dubbed -The Big E") was the company's brand spokesman. UA's marketing budect was spent on athlete influencers print, digital and television advertising and payments to college teams to wear the company's products. Steve Battista. UA's senior vice president of brand, wanted UA's ads featuring protessional athletes wearing Under Armour apparel to come across as similar to comic book superheroes. UA's signature commercial -Protect This House" was featured in numerous college foothall and NFL stadiums in both print and video forms. Other commercials included "Click-Clack, I Think You Hear Us Coming" (for the footwear line launch). "Athlete's Run" (for running shoes), and-Protect This House, I WiI" (for the women's line of products). UA was the otficial outfitier for around $0 universities (including Auburn University, University of Maryland, and Texas Tech University). while Nike had over a 100 universities under contract. UA paid its universities for the privilege of being named the "Oificial Outfitter. "i9 UA priced its products competitively on a par with Nike and Adidas. The company supported its product positioning with a policy of full retail pricing, rarely allowing its brand to be discounted. The idea was to add to the company's up-market appeal and position its brand as distinct from competing brands. UA, however, was forced to discount its prices in the running shoe line because of overstock. In 2009, UA generated apptoximately 78\% of its revenues from its U.S. wholesale distribution channel. UA was highly dependent on its two primary retailers-Dick's. Sporting Goods and The Sports Authority-which accounted for 30% of its wholesale distribution. In addition to the two retailers, UA also sold through stores such Sinder Armour as Modell's Sporting Goodk, Academy Sports and Outdoors in the United States, and Sportcheck International and Sportsman International in Canada. UA's distribution channels also included independent and specialty retailers, institutional athletic departments, leagues and teams, and company-owned stores as well as its website. When UA got into footwear, it extended its distribution to include footwear chains such as Finish Line and Foot Locker. Worldwide. UA sold its peodact in over 20000 stores. In September 2010. UA employed approximately 3,000 people. About half of the employees worked at the company's manufacturing facility, the Special Make-Up Shop, and various company-owned stores. The rest worked at UA's distribution facilities and the corporate headquarters. The company's employees were non-univonized. The company reported that in 2008 it received about 26,000 resumes of which it hired 215 employees. Eight executives made up UA's top management team. Kevin A. Plank was the President, Chief Executive Officer, and Chairman of the Board, Wayne A. Marino was the Chief Operating Olficer, and Brad Dickerson was the Chief Financial Otficer. The operations of the company were divided into apparel (led by Senior Vice President. Henry B. Stafford) and footwear (headed by Senior Vice President, Gene McCarthy). Distribution was the responsibility of Dan J. Sawall (Vice President of Retail), and John S. Rogers (Vice President/General manager of e-Commerce). Finally, Kevin Plank's older brother, I. Scott Plank headed the company's domestic and global business development efforts as an Executive Vice President. Football, the sport that gave UA its start, not only doeninated the company's product categories, but also permeated its culture. For example, employees were referred to as "teammates." Further, posted on the walls of company offices were -Under Armour Huddles." short, pithy statements that provided guidance to all. Examples were "manage the clock," "execute the play," and "run the huddle," Plank himself set the aggressive lone for the company by never considering UA to be too small to take on giants such as Nike. Plank and Marino, the COO, had developed a tradition of meeting at Plank's house every Saturday morning at 6000am. Accompanied by personal traincrs, the two would engage in a strenuous physical workout while talking about Under Armour. Tori Hanna. UA's director of women's sports marketing, talked about bow Plank's belief in playing offense even in a tough coonomy percolated throughout the company. Table 4 contains UA's financials for the last three years. The company broke down its revenues into apparel, footwear, acoessories, and licensing 21 It did not, however, provide category-wise operating margins. The company explaincd that