Please see attached and help me with answers.

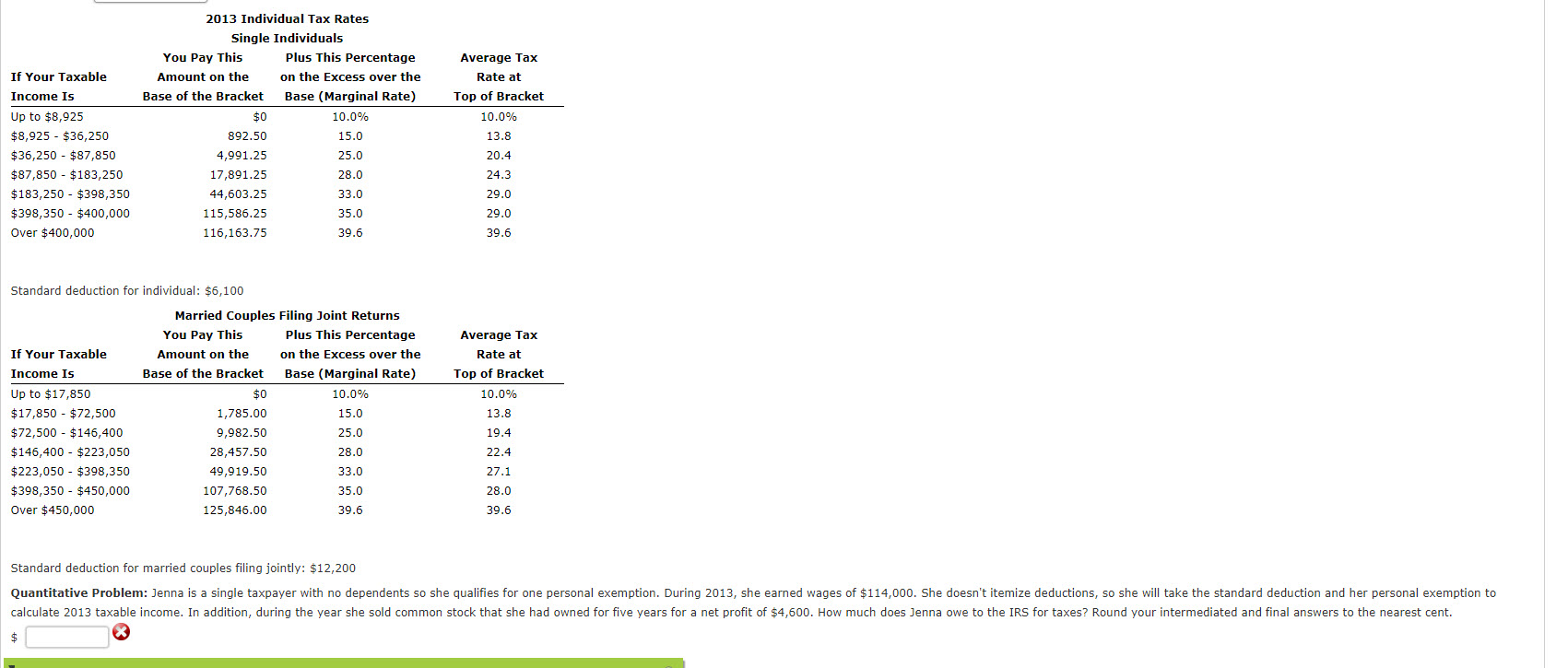

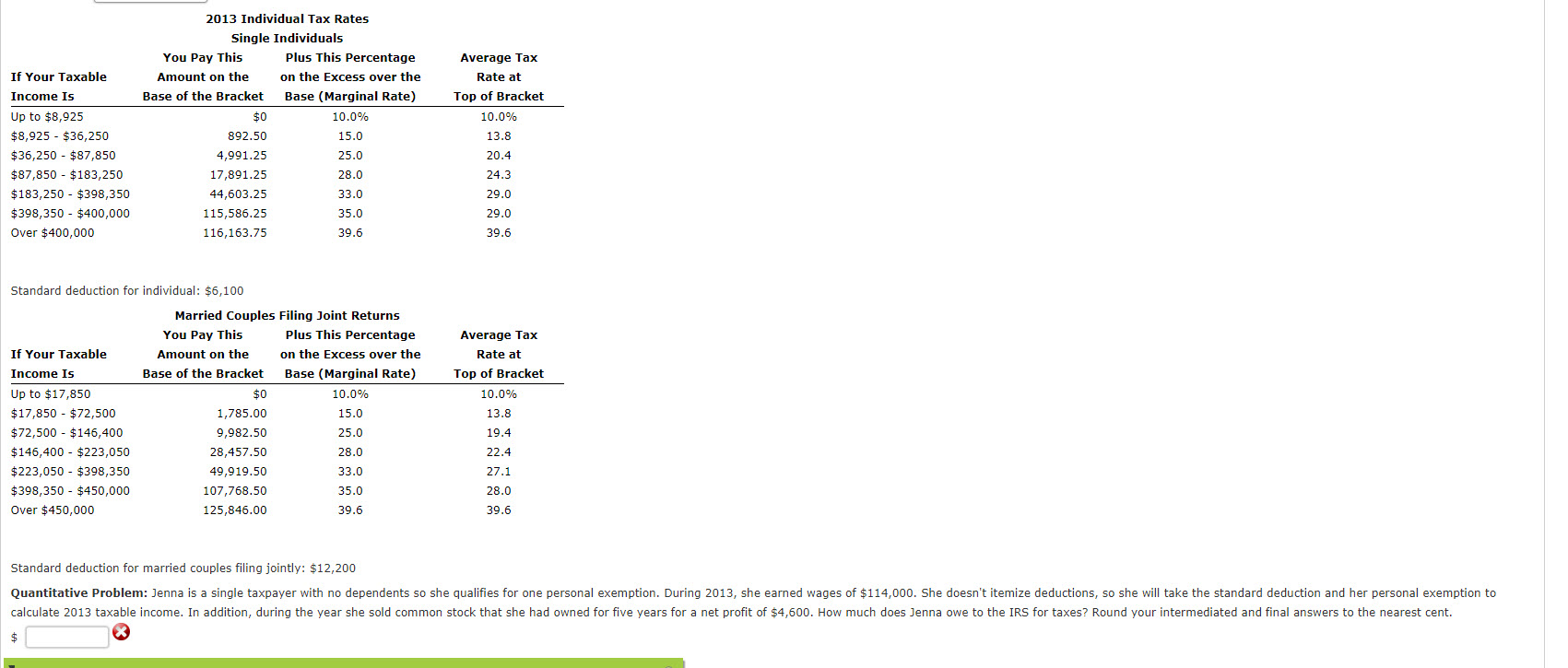

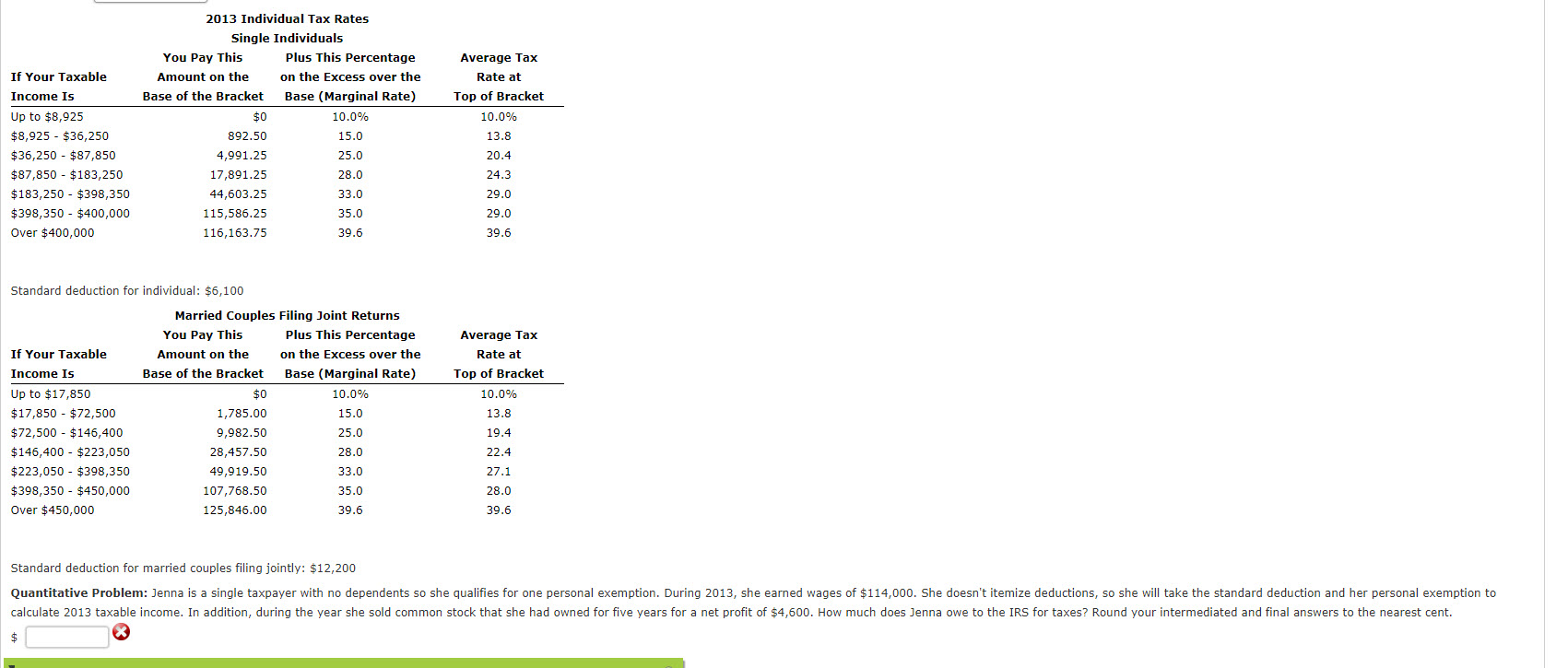

Quantitative Problem:Jenna is a single taxpayer with no dependents so she qualifies for one personal exemption. During 2013, she earned wages of $114,000. She doesn't itemize deductions, so she will take the standard deduction and her personal exemption to calculate 2013 taxable income. In addition, during the year she sold common stock that she had owned for five years for a net profit of $4,600. How much does Jenna owe to the IRS for taxes? Round your intermediated and final answers to the nearest cent.

