please see all screenshots

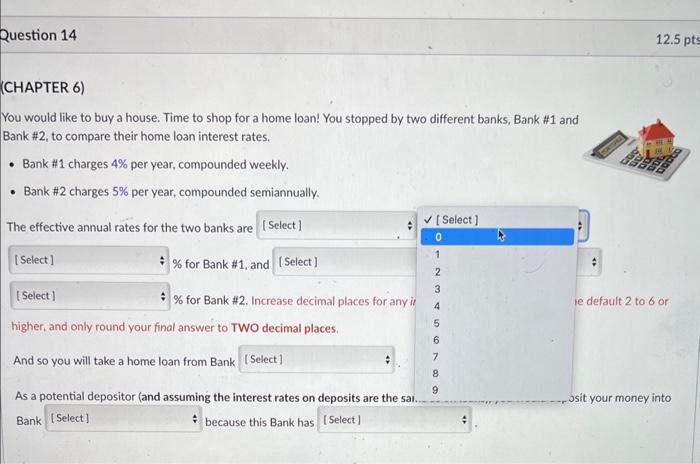

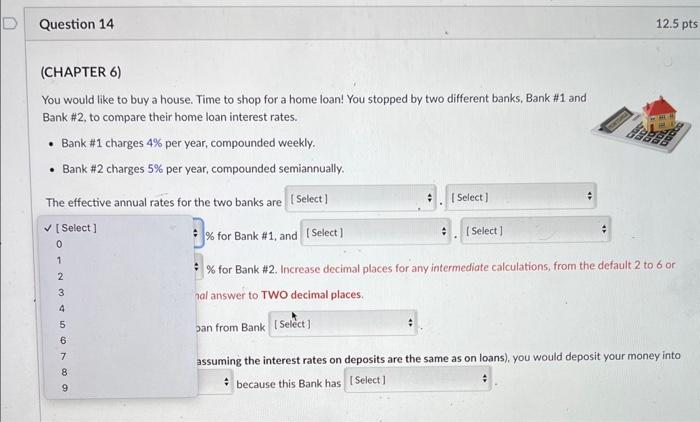

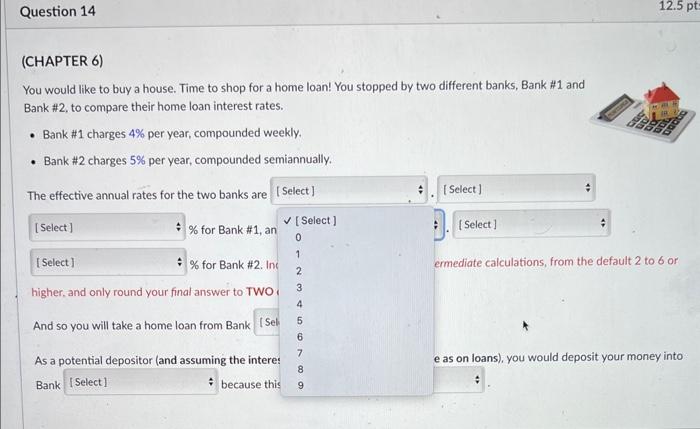

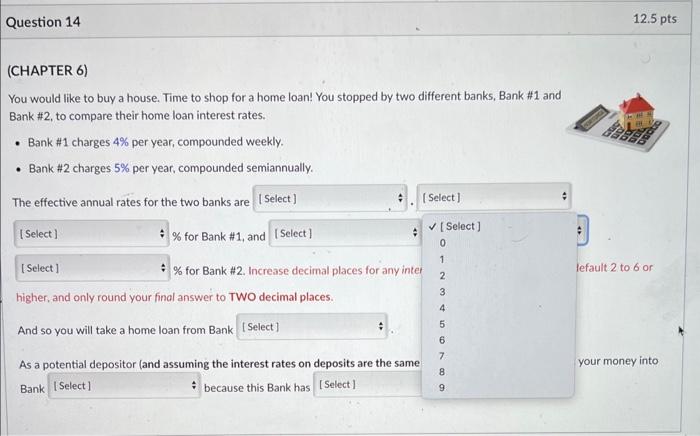

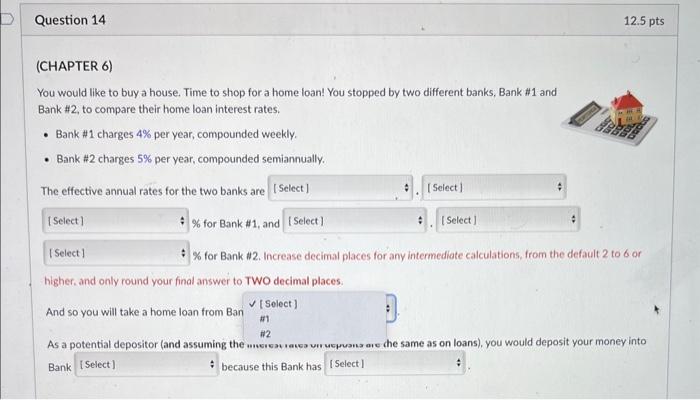

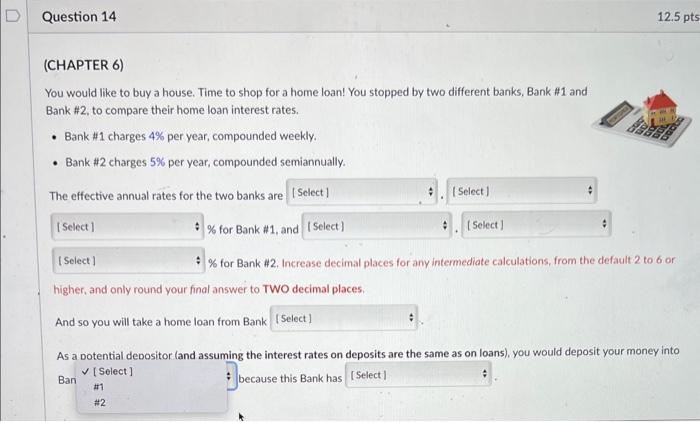

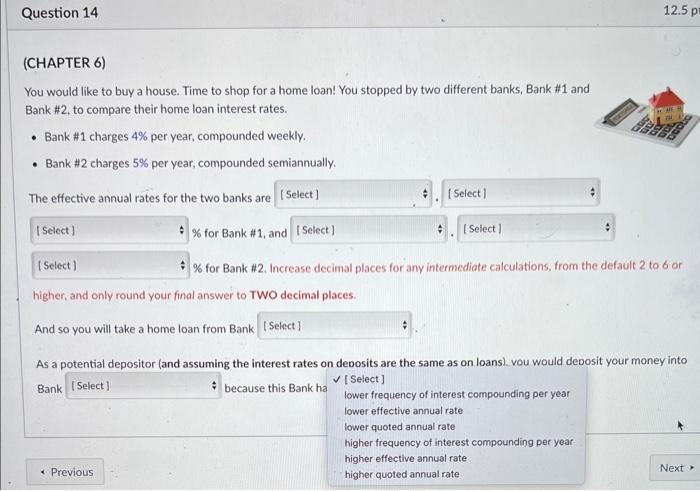

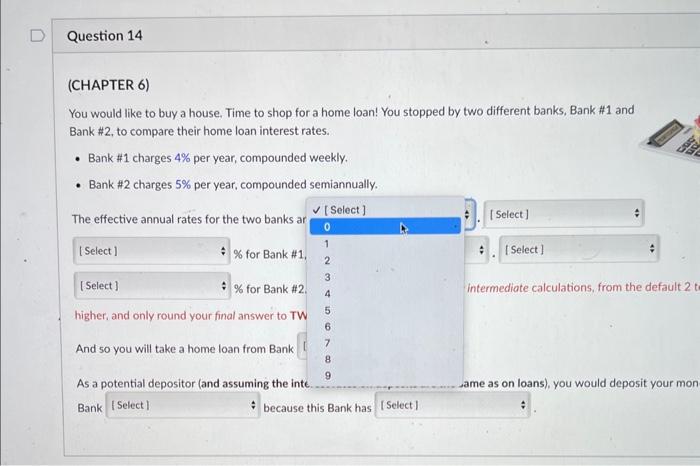

Your friend offers to you to invest your money into his partnership business, In return, you will receive $5,500 at the beginning of each of the next 6 years. Your friend's partnership generates a 3% annual return. What is the maximum that you would be willing to invest today into your friend's business? In the problem above I am working with In the problem above I need to calculate the In the format $,$$, in the problem above my numerical answer is dollars. Increase decimal places for any intermediate calculations, from the default 2 to, for example, 6 or even higher. The more the better! Only round your final answer. You would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and Bank #2, to compare their home loan interest rates. - Bank #1 charges 4% per year, compounded weekly. - Bank #2 charges 5% per year, compounded semiannually. The effective annual rates for the two banks ar would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and nk #2, to compare their home loan interest rates. Bank #1 charges 4% per year, compounded weekly. Bank #2 charges 5% per year, compounded semiannually. le effective annual rates for the two banks are would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and k#2, to compare their home loan interest rates. Bank #1 charges 4% per year, compounded weekly. Bank #2 charges 5% per year, compounded semiannually. e effective annual rates for the two banks are Select ] % for Bank #1, and % for Bank #2. Increase decimal places for any intermediate calculations, from the default 2 to 60 nal answer to TWO decimal places. jan from Bank assuming the interest rates on deposits are the same as on loans), you would deposit your money in because this Bank has You would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and Bank #2, to compare their home loan interest rates. - Bank #1 charges 4% per year, compounded weekly. - Bank #2 charges 5% per year, compounded