Question

Please refer to the financial information for Nile Holdings above. Nile must decide how to finance a $100 million investment. Suppose Nile expects $4.52 in

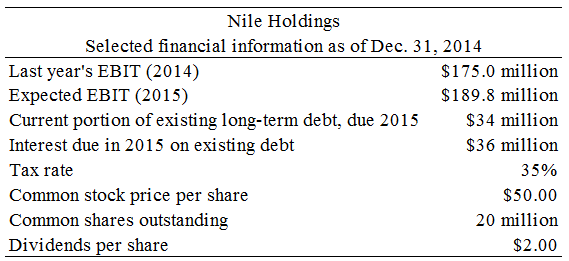

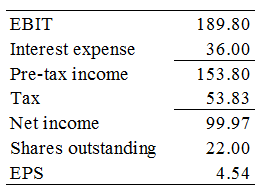

Please refer to the financial information for Nile Holdings above. Nile must decide how to finance a $100 million investment. Suppose Nile expects $4.52 in EPS next year if it does not go through with the investment and associated financing. As a shareholder, to satisfy its funding needs for the investment opportunity, do you prefer the company issue $100 million in new debt at an interest rate of 7% and a payment of $20 million due on the debt next year, or issue 2 million shares of equity at a target price of $50? Show supporting calculations, and provide arguments and potential counter-arguments for your recommendation.

Nile Holdings Selected financial information as of Dec. 31, 2014 !..ast year's, 1TI.. (201 4) Expected EBIT (2015) $175.0 million $189.8 million Interest due in 2015 on existing debt Tax rate Common stock price per share Common shares outstanding Dividends per share $36 million 35% $50.00 20 million $2.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started