the 2009 decline in gross profit margins was due to a less favorable footwear and apparel product mix and the liquidation of unsold footweat inventory. The company's finances were affected by scasonality with the last two quarters showing better numbers because of the Fall football season. The company did not break down revenues geographically, although one report indicated that in 2009 . UA obtained nearly 94% of its revenues from the United States and Canada. The Pursuit of Three Percent Several experts criticized the company's foray into footwear. Laura Rics, a marketing expert, was quite critical of UA's cntry into footwear: "The key to remember is that Uinder Arwour awn t mast at erent briand, Vinder Ammour pionecred and dominater a great category. fos power comes from the catogary it owns in the mind, not the brand aame it putt on the package. "Under Arment" are the ward shat represert that category in wuind. So patring the Uinder Armour brand name an anoeher catckory is not koing to kuanantre muccess, eppevially if that catecory has lirtle do do with performance chothing. Uhiler Armour is an apparel hpand. Nike is a foorwnar brand. Each might sell other staff too, bue the brands are rooted in these catheories and can x grow too far from thren. Hewe is a compary (U/A) with no crndibility an adhletic whoer atmocking one of the world'r mast icomic and dominant brands for athlecic footwnar. Furthermore, Einder Arwoar wax doang so with ne clear-cut prodlact advantoge and with a name that definnd a totally differout strategy, 21 John Horan, publisher of Sporting Goods tntelligence, an industry newsleter, talked about the U.S. sports apparelfootwear market becoming a duopoly with Nike and Under Armour. He believes that Under Armour is one of a very small number of coenpanies that has successfully challenged Nike in the marketplace. But Plank and his team were attracted by the US\$31 billion international branded footwear market. Their contention was that even a 3% share of the market would nearfy double UA's total revenues. They based their support of the footwear fotay on the strength of UA's brand. In addition. UA's icam believed that the strone relationships they had with the distribution channel was a viable foundation to succeed in the new catcgory. In a number of intervicwx. Plank and has top management team memhers had reiterated the importance of the international markets for its apparcl products. In fact, Pank's favorite line was "We baven't sold a single T-shirt in China." UA was a company that was largely dependent on the U.S. market for its revenues. As Plank reflected on UA's second quarter 2010 financial results, he thought about what he wanted UA to be. Should the company attempt to be a leading athletic brand with products beyond apparcl, or should UA cement its reputation as the leading US. performance apparel maker and extend its dominance globally? EN D NOTES 1. Under Armoer Prea Release, July 27, 2010 hnpolinnestor Rapid Rise ef Under Armeur, Mnpelka.com. April 9 . underarmourcomireleases dtan. 3099. Deasauer, Catin. For Under Armour CEO and Foof, btip:/Wwe foolcominvestinghigh.growth/2008 con, March ane, De Lollik, Barthara, No Swcat: Masa an $ splember 20,3040. December 12. 2004, hnpoliksateday com, abd, Heath. 4. Heath. Thomat. Taking on the Giansc How Under Armour Thotsac, op. cit. Founder Kevis Fank Is Going Head-4e-Head with the 12. Under Armoer, 2006 Annual Recport. Industry's Biegest Playen. The Washingtem Petr. 13. Yahoo Finance and Heath. Thimas, op. ait laniary 24, 2010, www washingtonpost coum 14. Under Armour. 2009 lok. 5. Webrites of Nike and Under Armeur. 15. Under Armser, vatious acks. 6. Standatd \& Poor's Iodustry Surveys, Apparel aad 16. Under Armoer, 2009 Jok. Footwear: retailers and Brands, September 3, 200? 17. Ihid 7. Ewe mike com 18. Under Armotr. 3000 Annual Report. 8. Bhid. 2010 Ananal Report. 19. Hider Armoer, 2009 10k 4. aww adidas.com 20. Under Armoet, Investor Relatione Wrhaide. 