Answered step by step

Verified Expert Solution

Question

1 Approved Answer

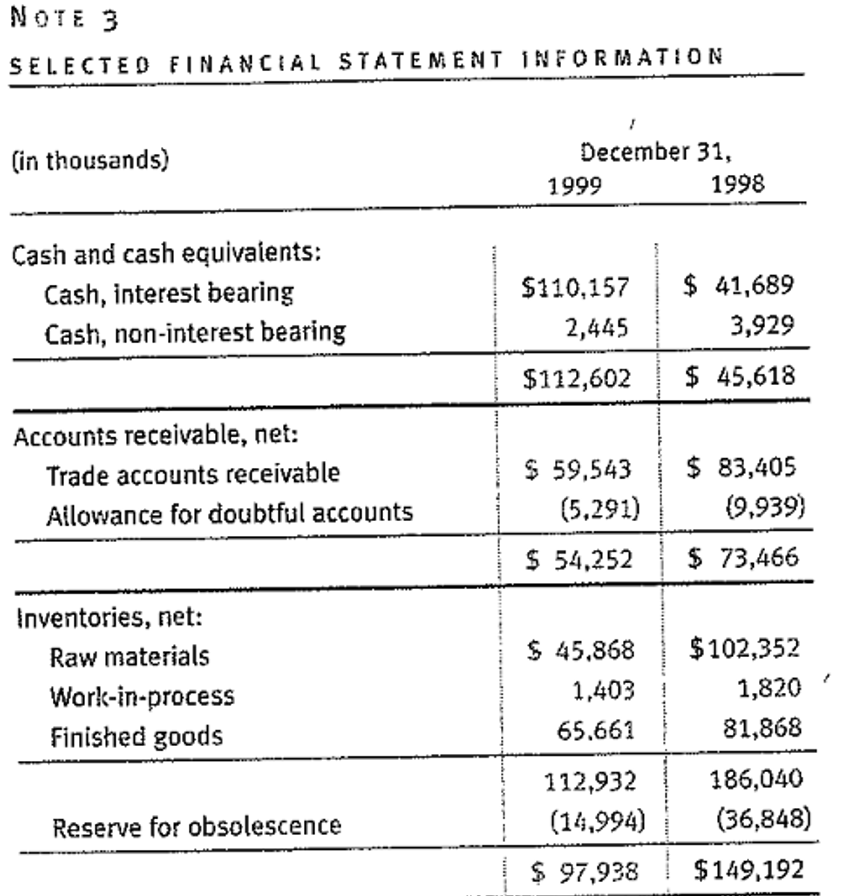

Please refer to a partial footnote from 1999 Callaway Golf Co. After long economic boom US firms were facing a major economic slowdown from 1999

Please refer to a partial footnote from 1999 Callaway Golf Co. After long economic boom US firms were facing a major economic slowdown from 1999 and on. Some of the investors questioned Callaways accounting treatment of account receivables and inventory obsolescence. Please compute how much Callaway managed up or down their 1999 earnings compared to 1998 by analyzing account receivable and Inventory accounts.

a. Account Receivables:

b. Inventory Obsolescence:

c. Summary conclusions:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started