please refer to requirments.

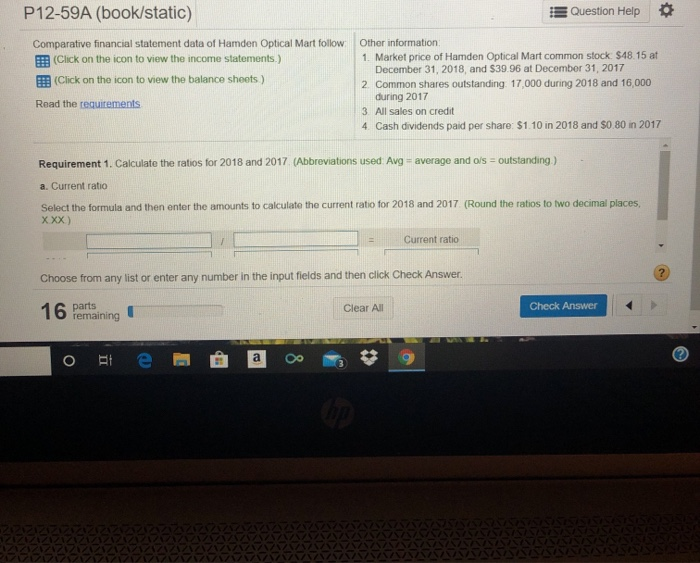

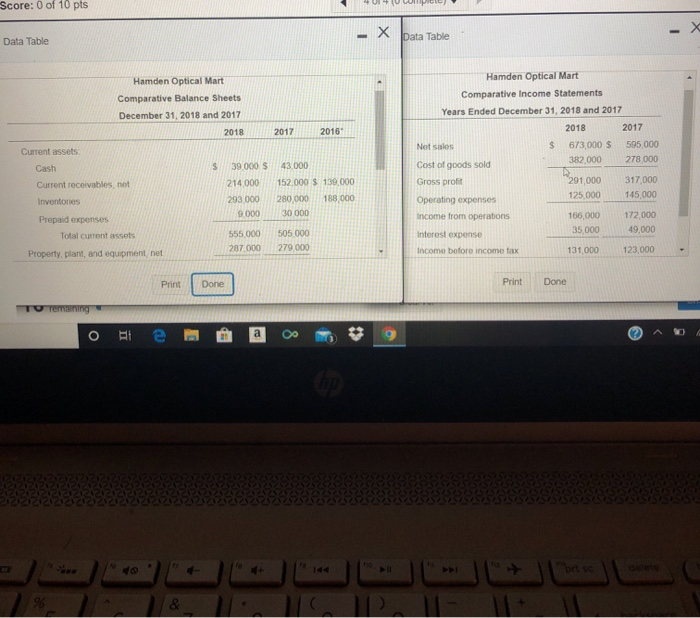

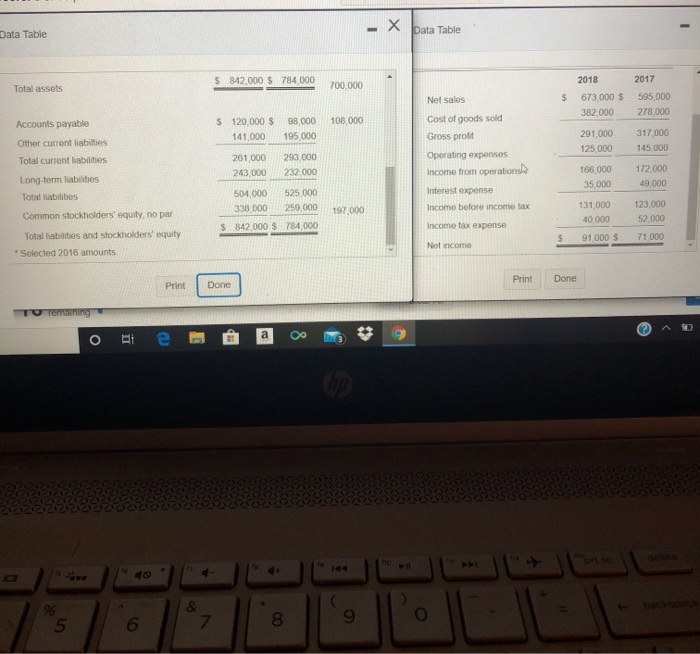

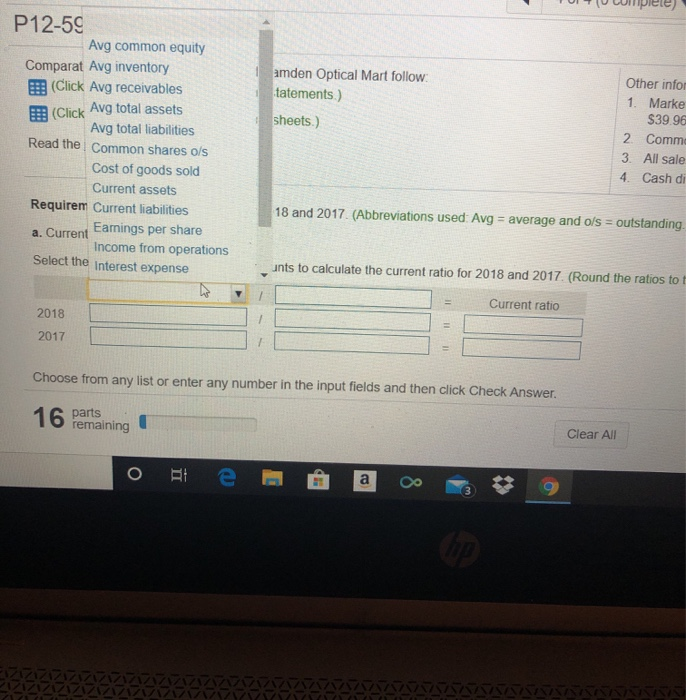

Question Help P12-59A (book/static) Comparative financial statement data of Hamden Optical Mart follow (Click on the icon to view the income statements.) Click on the icon to view the balance sheets) Read the requirements Other information 1. Market price of Hamden Optical Mart common stock $48.15 at December 31, 2018, and $39.96 at December 31, 2017 2. Common shares outstanding. 17,000 during 2018 and 16,000 during 2017 3. All sales on credit 4. Cash dividends paid per share: $1.10 in 2018 and 50 80 in 2017 Requirement 1. Calculate the ratios for 2018 and 2017 (Abbreviations used Avg = average and ols = outstanding) a. Current ratio Select the formula and then enter the amounts to calculate the current ratio for 2018 and 2017 (Round the ratios to two decimal places, XXX) Current ratio Choose from any list or enter any number in the input fields and then click Check Answer. 16 parts remaining Clear All Check Answer a ? BE - X Data Table Data Table $ 842.000 S 784 000 2018 Total assets 700.000 Net sales S 673,000 $ 382,000 2017 595,000 278,000 108,000 Accounts payable