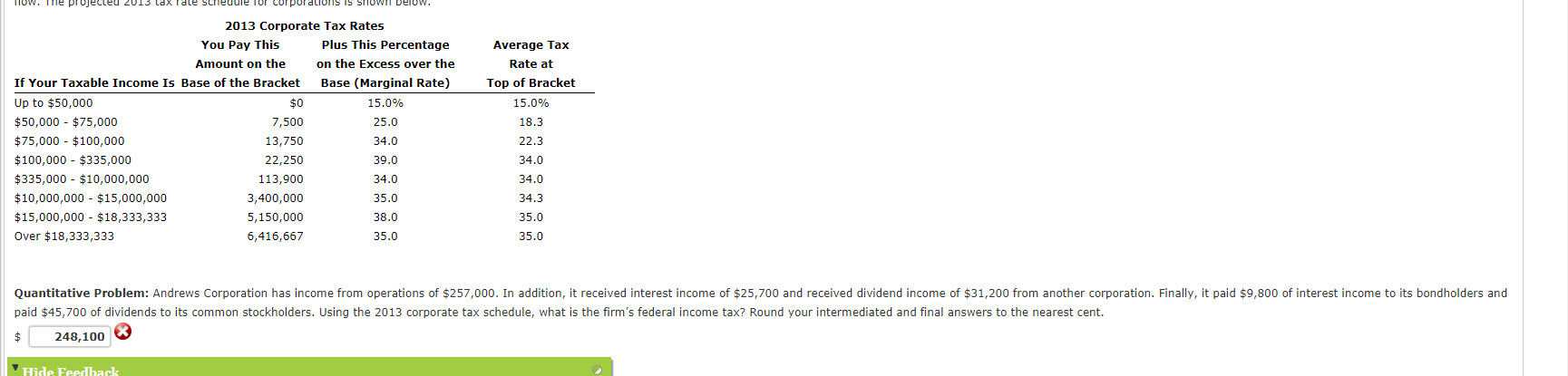

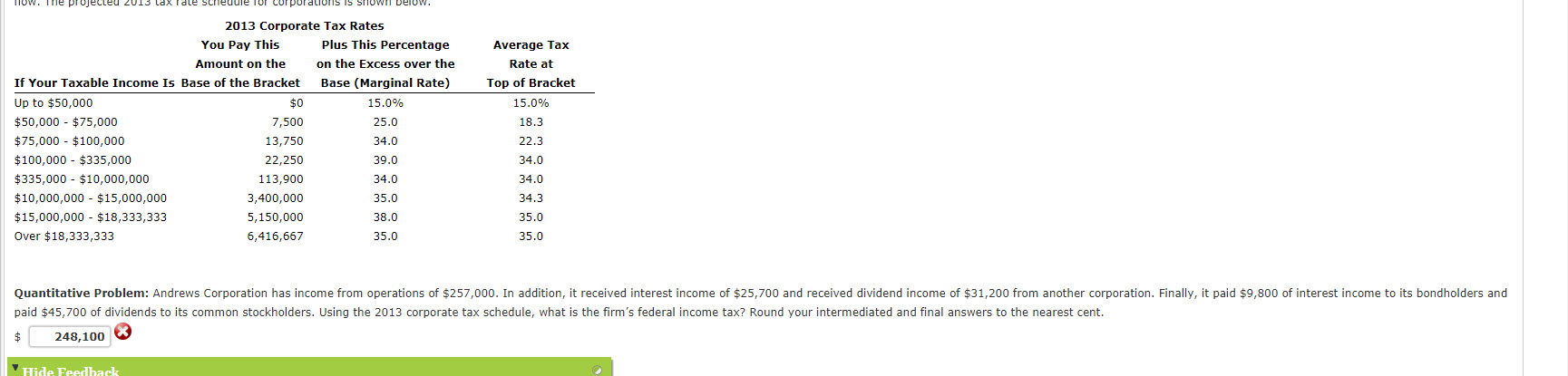

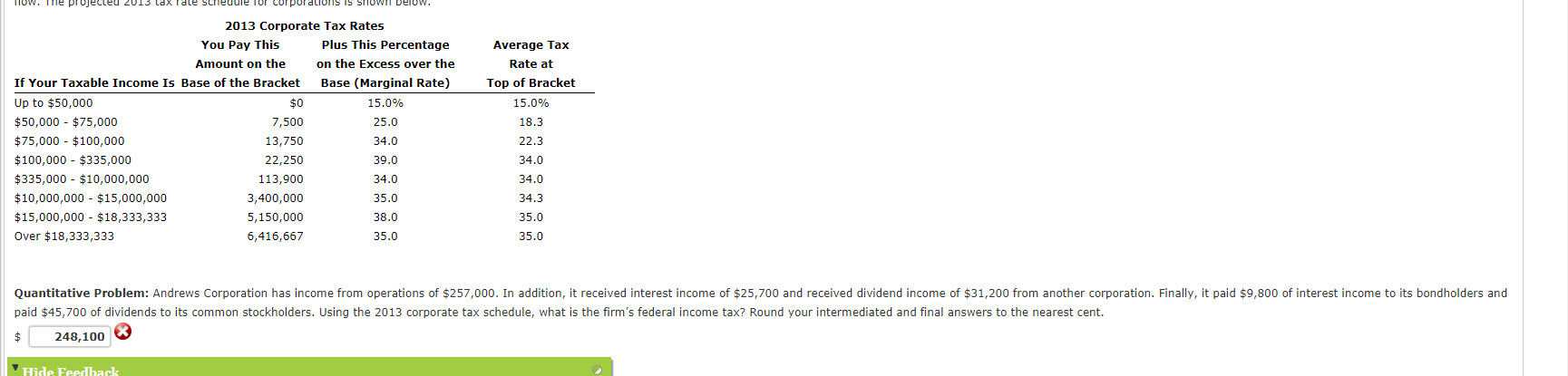

2013 Individual Tax Rates Si gle Individuals You Pay 11ii5 Plus 11iis Percentage Average Tax If vdur Taxable Arnuunt 0n the on the Excess ever the Rate at Indmue 15 has ul the Bracket 0050 (Ma minal Rate) 100 of Bracket 1 Up t0 $0,925 $0 10.0% 10.0% $0,925 - $35,250 092.50 15.0 13.0 $35,250 7 $07,050 4,991.25 25.0 20.4 $07,050 7 $103,250 17,091.25 20.0 24.0 $103,250 - $390,350 44,503.25 33.0 29.0 $390,350 7 $400,000 115,505.25 35.0 29.0 Over $400,000 115,153.75 39.5 39.5 Standard deductinll furlndividuai: $6,100 Married Collnles F illg Juinl