10. ww hasestrandi com. 21. Under Anmoer, nes 1nK 11. This sectioe is drawn from the following sources: 22. hatpilnicu typepadeom'rici hlog SooN1 Hander-armoer Palmisano, Trey, From Raes to Microfiber lnnide the too-trie-foe-iti diat htmil, extraried September ZK, anto. Ram Subramanian Monedair Saute Universio Pradeep Gopalakrishna Lubin Sohool of Busines Puce University Kevin A. Plank, the founder and Chief Executive Officer of Under Armour (UA). reviewed the peess bricfing that was to accompany the company's release of the financial performance for the second quarter of fiscal 2010. Plank noted that the second quarter saw the second consecutive decline in footwear sales. UA's footwear sales had declined by 45% over second quarter 3009 and was showing a 16.6% decline for the first six months of 2010 over 2009 . This was in contrast to apparel, the company's core category, which saw a 32.2% uptick over 2009 , and accessories that had gone up by 28% (Table 1 shows summary performance for the first two quarters of fiscal 2010)1 TABLE 20-1 Under Armour's Summary Financials for First Two Quarters of 2010 (in USS millions) SOURKE Under Aemien M00. 3016 The Sporting Goods Manufacturers Association (SGMA) projected the industry's revenues in the United States to hit US\$75.03 billion (wholesale) in 2010 , an increase of 4.5% over 20092 Sports apparel and athletic footwear were two important industry catcgories. Sports apparel accounted for approximately USS30 biltion in revenues and was projected to grow at 2.4%, while footwear was US\$12.9 billion with a projected growth rate of 5.1%. The womenis segment of the sports apparel category was the fastest growing industry segment with an anticipated 42% growth rate. The sporting goods industry was cyclical in nature and was impacted by the macrocconomic busincss cycle. There was a high correlation between dipoeable income and industry sales. The 4.3% drop in 2009 industry revenues over 2008 was due to the 20002009 recession, and as the economy recovers s0 will consumer spending on fitness and athletic apparel. Ten brands accocinted for 30 S. of the sports apparel market share. The rest were spread out amone numerous small companies that focused on specific segments. Apparel made from synthetic products was the fasteit growing segment of the sports apparel markef. This category was referred to as "performance apparel" (the category created by (.A), and products in this category were purchased for use in active sports or exercise. Performance apparel consisted of apparel that provided compression. moisture management, and temperature control. The sports apparel market was fragmented, with Nike ( 16.4% market share in 2008 ) and Adidas (1.3.8\%) accounting for less than one-thind of the market. Champion, a brand owned by Haneshrands lnc, was reganded as an up-and-ooening player in this segmeat. The performance apparel segment was concentrated with W'A holding a 78% market share in 2009. ." The athletic footwear market was domtinated by Nike and Adidas (that also owned the Recbok brand). In 2009 , Nike had an estimated 35% market sharc, Adidas 22%, followed by New Balance and Puma." Sporting goods companics typically designed the product and outsourced manufacturing to contract manufacturers in various Asian countrics. In the footwear segmeat, Vietnam, China, and Indonesia were the leading countries for contract manufacture, while Chim, Thailand, and Indonesia were the most used by sports apparel companies. Many leading sporting goods companies (Nike, Adidas, and UA, among them) sourced inputs (such as synthetic rubber and fiber, leather, and canvas) to take advantage of purchasing power and pass on the inpets to the contract manufacturers. Nike, for example, also used a Japanese company for global procurement of key inputs The contract manufacturers were responsible for shipping the finished products cither to the client (for sale through company stores or online) or to the warehouses of retail chains. All the leading sporting goods companies had local offices to monitor their contract manufacturers Sporting goods were sold in the United States through department stores (such as Scars). mass merchandisers (such as Target and Wal-Mart), sports specialty chaias (such as Dick's Sporting Goods. Modell s, and The Sports Authority), and thousands of independent stores, both freestanding and mall-based." According to Standard k. Poor ' x. in 20099 sports specialty stores accounted for 307 of sporting goods sales, followed by 22% for mass merchandisers, and 14% for department stores. Internet retailers, factory stores, and independent outlets accounted for the rest of the retail sales. Leading coenpanies in the industry sold their products throuph a wide variety of channels, including company owned "flagship" and factory-outlet stotes, as well as via the Internet. Consumers faced a number of choices in cach catcgory of sporting goods, with some categories like athletic footwear offering 30 plus well-known brands Sporting goods companies competed on a varicty of price