PLEASE REFER TO PREVIOUS QUESTION. THIS IS A CONTINUATION TO PREVIOUS QUESTION . PLEASE REFER TO PREVIOUS QUESTION.

PLEASE REFER TO PREVIOUS QUESTION IN MY POSTS. PLEASE IM NOT ALLOWED TO POST THE WHOLE QUESTION SO PLEASE REFER TO PREVIOUS TWO QUESTIONS

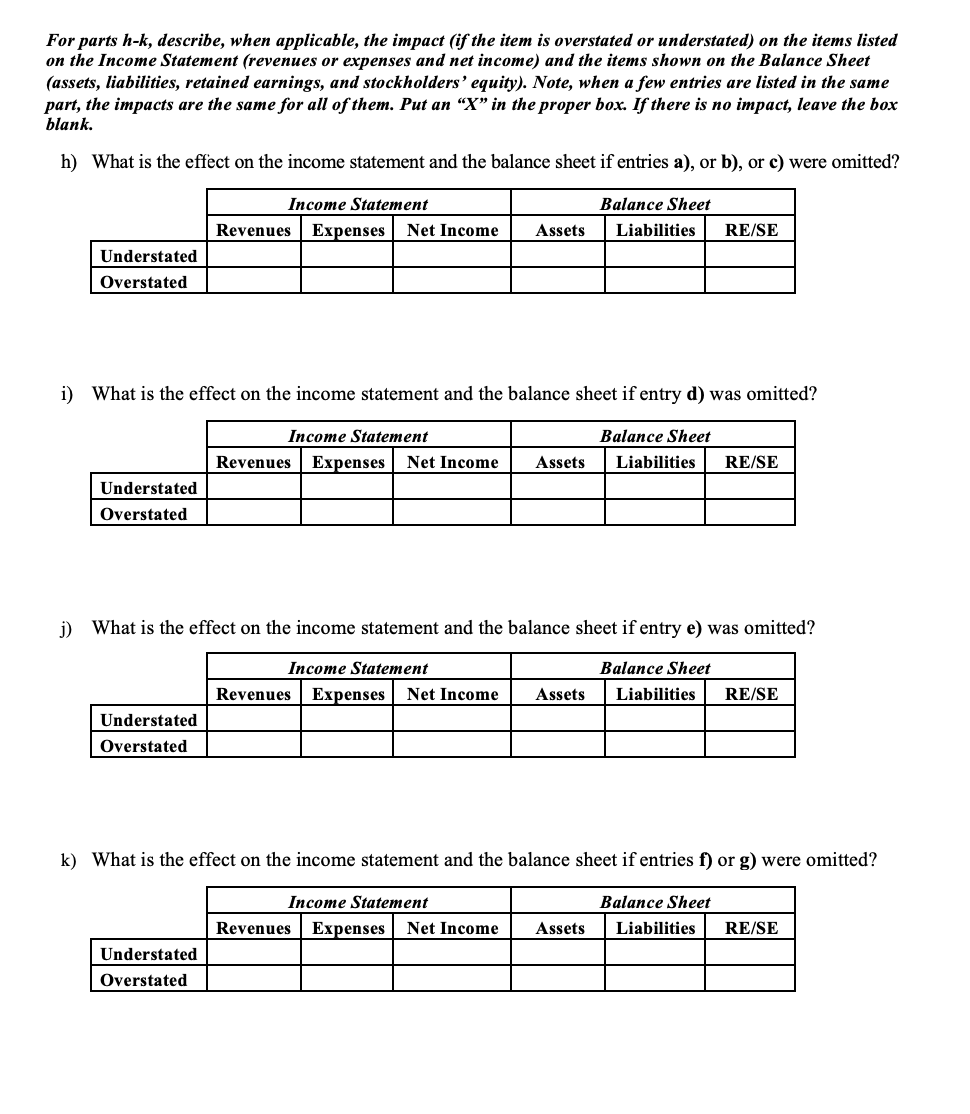

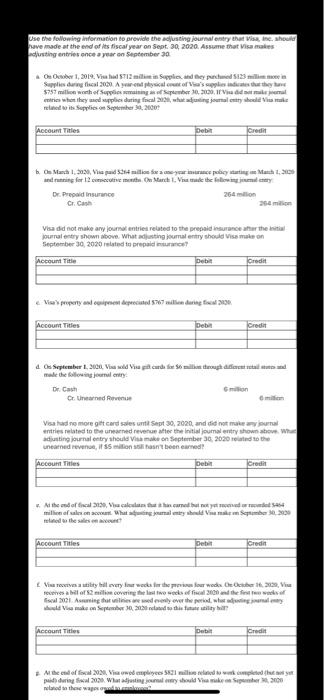

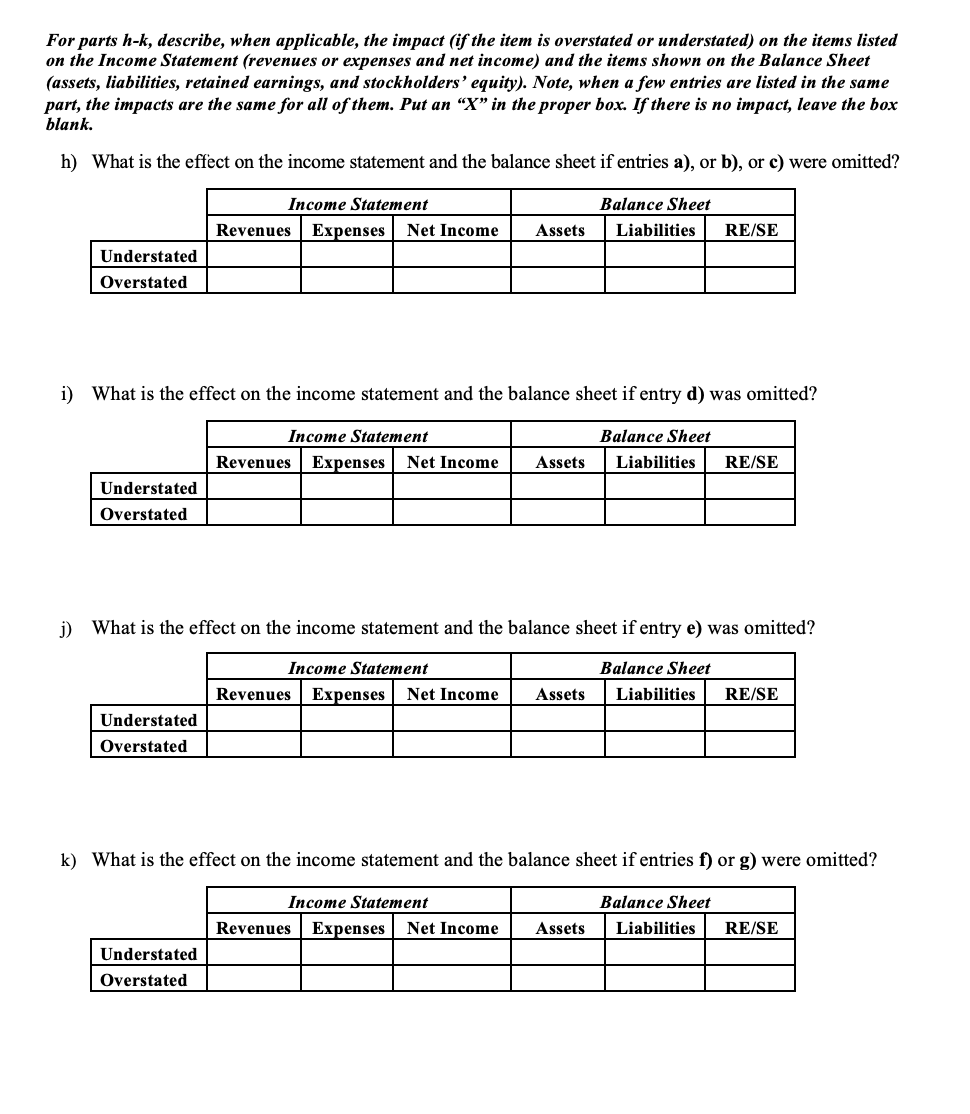

For parts h-k, describe, when applicable, the impact (if the item is overstated or understated) on the items listed on the Income Statement (revenues or expenses and net income) and the items shown on the Balance Sheet (assets, liabilities, retained earnings, and stockholders' equity). Note, when a few entries are listed in the same part, the impacts are the same for all of them. Put an X in the proper box. If there is no impact, leave the box blank. h) What is the effect on the income statement and the balance sheet if entries a), or b), or c) were omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated i) What is the effect on the income statement and the balance sheet if entry d) was omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Ass RE/SE Understated Overstated j) What is the effect on the income statement and the balance sheet if entry e) was omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated k) What is the effect on the income statement and the balance sheet if entries f) or g) were omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated Use the following information to provide the adjusting journal entry that is, Inc. should ve made at the end of its fiscal year on Sept 20, 2020 Assume that is makes rusting entries once a year on September 30 Ober 1, 2019. Supplies they punched 5123 min Supplies during fiscal 2003. Aartyscalcesco Via's applies indicates that they have $757 million of Sep 20.00. Video is the place during facility make related issupplies September 30, 2000 Account Tales Credit be