Answered step by step

Verified Expert Solution

Question

1 Approved Answer

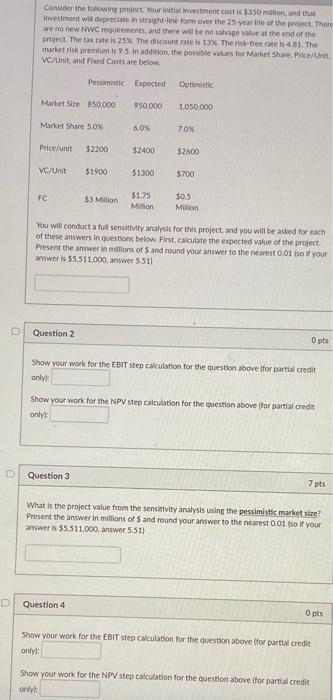

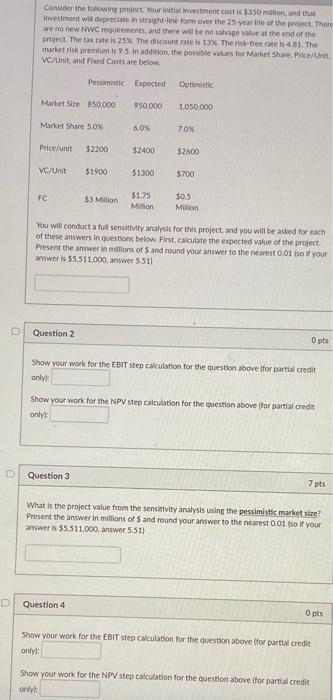

Please see attached file: Convider the folbwing project, Your initad investanent cost is $350 manonyand that imvestinent will deprectate in waight -line forriover the 25

Please see attached file:

Convider the folbwing project, Your initad investanent cost is $350 manonyand that imvestinent will deprectate in waight -line forriover the 25 -year life of the project. There are no new RhVC regulrementh, and there will be no walvage value at the end of the irolect. The bar rate is 25% The discoune note is 135 . The risk-free race is 4 a . The market risk premtim is 9.5 in addiban, the posside values for Market Share. Price Une? VCrunit and fiked Conti are below. You wit condact a ful sensitivity anatysis for this project, and you will be asked for each of these answers in questions below. Fist. calculate the expected value of the project. Piesent the answer ie milions of $ and round your answer to the nearest 0.01 fso it your anwer is $5,511,000 answer 5.511 Question 2 Show your work for the Eart step calculation for the question above ifor partial credit only: Show your work for the NPV step calculation for the question above (for partial credit only? Question 3 What is the projoct value froen the sensizivity aralysis using the pessimistic market size? Present the answer in millans of $ and round your anwer to the nearest 0.01 (so if your anwer is 55,511,000, answer 5.51 ) Question 4 Show your work for the EBiT step calculation for the question above ffor partial credit only: Show your work for the NPV step calcuabion for the question above (for partial credit) onht Convider the folbwing project, Your initad investanent cost is $350 manonyand that imvestinent will deprectate in waight -line forriover the 25 -year life of the project. There are no new RhVC regulrementh, and there will be no walvage value at the end of the irolect. The bar rate is 25% The discoune note is 135 . The risk-free race is 4 a . The market risk premtim is 9.5 in addiban, the posside values for Market Share. Price Une? VCrunit and fiked Conti are below. You wit condact a ful sensitivity anatysis for this project, and you will be asked for each of these answers in questions below. Fist. calculate the expected value of the project. Piesent the answer ie milions of $ and round your answer to the nearest 0.01 fso it your anwer is $5,511,000 answer 5.511 Question 2 Show your work for the Eart step calculation for the question above ifor partial credit only: Show your work for the NPV step calculation for the question above (for partial credit only? Question 3 What is the projoct value froen the sensizivity aralysis using the pessimistic market size? Present the answer in millans of $ and round your anwer to the nearest 0.01 (so if your anwer is 55,511,000, answer 5.51 ) Question 4 Show your work for the EBiT step calculation for the question above ffor partial credit only: Show your work for the NPV step calcuabion for the question above (for partial credit) onht

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started