semiannually. The effective annual rates for the two banks are You would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and Bank #2, to compare their home loan interest rates. - Bank #1 charges 4% per year, compounded weekly. - Bank #2 charges 5% per year, compounded semiannually. The effective annual rates for the two banks are You would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and Bank #2, to compare their home loan interest rates. - Bank #1 charges 4\% per year, compounded weekly. - Bank #2 charges 5% per year, compounded semiannually. The effective annual rates for the two banks are % for Bank #1, and \% for Bank #2. Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher, and only round your final answer to TWO decimal places. And so you will take a home loan from Ba Bank because this Bank has would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and #2, to compare their home loan interest rates. 3ank #1 charges 4% per year, compounded weekly. Bank # 2 charges 5% per year, compounded semiannually. effective annual rates for the two banks are \% for Bank #1, and \% for Bank #2. Increase decimal places for any intermediate calculations, from the default 2 to 6 ther, and only round your final answer to TWO decimal places. id so you will take a home loan from Bank a dotential decositor (and assuming the interest rates on deposits are the same as on loans), you would deposit your money because this Bank has (CHAPTER 6) You would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and Bank #2, to compare their home loan interest rates. - Bank #1 charges 4\% per year, compounded weekly. - Bank #2 charges 5% per year, compounded semiannually. The effective annual rates for the two banks are % for Bank #1, and \% for Bank #2. Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher, and only round your final answer to TWO decimal places. And so you will take a home loan from Bank As a potential depositor (and assuming the interest rates on debosits are the same as on loans). vou would debosit your money into Bank because this Bank ha [Select] lower frequency of interest compounding per year lower effective annual rate lower quoted annual rate higher frequency of interest compounding per year higher effective annual rate higher quoted annual rate