Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please recording the adjusted trial balance What is the value of the office supplies used by Scissors Alive in January 2019? 1) My office supplies

Please recording the adjusted trial balance

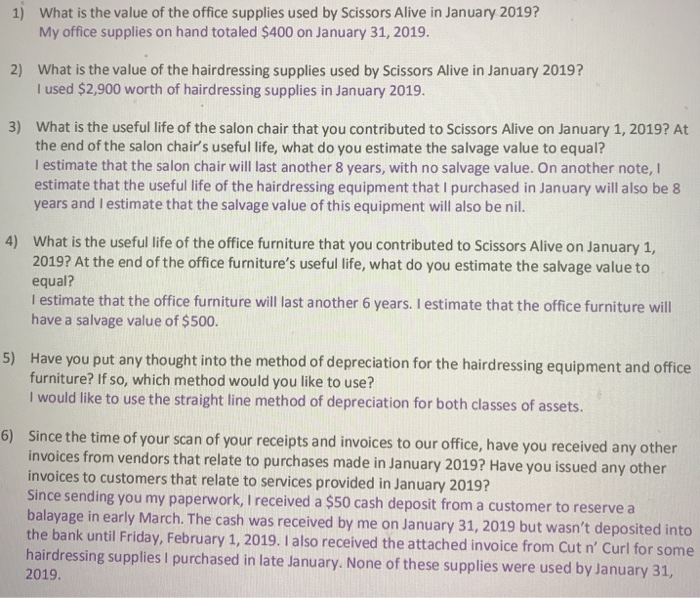

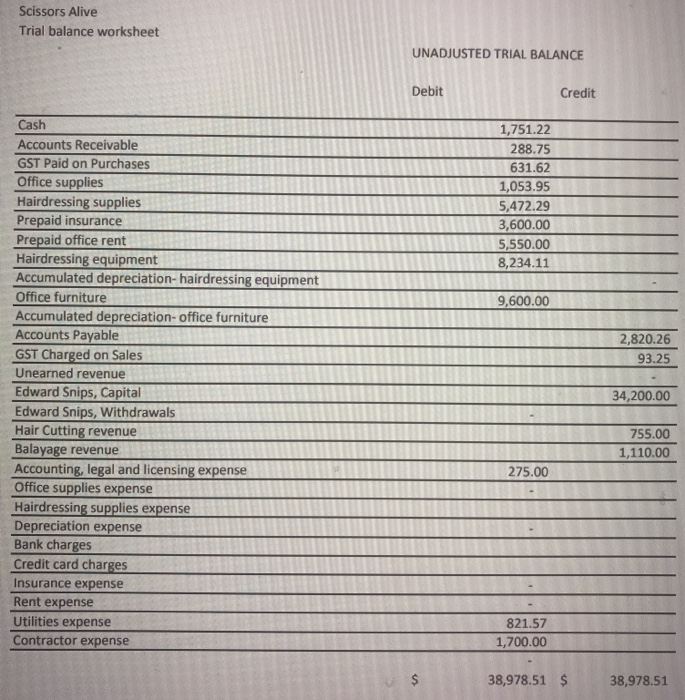

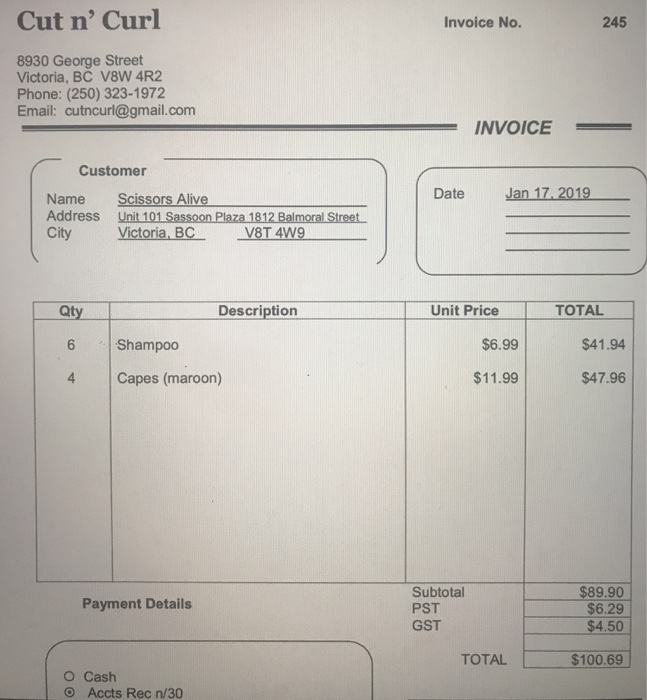

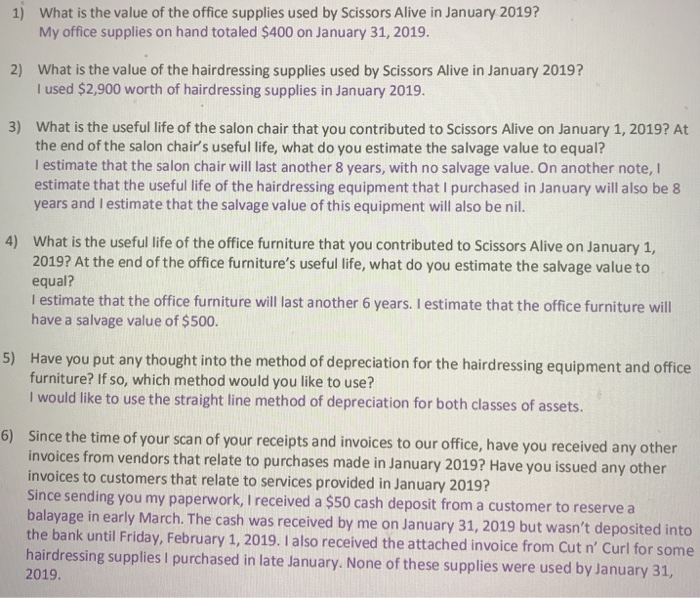

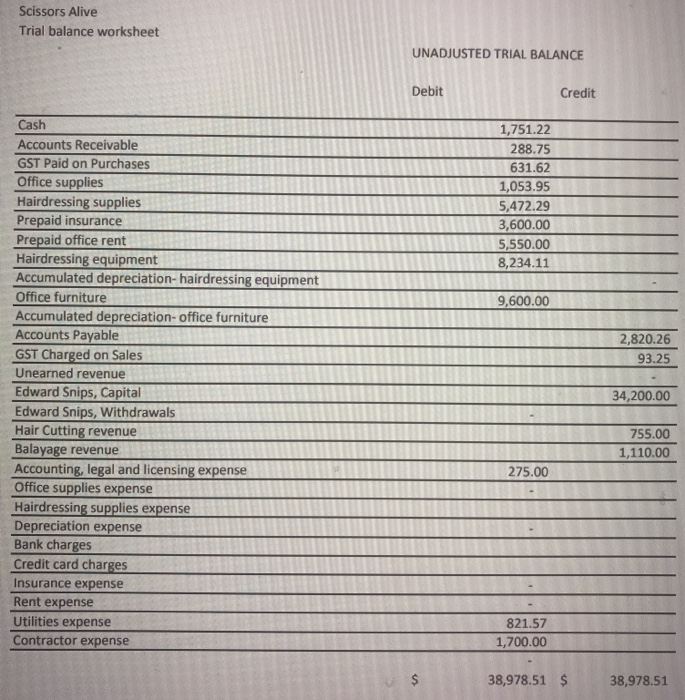

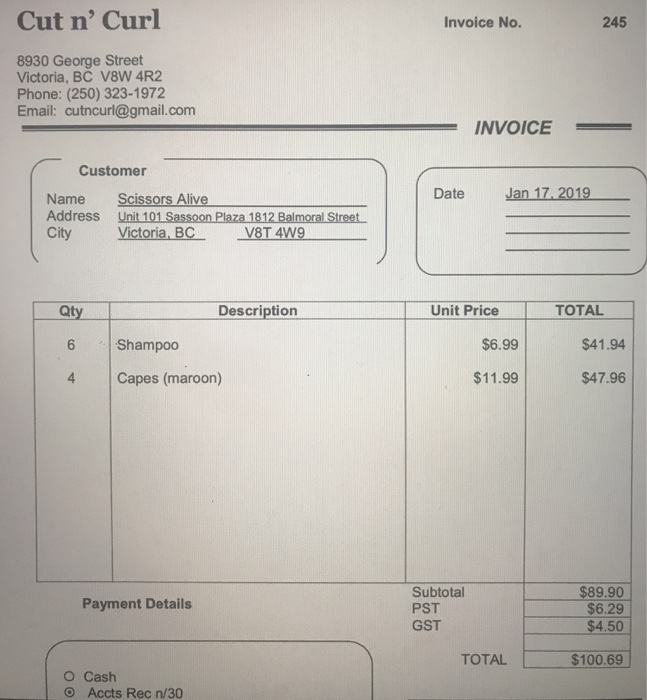

What is the value of the office supplies used by Scissors Alive in January 2019? 1) My office supplies on hand totaled $400 on January 31, 2019. 2) What is the value of the hairdressing supplies used by Scissors Alive in January 2019? I used $2,900 worth of hairdressing supplies in January 2019 3) What is the useful life of the salon chair that you contributed to Scissors Alive on January 1, 2019? At the end of the salon chair's useful life, what do you estimate the salvage value to equal? I estimate that the salon chair will last another 8 years, with no salvage value. On another note, I estimate that the useful life of the hairdressing equipment that I purchased in January will also be 8 years and I estimate that the salvage value of this equipment will also be nil. What is the useful life of the office furniture that you contributed to Scissors Alive on January 1, 2019? At the end of the office furniture's useful life, what do you estimate the salvage value to equal? l estimate that the office furniture will last another 6 years. I estimate that the office furniture will have a salvage value of $500 4) Have you put any thought into the method of depreciation for the hairdressing equipment and office furniture? If so, which method would you like to use? I would like to use the straight line method of depreciation for both classes of assets. 5) 6) Since the time of your scan of your receipts and invoices to our office, have you received any other invoices from vendors that relate to purchases made in January 2019? Have you issued any other invoices to customers that relate to services provided in January 2019? Since sending you my paperwork, I received a $50 cash deposit from a customer to reserve a balay age in early March. The cash was received by