please review my prior work and help with requirement 2 & 3.

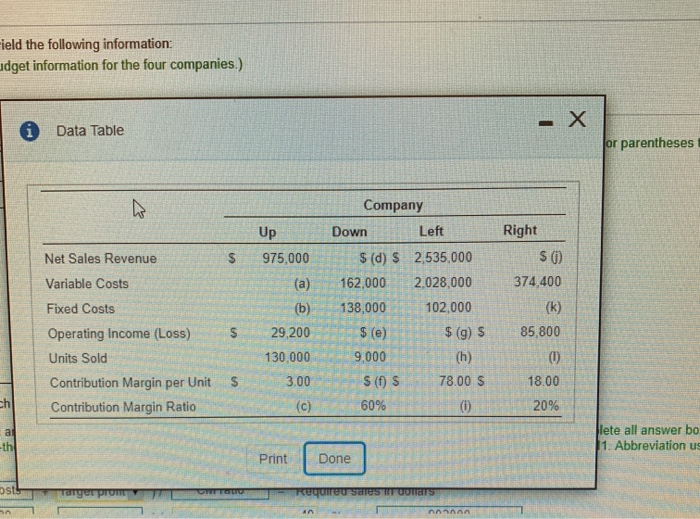

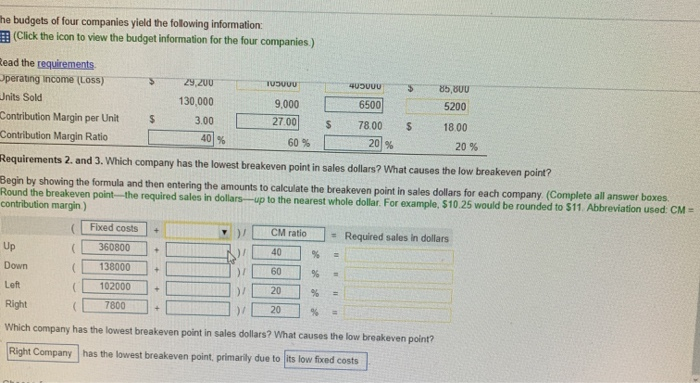

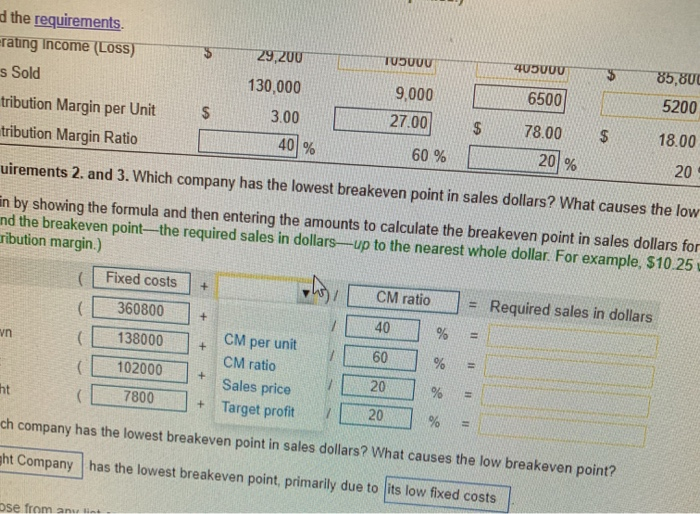

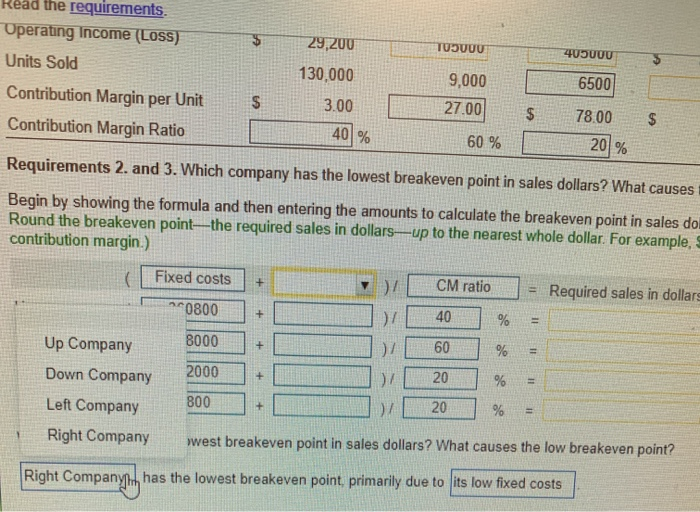

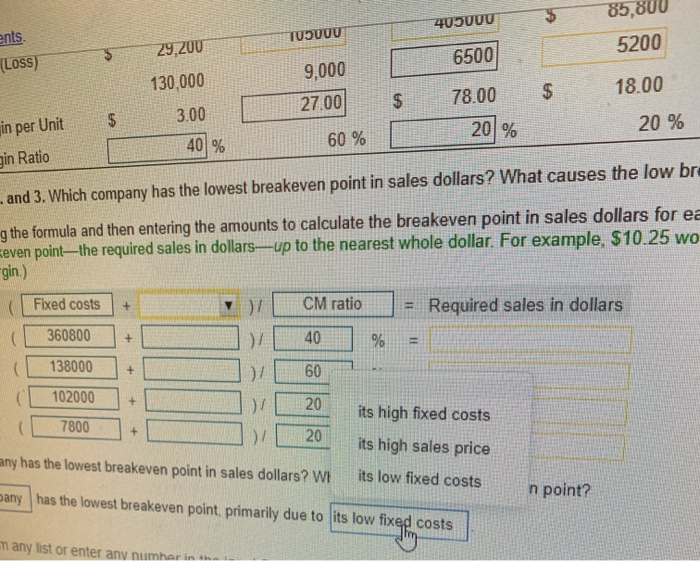

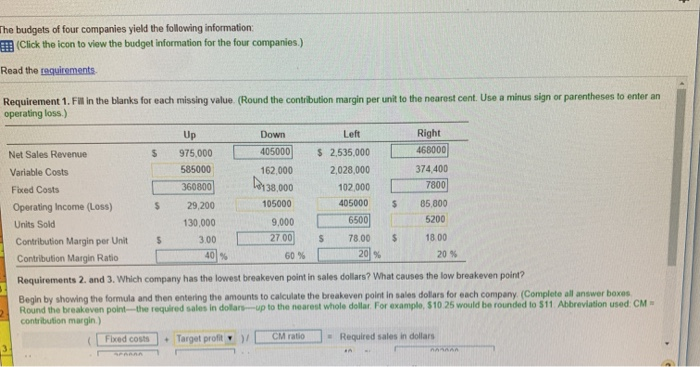

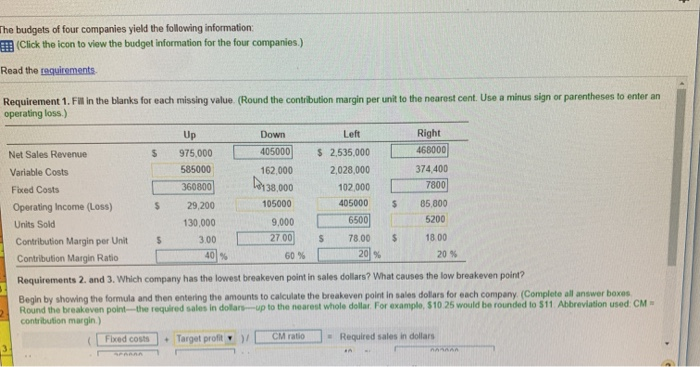

The budgets of four companies yield the following information (Click the icon to view the budget information for the four companies.) Read the requirements Requirement 1. Fill in the blanks for each missing value. (Round the contribution margin per unit to the nearest cent. Use a minus sign or parentheses to enter an operating loss.) Right Left Up Down 468000 975,000 585000 405000 S 2,535,000 Net Sales Revenue 374,400 162.000 2,028,000 Variable Costs M38.000 7800 360800 102,000 Fixed Costs 405000 105000 85.800 S Operating Income (Loss) 29,200 6500 5200 9,000 130,000 Units Sold 27.00 78.00 18.00 3.00 Contribution Margin per Unit 20 % 40% 20 % 60 % Contribution Margin Ratio Requirements 2. and 3. Which company has the lowest breakeven point in sales dollars? What causes the low breakeven point? Begin by showing the formula and then entering the amounts to calculate the breakeven point in sales dollars for each company (Complete all answer boxes Round the breakeven point-the required sales in dollars-up to the nearest whole dollar. For example, $10.25 would be rounded to $11 Abbreviation used: CM 2 contribution margin.) CM ratio Fixed costs Target profit ) Required sales in dollars ield the following information: udget information for the four companies.) - X i Data Table or parentheses Company Right Left Up Down $ () 975,000 (d) S 2,535.000 Net Sales Revenue 374,400 162,000 2,028,000 Variable Costs (a) 138,000 102,000 (k) Fixed Costs (b) 85 800 29,200 $ (e) $ (g) S Operating Income (Loss) 130,000 9.000 (h) (1) Units Sold S () S 78.00 S 