Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please review the case titled Hecht v. Andover Assoc. Mgmt. Co. Who are the parties in the case? What is the procedural history of the

Please review the case titled Hecht v. Andover Assoc. Mgmt. Co.

Who are the parties in the case?

What is the procedural history of the case?

(i.e., how did the case get to the New York Supreme Court?)

What facts may prove, upon remand to the trial court, that Andover Management was grossly negligent?

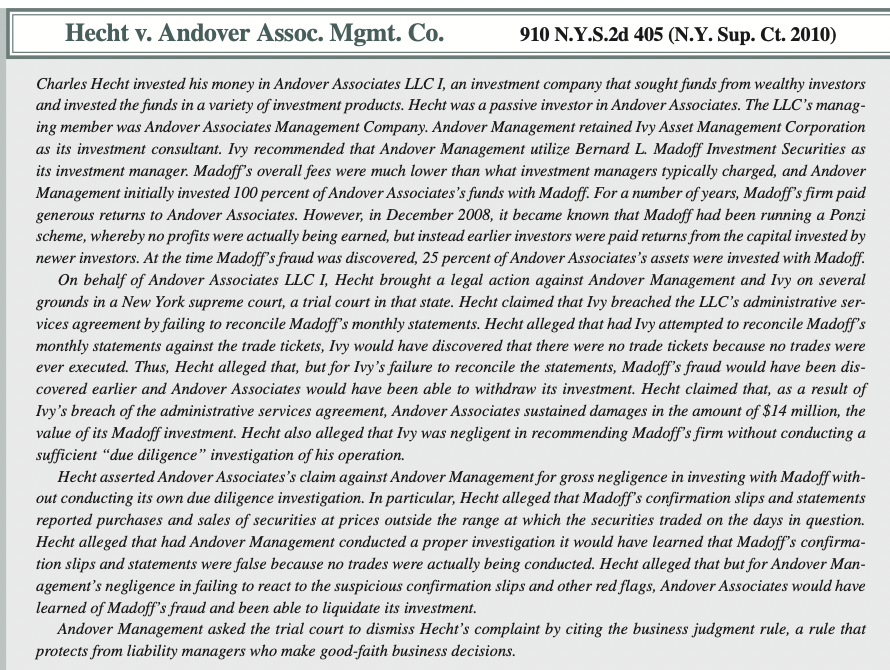

Hecht v. Andover Assoc. Mgmt. Co. 910 N.Y.S.2d 405 (N.Y. Sup. Ct. 2010) Charles Hecht invested his money in Andover Associates LLC I, an investment company that sought funds from wealthy investors and invested the funds in a variety of investment products. Hecht was a passive investor in Andover Associates. The LLC's manag- ing member was Andover Associates Management Company. Andover Management retained Ivy Asset Management Corporation as its investment consultant. Ivy recommended that Andover Management utilize Bernard L. Madoff Investment Securities as its investment manager. Madoff's overall fees were much lower than what investment managers typically charged, and Andover Management initially invested 100 percent of Andover Associates's funds with Madoff. For a number of years, Madoff's firm paid generous returns to Andover Associates. However, in December 2008, it became known that Madoff had been running a Ponzi scheme, whereby no profits were actually being earned, but instead earlier investors were paid returns from the capital invested by newer investors. At the time Madoff's fraud was discovered, 25 percent of Andover Associates's assets were invested with Madoff. On behalf of Andover Associates LLC I, Hecht brought a legal action against Andover Management and Ivy on several grounds in a New York supreme court, a trial court in that state. Hecht claimed that Ivy breached the LLC's administrative ser- vices agreement by failing to reconcile Madoff's monthly statements. Hecht alleged that had Ivy attempted to reconcile Madoff's monthly statements against the trade tickets, Ivy would have discovered that there were no trade tickets because no trades were ever executed. Thus, Hecht alleged that, but for Ivy's failure to reconcile the statements, Madoff's fraud would have been dis- covered earlier and Andover Associates would have been able to withdraw its investment. Hecht claimed that, as a result of Ivy's breach of the administrative services agreement, Andover Associates sustained damages in the amount of $14 million, the value of its Madoff investment. Hecht also alleged that Ivy was negligent in recommending Madoff's firm without conducting a sufficient "due diligence" investigation of his operation. Hecht asserted Andover Associates's claim against Andover Management for gross negligence in investing with Madoff with- out conducting its own due diligence investigation. In particular, Hecht alleged that Madoff's confirmation slips and statements reported purchases and sales of securities at prices outside the range at which the securities traded on the days in question. Hecht alleged that had Andover Management conducted a proper investigation it would have learned that Madoff's confirma- tion slips and statements were false because no trades were actually being conducted. Hecht alleged that but for Andover Man- agement's negligence in failing to react to the suspicious confirmation slips and other red flags, Andover Associates would have learned of Madoff's fraud and been able to liquidate its investment. Andover Management asked the trial court to dismiss Hecht's complaint by citing the business judgment rule, a rule that protects from liability managers who make good-faith business decisions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Parties in the Case Charles Hecht Investor who placed money in Andover Associates LLC I Andover Asso...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started