Please see info below to answer above questions.

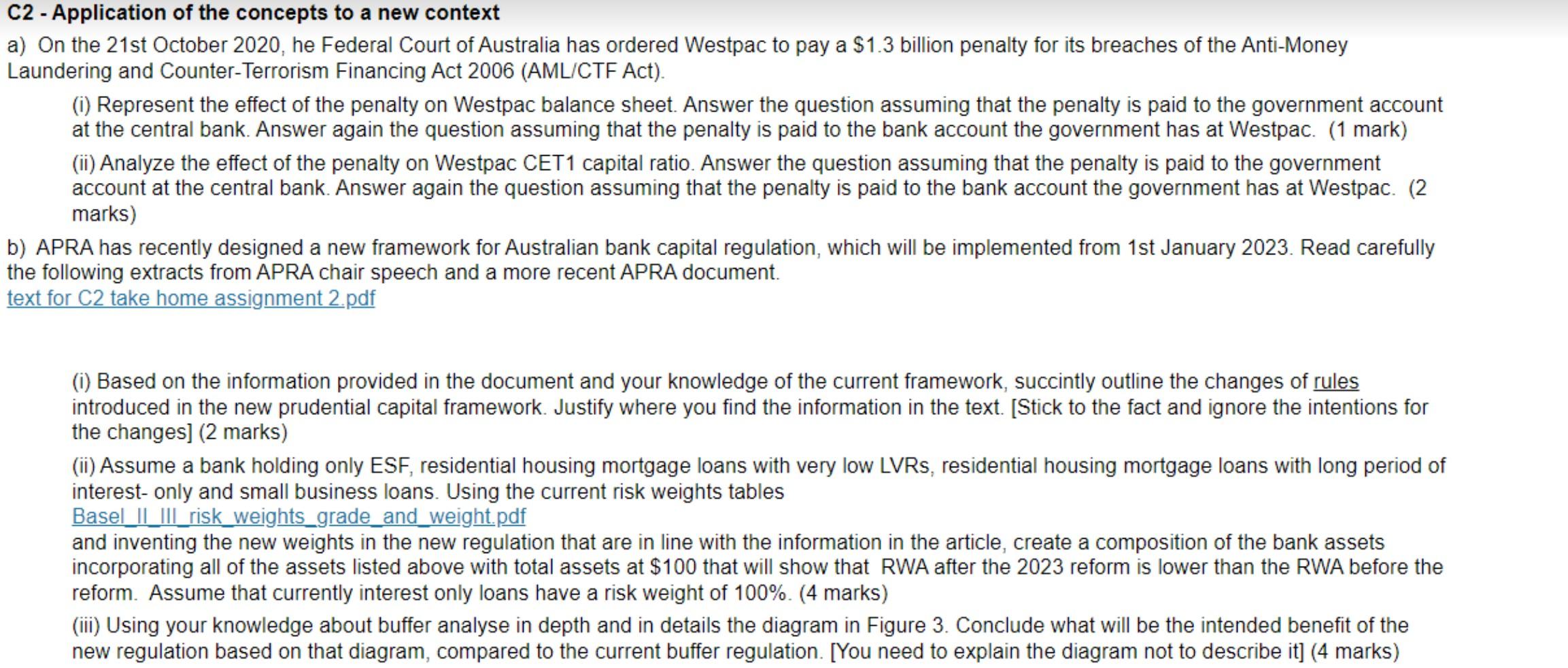

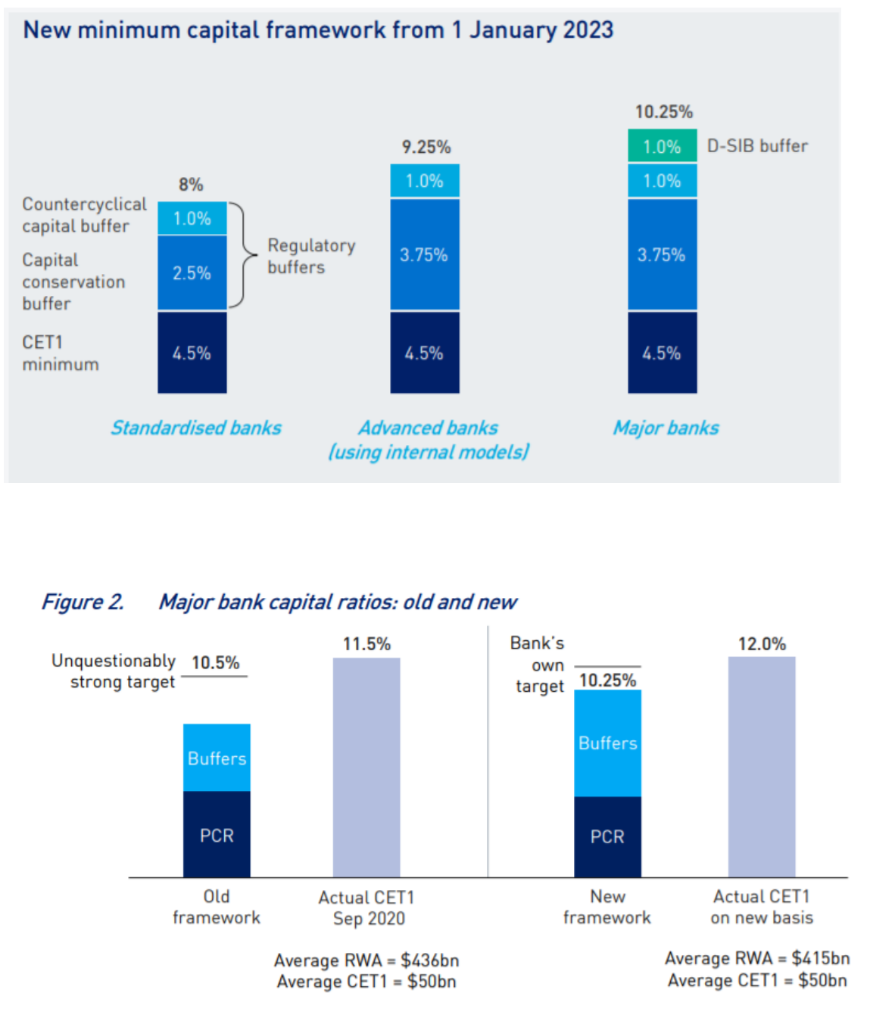

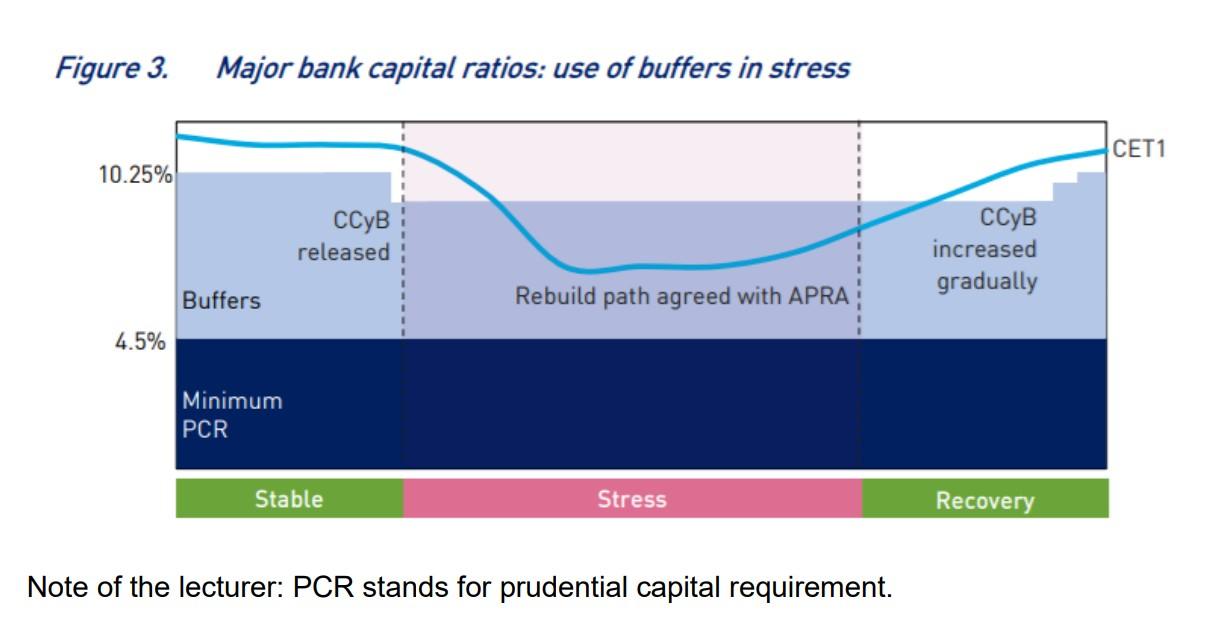

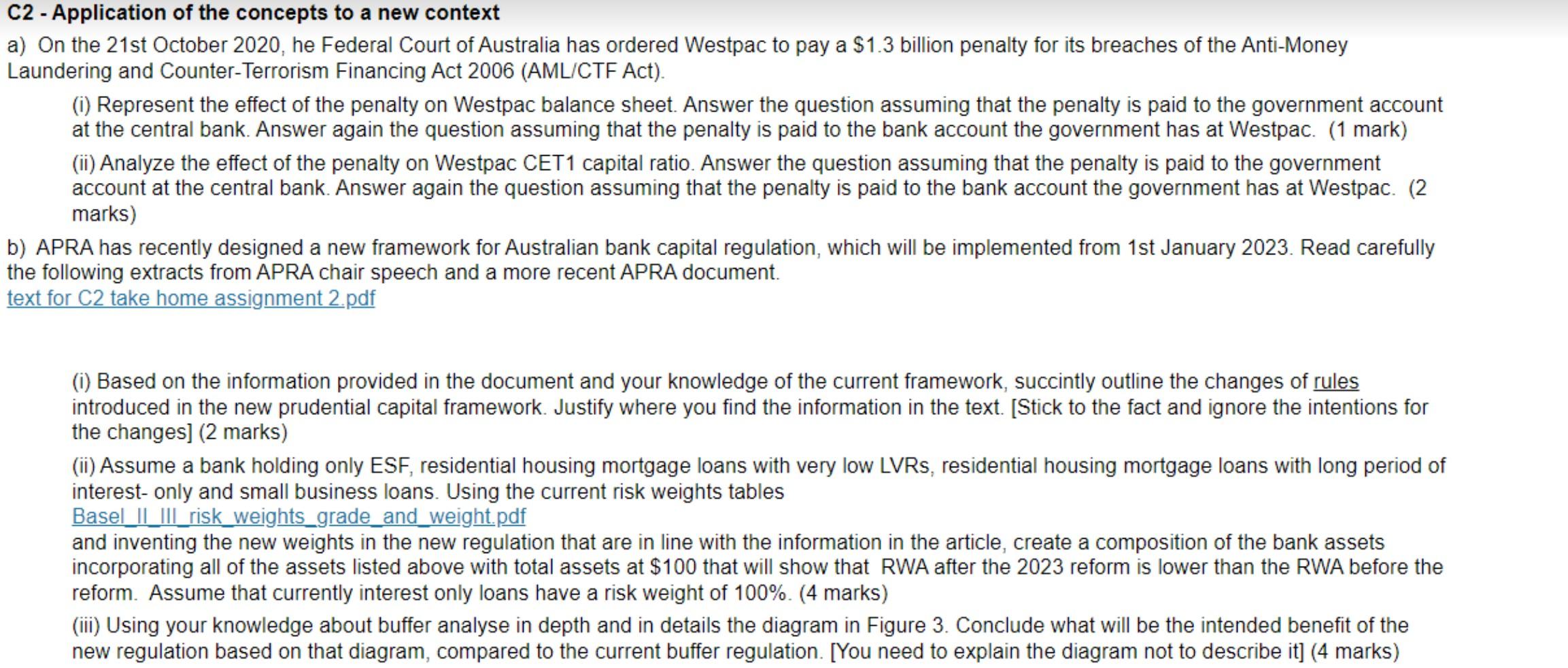

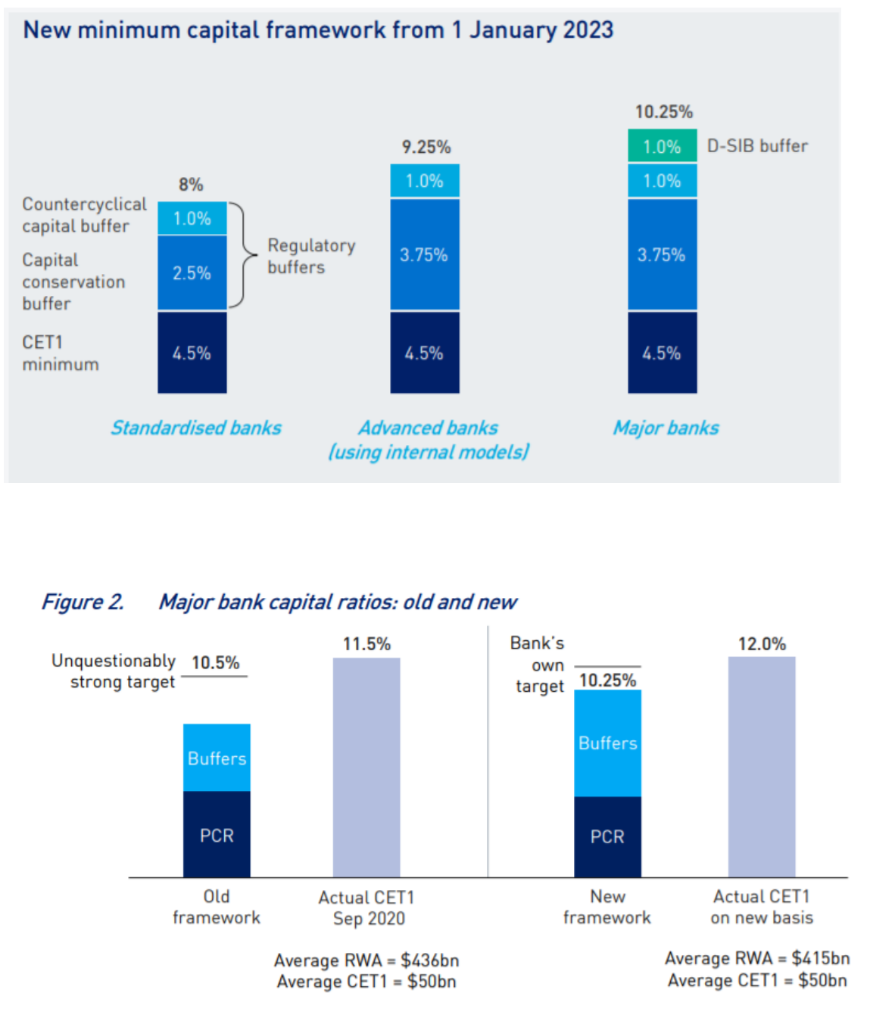

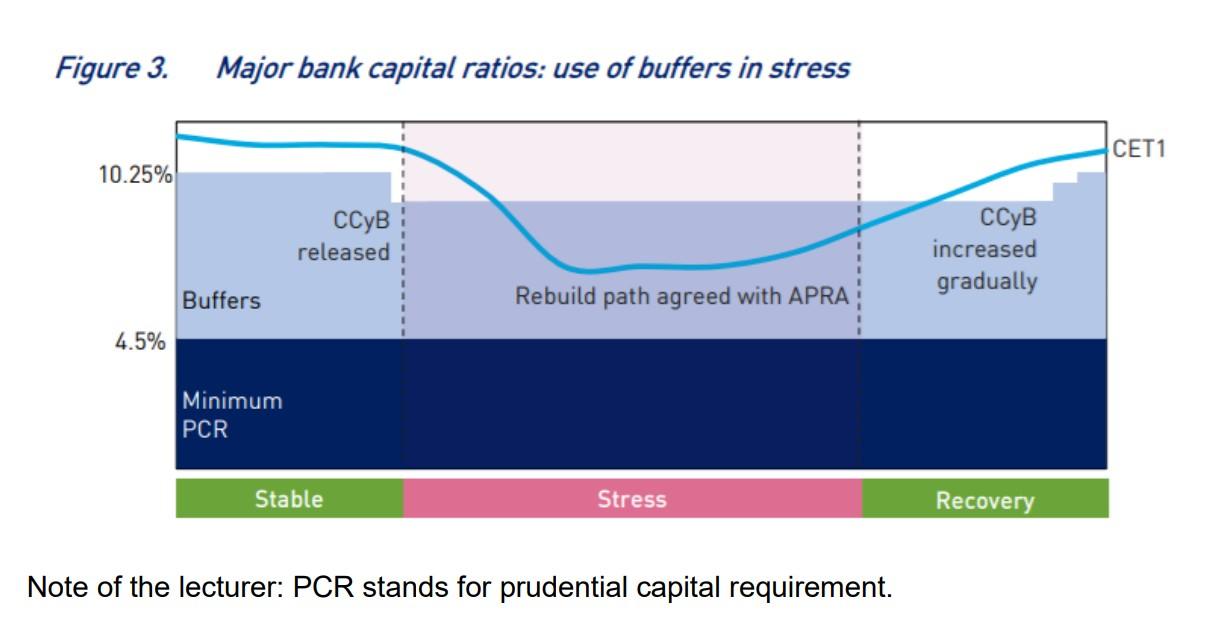

APRA Chair Wayne Byres About bank capital requirements 18 November 2020 Bank capital Ill turn now to another piece of unfinished business that I have spoken about at many of these events bank capital. This has been a long-running exercise,4 influenced not just by our own views, but the direction set by the Financial System Inquiry and the international Basel reforms. We want to bring this to the finish