me on January 31, 2019 but wasn't deposited into the bank until Friday, February 1, 2019. I also received the attached invoice from Cut n' Curl for some hairdressing supplies I purchased in late January. None of these supplies were used by January 31 2019 Scissors Alive Trial balance worksheet UNADJUSTED TRIAL BALANCE Debit Credit Cash Accounts Receivable GST Paid on Purchases Office supplies 1,751.22 288.75 631.62 1,053.95 5,472.29 Prepaid insurance Prepaid office rent Hairdressing equipment Accumulated depreciation- hairdressing equipment 5,550.00 8,234.11 Accumulated depreciation-office furniture Accounts Payable GST Charged on Sales 2,820.26 93.25 Unearned revenue 34,200.00 Hair Cutting revenue Balayage revenue 1,110.00 275.00 Office supplies expense Hairdressing supplies expense Depreciation expense Bank charges Insurance expense Rent expense Utilities expense Contractor expense 821.57 1,700.00 38,978.51 $ 38,978.51 Cut n' Curl Invoice No. 245 8930 George Street Victoria, BC V8W 4R2 Phone: (250) 323-1972 Email: cutncurl@gmail.com INVOICE Customer Date Jan 17 2019 Name Scissors Alive Address Unit 101 Sassoon Plaza 1812 Balmoral Street City Victoria, BC VT 4W9 Qty 6 4 Capes (maroon) Description Unit PriceTOTA 6 Shampoo $41.94 $6.99 $47.96 $11.99 Subtotal PST GST $89.90 $6.29 $4.50 Payment Details TOTAL $100.69 O Cash O Accts Rec n/30 What is the value of the office supplies used by Scissors Alive in January 2019? 1) My office supplies on hand totaled $400 on January 31, 2019. 2) What is the value of the hairdressing supplies used by Scissors Alive in January 2019? I used $2,900 worth of hairdressing supplies in January 2019 3) What is the useful life of the salon chair that you contributed to Scissors Alive on January 1, 2019? At the end of the salon chair's useful life, what do you estimate the salvage value to equal? I estimate that the salon chair will last another 8 years, with no salvage value. On another note, I estimate that the useful life of the hairdressing equipment that I purchased in January will also be 8 years and I estimate that the salvage value of this equipment will also be nil. What is the useful life of the office furniture that you contributed to Scissors Alive on January 1, 2019? At the end of the office furniture's