Retullls You Pay 111i: Plus 111i; Percentage Average Tax If vdur 1axahle Amaunt on the on the Excess over the Rate at Indmue 15 has ul the Bracket 009a (Ma rui al Rate) 100 of Bracket , Up to $17,050 $0 10.0% 10.0% $17,050 - $72,500 1,705.00 15.0 13.0 $72,500 7 $145,400 9,902.50 25.0 19.4 $145,400 7 $223,050 20,457.50 20.0 22.4 $223,050 - $390,350 49,910.50 33.0 27.1 $390,350 7 $450,000 107,750.50 35.0 20.0 Over $450,000 125,045.00 39.5 39.5 Standard dedutdan fur niarned cnuples ling juint'y: $12,200 Quantitative Problem: Jenna is a single taxpayer with no denendents 50 she dualiiies fol sne persuna1 Exethioll. During 2013. she earned wages 0f $114,000. She doesn't itemrze deduclmns, 50 she him take the standard deductmn and her persona1 Exemption to calculane 2013 taxable incnme. 1n addr'tidn, during the year she said cnmmnn stock that she had owned lar ve years fur a net prot 0f $4,500. new mllch dues Jenna awe to the ms for taxes? Round ydur intermediated and nal answers ta die nearest cent. lluw. me wweuau 2013 tax late euleuule um Lululallullb' is snuwn uemw. 2013 Cornnrate Tax Males You Paly This Plus 11ii5 Percentage Average Tax mount on me on the Exoas over the Rate at If Yul" Taxable Incolne ls Ease of le Bracket Ease (Marginal ute) Toll DI Brackel up to $50,000 $0 15.0% 15.0% $50,000 - $75,000 7,500 15.0 15.3 575,000 7 $100,000 13,750 34.0 22.! $100,000 . $335,000 22,250 39.0 34.0 $335,000 , $10,000,000 113,900 34.0 34.0 $10,000,000 - $15,000,000 3,400,000 35.0 34.3 315,000,000 7 $10,333,333 5,150,000 30.0 35.0 Over $10,333,333 6,415,667 35.0 35.0 Quantitative Pmblem: Andrews Cornorallun has income lrom operations 0f 5257.000. In additiun, il recelved interest income uf 525.700 and received dlvidend inwme 01 $31,200 lmni andther camaratlun. nally, it Bald 59,300 or interest income to its bundhulders and paid $45,700 er dividends t0 its cummnn staekhdiders. Us'lng the 2013 curpomle tax schedule, what is the rm's fedeml inceme tax? Rullrld yedr intermediated and nal answers t0 the nearest cent