Mascherating Mach 1.200 Dr. Prepaid Insurance Crash 264 million Visa did not make any journal entries related to the prepaid insurance after the journal entry shown above. What adjusting journal entry should vissa on September 30, 2020 related to prepaid Account Title Debit Credit Vis property and compie 577 dragon Account Titles Debia Credit 4 Os September 1.200. Viold Vil cardelegata made the following Dr. Cash milion Cc Unred Reve Vald no more gift card sales ute Sept 30, 2020, and did not make anyua entries related to the earned revenue ster the initial journal entry shown above. W diting journal entry should make on September 30, 2020 related to the unearned revenue, il sist been earned! Account Titles Credit be Althead offiscal 20, Valenti.cara buyers million What material em Set 3000 sed the sales Account Titles Detail Credin Vineretve a bit every time was the four woda Oceber Ve res a los line covering the last two weeks of fiscal 20 and the feed El Aring that is reeds ver the period when my Vimeo Spediya Account Titles Credit Men offocal 2021. View complies widowed ped during 2020. What would like S200 made the For parts h-k, describe, when applicable, the impact (if the item is overstated or understated) on the items listed on the Income Statement (revenues or expenses and net income) and the items shown on the Balance Sheet (assets, liabilities, retained earnings, and stockholders' equity). Note, when a few entries are listed in the same part, the impacts are the same for all of them. Put an X in the proper box. If there is no impact, leave the box blank. h) What is the effect on the income statement and the balance sheet if entries a), or b), or c) were omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated i) What is the effect on the income statement and the balance sheet if entry d) was omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Ass RE/SE Understated Overstated j) What is the effect