useful life, what do you estimate the salvage value to equal? l estimate that the office furniture will last another 6 years. I estimate that the office furniture will have a salvage value of $500 4) Have you put any thought into the method of depreciation for the hairdressing equipment and office furniture? If so, which method would you like to use? I would like to use the straight line method of depreciation for both classes of assets. 5) 6) Since the time of your scan of your receipts and invoices to our office, have you received any other invoices from vendors that relate to purchases made in January 2019? Have you issued any other invoices to customers that relate to services provided in January 2019? Since sending you my paperwork, I received a $50 cash deposit from a customer to reserve a balay age in early March. The cash was received by me on January 31, 2019 but wasn't deposited into the bank until Friday, February 1, 2019. I also received the attached invoice from Cut n' Curl for some hairdressing supplies I purchased in late January. None of these supplies were used by January 31 2019 Scissors Alive Trial balance worksheet UNADJUSTED TRIAL BALANCE Debit Credit Cash Accounts Receivable GST Paid on Purchases Office supplies 1,751.22 288.75 631.62 1,053.95 5,472.29 Prepaid insurance Prepaid office rent Hairdressing equipment Accumulated depreciation- hairdressing equipment 5,550.00 8,234.11 Accumulated depreciation-office furniture Accounts Payable GST Charged on Sales 2,820.26 93.25 Unearned revenue 34,200.00 Hair Cutting revenue Balayage revenue 1,110.00 275.00 Office supplies expense Hairdressing supplies expense Depreciation expense Bank charges Insurance expense Rent expense Utilities expense Contractor expense 821.57 1,700.00 38,978.51 $ 38,978.51 Cut n' Curl Invoice No. 245 8930 George Street Victoria, BC V8W 4R2 Phone: (250) 323-1972 Email: cutncurl@gmail.com INVOICE Customer Date Jan 17 2019 Name Scissors Alive Address Unit 101 Sassoon Plaza 1812 Balmoral Street City Victoria, BC VT 4W9 Qty 6 4 Capes (maroon) Description Unit PriceTOTA 6 Shampoo $41.94 $6.99 $47.96 $11.99 Subtotal PST GST $89.90 $6.29 $4.50 Payment Details TOTAL $100.69 O Cash O Accts Rec n/30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started