Other current liabilities Total current liabilities $ 120,000 $ 141 000 98 000 195.000 291,000 125.000 317 000 145.000 261,000 243,000 293 000 232 000 Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income tax Long term liabilities Total liabilities 166.000 35,000 172.000 49.000 504,000 338 000 525 000 250,000 197,000 131,000 40.000 123,000 52.000 Common stockholders' equity, no par Total liabilities and stockholders' equity $ 842 000 $ 784 000 Income tax expense $ 91 000 $ 71 000 Not income * Selected 2016 amounts Done Print Print Done Tremaining 2 a OO ons & 5 7 9 6 8 O P12-59 Avg common equity Comparat Avg inventory (Click Avg receivables amden Optical Mart follow tatements.) sheets.) E (Click Avg total assets Avg total liabilities Read the common shares ols Cost of goods sold Current assets Requirem Current liabilities Other infor 1. Marke $39.96 2 Comme 3. All sale 4. Cash di 18 and 2017 (Abbreviations used Avg = average and ofs = outstanding. a. Current Earnings per share Income from operations Select the interest expense unts to calculate the current ratio for 2018 and 2017. (Round the ratios tot Current ratio 2018 2017 Choose from any list or enter any number in the input fields and then click Check Answer. 16 parts remaining Clear All O RA a hop