18.00 S 3.00 Contribution Margin per Unit ch 60% () 20% Contribution Margin Ratio (c) lete all answer bo 1. Abbreviation us at th Done Print osts Reqairedsares dOnars Targer pro nnn000 he budgets of four companies yield the following information: (Click the icon to view the budget information for the four companies) Read the reguirements Operating Income (Loss) 29,200 TUDUUU 40DU00 85,8U0 Units Sold 130,000 9,000 6500 5200 Contribution Margin per Unit 27.00 3.00 S 78.00 18.00 Contribution Margin Ratio 40% 20 % 60 % 20 % Requirements 2. and 3. Which company has the lowest breakeven point in sales dollars? What causes the low breakeven point? Begin by showing the formula and then entering the amounts to calculate the breakeven point in sales dollars for each company. (Complete all answer boxes Round the breakeven point-the required sales in dollars--up to the nearest whole dollar. For example, $10.25 would be rounded to $11. Abbreviation used: CM contribution margin) Fixed costs CM ratio Required sales in dollars Up 360800 ( 40 138000 Down 60 102000 20 Left % 7800 Right 20 % Which company has the lowest breakeven point in sales dollars? What causes the low breakeven point? Right Company has the lowest breakeven point, primarily due to its low fixed costs d the requirements. rating Income (Loss) 85,800 29,200 TUSUUU 405000 6500 s Sold 5200 130,000 9,000 27.00 tribution Margin per Unit 3.00 $ 78.00 18.00 40 % tribution Margin Ratio 20 % 60% 20 uirements 2. and 3. Which company has the lowest breakeven point in sales dollars? What causes the low in by showing the formula and then entering the amounts to calculate the breakeven point in sales dollars for nd the breakeven point-the required sales in dollars-up to the nearest whole dollar. For example, $10.25 v ribution margin.) Fixed costs CM ratio + Required sales in dollars 360800 40 + % CM per unit 138000 ( n 60 % CM ratio 102000 20 + % Sales