Question

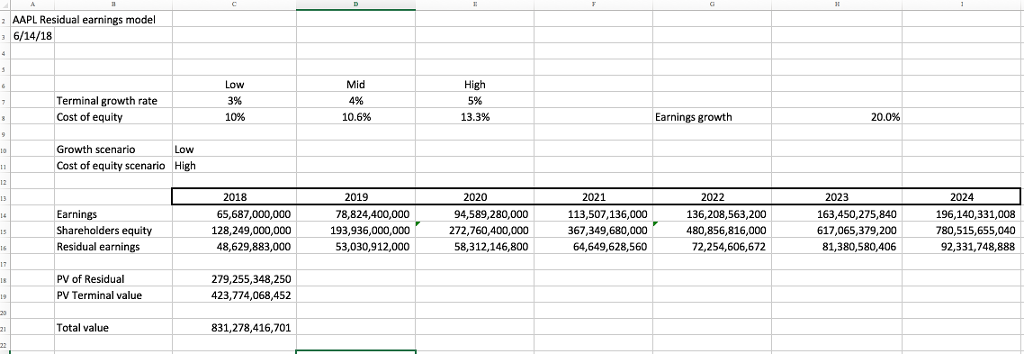

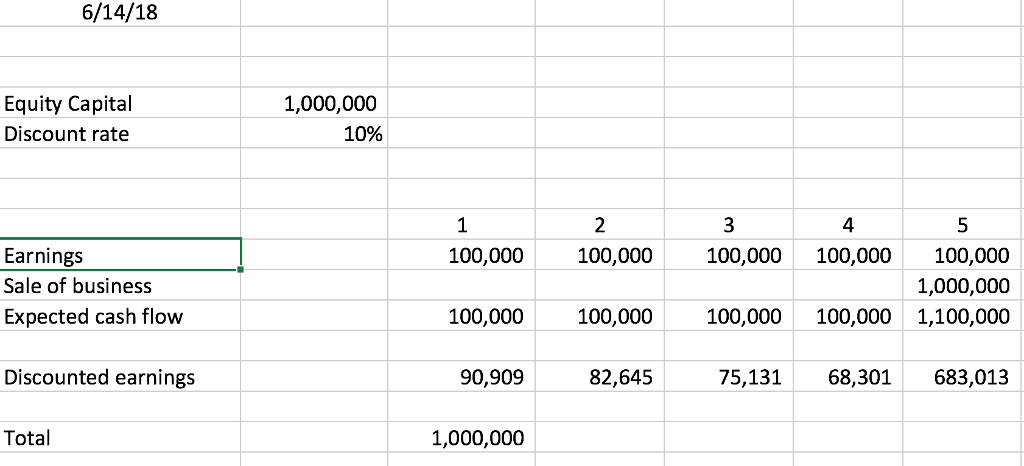

Please refer to the linked file below to complete the following questions. Use the excel template for the residual earnings model to understand the model

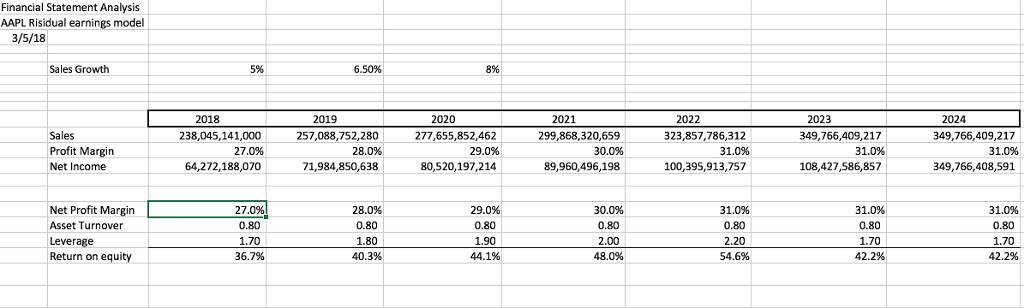

Please refer to the linked file below to complete the following questions.

Use the excel template for the residual earnings model to understand the model

1. Examine the Apple valuation model and compare the valuation to the actual market capitalization on Yahoo finance (Note if there is a difference and explain in a few sentences what the difference could be attributed to).

2. Pick a different public company and acquire their earnings forecast on Yahoo finance

3. Acquire the Balance Sheet (Shareholders' equity) info on Yahoo finance (for the book value of the company)

4. Plugging in the assumptions for cost of equity and perpetual growth into the attached valuation model Perform a valuation of the stock (Adjust the assumptions once again to match the true market capitalization found on Yahoo Finance).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started