Answered step by step

Verified Expert Solution

Question

1 Approved Answer

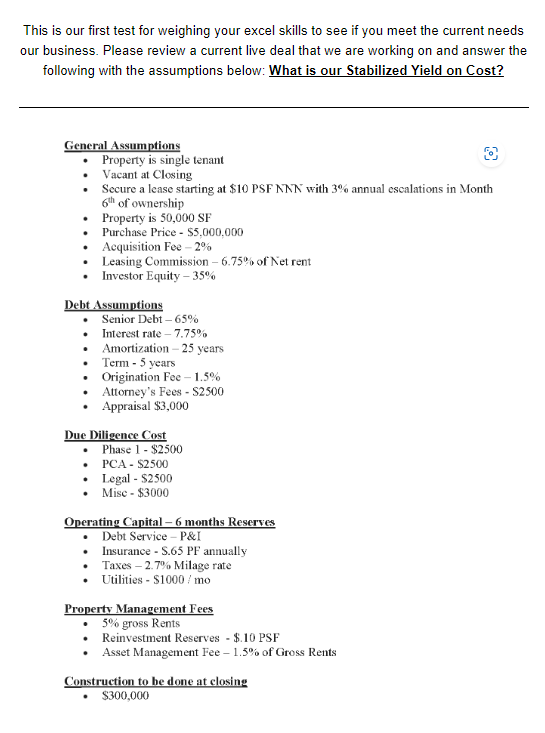

Please review a current live deal that we are working on and answer the following with the assumptions below: What is our Stabilized Yield on

Please review a current live deal that we are working on and answer the

following with the assumptions below: What is our Stabilized Yield on Cost?

General Assumptions

Property is single tenant

Vacant at Closing

Secure a lease starting at $ PSF NNN with annual escalations in Month

of ownership

Property is

Purchase Price $

Acquisition Fee

Leasing Commission of Net rent

Investor Equity

Debt Assumptions

Senior Debt

Interest rate

Amortization years

Term years

Origination Fee

Attorney's Fees $

Appraisal $

Due Diligence Cost

Phase $

PCA $

Legal $

Mise $

Operating Capital months Reserves

Debt Service P&I

Insurance S PF annually

Taxes Milage rate

Utilities $ mo

Property Management Fees

gross Rents

Reinvestment Reserves $ PSF

Asset Management Fee of Gross Rents

Construction to be done at closine

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started