Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please refer to the textbook, page 2 9 8 , Chapter 9 , and answer the questions for the case study Stock Valuation at Ragan

Please refer to the textbook, page Chapter and answer the questions for the case study "Stock Valuation at Ragan Engines".

You need to submit both your Excel Worksheet and a short Writeup as part of the submission. has asked Dan Ervin to analyze Ratan's value.

Ragan Engines, Inc, was founded nine jears ago by a brother and sistetCarrington and Genevieve Raganand has remained a privately

owned company. The company manufactures marine engines for a variety of applications. Ragain has experienced rapid growth because of

a proprietary technology that increases the fuet efficiency of its engines with very little sacrifice in performance. The compary is equally

owned by Carrington and Genevieve. The original agreement between the siblings gave each shares of stock.

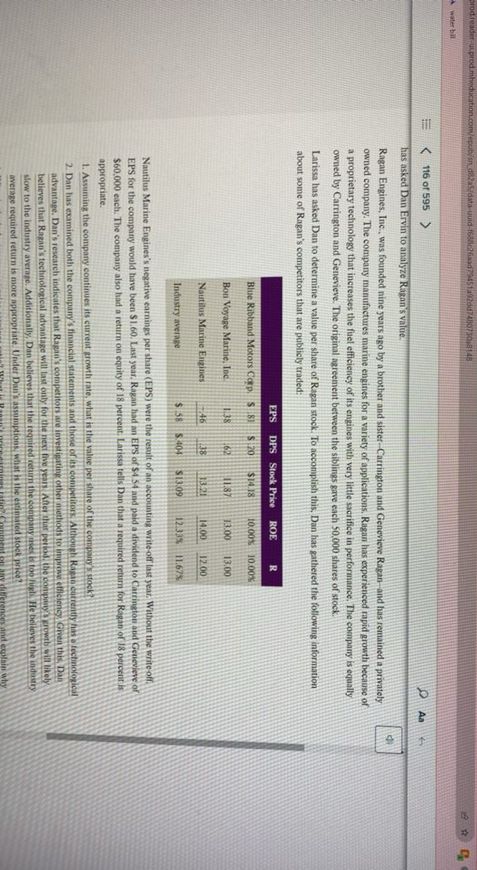

Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information

about some of Ragan's competitors that are publicly traded:

Nautilus Marine Engines's negative earnings per share EPS were the result of an accouating writeofr last year. Without the write off.

EPS for the company would have been $ Last yoar, Razan had an EPS of and poid a dividend to Carrinetoe and Genevieve of

appropriate.

Assuming the company continues its current promth rate, what is the salue per share of the coimpany stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started