line. There are a number of key outcomes that these changes are designed to achieve. The first point I would make, however, is that we believe the banking system is adequately capitalised. The result of this reform will not be that the industry needs to raise additional capital. What we are seeking to do is complex and multi-faceted. We want to make the capital regime: more risk-based by adjusting risk weights in a range of areas, some up (e.g. for higher risk housing) and some down (e.g. for small business); more flexible by changing the mix between minimum requirement and buffers, utilising more of the latter; () () We are just putting the finishing touches to the consultation package, which we will release in the next few weeks. Without delving into all the details, probably the most fundamental change flowing from the proposals is that bank capital adequacy ratios (note of the lecturer: actual capital adequacy ratios) will change. Specifically, they will tend to be higher. That is because the changes we are proposing will, in aggregate, reduce risk-weighted assets for the banking system. Given the amount of capital banks have will be unchanged, lower risk-weighted assets will produce higher capital ratios. However, that does not mean banks will be able to hold less capital overall. () The balance will be maintained by requiring banks to hold larger buffers over their minimum requirements. () In our case, bank capital ratios will go up, but the dollar amount of capital the banking system has to hold should be largely unchanged.5 You might then ask why we are proposing an extensive set of changes, if we dont want to change the amount of capital held? One reason is to improve risk sensitivity. We will be adjusting risk weights in a range of areas to help make sure capital is better allocated according to risk. Housing loans, which dominate the industrys balance sheet, will be a particular area of focus. Within the standardised approach, for example, you can expect to see that lower risk loans such as amortising loans with low loan-to-valuation ratios (LVRs) will get lower risk weights, but higher risk loans for example, loans with extended interest-only terms will get relatively higher risk weights. A second reason is to make the framework more flexible, especially in times of stress. Holding a larger proportion of capital requirements in the form of buffers means there is more buffer available to be utilised in times of crisis, helping preserve the flow of credit at a time when it is most needed. Some of this will involve an expansion of the Capital Conservation Buffer, and some will be achieved by establishing a non-zero Countercyclical Capital Buffer as the default setting (note of the lecturer set up at 1% by default). Both of these steps are mirroring steps being considered elsewhere in the world.