on the income statement and the balance sheet if entry e) was omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated k) What is the effect on the income statement and the balance sheet if entries f) or g) were omitted? Income Statement Revenues Expenses Net Income Balance Sheet Liabilities Assets RE/SE Understated Overstated Use the following information to provide the adjusting journal entry that is, Inc. should ve made at the end of its fiscal year on Sept 20, 2020 Assume that is makes rusting entries once a year on September 30 Ober 1, 2019. Supplies they punched 5123 min Supplies during fiscal 2003. Aartyscalcesco Via's applies indicates that they have $757 million of Sep 20.00. Video is the place during facility make related issupplies September 30, 2000 Account Tales Credit be Mascherating Mach 1.200 Dr. Prepaid Insurance Crash 264 million Visa did not make any journal entries related to the prepaid insurance after the journal entry shown above. What adjusting journal entry should vissa on September 30, 2020 related to prepaid Account Title Debit Credit Vis property and compie 577 dragon Account Titles Debia Credit 4 Os September 1.200. Viold Vil cardelegata made the following Dr. Cash milion Cc Unred Reve Vald no more gift card sales ute Sept 30, 2020, and did not make anyua entries related to the earned revenue ster the initial journal entry shown above. W diting journal entry should make on September 30, 2020 related to the unearned revenue, il sist been earned! Account Titles Credit be Althead offiscal 20, Valenti.cara buyers million What material em Set 3000 sed the sales Account Titles Detail Credin Vineretve a bit every time was the four woda Oceber Ve res a los line covering the last two weeks of fiscal 20 and the feed El Aring that is reeds ver the period when my Vimeo Spediya Account Titles Credit Men offocal 2021. View complies widowed ped during 2020. What would like S200 made the