points, with most product catepories offering some variation of the "good," better," "best" possibilities. UA regarded its key competitors as Nike and Adidac. In addition. Champion competed with UA in the apparel category. Founded in 1964 by Bill Bowerman and Phil Knight, Nike was the world's leading supplier of athletic footwear and appareL. It reported revenues of US519.014 billion, gross margins of 46.3%, and net income of US51.907 billion in 2010 . It sold US510.332 billion worth of footwear, US55.037 of apparel, and USS1.035 million of equipment (the rest of the revenues came from licensing and its other brands such as Cole Haan). Fifty-eight percent of its revenues came from intemational markets It sold its products in over 170 countries, and it employed around 30,000 people. The company identified its target market as any individual playing a sport anywhere in the world. It s slogan in this regard was, "If you have a body, you are an athlete." Nike was positioned as a premium brand and the company sought to maximize its brand equity. It sold through 23,000 U.S and 24,000 international outlets. Its 2010 marketing budget was US\$2 356 billion. The company's athletic endorsers included Tiger Woods, Kobe Bryant, LeBron James and Cristiano Ronaldo. In its 2010 annual report, Nike's CEO. Mark Parker, spoke about China being the next great opportunity for the company. In addition, he identified "action sports" as a key growth category and emphasized the need to leverage the company's Nike, Converse, and Hurley brands in this category. He spoke about the strength of the Nike brand: -The NIKE brand will alwars be our greatod competitive afvandege. Ir's the source of our most advanced RAD. If deliven insight and sall and lenerusc to every NIKE, Inc brand and busines. If x the source of our cullure and penonaliry ther connects so strongh with consoners atraind the warld. Thr NIKE Brand is a sockre of butant condibulity and opportunity that we never take for granted - The Adidas Group was a Germany-based globul industry leader. It was the largest athletic products company in Europe and second in the world, after Nike. It reported 2009 revenues of 10.381 billion euros, a gross profit of 4.712 billion curos, and net income of 245 million curos. It employed 39.596 people and sold products under the Adidas, Reebok, Rockport, and Taylor Made brand names. It used leading athletes such as Lionel Messi and David Beckham to endorse its products Each of the company's subsidiaries created brands that catered to specific target markets, such as Taylor Made for golf, Rockport for the metropolitan professional, and Recbok Classic for the lifestyle consumer. Champion, a leading sports apparel company, was part of Hanesbrands, Inc. Hanesbrands, Inc, was spun off from Sara Lee Corporation and owned brands such as Hanex Champion, Playtex, and Legger Champion competed in the sports apparel and performance sports apparel segments with T-shirts shorts fleece, sports bras, and thermals. The company obtained 89% of its revenues from the United States. It reported revenues of US\$3.691 billion in fiscal 2010, gross profits of US\$1.265 billion, and net income of US\$51.83 million. It employed 47400 employees In 1995, Kevin Plank was a walk-on special teams player for the University of Maryland football team. He played on the field goal, punting, and kicking teams. At 5'11" and 228 pounds, Plank tended to sweat a lot during the long, arduous practice sessions. Frustrated by being weighed down by the accumulated sweat in his cotton T-shirt, Plank began to search for alternatives. He began looking for synthetic material that would wick the sweat from his body and make him lighter and faster. He took various promising fabrics to a local fabric store to be sewn as a T-shirt. After spending US\$450 on seven prototypes. Plank found a fabric usually used in women's lingerie to work very well as a tight-fitting compression T-shirt. The T-shirt (inner wear) wicked away sweat, thus keeping the outerwear light. Plank used his savings of US\$17,000 from a campus flower business to order 500 shirts. Plank gave these shirts to his high school and college teammates and also mailed them to college and professional football player friends from around the country. Plank talked about the importance of player recommendation to the success of the startup company. These early influencers included Jim Druckenmiller, then a backup quarterback for the San Francisco 49ers, and his teammate, Frank Wycheck (a teammate of Plank's