please round as directed my grade depends on it!!!!

please round as directed my grade depends on it!!!!

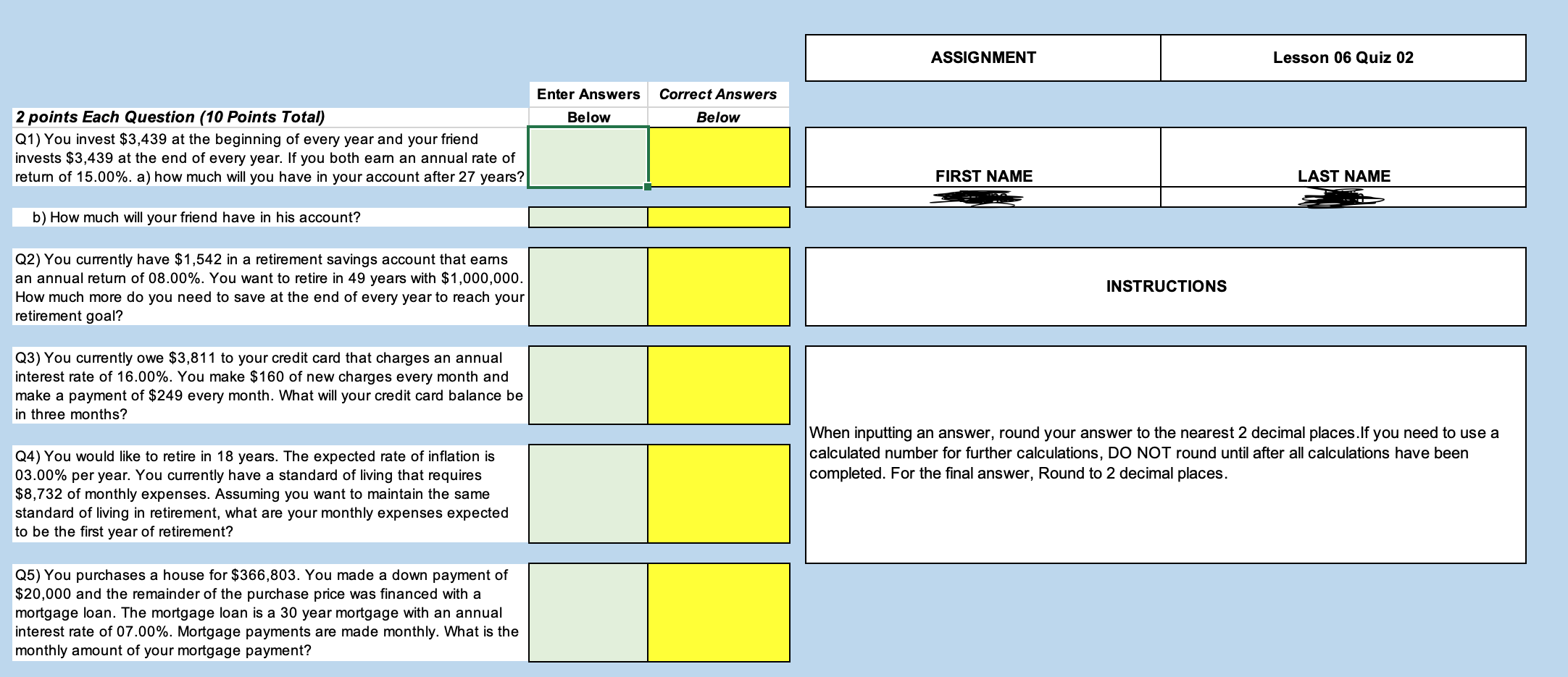

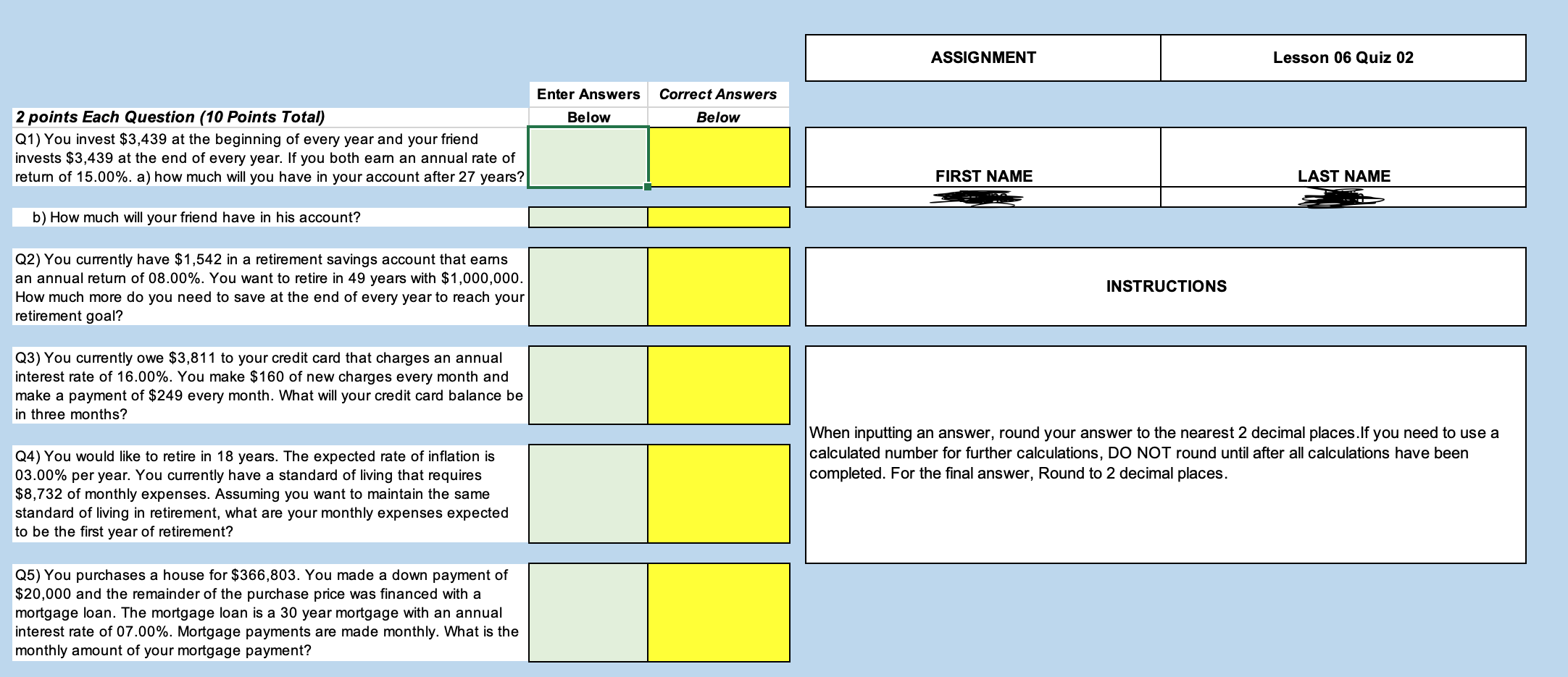

2 points Each Question (10 Points Total) Q1) You invest $3,439 at the beginning of every year and your friend invests $3,439 at the end of every year. If you both earn an annual rate of return of 15.00%. a) how much will you have in your account after 27 years? b) How much will your friend have in his account? Q2) You currently have $1,542 in a retirement savings account that earns an annual return of 08.00%. You want to retire in 49 years with $1,000,000. How much more do you need to save at the end of every year to reach your retirement goal? Q3) You currently owe $3,811 to your credit card that charges an annual interest rate of 16.00%. You make $160 of new charges every month and make a payment of $249 every month. What will your credit card balance be in three months? Q4) You would like to retire in 18 years. The expected rate of inflation is 03.00% per year. You currently have a standard of living that requires $8,732 of monthly expenses. Assuming you want to maintain the same standard of living in retirement, what are your monthly expenses expected to be the first year of retirement? Q5) You purchases a house for $366,803. You made a down payment of $20,000 and the remainder of the purchase price was financed with a mortgage loan. The mortgage loan is a 30 year mortgage with an annual interest rate of 07.00%. Mortgage payments are made monthly. What is the monthly amount of your mortgage payment? Enter Answers Below Correct Answers Below ASSIGNMENT Lesson 06 Quiz 02 FIRST NAME LAST NAME INSTRUCTIONS When inputting an answer, round your answer to the nearest 2 decimal places. If you need to use a calculated number for further calculations, DO NOT round until after all calculations have been completed. For the final answer, Round to 2 decimal places. 