Answered step by step

Verified Expert Solution

Question

1 Approved Answer

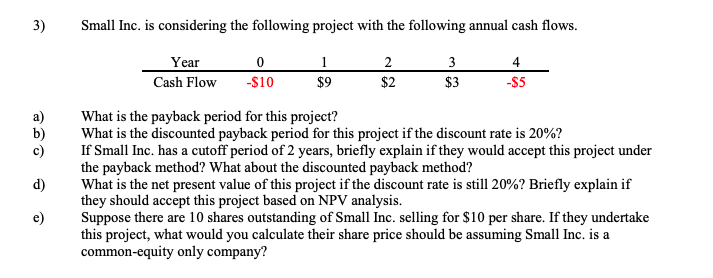

Please refrain from using excel thanks! 3) Small Inc. is considering the following project with the following annual cash flows. Year Cash Flow -S10 0

Please refrain from using excel thanks!

3) Small Inc. is considering the following project with the following annual cash flows. Year Cash Flow -S10 0 4 $9 $2 $3 -$5 What is the payback period for this project? What is the discounted payback period for this project if the discount rate is 20%? If Small Inc. has a cutoff period of 2 years, briefly explain if they would accept this project under the payback method? What about the discounted payback method? What is the net present value of this project if the discount rate is still 20%? Briefly explain if they should accept this project based on NPV analysis. Suppose there are 10 shares outstanding of Small Inc. selling for $10 per share. If they undertake this project, what would you calculate their share price should be assuming Small Inc. is a common-equity only company? a) b) c) d) e)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started