at the University of Maryland). The first big exposure for Plank came serendipitously. A front-page photograph in USA Todlay of then-Oakland Raiders quarterback, Jeft George, showed George wearing the UA mock turtleneck T-shirt visibly under his uniform. This surprised Plank because he hadn't sent a sample to George. While the George photograph gave the fledgling company publicity, it did not turn into sales. Plank sent samples to every equipment manager in the Atlantic Coast Conference. His first big break came when the equipment manager for Georgia Tech University placed an order for 350 T-shirts North Carolina State University followed with an order and the network of equipment managers soon resulted in sales to other colleges and National Football League teams Further exposure came with the release of Oliver Stone's football movic Any Given Sunday. Plank had heard about the movie from a former high school classmate and sent samples of his product to the costume designer. It resulted in the movie's star, Jamie Foxx wearing a UA jockstrap prominently in a locker room scene. Anticipating publicity from the movic, Plank paid US\$25,000 for an advertisement in ESPN The Maguzine. The advertisement generated orders worth US5750,000 and the three-year old company was on its way. In effect, Plank had created, using US\$17000 of his own cash and a US\$40,000 credit card debt, a new category of sports apparel. one that focused on the athlete's performance, and hence dubbed "performance apparel" Plank talked about how the company was able to create an entirely new category: "Analysts often ask me-"How was the door left so wide open for UiA's entry imt the indur. mri? 1 tell them that my many detractors did not think consumers would pay $25 to $35 for a T-shirt, But, when you grive consuaners some tangible benefit, your ire able to reinsint entire product culegaries. 13 Plank took the company public in a 2005 IPO. Under Armour was granted the rights to outfit the fictitious Dillon Panthers high school football team when the television show Friday Night Lights premiered in 2006 on NBC. The company, headquartered in Baltimore, Maryland, had a market cap of US\$2.28 billion in September 2010. Plank owned 25\% of UA shares and also controlled 77% of the company's voting shares. 13 UA sold products in three categories apparel, footwear, and accessories (Table 2 contains a sample list of UA's products). UA sold a wide variety of innerwear and outerwear in the apparel seement, a broad line of footwear, and a line of accessories for both men and women UAs price points were comparable to those of competilors like Nike, Adidns, and Champion (Tuble 3 provides a price comparison of selected products for UA and its competitors). Under Armour created the performanee apparel segment, a sub-segment of the sports apparel catceory, and had a 78% market in 2009 . UA's core apparel product was the tight-fitting comprescion T-shirt. It was a three-layered synthetic fabric that used moisture wicking technology to speed up the evaporation of sweat. 34Mine.1: ww w unacrarmonen aven In tests. UA demonstrated that its T-shirt was 52? liehter than a cotton T-shirt after 60 minutes of exercixc. In addition, tests indicated that a LA T-shirt releascd 80% of its motsture after 30 minutes, in comparison to a cotton T-shirt that released 39% of its asoisture afler the sarne period. UA's T-shist was alwo able to kecp the body 35 Jecrees cooler than cotton. The initial product was marketed as HeatGear. The same microtiber technology was used to develop a linc of cold weather T-shirts called ColdGear. In 2010 . UA had additional products cmbodying the same iechnolory and was sold under the LooseGear and AllscasonsGear trade names. In addition to the microfiber technology for temperature control, UA also developed "Lockertag" technology to prevent skin irritation from tags and labels. UA's technology heat-sealed the label onto the shirt, thereby preventing the irritation caused by the tag rubking against the skin. The company's other product technologies included UA Metal and UA Tech for men, and Duplicity spoets Bras for women. UA sold a line of sports aceessoties that featured items such as sweathands, headbands, running goggles, backpacks, and water bottes. The footwear line was launched in 2006 in the form of football cleats, followed by baseball cleats. The company soon established itself as the number-two player fin terms of market share) behind Nike in the niche scgment of athlctic cleats. A four-product