Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please respond as soon as possible. Thank you. Required information Learning Objective 02-A1: Analyze and record transactions and their impact on financial statements. Transactions are

Please respond as soon as possible. Thank you.

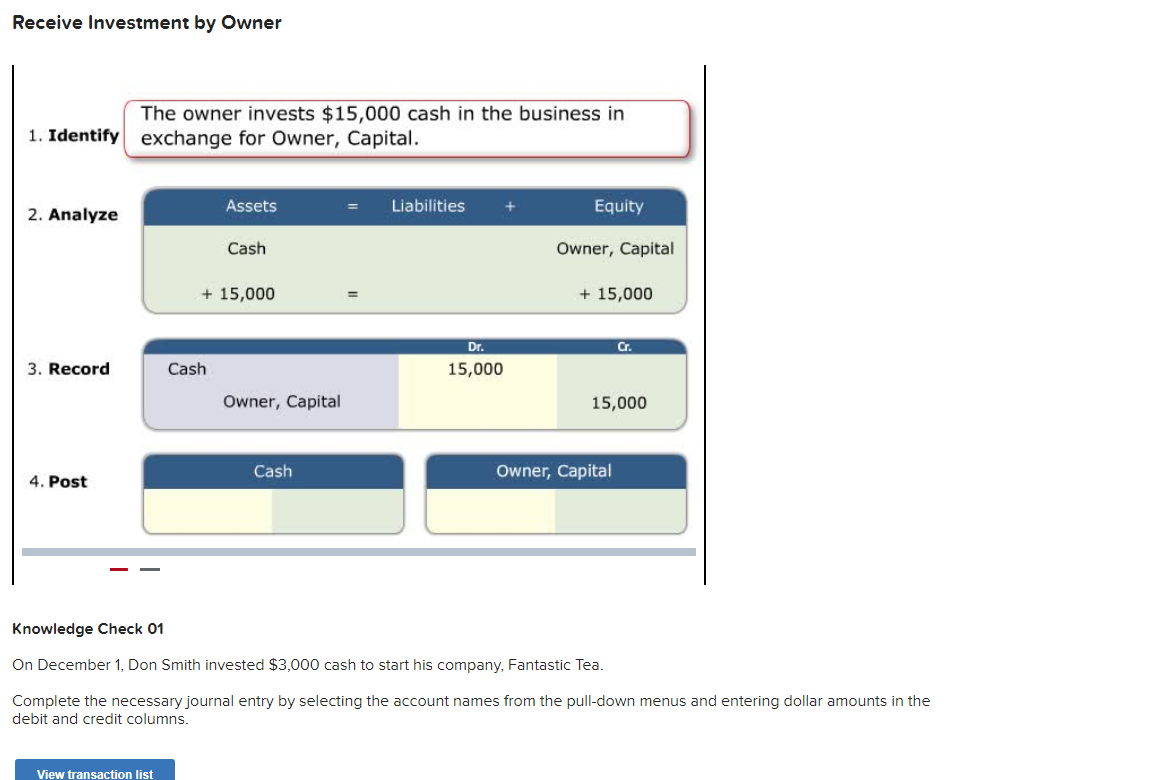

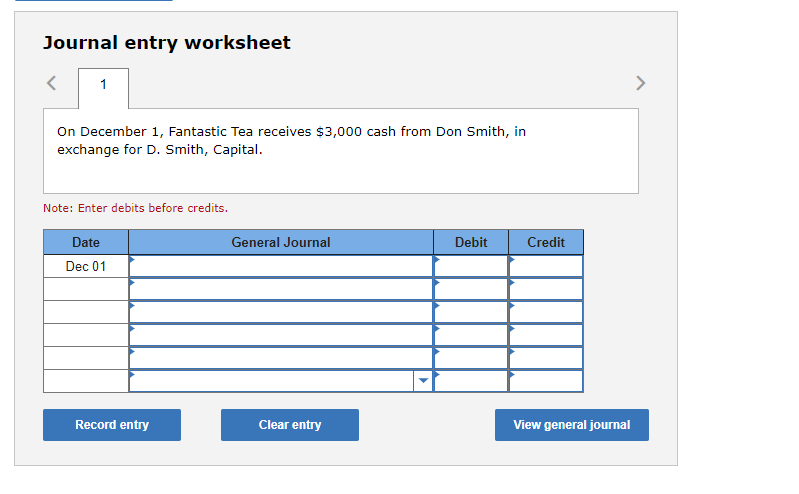

Required information Learning Objective 02-A1: Analyze and record transactions and their impact on financial statements. Transactions are recorded in a journal. Each entry in a journal is posted to the accounts in the ledger. This provides information that is used to produce financial statements. Balance column accounts are widely used and include columns for debits, credits, and the account balance. We analyze transactions using concepts of double-entry accounting. This analysis is performed by determining a transaction's effects on accounts. Receive Investment by Owner 1. Identify The owner invests $15,000 cash in the business in exchange for Owner, Capital. 3. Record 4. Post Knowledge Check 01 On December 1 , Don Smith invested $3,000 cash to start his company, Fantastic Tea. Complete the necessary journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Journal entry worksheet On December 1 , Fantastic Tea receives $3,000 cash from Don Smith, in exchange for D. Smith, Capital. Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started