2 points Each Question (10 Points Total) Q1) You invest $3,439 at the beginning of every year and your friend invests $3,439 at the end of every year. If you both earn an annual rate of return of 15.00%. a) how much will you have in your account after 27 years? b) How much will your friend have in his account? Q2) You currently have $1,542 in a retirement savings account that earns an annual return of 08.00%. You want to retire in 49 years with $1,000,000. How much more do you need to save at the end of every year to reach your retirement goal? Q3) You currently owe $3,811 to your credit card that charges an annual interest rate of 16.00%. You make $160 of new charges every month and make a payment of $249 every month. What will your credit card balance be in three months? Q4) You would like to retire in 18 years. The expected rate of inflation is 03.00% per year. You currently have a standard of living that requires $8,732 of monthly expenses. Assuming you want to maintain the same standard of living in retirement, what are your monthly expenses expected to be the first year of retirement? Q5) You purchases a house for $366,803. You made a down payment of $20,000 and the remainder of the purchase price was financed with a mortgage loan. The mortgage loan is a 30 year mortgage with an annual interest rate of 07.00%. Mortgage payments are made monthly. What is the monthly amount of your mortgage payment? Enter Answers Below Correct Answers Below ASSIGNMENT Lesson 06 Quiz 02 FIRST NAME LAST NAME INSTRUCTIONS When inputting an answer, round your answer to the nearest 2 decimal places. If you need to use a calculated number for further calculations, DO NOT round until after all calculations have been completed. For the final answer, Round to 2 decimal places

please round as directed my grade depends on it!!!!

please round as directed my grade depends on it!!!!