running shoe line (running shoes were a US55 bullion market and the largest segment in athletic footwear) was launched on January 31, 2009. The running shoes featured a proprictary technology, Cartilage, that has, accotding to a company press release, an -independent suspension system [that] serves as the connective tissuc between a runner and his environ. ment to enhance performance and provide an esecptionally stable and smeoth ride." Plank believes that Under Armour will surpass Nike as the pecferred brand of today's teenagers. In spite of the high-protile launch, Under Armour couldnit meet their sales expectations for running shoes UA replaced its head of footwear operatiocs and decided to revamp the line. The company had to mark down its prices to dear inventory, and Wall Strect responded by pummcling its stock price, UA announced that it was forgoeng any new footwear launch until late 2010 or carly 2011 . Mank cautioned analysts to be paticnt whale the cocnpany navigated its way through the 18 -month cycle necessary to bring new models to market. UA outsourced almost all of its manufacturing to contract manufacturers in Asia and Latin America. In 2009,22 manufacturets operating in 17 countries manufactured the company's products A team from UA cvaluated potcatial contract manufacturers on quality, social compliance, and financial strength prior to certifying them. UA' Hong Kong and Guangehou, China offices supported and monitorcd the company's outsourced manufacturing activities for apparel and footwear. Manufacturers procured raw materials (specialty fabrics, canvas, ctc.) and provided finished products to the company's distribution facilities. Manufacturing contracts were typically for the short-term and UA ensured that it had multiple manufacturers for a single product. UA operated a small manufacturing facility in Glen Burnie, Maryland, called Special Make-Up Shop. This 17000-squarc-foot shop manufactured apparel products for the company's high-profile athletes, leagues, and teams. The purpose of this operation was to provide superior (and quick) service to special customers. The company treated the cost of operating this facility as a marketing expense. UA operated two leased distribution facilities in Glen Plurnie. Maryland, an short distance away from the company's headquarters in Baltimore. Maryland. The first was a 359.000-squarefoot facility, while the second occupied 306.000 square feet. Products were shipped to retailers and company stores via a third-party logistics provider. both in the United States and in Europe. Inventory management was critical because of two factors. Industry practice was for retailers to return defective or improperly shipped merchandise. In addition, because of overseas sourcing, the lead times for design and production was lone, which meant that ptoduction orders were to be made much before customer orders for new products UA's 2009 annual report summed up the company's vision as: "The athletic brand of this generation. And next. - To guide its marketing, UA also developed a brand mission:"To make all athletes better through passion, science and the relentless pursuit of innovation." UA spent between 12% and 13% of revenues on marketing. In The market for sporting apparel and gear spanned the entire population, although primary wsers were the sports-oriented andlor active and health conscious segments Young males constituted a large segment of this market, although recent trends indicated an upsurge in the female and older age group segments. UA targeted individuals in the 1525 age group From the inception of UA. Phank relicd on what he called "influcncers" to market his products. After high school, determined to get a scholarship to play Division I football, Plank enrolled in Fork Union Military Academy to bulk up, play with top high school athletes, and attract the attention of major programs. Fork Union Military Academy was well-known as a "foothall mill." that sent a lot of athletes to the top college football programs. The contacts that Plank made at Fork helped him select his first influencers. An early series of infleencers included former and current NFL. players such as Jim Druckenmiller, Frank. Wycheck, and Eddie George. Later influencers included Brandon Jacobs (of the NFL. New York Giants). Heather Mitts (U.S. women's soceer player). Brandon Jennings (of the NBA Milwaukee Bucks), and Lindsay Vonn (a gold medal-winning US. skier from the Vancouver Olympics). Plank's former teammate. Eric Ogbogu (who played