Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please right the whole answer do not round them thanks Zhdanov, Inc forecasts that its free cash flow in the coming year, i.e, at t=

please right the whole answer do not round them thanks

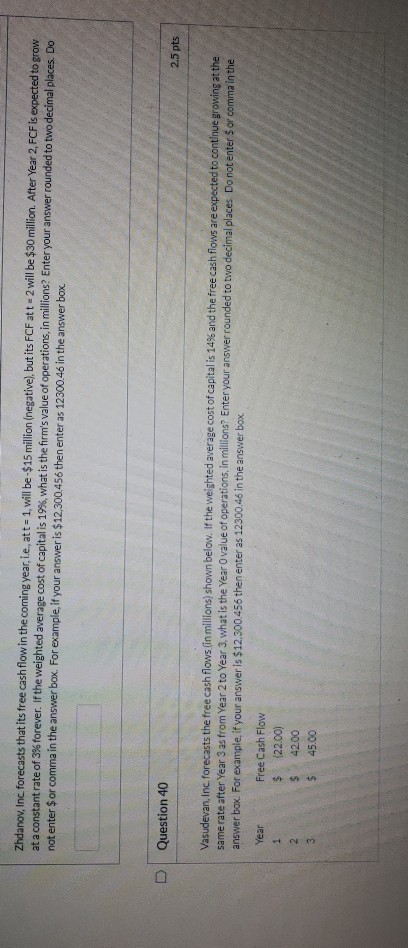

Zhdanov, Inc forecasts that its free cash flow in the coming year, i.e, at t= 1, will be -$15 million (negative), but its FCF att 2 will be $30 million. After Year 2, FCF is expected to grow at a constant rate of 3% forever. If the weighted average cost of capital is 19%, what is the firm's value of operations, in millions? Enter your answer rounded to two decimal places. Do not enter $or comma in the answer box. For example, if your answer is $12,300,456 then enter as 12300.46 in the answer box Question 40 2.5 pts Vasudevan, Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3. what is the Year O value of operations, in millions? Enter your answer rounded to two decimal places. Do not enters or comma in the answer box. For example, if your answer is $12.300.456 then enter as 12300.46 in the answer box Year 1 2 Free Cash Flow $ (22.00) $ 42.00 $ 45.00 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started