Please review the Mini-case in Chapter 3 of your text book - Computron Industries. The projected information for 2020 is provided in the last column. Based on the case information, first compute these two profitability ratios, these two liquidity ratios and these two leverage ratios. 1. Profitability position based on ROA and ROE for 2020 2. Liquidity position based on Current and Quick Ratios for 2020 3. Leverage position based on Debt-to-Equity ratios and times-interest-earned ratio for 2020. 4. Discuss what is the Du Pont equation? How can it be used to manage the performance of the Company?

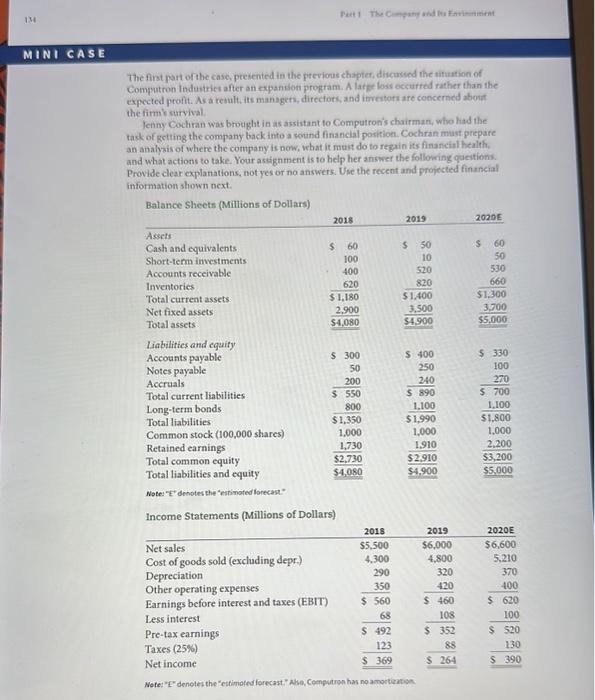

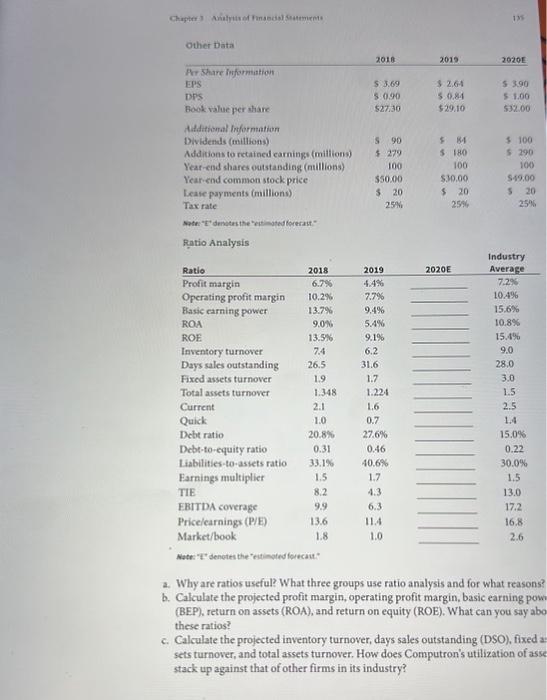

Please review the Mini-case in Chapter 3 of your text book - Computron Industries. The projected information for 2020 is provided in the last column. Based on the case information, first compute these two profitability ratios, these two liquidity ratios and these two leverage ratios. 1. Profitability position based on ROA and ROE for 2020 2. Liquidity position based on Current and Quick Ratios for 2020 3. Leverage position based on Debt-to-Equity ratios and times-interest-earned ratio for 2020 , 4. Discuss what is the Du Pont equation? How can it be used to manage the performance of the Company? The first part of the case, presented in the previons chapter, discussed the sifustion of Computron Industries after an expansos program. A large loss occurted rather than the expected profit. As a rebult, its managers, directots, and ifresters are concermed abonit the firmis survival. lenny Cochran was brotight in as assistant to Computron's chairman, who had the tack of getting the company back into a sound fina ncial position. Cochran mast prepare an analysis of where the company is now, what it mest do to regain its financial health. and what actions to take. Your astignment is to belp her answer the following questions. Provide clear explanations, not yes or no answers. Use the recent and projected financial information shown next. Income Statements (Millions of Dollars) 135 Ratio Analysis a. Why are ratios useful? What three groups use ratio analysis and for what reasons? b. Calculate the projected profit margin, operating profit margin, basic earning pown (BEP), return on assets (ROA), and return on equity (ROE). What can you say abo these ratios? c. Calculate the projected inventory turnover, days sales outstanding (DSO), fixed a sets turnover, and total assets turnover. How does Computron's utilization of asse stack up against that of other firms in its industry? d. Calculate the projected current and quick ratios based on the projected balance sheet and income statement data. What can you say about the company's liquidity position and its trend? c. Calculate the projected debt ratio, debt-to-equity ratio, liabilities-to-assets ratio, times-interest-carned ratio, and BBITDA coverage ratios. How does Compritron compare with the industry with respect to financial leverage? What can you conclude from these ratios? f. Calculate the projected pricelearnings ratio and market/book fatio. Do these ratios indicate that investors are expected to have a high or low opinion of the company? g. Perform a common size analysis and percentage change analysis. What do these analyses tell you about Computron? h. Use the extended DuPont equation to provide a breakdown of Computron's projected return on equity. How does the projection compare with the previous years and with the industry's DuPont equation? i. What are some potential problems and limitations of financial ratio analysis? j. What are some qualitative factors that analysts should consider when evaluating a company's likely future financial performance? DDITIONAL CASES The following cases from Cengage Compose cover many of the concepts discussed in this chapter and are available at http://compose.cengage.com. Klein-Brigham Series: Case 35, \"Mark X Company (A),\" illustrates the use of ratio analysis in the evaluation of a firm's existing and potential financial positions; Case 36, \"Garden State Container Corporation,\" is similar in content to Case 35; Case 51, \"Safe Packaging Corporation,\" updates Case 36; Case 68, \"Sweet Dreams Inc.,\" also updates Case 36; and Case 71, \"Swan-Davis, Inc.,\" illustrates how financial analysis-based on both historical statements and forecasted statements - is used for internal management and lending decisions