seven years in the NFL and was dubbed -The Big E") was the company's brand spokesman. UA's marketing budect was spent on athlete influencers print, digital and television advertising and payments to college teams to wear the company's products. Steve Battista. UA's senior vice president of brand, wanted UA's ads featuring protessional athletes wearing Under Armour apparel to come across as similar to comic book superheroes. UA's signature commercial -Protect This House" was featured in numerous college foothall and NFL stadiums in both print and video forms. Other commercials included "Click-Clack, I Think You Hear Us Coming" (for the footwear line launch). "Athlete's Run" (for running shoes), and-Protect This House, I WiI" (for the women's line of products). UA was the otficial outfitier for around $0 universities (including Auburn University, University of Maryland, and Texas Tech University). while Nike had over a 100 universities under contract. UA paid its universities for the privilege of being named the "Oificial Outfitter. "i9 UA priced its products competitively on a par with Nike and Adidas. The company supported its product positioning with a policy of full retail pricing, rarely allowing its brand to be discounted. The idea was to add to the company's up-market appeal and position its brand as distinct from competing brands. UA, however, was forced to discount its prices in the running shoe line because of overstock. In 2009, UA generated apptoximately 78\% of its revenues from its U.S. wholesale distribution channel. UA was highly dependent on its two primary retailers-Dick's. Sporting Goods and The Sports Authority-which accounted for 30% of its wholesale distribution. In addition to the two retailers, UA also sold through stores such Sinder Armour as Modell's Sporting Goodk, Academy Sports and Outdoors in the United States, and Sportcheck International and Sportsman International in Canada. UA's distribution channels also included independent and specialty retailers, institutional athletic departments, leagues and teams, and company-owned stores as well as its website. When UA got into footwear, it extended its distribution to include footwear chains such as Finish Line and Foot Locker. Worldwide. UA sold its peodact in over 20000 stores. In September 2010. UA employed approximately 3,000 people. About half of the employees worked at the company's manufacturing facility, the Special Make-Up Shop, and various company-owned stores. The rest worked at UA's distribution facilities and the corporate headquarters. The company's employees were non-univonized. The company reported that in 2008 it received about 26,000 resumes of which it hired 215 employees. Eight executives made up UA's top management team. Kevin A. Plank was the President, Chief Executive Officer, and Chairman of the Board, Wayne A. Marino was the Chief Operating Olficer, and Brad Dickerson was the Chief Financial Otficer. The operations of the company were divided into apparel (led by Senior Vice President. Henry B. Stafford) and footwear (headed by Senior Vice President, Gene McCarthy). Distribution was the responsibility of Dan J. Sawall (Vice President of Retail), and John S. Rogers (Vice President/General manager of e-Commerce). Finally, Kevin Plank's older brother, I. Scott Plank headed the company's domestic and global business development efforts as an Executive Vice President. Football, the sport that gave UA its start, not only doeninated the company's product categories, but also permeated its culture. For example, employees were referred to as "teammates." Further, posted on the walls of company offices were -Under Armour Huddles." short, pithy statements that provided guidance to all. Examples were "manage the clock," "execute the play," and "run the huddle," Plank himself set the aggressive lone for the company by never considering UA to be too small to take on giants such as Nike. Plank and Marino, the COO, had developed a tradition of meeting at Plank's house every Saturday morning at 6000am. Accompanied by personal traincrs, the two would engage in a strenuous physical workout while talking about Under Armour. Tori Hanna. UA's director of women's sports marketing, talked about bow Plank's belief in playing offense even in a tough coonomy percolated throughout the company. Table 4 contains UA's financials for the last three years. The company broke down its revenues into apparel, footwear, acoessories, and licensing 21 It did not, however, provide category-wise operating