Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please reply or the same date it purdues machine at a cost od 606 The machine is expected to have a unui offive years with

please reply

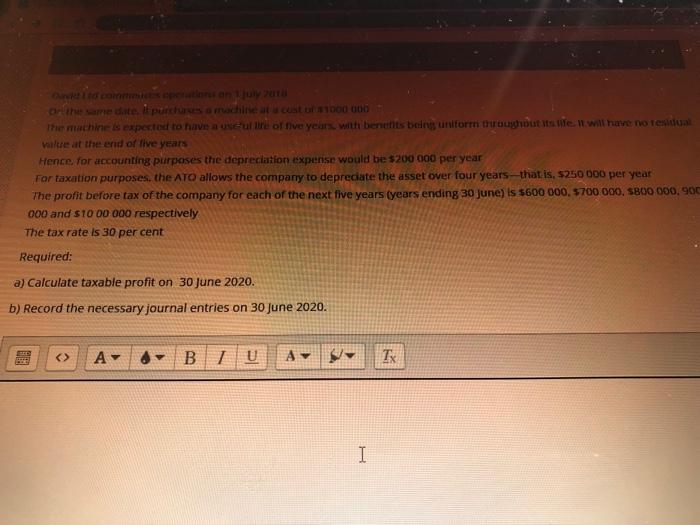

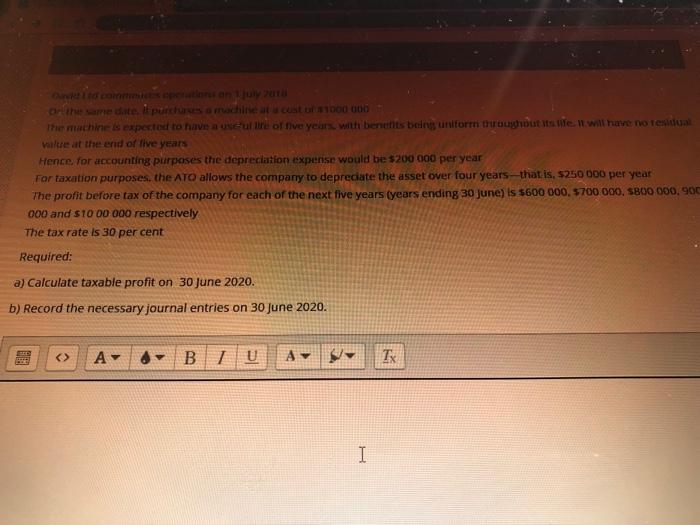

or the same date it purdues machine at a cost od 606 The machine is expected to have a unui offive years with benents being uniform throughout it. It will have no residual Walte at the end of five years Hence for accounting purposes the depreciation experise would be $200 000 per year For taxation purposes, the ATO allows the company to depreciate the asset over four years that is, $250 000 per year The profit before tax of the company for each of the next five years (years ending 30 june) is $600 000 5700 000, SB00 000,900 000 and $10 00 000 respectively The tax rate is 30 per cent Required: a) Calculate taxable profit on 30 June 2020. b) Record the necessary journal entries on 30 June 2020. - A TX I or the same date it purdues machine at a cost od 606 The machine is expected to have a unui offive years with benents being uniform throughout it. It will have no residual Walte at the end of five years Hence for accounting purposes the depreciation experise would be $200 000 per year For taxation purposes, the ATO allows the company to depreciate the asset over four years that is, $250 000 per year The profit before tax of the company for each of the next five years (years ending 30 june) is $600 000 5700 000, SB00 000,900 000 and $10 00 000 respectively The tax rate is 30 per cent Required: a) Calculate taxable profit on 30 June 2020. b) Record the necessary journal entries on 30 June 2020. - A TX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started