price 7800 ht ( 20 Target profit + % ch company has the lowest breakeven point in sales dollars? What causes the low breakeven point? ght Company has the lowest breakeven point, primarily due to its low fixed costs Dse from anu int Read the requirements Operating Income (Loss) 29,200 TUDUUU 405000 Units Sold 130,000 6500 9,000 Contribution Margin per Unit 27.00 3.00 $ 78.00 40 % 20 % Contribution Margin Ratio 60% Requirements 2. and 3. Which company has the lowest breakeven point in sales dollars? What causes Begin by showing the formula and then entering the amounts to calculate the breakeven point in sales dol Round the breakeven point-the required sales in dollars-up to the nearest whole dollar. For example, contribution margin.) Fixed costs CM ratio Required sales in dollars 0800 40 60 8000 % + Up Company 20 2000 % Down Company 20 800 Left Company Right Company west breakeven point in sales dollars? What causes the low breakeven point? Right Company has the lowest breakeven point, primarily due to its low fixed costs II 96 a 85,800 00OCot ents 5200 29,200 6500 (Loss) 9,000 130,000 18.00 $ 78.00 $ 27.00 3.00 $ 20 % 20 % in per Unit 60 % 40 % gin Ratio and 3. Which company has the lowest breakeven point in sales dollars? What causes the low br g the formula and then entering the amounts to calculate the breakeven point in sales dollars for ea even point-the required sales in dollars-up to the nearest whole dollar. For example, $10.25 wo gin.) CM ratio Fixed costs Required sales in dollars + 360800 40 % 138000 60 + 102000 20 its high fixed costs 7800 20 + its high sales price any has the lowest breakeven point in sales dollars? W its low fixed costs n point? oany has the lowest breakeven point, primarily due to its low fixed costs m any list or enter any numher

please review my prior work and help with requirement 2 & 3.

please review my prior work and help with requirement 2 & 3.