C2 - Application of the concepts to a new context a) On the 21st October 2020, he Federal Court of Australia has ordered Westpac to pay a $1.3 billion penalty for its breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act). (1) Represent the effect of the penalty on Westpac balance sheet. Answer the question assuming that the penalty is paid to the government account at the central bank. Answer again the question assuming that the penalty is paid to the bank account the government has at Westpac. (1 mark) (ii) Analyze the effect of the penalty on Westpac CET1 capital ratio. Answer the question assuming that the penalty is paid to the government account at the central bank. Answer again the question assuming that the penalty is paid to the bank account the government has at Westpac. (2 marks) b) APRA has recently designed a new framework for Australian bank capital regulation, which will be implemented from 1st January 2023. Read carefully the following extracts from APRA chair speech and a more recent APRA document. text for C2 take home assignment 2.pdf (1) Based on the information provided in the document and your knowledge of the current framework, succintly outline the changes of rules introduced in the new prudential capital framework. Justify where you find the information in the text. [Stick to the fact and ignore the intentions for the changes) (2 marks) (ii) Assume a bank holding only ESF, residential housing mortgage loans with very low LVRs, residential housing mortgage loans with long period of interest-only and small business loans. Using the current risk weights tables Basel_|| |||_risk_weights_grade_and_weight.pdf and inventing the new weights in the new regulation that are in line with the information in the article, create a composition of the bank assets incorporating all of the assets listed above with total assets at $100 that will show that RWA after the 2023 reform is lower than the RWA before the reform. Assume that currently interest only loans have a risk weight of 100%. (4 marks) (iii) Using your knowledge about buffer analyse in depth and in details the diagram in Figure 3. Conclude what will be the intended benefit of the new regulation based on that diagram, compared to the current buffer regulation. [You need to explain the diagram not to describe it] (4 marks) New minimum capital framework from 1 January 2023 10.25% 9.25% 1.0% D-SIB buffer 8% 1.0% 1.0% 1.0% Countercyclical capital buffer Capital conservation buffer Regulatory buffers 3.75% 3.75% 2.5% CET1 minimum 4.5% 4.5% 4.5% Standardised banks Major banks Advanced banks (using internal models) Figure 2. Major bank capital ratios: old and new 11.5% 12.0% Unquestionably 10.5% strong target Bank's own target 10.25% Buffers Buffers PCR PCR Old framework Actual CET1 Sep 2020 New framework Actual CET1 on new basis Average RWA = $436bn Average CET1 = $50bn Average RWA = $415bn Average CET1 = $50bn Figure 3. Major bank capital ratios: use of buffers in stress CET1 10.25% CCyB released increased gradually Rebuild path agreed with APRA Buffers 4.5% Minimum PCR Stable Stress Recovery Note of the lecturer: PCR stands for prudential capital requirement. C2 - Application of the concepts to a new context a) On the 21st October 2020, he Federal Court of Australia has ordered Westpac to pay a $1.3 billion penalty for its breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act). (1) Represent the effect of the penalty on Westpac balance sheet. Answer the question assuming that the penalty is paid to the government account at the central bank. Answer again the question assuming that the penalty is paid to the bank account the government has at Westpac. (1 mark) (ii) Analyze the effect of the penalty on Westpac CET1 capital ratio. Answer the question assuming that the penalty is paid to the government account at the central bank. Answer again the question assuming that the penalty is paid to the bank account the government has at Westpac. (2 marks) b) APRA has recently designed a new framework for Australian bank capital regulation, which will be implemented from 1st January 2023. Read carefully the following extracts from APRA chair speech and a more recent APRA document. text for C2 take home assignment 2.pdf (1) Based on the information provided in the document and your knowledge of the current framework, succintly outline the changes of rules introduced in the new prudential capital framework. Justify where you find the information in the text. [Stick to the fact and ignore the intentions for the changes) (2 marks) (ii) Assume a bank holding only ESF, residential housing mortgage loans with very low LVRs, residential housing mortgage loans with long period of interest-only and small business loans. Using the current risk weights tables Basel_|| |||_risk_weights_grade_and_weight.pdf and inventing the new weights in the new regulation that are in line with the information in the article, create a composition of the bank assets incorporating all of the assets listed above with total assets at $100 that will show that RWA after the 2023 reform is lower than the RWA before the reform. Assume that currently interest only loans have a risk weight of 100%. (4 marks) (iii) Using your knowledge about buffer analyse in depth and in details the diagram in Figure 3. Conclude what will be the intended benefit of the new regulation based on that diagram, compared to the current buffer regulation. [You need to explain the diagram not to describe it] (4 marks) New minimum capital framework from 1 January 2023 10.25% 9.25% 1.0% D-SIB buffer 8% 1.0% 1.0% 1.0% Countercyclical capital buffer Capital conservation buffer Regulatory buffers 3.75% 3.75% 2.5% CET1 minimum 4.5% 4.5% 4.5% Standardised banks Major banks Advanced banks (using internal models) Figure 2. Major bank capital ratios: old and new 11.5% 12.0% Unquestionably 10.5% strong target Bank's own target 10.25% Buffers Buffers PCR PCR Old framework Actual CET1 Sep 2020 New framework Actual CET1 on new basis Average RWA = $436bn Average CET1 = $50bn Average RWA = $415bn Average CET1 = $50bn Figure 3. Major bank capital ratios: use of buffers in stress CET1 10.25% CCyB released increased gradually Rebuild path agreed with APRA Buffers 4.5% Minimum PCR Stable Stress Recovery Note of the lecturer: PCR stands for prudential capital requirement