margins. The company explaincd that the 2009 decline in gross profit margins was due to a less favorable footwear and apparel product mix and the liquidation of unsold footweat inventory. The company's finances were affected by scasonality with the last two quarters showing better numbers because of the Fall football season. The company did not break down revenues geographically, although one report indicated that in 2009 . UA obtained nearly 94% of its revenues from the United States and Canada. The Pursuit of Three Percent Several experts criticized the company's foray into footwear. Laura Rics, a marketing expert, was quite critical of UA's cntry into footwear: "The key to remember is that Uinder Arwour awn t mast at erent briand, Vinder Ammour pionecred and dominater a great category. fos power comes from the catogary it owns in the mind, not the brand aame it putt on the package. "Under Arment" are the ward shat represert that category in wuind. So patring the Uinder Armour brand name an anoeher catckory is not koing to kuanantre muccess, eppevially if that catecory has lirtle do do with performance chothing. Uhiler Armour is an apparel hpand. Nike is a foorwnar brand. Each might sell other staff too, bue the brands are rooted in these catheories and can x grow too far from thren. Hewe is a compary (U/A) with no crndibility an adhletic whoer atmocking one of the world'r mast icomic and dominant brands for athlecic footwnar. Furthermore, Einder Arwoar wax doang so with ne clear-cut prodlact advantoge and with a name that definnd a totally differout strategy, 21 John Horan, publisher of Sporting Goods tntelligence, an industry newsleter, talked about the U.S. sports apparelfootwear market becoming a duopoly with Nike and Under Armour. He believes that Under Armour is one of a very small number of coenpanies that has successfully challenged Nike in the marketplace. But Plank and his team were attracted by the US\$31 billion international branded footwear market. Their contention was that even a 3% share of the market would nearfy double UA's total revenues. They based their support of the footwear fotay on the strength of UA's brand. In addition. UA's icam believed that the strone relationships they had with the distribution channel was a viable foundation to succeed in the new catcgory. In a number of intervicwx. Plank and has top management team memhers had reiterated the importance of the international markets for its apparcl products. In fact, Pank's favorite line was "We baven't sold a single T-shirt in China." UA was a company that was largely dependent on the U.S. market for its revenues. As Plank reflected on UA's second quarter 2010 financial results, he thought about what he wanted UA to be. Should the company attempt to be a leading athletic brand with products beyond apparcl, or should UA cement its reputation as the leading US. performance apparel maker and extend its dominance globally? EN D NOTES 1. Under Armoer Prea Release, July 27, 2010 hnpolinnestor Rapid Rise ef Under Armeur, Mnpelka.com. April 9 . underarmourcomireleases dtan. 3099. Deasauer, Catin. For Under Armour CEO and Foof, btip:/Wwe foolcominvestinghigh.growth/2008 con, March ane, De Lollik, Barthara, No Swcat: Masa an $ splember 20,3040. December 12. 2004, hnpoliksateday com, abd, Heath. 4. Heath. Thomat. Taking on the Giansc How Under Armour Thotsac, op. cit. Founder Kevis Fank Is Going Head-4e-Head with the 12. Under Armoer, 2006 Annual Recport. Industry's Biegest Playen. The Washingtem Petr. 13. Yahoo Finance and Heath. Thimas, op. ait laniary 24, 2010, www washingtonpost coum 14. Under Armour. 2009 lok. 5. Webrites of Nike and Under Armeur. 15. Under Armser, vatious acks. 6. Standatd \& Poor's Iodustry Surveys, Apparel aad 16. Under Armoer, 2009 Jok. Footwear: retailers and Brands, September 3, 200? 17. Ihid 7. Ewe mike com 18. Under Armotr. 3000 Annual Report. 8. Bhid. 2010 Ananal Report. 19. Hider Armoer, 2009 10k 4. aww adidas.com 20. Under Armoet, Investor Relatione Wrhaide. 10. ww hasestrandi com. 21. Under Anmoer, nes 1nK 11. This sectioe is drawn from the following sources: 22. hatpilnicu typepadeom'rici hlog SooN1 Hander-armoer Palmisano, Trey, From Raes to Microfiber lnnide the too-trie-foe-iti diat htmil, extraried September ZK, anto I. External Environment

- Natural Environment

- Societal Environment

- Task Environment

II. Internal Environment

- Corporate Structure

- Corporate Culture

- Corporate Resources

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started