Answered step by step

Verified Expert Solution

Question

1 Approved Answer

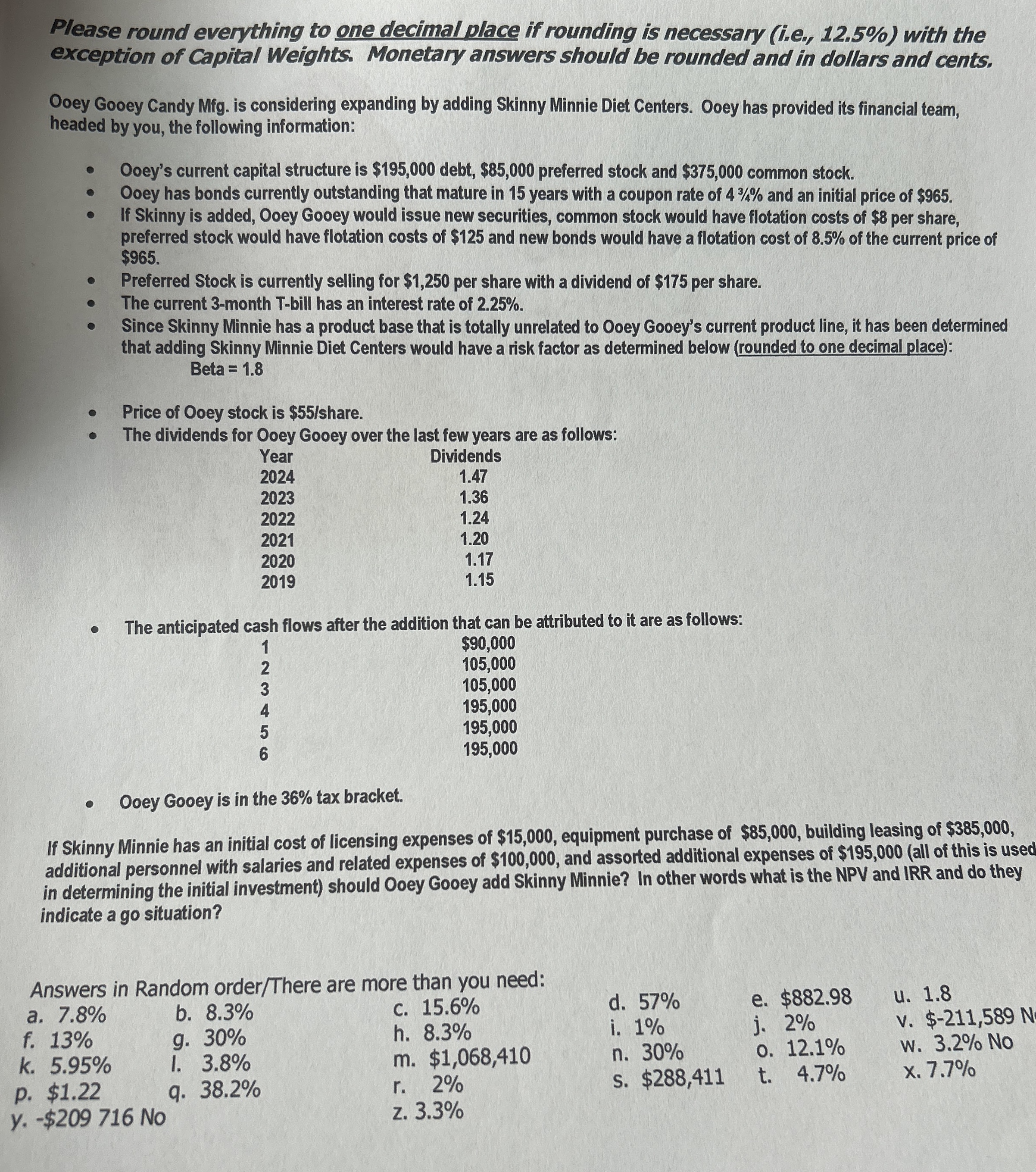

Please round everything to one decimal place if rounding is necessary ( i . e . , 1 2 . 5 % ) with the

Please round everything to one decimal place if rounding is necessary ie with the

exception of Capital Weights. Monetary answers should be rounded and in dollars and cents.

Ooey Gooey Candy Mfg is considering expanding by adding Skinny Minnie Diet Centers. Ooey has provided its financial team,

headed by you, the following information:

Ooey's current capital structure is $ debt, $ preferred stock and $ common stock.

Ooey has bonds currently outstanding that mature in years with a coupon rate of and an initial price of $

If Skinny is added, Ooey Gooey would issue new securities common stock would have flotation costs of $ per share,

preferred stock would have flotation costs of $ and new bonds would have a flotation cost of of the current price of

$

Preferred Stock is currently selling for $ per share with a dividend of $ per share.

The current month Tbill has an interest rate of

Since Skinny Minnie has a product base that is totally unrelated to Ooey Gooey's current product line, it has been determined

that adding Skinny Minnie Diet Centers would have a risk factor as determined below rounded to one decimal place:

Beta

Price of Ooey stock is $ share.

The dividends for Ooey Gooey over the last few years are as follows:

The anticipated cash flows after the addition that can be attributed to it are as follows:

Ooey Gooey is in the tax bracket.

If Skinny Minnie has an initial cost of licensing expenses of $ equipment purchase of $ building leasing of $

additional personnel with salaries and related expenses of $ and assorted additional expenses of $all of this is used

in determining the initial investment should Ooey Gooey add Skinny Minnie? In other words what is the NPV and IRR and do they

indicate a go situation?

Answers in Random orderThere are more than you need:

a

b

c

d

e $

u

f

h

j

v $

k

g

i

o

w No

p $

m $

n

r

s $

t

x

y $ No

z

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started